The bleeding control tablets industry is valued at USD 5.47 billion in 2025. As per FMI's analysis, the bleeding control tablets will grow at a CAGR of 4.6% and reach USD 8.57 billion by 2035. Owing to the increasing need for emergency and surgical bleeding control for patients with limited access to advanced medical interventions, the industry has garnered significant attention.

In 2024, there was notable developments in the bleeding control tablets sector. This happened because of new products coming out, approvals from regulators, and increased demand from healthcare providers and patients.

One of the important events was when Toagosei Co., Ltd. introduced a special agent that helps stop bleeding, specifically for dental procedures. This event showed that companies are making products that meet specific medical needs.

The need for bleeding control tablets is anticipated to grow as healthcare systems all over the world remain committed to advancing sustainable interventions and providing effortless solutions. In addition, broader accessibility to these tablets due to improvements in terms of their effectiveness, side effects, and proper formulation is projected to drive their growth in the sector.

Key Market Insights

| Metric | Key Insights |

|---|---|

| Industry Size (2025E) | USD 5.47 billion |

| Industry Size (2035F) | USD 8.57 billion |

| CAGR (2025 to 2035) | 4.6% |

Explore FMI!

Book a free demo

The market for haemorrhage control tablets is anticipated to grow in a steady manner as the need for convenient and effective solutions for controlling trauma and surgical bleeding persists.

Novartis launched a new AI-based product whose applications across industries go beyond just medicines, and a trend towards niche hemostatic products points to excellent prospects for innovative pharmaceutical companies. On the contrary, industries that adapt to new technologies and regulatory standards risk losing industry share once the sector gets saturated.

Invest in Product Innovation and AI Integration

Executives should focus investment on research and development of bleeding control tablets with cutting-edge technologies such as artificial intelligence, predictive analytics, and personalized treatment. These technologies will enhance product effectiveness and make the company a leader in a competitive sector.

Align with Regulatory Changes and Market Needs

Target leading the way in anticipating changing regulatory requirements and sector demand, especially in growing segments where trauma and surgical services are increasing. Ensure products comply with new health regulations as well as meet unmet medical needs like complex treatments for bleeding disorders.

Strategic Partnerships and M&A for Growth

Form strategic alliances or engage in mergers and acquisitions with firms selling complementary technologies or gaining new distribution channels. This will strengthen the company's ability to scale, enhance its product line, and extend into high-growth geographies or niches within the bleeding control sector.

| Risk | Probability & Impact |

| Regulatory Delays and Changes | High Probability - High Impact |

| Technological Obsolescence | Medium Probability - High Impact |

| Supply Chain Disruptions | Medium Probability - Medium Impact |

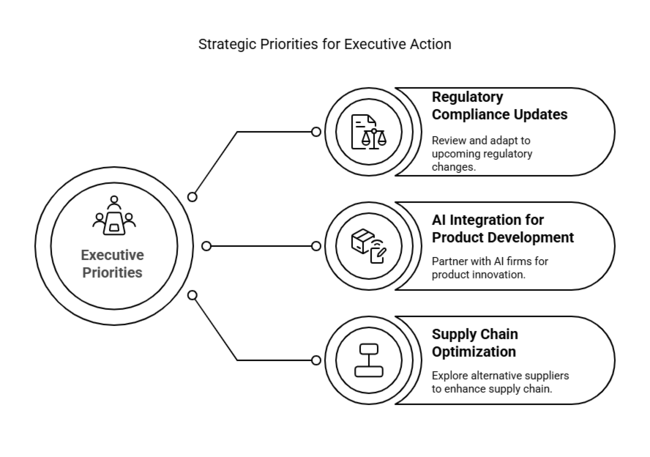

| Priority | Immediate Action |

|---|---|

| Regulatory Compliance Updates | Conduct a thorough review of upcoming regulatory changes and adjust product development accordingly. |

| AI Integration for Product Development | Initiate partnerships with AI tech firms to integrate predictive analytics and machine learning into bleeding control tablets. |

| Supply Chain Optimization | Run a feasibility study on alternative suppliers for key raw materials to mitigate supply chain risks. |

To stay ahead in the company and remain at the forefront of the fast-changing sector for bleeding control tablets, the customer ought to make investments in AI-based technology and tailored treatment options, along with coordinating product innovation with shifting regulatory requirements.

With a continued emphasis on next-generation technology, the company will outshine competition and respond to increased demand for tailored solutions across trauma and surgery. The client also needs to strengthen alliances with the regulatory authorities, increase R&D for future-gen formulations, and streamline their supply chain to promote scalability.

| Countries | Impact of Policies and Government Regulations |

|---|---|

| United States |

|

| European Union |

|

| Japan |

|

| South Korea |

|

The bleeding control tablet sector in the USA is projected to grow at a robust rate of 5.2% compound annual growth rate (CAGR) in the forecast period of 2025 to 2035, owing to technological advancements and increasing trauma-related incidents, along with growing awareness pertaining to emergency care.

The USA has made tremendous strides in the development of its healthcare system, achieving high-quality standards and the use of advanced medical technologies and devices, such as bleeding control solutions that incorporate AI and IoT to elevate functionality in trauma care. While the rigorous FDA approvals and regulatory pathways might seem daunting, they actually serve to reinforce sector trust with their focus on safety and efficacy.

The UK bleeding control tablets sector is projected to grow at a CAGR of 4.3% from 2025 to 2035. The sector in the UK means that new players attempting to enter this space may need to concentrate first on gaining traction with the NHS or the wider healthcare system to fuel demand for their products; however, depending on the type of bleeding control solution the company is offering, they may also benefit from demand in emergency or surgical settings within the NHS.

These products must be approved by the Medicines and Healthcare Products Regulatory Agency, and as of Brexit, companies must follow both UK and international standards to achieve regulatory approval.

The bleeding control tablet sector in France is expected to grow with a 4.7% CAGR in the forecast period of 2025 to 2035. With its robust healthcare system and the government's focus on enhancing immediate patient treatment through emergency prehospital environments, France has emerged as a major market for bleeding control products.

France’s health system is among the largest in Europe, and it has a focused emphasis on trauma care, especially in rural areas, where access to emergency services can be limited. France's regulatory framework closely follows the European Union's Medical Device Regulations (MDR), and manufacturers seeking industry access must meet these rigorous standards.

Germany is estimated to see 5.0% revenue growth in the bleeding control tablets sector between 2025 and 2035, and it is one of the largest healthcare sectors in Europe. Germany is among the top sectors for bleeding control tablets, due to the country’s strong healthcare system with high standards and advanced emergency medical care infrastructure.

Products should follow EU Medical Device Regulations (MDR) and must be CE-marked prior to reaching the sector, as there are strict regulatory requirements in Germany. The country is also witnessing the growing use of bleeding control solutions that are easy to carry, store, and administer by hospital staff in new emergency medical settings.

The Italian bleeding control tablets are expected to grow at a healthy CAGR of 4.0% during 2025 to 2035. One of the most robust healthcare systems, Italy has been at the forefront of technological advancements in the field of medicine, including blood clotting. Essentially, Italy has a whole variety of hospitals that are well-integrated and can act as a rapid response to any emergency scenario in the country.

Italy’s regulatory environment operates under the existing EU framework, via the MDR, and is subject to CE marking compliance. The sector is also seeking low-cost alternatives, as the Italian government aims to control spending on healthcare services for the expanding elderly population.

The South Korean bleeding control tablets sector is expected to grow at a CAGR of 4.5% during the period 2025 to 2035, driven by the demand for advanced medical technologies and high standards in healthcare.

South Korea is paving the path towards adopting smart medical solutions such as IoT-enabled devices and digital health technologies, thus making it a promising business potential for bleeding control tablets installed with advanced technologies such as sensors and real-time monitoring. South Korea has a stringent regulatory landscape, where all medical products must obtain approval from the Korea Food and Drug Administration (KFDA).

The Japan bleeding control tablets sector is expected to be growing at a CAGR of 3.8% during the next decade, owing to moderate but active development of the bleeding control tablets sectors in Japan during 2025 to 2035. In Japan, the reasons for the above concerns regarding bleeding control products are mostly based on the emphasis on their efficiency, reliability, and usability for both emergency and long-term care.

Japan’s government is building healthcare infrastructure, focusing on trauma and emergency care, yet the market is very sensitive to cost based on the emphasis on economic efficiency.

China's bleeding control tablets sector revenue is expected to grow at a CAGR of 6.5% during 2025 to 2035 owing to rapid healthcare modernization, increasing healthcare expenditure, and rising awareness regarding trauma care. Large diverse country with diverse healthcare needs, this presents a tremendous opportunity for bleeding control tablet manufacturers.

China has to improve its regulatory environment to be more transparent and efficient, with its National Medical Products Administration (NMPA) now responsible for the regulation of medical products. The approval process in China can take a long time, but the country is adopting international standards more quickly, which should facilitate industry access for global manufacturers.

The sector for bleeding control tablets in Australia and New Zealand is expected to grow at a 5.5% CAGR from 2025 to 2035, benefiting from the high standards of medical care in these countries, as well as their excellent healthcare infrastructure and rising demand for trauma care solutions.

Australia and New Zealand boast robust health systems and focus on emergency response and trauma care, which is an environment highly conducive to the adoption of bleeding control tablets.

These countries have similar regulatory landscapes, with regulatory standards for medical products that require rigorous review and approval processes through agencies such as the Therapeutic Goods Administration (TGA) in Australia and Medsafe in New Zealand.

The India bleeding control tablets sector is expected to grow at a promising CAGR of 7% between 2025 and 2035 due to shifts in the emergency care framework across India, rising rates of trauma across the region, and improving healthcare infrastructure in the country.

Bleeding control tablets are a prime example of the new medical solutions needed in India, as the country gets modernized in healthcare and more effective predictive health analytics, drug discovery, precision supply chain technologies for hospitals. The Center Drugs Standard Control Organization (CDSCO) is the authority for medical product approvals.

Excessive menstrual bleeding, or menorrhagia, is anticipated at the CAGR of 6.5% to emerge as the most profitable segment in the bleeding control component tablets market throughout the period of 2025 to 2035.

Increasing awareness surrounding women's health concerns is leading to more women being diagnosed and treated for menorrhagia, further driving the demand for effective solutions for superior management of bleeding since this condition is manageable.

There is a global trend in this direction away from traditional bleeding control therapies, including hormone treatments and intrauterine devices (IUD), or surgical procedures.

Online Pharmacies segment is anticipated to be the most lucrative for the bleeding control tablets segment at the CAGR of 7.0% from 2025 to 2035. There is tremendous growth in the e-pharmacy sector, fueled mainly by a change in consumer purchasing behavior, more convenience in online shopping, and a growing trend of e-commerce in the healthcare sector.

This should come as no surprise, as consumers are increasingly turning to online pharmacies for the convenience of being able to place an order from home, the availability of a broader range of products, and products delivered to their home.

The leading companies operating in the bleeding control tablets segment are adopting several growth strategies to sustain the competition. Such strategies are almost exclusively centered around innovation, partnerships, pricing, and geographic reach.

Key stakeholders in the ecosystem are investing major resources in research and development (R&D) to formulate innovative compositions with better effectiveness, quick actions, and better patient outcomes. Beyond innovation and partnerships, companies are using aggressive pricing strategies to gain industry share.

Bleeding control tablets are mainly used to treat menorrhagia, hemophilia, and dysfunctional uterine bleeding.

Hospitals, specialty clinics, retail pharmacies, drug stores, and online pharmacies are the primary users of bleeding control tablets.

Geographies such as North America, Europe, East Asia, and South Asia exhibit different degrees of demand, with high growth observed in North America and Europe.

The drivers are rising awareness of bleeding disorders, rising trend for non-surgical treatments, and innovations in drug formulations.

Regulatory policies in various nations provide safety and efficacy levels for the manufacture, supply, and pricing of bleeding control tablets.

The industry is segmented into Menorrhagia, Hemophilia, Dysfunctional Uterine Bleeding, Others

The industry is segmented into Hospitals, Specialty Clinics, Retail Pharmacies, Drug Stores, Online Pharmacies

The industry is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, The Middle East & Africa

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Analysis by Product, Testing Methods, End User, and Region - Forecast for 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Cardiovascular Diagnostics Market Report- Trends & Innovations 2025 to 2035

Prostate-Specific Antigen Testing Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.