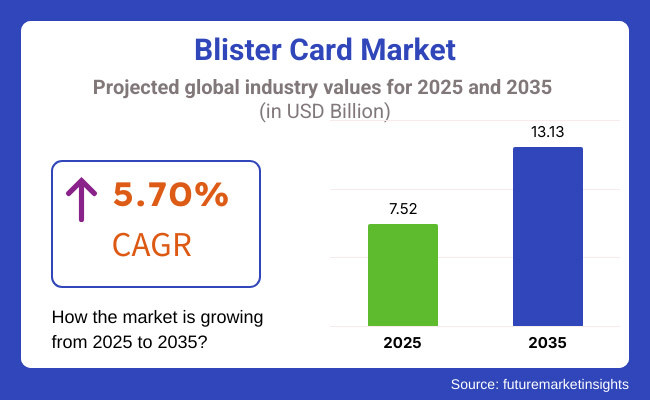

The blister card market is anticipated to be valued at USD 7.52 billion in 2025. It is expected to grow at a CAGR of 5.70% during the forecast period and reach a value of USD 13.13 billion in 2035.

A blister card is a packaging option with a transparent plastic blister welded onto a printed cardboard backing, utilized for safely showcasing and safeguarding pharmaceuticals, electronics, toys, and personal care items. It provides greater product visibility, brand awareness, and security from contamination, theft, and damage, improving shelf life in retail outlets.

Growth in the market for blister cards is induced by the increasing need for tamper-proof packaging of drugs, guaranteeing product safety and regulatory compliance, and growing retail markets, which demand inexpensive, light, and attractive packaging. These factors contribute to increased adoption, enhancing product security, branding, and extended shelf life in various industries.

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The industry expanded with rising demand in the pharmaceutical, consumer electronics, and retail sectors where this packaging was necessary to guard products, beautify displays, and reinforce brands. | While demand will remain high, it will increasingly focus on sustainable and recyclable materials and demand a large variety of fiber-based and biodegradable materials. |

| Plastic-based solutions remained most sought after because they were inexpensive, durable, and provided safe, tamper-proof protection for fragile items. | Traditional plastic blister packaging will decline as laws prompt the quest for eco-friendly options, meaning higher use of paperboard-based and compostable materials for blister packaging. |

| Branding and beauty played a critical role in consumer purchasing decisions, with firms paying for quality prints and artistic work. | Packaging innovation will be focused on sustainability and interactivity, with companies integrating smart packaging technologies and QR codes to improve consumer engagement. |

| Regulatory measures regarding plastic waste and recycling were on the rise but not strictly applied, resulting in a gradual transition towards sustainable packaging. | Government policies will tighten, imposing extended producer responsibility (EPR) rules and demanding increased recyclability and lower plastic content. |

| The pharmaceutical industry was a key driver of demand for blister cards, driven by the need for secure, tamper-evident, and single-dose packaging solutions. | Medication blister packaging will remain a need but will face a shift in the direction of eco-friendly blister packs that can be recycled and biodegraded to align with global sustainability practices. |

| The development of e-commerce generated increased need for protective and safe blister packaging, which ensured product safety in transit. | E-commerce packaging will feature more environmentally friendly solutions, with companies exploring compostable blister packs and reusable packaging systems to minimize waste. |

| Cost was the overriding consideration in material choice, with most producers favoring cost over sustainability. | Sustainable blister cards will become increasingly cost-competitive as material technology innovations and more regulatory pressure to eliminate non-recyclable plastics come into place. |

| Recycling was still problematic owing to the mix of materials in conventional packages, which complicated separation and processing. | Circular economy models will drive innovation, with new designs allowing for effortless separation of materials, increasing recycling efficiency, and facilitating closed-loop production systems. |

Eco-Conscious and Smart Packaging Transforming the Market

The market is changing fast with brands focusing on sustainability and intelligent packaging solutions. Brands actively substitute conventional plastic with biodegradable materials, recycled paperboard, and plant-based coatings to cater to increasing eco-friendly demands. Consumers are looking for blister cards that use less plastic, easy recycling and compostable material, and businesses have been using alternative packaging solutions.

Interactive technologies like QR codes, NFC tags, and augmented reality are creating broader consumer engagement opportunities through interactive product information, digital loyalty programs, and authenticity verification. All these diminish the environmental footprint and give brands competitive advantage in an environmentally driven marketplace.

Personalization and High-Impact Design Driving Consumer Appeal

Customization and impactful visuals transform the market with brands concentrating on building consumer experience with design innovation. Brands add dramatic graphics, embossed finishes, and holographic effects to deliver visually dramatic packaging that is impossible to ignore.

Personalization continues to escalate with brands able to customize packaging with localized messaging, special color treatments, and sole limited-edition designs. Companies also test ergonomic blister designs for convenient access and enhanced functionality, providing both beauty and convenience to users. Through the integration of creativity with consumer-oriented design, companies reinforce their market positions and create stronger customer relationships.

| Attributes | Details |

|---|---|

| Top End-use Industry | Pharmaceuticals |

| Market Share in 2025 | 40.1% |

The market is heavily dominated by the pharmaceutical industry, which is expected to hold a 40.1% market share in 2025. The growing need for unit-dose packaging, tamper-evident solutions, and longer shelf life is stimulating the use of blister cards. Stringent regulatory requirements also contribute to their utilization in prescription as well as over-the-counter medications.

Pharmaceutical manufacturers prefer blister card packaging due to its cost-saving, patient compliance advantages, and contamination protection. Advances in child-resistant, elderly-friendly, and environmentally friendly blister packs are also driving demand further. The growth in self-medication patterns and e-pharmacies is also driving demand for safe and informative packaging solutions, further solidifying the dominance of the segment.

According to FMI research, the sector is dominated by two major types of products: clamshell and carded packaging. Clamshell packs are preferred for their durability, excellent visibility of the product, and strong sealing characteristics. Clamshell packaging serves the purpose of electronic goods, consumer goods, and retail packaging applications, protecting against tampering and external damage.

Carded packs find a wider spectrum of uses in pharmaceuticals, personal care, and food products. They offer cost-effective and lightweight solutions while being customizable, making them suitable for unit-dose medication and small consumer products. Greater branding potential and environmentally friendly designs have also increased their demand, especially in sustainable and recycling-based packaging trends.

The industry is driven by two key technologies: cold forming and thermoforming. Cold forming is considered the best-forming technology in terms of barrier properties against moisture, oxygen, and light. Therefore, sensitive medicines have a longer shelf life but at a higher cost. Unfortunately, limited design flexibility accompanies it.

Thermoforming is also very popular and, of course, cost-effective and versatile in design. It's the most common method among pharmaceuticals, consumer goods, and food packaging industries. Its transparency permits clear visibility of the product, is lightweight, and facilitates easy adaptation to changing requirements; hence the most preferred for high-volume production which requires efficiency in material.

| Country | CAGR |

|---|---|

| India | 7.9% |

| China | 7.3% |

| Germany | 6.5% |

| Australia | 5.9% |

| USA | 5.6% |

| India | 7.9% |

India to Lead the Market with Strong Growth

India is expanding rapidly, driven by the booming pharmaceutical sector and increasing demand for secure and tamper-proof packaging. The country’s growing healthcare infrastructure, rising chronic disease cases, and government initiatives to regulate packaging standards are major drivers boosting the demand for blister card packaging at a 7.9% CAGR.

The rise of eCommerce and organized retail in India is further accelerating market growth, as brands require visually appealing and durable packaging. Additionally, sustainability trends are influencing manufacturers to adopt eco-friendly and recyclable blister cards, aligning with India's environmental policies and consumer preferences for sustainable packaging solutions.

China’s Market to Benefit from Pharmaceutical and Consumer Goods Growth

China’s rapid urbanization and growing pharmaceutical industry are key factors driving the market, which is expected to grow at a 7.3% CAGR. The increasing demand for over-the-counter (OTC) drugs, dietary supplements, and personal care products is pushing manufacturers to invest in high-quality blister packaging to ensure product safety and extended shelf life.

The growth of China’s eCommerce sector is driving demand for packaging that offers durability and tamper resistance for shipped products. Government regulations on product safety and anti-counterfeiting measures are also pushing businesses to adopt innovative solutions, strengthening China’s position in the market.

Germany Expand with Sustainable Packaging Innovations

Germany is growing at a 6.5% CAGR, driven by the country’s strong pharmaceutical and medical device industries. With stringent regulations for safe and tamper-evident packaging, pharmaceutical companies are increasingly adopting blister packaging to meet compliance standards while ensuring consumer protection.

Sustainability is a major driver, as Germany leads in eco-friendly packaging innovations. The push for recyclable and biodegradable blister cards is transforming the market, with companies investing in sustainable materials to reduce plastic waste. Additionally, the expansion of the cosmetics and consumer electronics sectors is further fueling demand for packaging.

Australia Driven by Healthcare and Retail Demand

Australia is experiencing steady growth at a 5.9% CAGR, fueled by rising healthcare awareness and an aging population. The demand for secure and user-friendly pharmaceutical packaging is increasing, prompting pharmaceutical companies to adopt for better medication management and dosage accuracy.

Additionally, the retail and FMCG (Fast-Moving Consumer Goods) sectors are driving the demand for blister packaging. The growing preference for convenient and visually appealing packaging in supermarkets and pharmacies is encouraging manufacturers to innovate. The shift toward sustainable materials are also gaining traction, in line with Australia's environmental regulations.

The USA Witness Growth with Regulatory and Retail Developments

The USA is seeing increased demand in packaging due to strict FDA regulations for pharmaceutical packaging. The market is expected to grow at a 5.6% CAGR, driven by rising consumption of prescription and OTC drugs, along with growing concerns about child-resistant and senior-friendly packaging.

Additionally, the expansion of eCommerce and retail industries is accelerating demand for secure and tamper-proof packaging. Blister cards are widely used in consumer electronics, personal care products, and small hardware items. Sustainability initiatives are also pushing manufacturers to develop recyclable blister packaging, aligning with the USA focus on eco-friendly solutions.

The blister card industry is fragmented. Leading companies such as Amcor, Berry Global, and Sealed Air dominate the sector, offering diverse packaging solutions across various industries. These firms continuously innovate, focusing on sustainable materials and advanced technologies to meet evolving consumer demands.

The pharmaceutical industry plays a major role in driving demand, using transparent packaging designs that display detailed drug information for informed consumers. Similarly, the electronics sector relies on this packaging for small components like USB drives, ensuring protection and visibility.

Sustainability trends are shaping the market, with companies adopting eco-friendly materials and production methods. For example, Teijin introduced Tesliner, a thin, flexible material that provides a lightweight and user-friendly packaging solution.

Despite market fragmentation, leading players maintain their positions through continuous innovation, strategic partnerships, and responsiveness to consumer demands. The focus on sustainability and advanced packaging solutions indicates a dynamic and evolving industry landscape.

The blister card market is expanding due to rising demand for effective packaging solutions across various industries. This growth is driven by the need for secure and visually appealing packaging that enhances product visibility and consumer trust.

Sustainability concerns are prompting manufacturers to adopt eco-friendly materials and innovative designs. Companies are increasingly using recycled materials and incorporating features like QR codes and RFID tags to improve product tracking and reduce environmental impact.

The market is highly competitive, featuring key players such as Amcor, Berry Global, Sealed Air, and Teijin. These companies focus on technological advancements and strategic partnerships to maintain their market positions and meet evolving consumer demands.

The market continues to evolve as companies focus on cost efficiency, durability, and consumer convenience. Customization and branding play a crucial role in attracting buyers, leading manufacturers to offer visually appealing and functional packaging solutions. The growing emphasis on anti-counterfeiting measures also influences design choices, ensuring product authenticity and security.

The market is anticipated to reach USD 7.52 billion in 2025 and grow to USD 13.13 billion by 2035.

The future prospects of product sales are strong, driven by increasing demand for tamper-proof packaging, sustainability trends, and expanding retail sectors.

Key product manufacturers include Amcor, Berry Global, Sealed Air, Teijin, Rohrer Corp, and SupplyOne, Inc.

The Asia-Pacific region, particularly India and China, is expected to generate lucrative opportunities for market players due to rapid industrialization and a growing pharmaceutical sector.

The market is segmented by product type into clamshell and carded.

Based on the technology type, the market is segmented into cold forming technology and thermoforming technology.

The market are categories based on material type, including plastic, aluminum, paper & paperboard, and others.

Based on end-use industry, the market is segmented into food, pharmaceuticals, veterinary & nutraceuticals, medical devices, electronics & electricals, industrial goods, and consumer goods.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Specialty Pulp and Paper Chemicals Market Analysis – Growth & Forecast 2025 to 2035

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

PVC Packing Straps Market Report – Key Trends & Forecast 2025 to 2035

Reusable Packing Market Analysis – Size, Share & Forecast 2025 to 2035

Poultry Packaging Market Insights - Trends & Future Outlook 2025 to 2035

Polystyrene Packaging Market Analysis - Size & Growth Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.