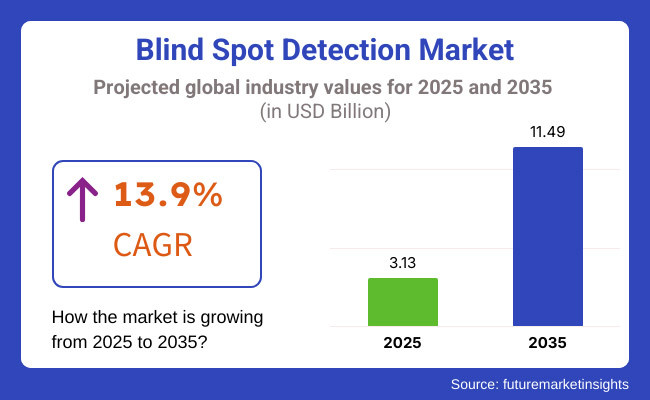

The blind spot detection market is set to witness robust growth between 2025 and 2035, driven by increasing demand for advanced driver assistance systems (ADAS), rising vehicle safety regulations, and growing adoption of autonomous driving technologies. The market is projected to reach USD 3.13 billion in 2025 and expand to USD 11.49 billion by 2035, reflecting a compound annual growth rate (CAGR) of 13.9% over the forecast period.

Market growth is triggered due to the heightened emphasis on road safety, reduction in traffic accidents, and the integration of drive sensor technology with AI. Blind spot detection systems are increasingly available as standard equipment in passenger cars, commercial vehicles, and luxury automobiles, improving overall vehicle safety and driving performance.

As for technological innovations like radar-based detection, sensor fusion methods and camera-enabled monitoring, they widely enhance the accuracy of cloaked field detection. Furthermore, increasing adoption of strict regulations for the safety by governments is pushing the automotive manufacturers adopt these systems.

However, sounds high implementation cost, complex sensor calibration developing, and threats of cyber security act as a barrier to the market growth. To overcome these obstacles and make these& systems more reliable remains, many players in the industry are focusing on RD, strategic partnerships, and innovations in the area of artificial intelligence.

Explore FMI!

Book a free demo

North America has a substantial blind spot detection market share owing to rising road safety concerns and strict vehicle safety regulations in the USA The demand for blind spot detection systems in North America is driven by the increasing adoption of advanced driver assistance systems (ADAS). The two North American giants are at the forefront of this technology, with leading carmakers embedding blind spot detection systems into upcoming models.

Also, the increasing awareness among consumers regarding accident prevention, along with government initiatives for the promotion of vehicle safety standards, has further the growth of the market. Moreover, market growth is driven by the growth of electric vehicle (EV) market and autonomous driving technologies. However, challenges like high implementation costs and the risk of cyber security threats in connected vehicle systems are anticipated to restrain the adoption. To improve system efficiency and reliability, companies are investing in AI-powered sensors and radar technologies as well as integrated vehicles.

Europe is a significant market for blind spot detection systems, driven by stringent safety regulations and the increasing adoption of premium vehicles in countries such as Germany, France, and the United Kingdom. The growth of market players and automotive safety technology also accelerates market expansion.

The EU also has very strict laws in terms of vehicle safety and emissions, spurring manufacturers to add in more modern technologies, such as blind spot detection. Growing consumer demand for luxury and high-performance vehicles further Pacific proliferation in the market. Despite challenges such as complex integration processes and differing regulations across nations that could hinder widespread adoption. As the standards for safety evolve, companies are prioritizing advancements in AI-powered detection systems, improved integration of cameras and radars and more economical systems.

Asia-Pacific is expected to be the region that grows the most in the blind spot detection market, as the growth of the region can be contributions for the rapid urbanization, increased vehicle sales, and the government mandates for vehicle safety features in countries like China, Japan, South Korea, and India. The need for passenger and commercial vehicles with ADAS functions is accelerating as safety considerations increase and technology advances.

Adding to this, the growth of the automotive manufacturing industry, along with the growing penetration of smart vehicles is further contributing to the market growth. Nonetheless, the high price of the advanced safety suites and limited consumer understanding in some developing markets could affect adoption. Manufacturers are adopting more affordable radar and sensor technologies, business partnerships with automakers, and AI-based safety solutions to boost market penetration and increase automotive safety standards.

Challenges

High Cost of Implementation

High costs pertaining to the integration of sensor technologies, radar, and camera systems, are one of the primary challenges challenging the growth of the blind sport detection market. This poses a challenge for budget and mid-range vehicle manufacturers to include these systems economically, preventing widespread adoption of this technology.

Accuracy and False Alerts

To avoid false alerts from these systems, it is essential for the system to have extremely high accuracy or else they risk frustrating the driver and losing their trust on the system. Ensuring reliable detection upon the variations of environmental conditions, limitations of sensor and interference to external factors are difficult.

Opportunities

Advancements in AI and Sensor Technology

Article ContentAI and machine learning on board ABBAS Systems previously introduced the opportunity to highlight how new technologies from electronics and software backgrounds would impact USB integration with the vehicle (USB integration for Added-Value Applications). Advanced sensor fusion techniques that incorporate radar, LiDAR, and cameras could improve system performance.

Rising Demand for Advanced Driver Assistance Systems (ADAS)

The need for advanced blind spot detection systems is increasing with greater emphasis on vehicle safety as well as regulatory requirements for advanced driver assistance systems. This opens an opportunity for automakers and technology providers to take advantage of the trend by producing cost-effective and high-precision detection solutions.

The blind spot detection market was huge between 2020 and 2024 due to the factors such as increased safety consciousness among individuals and increased integration of ADAS in automobiles. But in entry-level vehicles, adoption slowed due to high costs and sensor limitations.

From 2025 to 2035, the market will benefit from innovations in AI-powered detection, 360-degree sensor coverage, and integration with autonomous driving technologies. Incidents of road accidents and fatalities are critical issues in various economies, prompting governments and legislative bodies to consolidate vehicular safety through regulations regarding mandatory safety features and wireless communication between vehicles (V2X), which are expected to further escalate the market penetration.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Increasing safety regulations encouraging ADAS adoption |

| Technological Advancements | Basic radar and camera-based detection |

| Industry Adoption | Primarily in premium and high-end vehicles |

| Supply Chain and Sourcing | Dependence on standalone sensor systems |

| Market Competition | Dominated by leading automotive tech firms |

| Market Growth Drivers | Rising consumer awareness and safety demand |

| Sustainability and Energy Efficiency | Focus on low-power sensor solutions |

| Consumer Preferences | Preference for safety features in premium models |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter mandates for blind spot detection in all vehicle categories |

| Technological Advancements | AI-powered multi-sensor fusion, LiDAR integration, and V2X connectivity |

| Industry Adoption | Expansion into mid-range and budget vehicles due to cost reductions |

| Supply Chain and Sourcing | Increased use of integrated ADAS platforms for comprehensive safety solutions |

| Market Competition | Growth of new entrants offering AI-driven, cost-effective solutions |

| Market Growth Drivers | Full-scale integration of ADAS and autonomous driving support features |

| Sustainability and Energy Efficiency | Development of energy-efficient, eco-friendly detection systems |

| Consumer Preferences | Demand for affordable, high-accuracy detection in all vehicle segments |

Major USA markets consideration wonderful growth for blind spot detection market due to increasing adoption of advanced driver-assistance systems (ADAS) technology and government regulations on vehicle safety. Government regulations, such as the requirement for new vehicle models to be equipped with several safety features including blind spot monitoring, are driving the growth of this market as well; National Highway Traffic Safety Administration (NHTSA) Growing awareness among consumers pertaining to road safety along with the rise in demand for semi-autonomous and fully autonomous vehicles is also spurring the adoption of blind spot detection systems. Moreover, the growth of top automotive manufacturers and technology pioneers simultaneously fuels the ongoing development of technology including AI-based detection and radar monitoring.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 13.7% |

The blind spot detection systems market in the United Kingdom is mainly being governed by the government based initiatives to reduce road accident rates and enhance vehicle safety standards. The increasing penetration of luxury and premium vehicles fitted with ADAS features has also provided a significant push to market demand.

The growth is also supported by a rising preference among consumers for electric and hybrid motor vehicles, most of which are equipped with pre-installed safety features such as lane re-departure warnings and blind spot monitoring. The growing focus on smart city initiatives and connected mobility also opens doors for AI-powered advanced safety systems, such as blind spot detection.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 13.2% |

The blind spot detection market holds a significant share for the European Union, being further propelled upward by the increasing deployment of the intelligent transportation system along with strict safety regulations (enforced by European Commission). Several Germany, France, and Italy are the leading innovating countries, where prominent automotive companies are incorporating advanced sensor-based safety technologies in the fleet of their vehicles. The effective focus on road safety in the region, along with the growing consumer inclination toward vehicles having better protective features, is growing the market. The growth trajectory of the market is also attributed to the advent of connected car technology and the shift towards autonomous driving solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 13.5% |

The demand for blind spot detection systems in Japan is also on the rise because of the country's major focus on safety, advanced technology, and the push for autonomous driving. The presence of prominent car manufacturers such as of Toyota, Honda, and Nissan, which consistently employ higher-end ADAS capabilities in their vehicles, has also aided market development.

Soaring urban traffic congestion and increasing demand for advanced driver assistance solutions have also been fuelling the demand for blind spot detection systems. This would help in markets growing, also increasing government initiatives for road safety and smart transportation infrastructure.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 13.3% |

The rising adoption of superior safety features by consumers in South Korea and favourable government regulations for achieving improved road safety are the primary drivers for the growth of the blind spot detection system market in this region.

Major OEMs, particularly Hyundai and Kia at this stage in their development, are also adding blind spot monitoring and collision avoidance systems to their new vehicle offerings. Also, the advancement of AI, radar, and LiDAR technologies in vehicles is driving the global vehicle insurance market. India’s investment in smart infrastructure and connected mobility solutions will further drive the adoption of advanced driver-assistance systems in passenger and commercial vehicles.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 13.6% |

The blind spot detection market is experiencing solid growth due to manufacturers and consumers emphasizing vehicle safety, accident prevention and driver assistance systems. This technology improves situational awareness by warning drivers if there are vehicles and objects in their blind spots, contributing to a major reduction in collision risk. Market growth has also been driven by the increasing integration of autonomous driving technologies, stricter road safety regulations, and rising consumer preference for premium vehicle functionalities.

Global government organizations are imposing strict safety regulations, due to which automobile manufacturers are integrating features such as blind spot detection, as a part of advanced driver assistance systems (ADAS) in their vehicle models.

Demand has further picked up with the proliferation of connected vehicles and smart mobility solutions. Moreover, increasing vehicle production, growing consumer spending on automotive safety, and advancements in sensor technologies are all contributing factors to the growth of the blind spot detection market.

Blind spot detection systems encompass multiple technologies, but the radar and camera sensors account for the largest share owing to their high accuracy and reliability under various weather and lighting conditions. Radar sensors use radio waves to identify vehicles or objects in neighbouring lanes, alerting drivers at real time.

With their long-range detection, and high usability in low visibility, they are an integral part of modern vehicle safety systems. Cost-effective, durable, and seamless integration with existing ADAS components have led many automotive manufacturers to employ radar sensors in their vehicle safety systems.

Camera sensors are well above where they were as automakers continue to improve vehicle safety and driver assistance technology. Such sensors allow visual confirmation of objects in blind spots, aiding drivers to make well-informed decisions for lane changes. High-resolution cameras, frequently paired with AI image-processing, improves object detection, lane-departure warning, and traffic sign recognition.

This widespread adoption of 360-degree camera systems and mirrorless vehicles, in conjunction with an increasing preference for camera-based systems for blind spot detection applications, is anticipated to propel demand for camera blind spot detection technologies in the near future. Furthermore, their contributions to automated parking, object detection, and lane-keeping assist functions make them popular for the options they afford in premium and mid-range vehicles.

Ultrasonic, LiDAR, infrared and pressure sensors have been used for blind spot detection, but they mainly serve as complementary technologies. Ultrasonic sensors are widely used in parking assist systems, while LiDAR and infrared sensors are emerging in fully automated driving systems. This trend confirms radar and camera sensors as the main component of modern blind spot detection systems as they continue to dominate the market, as sensor fusion technology advances.

By sales channel, OEMs dominate the blind spot detection market as automotive manufacturers constantly add these safety elements into new car models. While the initial move into blind spot detection came from the premium automotive arena, where luxury and premium vehicles were, and still are, frequently used to improve safety regulations and appeal to consumers, the technology is now emerging throughout all segments of the automotive market, with economy vehicles also incorporating blind spot detection systems to improve customer safety and responsive features in almost all ranges. Most OEMs if not all are seeing at least some form of ADAS package as standard or optional (blind spot monitoring, lane departure warning, rear cross-traffic alerts).

In the transition towards Level 2 and Level 3 autonomous driving capabilities, this has further strengthened the OEM focus on advanced integration of blind spot detection systems. To improve system accuracy and responsiveness, automakers are collaborating with technology providers, sensor makers and A. I. developers. Also, ongoing developments in wireless communication, V2X technology and artificial intelligence (AI) driven decision-making algorithms are empowering OEMs to provide smarter and more efficient blind spot detection systems.

Although OEMs hold a major share of the market, aftermarket will witness a significant growth due to rising use of blind spot detection system in retrofit. As consumers update their vehicle models, aftermarket safety enhancements are rising; auto safety is a top concern, sparking interest in blind spot detection systems.

E-commerce platforms, DIY installation kits, and mobile-based integration solutions have made such systems available to a broader consumer base. Fleet operatives, ride-sharing companies, and commercial vehicle owners are also in a race to retro-fit their fleets with aftermarket blind spot monitoring solutions to enhance driver safety at their varied establishments, enhancing peace of mind while reducing costs of accidents.

With the ever tightening road safety regulations and increasing consumer safety consciousness, the OEM's/ aftermarket suppliers would continue to innovate and widen up their product & services portfolio accordingly. Blind spot detection technology is likely to remain integral to modern res automotive safety systems, with advances in AI algorithms, sensor precision, and vehicle integration.

Market growth of blind spot detection market is rising as a result of rising road safety; better automotive technology has been developed and implemented, and legislations are in place to mandate driver assistance systems. Based on a technology that enhances safety by providing real-time alerts to potential obstacles in the vehicle's blind spots, blind spot detection systems are designed to minimize accidents.

Several sensors, including radar, ultrasonic, and camera-based systems, have contributed to increased accuracy and consequently increased market adoption. The automation and semi-automation of vehicles would also further lead to more innovation and investment in the sector.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Continental AG | 20-25% |

| Bosch | 15-20% |

| Denso Corporation | 10-15% |

| Aptiv | 8-12% |

| Valeo | 5-10% |

| Other Industry Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Continental AG | Provides advanced radar and camera-based blind spot detection systems for passenger and commercial vehicles. |

| Bosch | Offers sensor-based driver assistance solutions, including blind spot monitoring with lane-change assist. |

| Denso Corporation | Specializes in integrated vehicle safety systems, including rear and side obstacle detection. |

| Aptiv | Develops smart detection solutions using AI-powered image recognition for enhanced safety. |

| Valeo | Supplies ultrasonic and radar-based blind spot detection solutions with adaptive warning systems. |

Key Company Insights

Continental AG (20-25%)

Continental AG leads the market with its highly reliable radar-based blind spot detection systems, widely adopted by automakers globally. The company focuses on enhanced safety integration and connected mobility solutions to improve driver awareness and reduce collisions.

Bosch (15-20%)

Bosch is a key player in automotive safety technology, offering advanced sensor-driven blind spot monitoring systems that enhance lane-change safety and collision avoidance capabilities.

Denso Corporation (10-15%)

Denso specializes in comprehensive vehicle safety solutions, including side-impact prevention technologies and rear-vehicle detection, making it a preferred choice for OEMs.

Aptiv (8-12%)

Aptiv is recognized for AI-driven image recognition systems, which enable real-time hazard detection and predictive driver alerts, enhancing vehicle situational awareness.

Value (5-10%)

Value offers ultrasonic and radar-based detection solutions that work in various driving conditions, supporting adaptive safety features for next-generation vehicles.

Other Key Players (30-40% Combined)

Several emerging and established companies are contributing to innovation in blind spot detection technology. Notable players include:

The overall market size for the blind spot detection market was USD 3.13 billion in 2025.

The blind spot detection market is expected to reach USD 11.49 billion in 2035.

The blind spot detection market is expected to grow at a CAGR of 13.9% during the forecast period.

The demand for the blind spot detection market will be driven by increasing concerns about road safety, rising adoption of advanced driver assistance systems (ADAS), growing vehicle automation trends, stringent government regulations for vehicle safety, and technological advancements in sensor and radar technologies.

The top five countries driving the development of the blind spot detection market are the USA, Germany, China, Japan, and South Korea.

GCC Electric Golf Cart Market Growth - Trends & Forecast 2025 to 2035

ASEAN Electric Golf Cart Market Growth - Trends & Forecast 2025 to 2035

Japan Electric Golf Cart Market Growth - Trends & Forecast 2025 to 2035

Sales of Used Bikes through Bike Marketplaces Market- Growth & Demand 2025 to 2035

Engine Tuner Market - Growth & Demand 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.