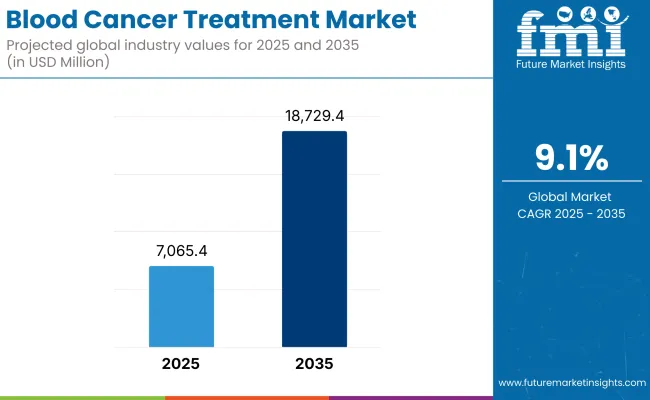

The market is expected to reach approximately USD 7,065.4 million in 2025 and expand to around USD 18,729.4 million by 2035, reflecting a compound annual growth rate (CAGR) of 9.1% over the forecast period.

The blood cancer treatment market is expanding due to advancements in personalized medicine, immunotherapy, and precision diagnostics. The increasing adoption of CAR-T cell therapy, bispecific antibodies, and immune checkpoint inhibitors is transforming treatment strategies for leukemia, lymphoma, and multiple myeloma. Additionally, liquid biopsy techniques are improving early detection and real-time monitoring, allowing for more effective disease management.

The growing emphasis on stem cell transplantation and innovative therapies is enhancing survival rates and reducing relapse risks. As healthcare infrastructure improves, access to cutting-edge treatments is expanding, particularly in emerging markets.

Telemedicine and digital health solutions are making consultations and follow-ups more convenient, ensuring better patient adherence. With continued investment in research and development, the market is set to witness further breakthroughs, offering safer and more effective treatment options for blood cancer patients worldwide.

The North American blood cancer therapy market has promising growth prospects in view of the rising incidence of cancers, reputable pharmaceutical companies in the region, and large government investments in oncology-related research.

Challenges such as very high treatment costs, inequalities in access to advanced therapies, and stringent requirements for approval of new interventions inhibit market growth because the USA continues to maintain a leadership position with increasing approvals of immunotherapies, rapid growth in CAR-T cell therapy, and increasing participation in clinical trial testing of candidate treatments for hematologic malignancies.

The main further growth drivers for the North American blood cancer treatment market will be increased artificial intelligence integration in personalized treatment selection, expanded patient access programs for expensive therapies, and growing emphasis on gene editing approaches for leukemia.

Europe is, and is expected to be, one of the larger markets for blood cancer treatment due to an advanced and widening acceptance of precision oncology, increased investments in cell-based therapies, and growing patient advocacy initiatives for improved access to advanced cancer treatment. Germany, France, and the UK are some of the major markets that do so well because of the existing well-established health systems, increasing funding toward leukemia and lymphoma research, and strong regulatory frameworks facilitating early approval of drugs.

Quite interestingly, though, there are negative factors such as complex reimbursement policies, pricing pressure on innovative therapies, and limited availability of specialized treatment centers that could hinder growth in this market. Increasing activities around stem cell transplantation are rapidly growing, and liquid biopsy technologies are being absolutely ramped up for future early detection, and an increasing collaboration between academic institutions and biotech firms in developing personalized therapies for hematologic cancers is paving the landscape for the European market.

Combination therapies are improving treatment options in patients with high risk.

The Asia-Pacific region is witnessing rapid growth in the blood cancer treatment market due to increasing cancer incidence, improving healthcare infrastructure, and rising government initiatives for cancer research and early diagnosis. Countries such as China, Japan, and India are key markets, with expanding pharmaceutical manufacturing capabilities, increasing clinical trial participation, and growing demand for cost-effective treatment solutions.

However, challenges such as affordability constraints, disparities in healthcare access, and limited awareness of advanced therapies may hinder market penetration. The increase of further global oncology drug manufacturers, the establishment of more CAR-T cell therapy facilities, and the integration of digital health solutions for remote monitoring of hematologic cancer patients have propelled the growth of the market.

In addition, advances in gene therapy coupled with increasing research on novel bispecific antibodies are improving the treatment options and thereby long-term survival rates for the region.

Challenges

Inadequate Infrastructure for Genetic Testing Hampers Early Diagnosis and Treatment Decisions.

Some challenges being faced in the blood cancer treatment market include exuberant pricing of targeted and cell therapies, lengthy and convoluted processes involved in gaining regulatory approval to conduct clinical trials, and long-term side effects associated with chemotherapy and immunotherapy treatments.

Some of the barriers which obstruct the expansion of the market include major difficulties associated with extensive donor matching in undergoing bone marrow transplantation; the high-pitched risk of developing treatment resistance in relapsing patients; and problems in the early detection of infiltrating aggressive hematology cancers.

Furthermore, advanced therapies remain inaccessible in poorer regions because of affordability constraints and lack of specialized oncology centers. The intricate management of treatment-related complications adds to the complexity, for instance, cytokine release syndrome (CRS) and immune system suppression, which further convolutes the markets.

Opportunities

The increased Focus On Pediatric Blood Cancers Is Driving Significant Advancements In Specialized Treatments

This increasing visibility directed toward blood cancer in children has stimulated a lot of progress in the field of unique treatment methods. Development, especially for childhood leukemia, one of the most common forms of cancer in children and lymphoma, is the most obvious proof that high research investments can accelerate the creation of targeted therapies, immunotherapy, and precision medicine approaches that enhance survival chances and reduce long-term side effects.

These novel treatment modalities such as CAR-T cell therapy and monoclonal antibodies have excellent effects in pediatric patients and provide healthier outcomes at lesser risk than traditional chemotherapy. Increasingly, clinical trials are also designed exclusively

to children, meaning that a treatment would be modified in consideration of the specific physiological needs of a child. Increased early diagnosis using support-type care programs also shows improved survival. The increase in collaboration among government and non-for-profit organizations, combined with pharmaceutical firms, has become an encouragement for the progressive expansion of attention to pediatric blood cancers, leading to the advancement of safer and clinically effective treatment methods.

Down the path to therapy for blood cancers composed of CAR-T cells and gene-edited treatments lay the promise of personalized and one of the most effective treatment options for leukemia, lymphoma, and multiple myeloma. The autologous CAR-T cell therapies use the T cells modified from the patient's own blood.

The results using these modified cells in patients targeting true cancer antigens have been spectacular. Many patients who had long-standing remissions with CAR-T cells have also benefited from the allogeneic manipulation of CAR-T. Allogeneic manipulation, especially with a healthy donor, speeds up the treatment, decreases costs, and widens access.

In addition, some of the breakthroughs in gene editing like CRISPR are enhancing CAR-T efficacy through better CAR-T cell drug persistence, reduced toxicity to the patient, and destruction of tumor resistance. Clinical trials and the path to registration are now paving the way for a very scalable, off-the-shelf option that will increase survival rates and accessibility for blood cancer patients all over the world.

The Integration of Liquid Biopsy in Blood Cancer Detection and Monitoring Is Revolutionizing How Hematologic Malignancies Are Diagnosed and Managed.

Liquid biopsy integration into blood cancer detection and monitoring is revolutionizing the way hematologic malignancies are diagnosed and cooked. By assessing the level of circulating tumor DNA or ctDNA and that of the minimal residual disease or MRD, liquid biopsy enables a non-invasive and real-time mode of monitoring for cancer progress and treatment response and relapse risk, thus obviating frequent bone marrow biopsies.

With further sensitivity for detecting gene mutations related to blood cancers such as leukemia and lymphoma and myeloma, where such mutations are sought as therapeutic targets, MRD testing also lets the treating physician see beyond the naked eye or the conventional techniques available.

It shows the tiny traces of these malignant cells so that he can alter the treatment on time and avert relapse. Liquid biopsy is thus becoming a mainstay in precision oncology for early intervention and personalized treatment in blood cancer with advances in next-generation sequencing and PCR-based techniques.

Targeted therapy, immunotherapy, and stem-cell transplantation opened the doors to innovations that would have made the global treatment of blood cancer prosper from the year 2020 to 2024, with increased incidences of the disease contributing to the growth, along with an expanded array of diagnostic options.

The introduction of CAR-T therapy, monoclonal antibodies, and immune checkpoint inhibitors have enhanced treatment responses and therefore survival. Furthermore, components of precision medicine and biomarker-targeted therapy gave rise to treatment that could be micro-based on the individuality of the patient. However, the adoption of such practices was hindered by the cost of therapy, coupled with the glaring inequalities with respect to patient access, especially in poorer regions.

Immunotherapy, with CRISPR-based gene-editing and the help of AI-based cancer detection, is forecast to have a high impact on market dynamics between 2025 and 2035. Decentralized clinical trials would accelerate drug development and provide patients with access to new drugs by enhancing telemedicine.

Thus, the concepts of sustainability shall become important in aspects such as green drug development and AI optimization for lesser resources. The regulatory framework appears to be positive and research is improving cancer genomics; with these factors, the market is believed to be heading toward affordable and effective treatments.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Novel therapies such as CAR-T cell treatment and novel immunotherapies with unmet medical requirements are specially expedited for approvals. |

| Technological Advancements | Next-generation sequencing (NGS) has emerged for accurate diagnosis, designing targeted therapies, and CAR-T cell therapy applications to enhance efficiency of treatment. |

| Consumer Demand | Awareness and demand for meaningful treatments with tolerable side effects swept between targeted therapies and immunotherapies against the former chemotherapy. |

| Market Growth Drivers | Increasing cases of blood cancers due to an aging population, an increase in healthcare spending, and heavy investments in oncology R&D. |

| Sustainability | Eco-designed manufacturing practices are being considered seriously by working on reducing hazardous wastes and applying green chemistry principles to drug development. |

| Supply Chain Dynamics | They worked on established distribution networks to assure the availability of therapies in developed regions, which challenged their way through reaching the remote or resource-limited settings. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Biosimilars and personalized medicine approaches with appropriate guidelines are assured to maintain quality in protocols and safety for the patients as well as for innovation. |

| Technological Advancements | Diagnostics and treatment planning aided by artificial intelligence, gene-editing technologies such as CRISPR to develop potential cures, and targeted drug delivery systems developed by nanotechnology are all integrated technologies. |

| Consumer Demand | Advancements in precision medicine and the availability of customized therapeutic options have been paving the way for increased interest in customized treatment plans based on genetic profiling. |

| Market Growth Drivers | Following the trends in emerging markets striving to develop a healthcare infrastructure, a growing emphasis on early detection and preventative strategies, and fruitful partnerships between big pharma and biotech firms would elevate innovation and access. |

| Sustainability | Full-blown practice of sustainability, including the use of biodegradable materials for packaging, energy-efficient manufacturing facilities, and projects reducing the carbon footprint of clinical trials and supply chains. |

| Supply Chain Dynamics | Digital technologies and e-commerce platforms optimize the supply chain, bringing in transparency, efficiency, and easy access, thereby ensuring timely delivery of treatments to a global patient population, including in underserved areas. |

Blood Cancer Treatment Market Overview

Another pivotal growth factor in the USA blood cancer treatment market is affected by advancement in the targeted therapies and immunotherapies. The blood cancer types, including leukemia, lymphoma, and multiple myeloma, have gained a rising share in Argentina demand for new treatment concepts. Government-oriented initiatives and investments in healthcare infrastructure are supporting the simultaneous growth of this market.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

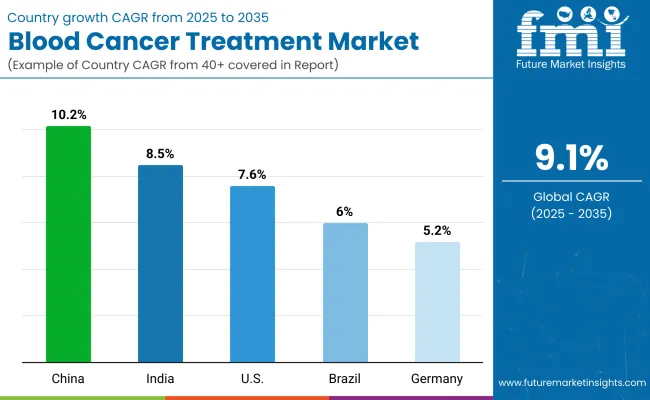

| 2025 to 2035 | 7.6% |

Market Outlook

China's blood cancer treatment market is expanding rapidly due to increasing healthcare investments and a growing patient population. The government's focus on improving healthcare infrastructure and access to advanced treatments contributes to market growth. Collaborations with international pharmaceutical companies facilitate the introduction of innovative therapies.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 10.2% |

Outlook on the Market

Blood cancer treatment was ever-growing in India with greater interest in technological advancement and healthcare spending. These impediments call for a cost-effective mode of treatment for these blood cancers. Government initiatives aim to provide affordable healthcare and subsequently paving the path for the emergence of private healthcare providers.

Factors for Market Growth

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 8.5% |

Taking Stock of the Market

The treatment for blood cancers within Germany presents a condition of advanced infrastructure, geared towards health, and a proper alignment towards research and development functions. It facilitates the move towards more advanced therapies endowed by innovations. An established system within healthcare ensures patient access to well-thought treatments.

Factors Contributing to Growth in the Market

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 5.2% |

Market Outlook

Brazil's blood cancer treatment market is growing, driven by improvements in healthcare infrastructure and increased government spending on healthcare. Efforts to expand access to cancer treatments and the development of specialized care centers enhance patient outcomes. Public awareness campaigns promote early detection and treatment.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 6.0% |

Targeted Therapy

Due to Is High Adoption Targeted Therapy Dominated The Application Segment In Blood Cancer Treatment Market.

Targeted therapy is one of the most advanced and widely adopted treatment approaches for blood cancers, specifically in leukemia, lymphoma, and multiple myeloma. This method focuses on blocking specific proteins and signalling pathways involved in cancer cell growth and survival, reducing damage to healthy cells. Common targeted therapies include tyrosine kinase inhibitors (TKIs) like imatinib for chronic myeloid leukemia (CML) and monoclonal antibodies such as rituximab for B-cell lymphomas.

The rising preference for precision medicine, increasing FDA approvals for targeted blood cancer drugs, and growing biomarker-driven therapy advancements are fueling market demand. North America and Europe lead in targeted therapy adoption due to advanced research infrastructure, while Asia-Pacific is witnessing rapid growth due to increasing access to personalized treatments.

Future trends include AI-driven drug discovery for next-generation targeted therapies, CRISPR-based gene-editing approaches, and combination therapies integrating targeted drugs with immunotherapy.

Stem Cell Transplantation

Stem Cell Transplantation Has Been the Curative Treatment For Blood Cancers Treatments

Blood cancers such as acute leukemia, multiple myeloma, and aggressive lymphomas are treated with stem cell transplantation, which is currently advised as curative therapy. This could either be from the patient (i.e., autologous) or from a donor (alio-) or foreign, depending on the localisation of the damage and the presence or lack of damage to the normal haematopoietic stem cells by the diseased cells.

Growing success cases for international registry of bone marrow donors around the world and advancements in reduced-intensity conditioning (RIC) for older patients have always influenced their markets. North America and Europe lead in stem cell transplant adoption due to established well-developed transplant centers and progress in management of graft-versus-host disease (GvHD).

However, Asia-Pacific is rapidly developing due to an increase in government funding and research collaboration.

Hospitals Are the Largest End Users for Blood Cancer Treatments, As They Provide Comprehensive Oncology Care

Blood cancer businesses stay mainly in hospital settings for managing patients because radiation therapy machines, chemo infusion centers, and stem cell transplant programs work within their limited capacities. Increased incidences of hematological cancers, growing numbers of clinical trials being conducted in hospitals for new blood cancer therapies, and increasing acceptance of AI-enabled patient monitoring systems are some of the reasons for the rising demand for hospital-based treatment of blood cancers.

The hospital-based treatment of blood cancer is dominating in North America and Europe while Asia-Pacific is showing rising trends because of improved healthcare infrastructure and increasing government expenditure on oncology care. Upcoming trends may include robot-assisted chemotherapy infusion, AI-enabled predictive analytics for response to treatment, and digital twin technology for personalized treatment planning of blood cancers.

Cancer Rehabilitation Centers

Cancer Rehabilitation Centers Are Playing an Increasingly Important Role In Post-Treatment Care For Blood Cancer Patients

In these centers, patients get a personalized program of rehabilitation that includes nutrition therapy, physiotherapy, and mental health counselling for treatment side effects such as fatigueness, neuropathy, and emotional distress. Survivorship care is being recognized to a greater extent now; graduates of holistic rehabilitation programs, and demand for personalized rehabilitation plans influenced by AI, are increasing, thereby widening the market scope.

North America and Europe hold the lion's share of cancer rehabilitation services since they have well-established survivorship programs, while the Asia Pacific in this area is stirring up and investing more. Future innovations include AI-based virtual rehabilitation programs and wearables for real-time patient-monitoring, along with next-gen immune-boosting therapies for faster post-cancer recovery.

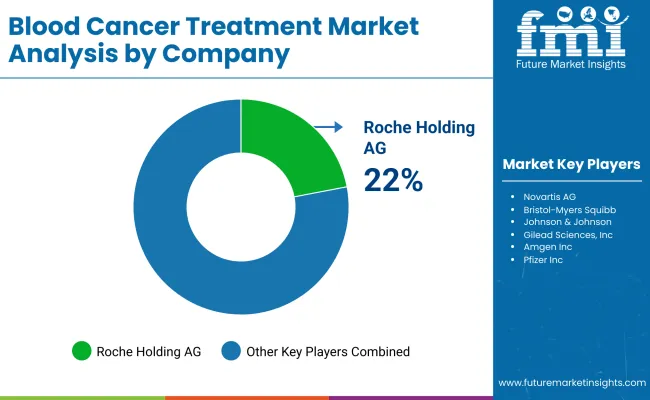

The marketplace is quite competitive concerning blood cancer therapy, mainly due to an increased prevalence of leukemia, lymphomas, and multiple myeloma, advancement in targeted therapies, and the growing uptake of immunotherapies and CAR-T cell therapies as competition factors. The companies score points in novel biologics, precision medicine, and next-generation chemotherapy regimens within their arms race.

A good deal of the marketplace comprises pharmaceutical behemoths, biotechnology innovators, and early-stage companies focusing on oncology.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Roche Holding AG | 22-26% |

| Novartis AG | 18-22% |

| Bristol-Myers Squibb | 10-14% |

| Johnson & Johnson | 8-12% |

| Gilead Sciences, Inc. | 5-9% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Roche Holding AG | Market leader offering Rituxan, Gazyva, and Venclexta for leukemia and lymphoma treatment. |

| Novartis AG | Develops CAR-T cell therapies such as Kymriah for aggressive blood cancers. |

| Bristol-Myers Squibb | Specializes in checkpoint inhibitors like Opdivo and Revlimid for multiple myeloma. |

| Johnson & Johnson | Provides Darzalex and Tecvayli for targeted blood cancer therapies. |

| Gilead Sciences, Inc. | Focuses on cell-based therapies like Yescarta for relapsed or refractory lymphoma. |

Key Company Insights

These include:

These companies focus on expanding the reach of blood cancer treatments, offering competitive pricing and cutting-edge innovations to meet diverse patient and healthcare provider needs.

Biological/Immunotherapy Applications, Chemotherapy, Radiation Therapy, Targeted Therapy and Stem Cell Transplantation

Hospitals, Speciality Clinics and Cancer Rehabilitation Centers.

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The global blood cancer treatment industry is projected to witness CAGR of 9.1% between 2025 and 2035.

The global Blood Cancer Treatment industry stood at USD 6,476.1 million in 2024.

The global Blood Cancer Treatment industry is anticipated to reach USD 18,729.4 million by 2035 end.

China is expected to show a CAGR of 7.8% in the assessment period.

The key players operating in the global Blood Cancer Treatment industry are Roche Holding AG, Novartis AG, Bristol-Myers Squibb, Johnson & Johnson, Gilead Sciences, Inc., Amgen Inc., Pfizer Inc., AbbVie Inc., Sanofi, Takeda Pharmaceutical Company and Others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 13: Global Market Attractiveness by Application, 2023 to 2033

Figure 14: Global Market Attractiveness by End User, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 28: North America Market Attractiveness by Application, 2023 to 2033

Figure 29: North America Market Attractiveness by End User, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 44: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 104: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blood Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Blood Sugar Tester Market Size and Share Forecast Outlook 2025 to 2035

Blood Flow Restriction Bands Market Size and Share Forecast Outlook 2025 to 2035

Blood-based Biomarker For Alzheimer's Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Blood Bank Reagent Market Size and Share Forecast Outlook 2025 to 2035

Blood Clot Retrieval Devices Market Size and Share Forecast Outlook 2025 to 2035

Blood Glucose Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Blood Pressure Transducers Market Size and Share Forecast Outlook 2025 to 2035

Blood Culture Test Market Size and Share Forecast Outlook 2025 to 2035

Blood Bag Tube Sealer Market Size and Share Forecast Outlook 2025 to 2035

Blood Bags Market Size and Share Forecast Outlook 2025 to 2035

Blood Warmer Devices Market Size and Share Forecast Outlook 2025 to 2035

Blood Temperature Indicator Market Size, Share & Forecast 2025 to 2035

Blood Testing Equipment Market Growth - Trends & Forecast 2025 to 2035

Blood Coagulation Analyzers Market Growth – Trends & Forecast 2025 to 2035

The Blood Fluid Warming System Market is segmented by product type, application, and end user from 2025 to 2035

Blood Volume Analyzer Market – Demand, Growth & Forecast 2025 to 2035

Blood Collection Devices Market Insights – Trends & Forecast 2025 to 2035

Blood Pressure Monitor Market Analysis by Product, Indication, End User and Region: Forecast for 2025 to 2035

Key Players & Market Share in the Blood-Based Biomarker Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA