The global blackout fabric market is likely to register substantial growth from 2025 to 2035, driven the growing inclination for energy-efficient and eco-friendly window treatment products, rapid uptake of smart home technologies, and favourable commercial applications.

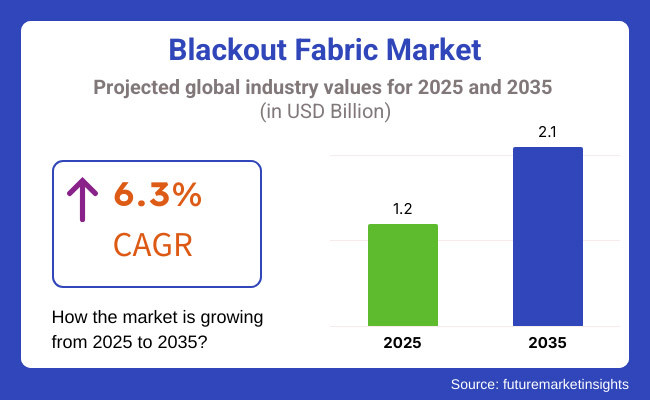

The market is estimated to be USD 1.2 Billion in 2025 and is projected to reach USD 2.1 Billion in 2035, growing at a CAGR of 6.3% through the forecast period. Awareness regarding energy saving, climate control in residential and commercial environments is the significant growth driving factor in the market.

Furthermore, the integration of blackout fabrics with motorized and automated window treatments is acting as a major growth inducing factor. Moreover, blackout fabrics are gaining recognition in the hospitality and healthcare sectors for their ability to improve privacy, reduce ambient noise, and control interior light levels.

Yet, issues like volatility in raw material prices and environmental effects related to synthetic fabric disposal could restrict market growth. To overcome these problems, the manufacturers are focusing on black out fabric solution which is eco-friendly and sustainable.

Explore FMI!

Book a free demo

North America is expected to remain the largest blackout fabric market segment, driven by the increasing demand for energy-saving and light blocking window covering solutions. Adoption of smart shading solutions is increasing in the USA and Canada, particularly in urban residential and commercial buildings.

The region’s strong focus on sustainability has prompted the introduction of eco-friendly blackout fabrics, which are made using recycled materials. Also, the rising emphasis on guest comfort in the hospitality sector is driving the demand for luxury blackout curtains and drapes in hotels and resorts.

Europe accounted for a significant share of the blackout fabrics market, as Germany, the UK, and France are some of the energy-efficient home improvement solution adoption countries. The European Union’s strict energy conservation laws are prompting the use of insulating blackout fabrics, which help reduce heating and cooling expenses.

Furthermore, the growing need for noise suppression and fire-resistant blackout materials in commercial centers is expected to propel the market growth. Another factor driving the increasing popularity of blackout blinds and curtains in the region is the rise of minimalist and sustainable interior design trends.

The blackout fabric market in the Asia-Pacific region is expected to grow at a faster rate due to swift urbanization, rising incomes, and a rising awareness of home automation solutions. Blackout fabric demand is on the rise, and China, Japan, and India are in the lead in the adoption of blackout fabrics due to increasing need for energy-effective window treatments and development of hospitality and real estate sectors.

The growing popularity of home offices and remote working is also driving demand for blackout curtains that enhance indoor lighting control.

Challenge

High Cost of Advanced Blackout Fabrics

High cost of advanced and sustainable fabric materials One of the most significant challenges in the blackout fabric market is the high cost involved with advanced and sustainable fabric materials. Premium blackout fabrics provide superior light privacy, energy efficiency, and noise reduction but their higher price point may restrict adoption in cost-sensitive markets.

The manufacturing of fire-retardant and UV-resistant blackout fabrics employs specialized materials and processes, further increasing manufacturing costs overall. Now manufacturers are working on optimizing production techniques and using alternative materials, to finally bring blackout fabrics to more consumers.

Opportunity

Innovation in Smart and Sustainable Blackout Fabrics

The growing smart home technologies trend in modern homes creates space for innovation opportunity in blackout fabric market. Over the years, tech-savvy consumers have been pursuing fabrics mentioned above, backed by motorized window treatment features, remote-controlled blinds, and AI-enabled solutions for intelligent shading. Eco-friendly blackout fabrics are also emerging on the markets as some health and environmentally friendly consumers are looking for options made from organic cotton, bamboo and recycled polyester.

There are also antimicrobial and hypoallergenic blackout fabrics in development, specifically aimed at the healthcare and hospitality sectors. The smart blackout fabric solution market is expected to grow at a strong pace over the next 10 years, owing to sustainability and convenience are two of the biggest drivers for consumer preference.

Between the year 2020 and 2024, the gradual growth of the Blackout Fabric Market can be attributed collectively to the increasing need for energy saving window treatments among growing demands as well as growing uptake in households and offices along with expanding home décor trends.

Increasing awareness regarding thermal insulation, protection against UV radiation, and sound absorption properties, all contributed towards the sale of blackout curtains, blinds, and drapes. Consumers preferred blackout fabrics that are fire-resistant, antimicrobial, and environmentally friendly, while smart motorized blackout shades emerged as go-to products for smart home integrations.

However, the growth of the market was impeded by high-cost raw materials, inability to have a large recycling base, and interruption of supply chains.

By 2025 to 2035 the market will be transformed with AI-driven smart shading systems, sustainable textile innovations, and self-cleaning blackout materials. Innovations such as IoT-enabled automated blinds, solar-reflective blackout fabrics, and nanotechnology-enhanced thermal insulation are sure to drive growth.

Sustainability will be critical, with manufacturers moving toward biodegradable, recycled polyester, and carbon-neutral blackout textiles. Moreover, smart cities, along with energy-efficient buildings and climate-adaptive window treatments, will also influence trends in the market, and consumers will widely adopt adaptive blackout fabrics with dynamic light filtration properties.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with fire safety, energy efficiency, and indoor air quality standards. |

| Material Innovation | Use of polyester, cotton blends, and PVC-coated blackout fabrics for enhanced insulation. |

| Industry Adoption | Increased use in residential spaces, hotels, theatres, and office buildings. |

| Smart & Connected Fabrics | Growing demand for motorized blackout blinds and remote-controlled window treatments. |

| Market Competition | Dominated by home décor brands, textile manufacturers, and energy-efficient window treatment suppliers. |

| Market Growth Drivers | Demand fuelled by energy-saving initiatives, privacy concerns, and UV protection needs. |

| Sustainability and Environmental Impact | Initial use of low-VOC coatings and eco-friendly dyeing processes. |

| Integration of AI & Smart Automation | Limited AI use in motorized shading and remote-controlled curtains. |

| Advancements in Manufacturing | Standard textile weaving and PVC or foam-backed coatings for light-blocking properties. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter sustainability mandates, requiring eco-friendly, recyclable, and low-VOC blackout fabrics. |

| Material Innovation | Transition to biodegradable, recycled, and smart textile materials with nanotechnology-infused coatings. |

| Industry Adoption | Expansion into smart homes, AI-driven shading solutions, and adaptive climate-responsive blackout fabrics. |

| Smart & Connected Fabrics | Widespread adoption of IoT-enabled blackout systems with AI-based light and temperature regulation. |

| Market Competition | Increased competition from smart home tech companies, nanotech textile innovators, and sustainable fabric start-ups. |

| Market Growth Drivers | Growth driven by smart urban planning, AI-integrated energy efficiency solutions, and automated shading systems. |

| Sustainability and Environmental Impact | Large-scale adoption of carbon-neutral blackout fabric manufacturing, waterless dyeing, and recyclable textile programs. |

| Integration of AI & Smart Automation | AI-driven smart window shading that auto-adjusts to weather conditions, voice-controlled blackout fabric systems. |

| Advancements in Manufacturing | Evolution of 3D-printed blackout fabrics, self-cleaning textile coatings, and dynamic opacity-changing materials. |

United States blackout fabric market is expected to hold a major share owing to the increasing demand for energy-efficient products, surge in home renovation & improvement activities and growing inclination toward privacy-oriented solutions in the region. As the real estate and hospitality businesses grow, this too is helping to drive the market along as hotels, office spaces and residential properties use blackout curtains and blinds to manage the light coming into their spaces.

Moreover, the fabric technology is also advancing with the development of eco-friendly and thermal insulating blackout fabric that are capturing new environmentally concerned consumers. The demand for such products is also stimulated by the growing prevalence of smart home automation, which includes motorized blackout shades and remote-controlled systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.6% |

The UK blackout fabric market is anticipated to feel the positive impact due to rise in the awareness regarding energy efficiency, noise reduction benefits and the trends of premium home decor solutions, driving the market demand over the forecast period. The increasing adoption of blackout curtains and blinds in commercial, hotels, and residential spaces is driving market growth.

Sustainability trends are further affecting consumer preferences and driving the demand for recycled and eco-friendly blackout fabrics. The incorporation of UV-resistant and flame-retardant properties into blackout fabrics is also increasing their attractiveness. Similarly, online retail platforms and direct-to-consumer brands are increasing access to quality blackout materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.1% |

Germany, France, and Italy are the leaders in the European Union blackout fabric market due to growing consumer interest in energy-efficient window coverings, improved aesthetics of residential areas, as well as better thermal insulation. The EU is not the only region taking ambitiously after blackout fabrics, its ambitious energy efficiency regulations are driving adoption in an effort to reduce indoor heating and cooling costs.

Future developments in smart textiles such as soundproof blackout and antimicrobial textiles are expected to contribute to market growth. With the popularity of sustainable interior design and the use of organic and biodegradable fabrics, innovation is being pushed even further. The growing number of e-commerce platforms offering specialized and customized blackout options will also spur the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 6.2% |

Owing to Japan's strong inclination towards minimalistic and functional home decor along with rising awareness about energy-efficient solutions, Japan's blackout fabric market is rapidly growing. With an increase in high-rise buildings, the demand for blackout fabrics in residential and commercial spaces is on the rise, especially in urban areas where light pollution and privacy are growing concerns.

Moreover, the advancement and application of fabric coating (heat reflective, anti-bacterial, etc.) are acting as a positive trend for product appeal. Japan’s growing smart home market is another factor driving demand for motorized blackout curtains and blinds with remote control functionality. Market growth is also being bolstered by the rising demand for noise-reducing blackout fabrics, especially in densely populated regions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.0% |

Rapid urbanization and increasing consumer interest in home automation also drive the growth of the South Korea blackout fabric market. Increasing usage of blackout curtains and blinds in high-rise apartments and commercial spaces is boosting the demand for market. The country’s expanding smart home industry is also spurring development of motorized, app-controlled blackout fabric solutions to the USA.

On the other side, multi-layered blackout fabrics with thermal insulation and noise reduction properties are becoming more popular. Increasing online retail channels and customization options are also rendering blackout fabric easily accessible to the public, thus bolstering growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.4% |

The Blackout Fabric market is witnessing a strong hold in two segments, Industrial Use and Hotels & Restaurants, as the industries and commercial sectors are actively seeking for privacy, energy efficiency and aesthetic appeal. Blackout Fabrics, which are the most part of light pollutants or sensor protection, play a key role in light therapy, thermal insulation, and blocking negative electrical impulses in certain sectors such as industrial and commercial. The use of blackout fabrics across various end-use segments is increasing as sustainability and cost-saving approaches take hold.

The use of blackout fabrics in the industrial sector has become commonplace because of their ability to manage exposure to light, improve the privacy of cubicles in the workplace of the workplace and act as a thermal insulator. Industrial blackout fabrics are also more durable, wear and tear resistant, and excel in large-scale production and storage settings compared to standard window coverings.

Growing demand for energy-efficient window treatments, especially in large of manufacturing plant and warehouses, has driven market adoption. Over 65% of industrial sites are believed to use blackout fabrics to help control temperature, cut down on glare and save energy.

The market is also strengthened by the growing availability of high-performance blackout materials, which may incorporate fire-retardant coatings, UV-blocking treatments, and anti-static surface finishes, resulting in improved safety and compliance with industrial regulations.

Adoption has further increased due to the application of smart blackout fabric technologies, including AI-powered daylight sensors, automated fabric control systems, and motorized curtains controlled remotely, enabling effective light and heat management in industrial settings.

Advanced Industrial Blackout Fabrics Industrial blackout fabrics with multi-layer insulation combined with soundproofing properties and reinforced thermal barriers are driving growth in the industrial blackout fabrics market by maximizing comfort and operational efficiency in the workplace.

The implementation of sustainable blackout fabric solutions, including eco-friendly textile blends, recycled polyester weaves, and solvent-free dyeing processes, has contributed to market growth, fostering compliance with international green manufacturing practices.

However, despite being able to control the light, saving energy, and contributing to workplace comfort, the industrial blackout fabric segment is predicted to face high cost of material along with complex installation and frequent maintenance. However, innovations emerging with AI-powered climate-adaptive fabric technology, self-cleaning blackout textiles, and fabric coatings with nanotech-enhanced properties are setting the stage for far more efficient, durable, and cost-effective solutions, sustaining a positive outlook for industrial blackout fabric markets globally.

The Blackout Fabric market is dominated by hotels and restaurants, which is a direct result of the growing focus on guest comfort, the overall look and feel of the interior, and more bottom lines. Unlike traditional window coverings, blackout fabrics offer superior noise reduction, greater privacy and effective light-blocking ability, making them a popular choice in hospitality environments.

Growing proliferation of premium blackout curtains and draperies in upscale hotels and premium restaurants is further driving adoption. Blackout fabric solutions can be found integrated in over 60% of hospitality establishments, studies show that this greatly improves guest experience, promotes better sleep, and enhances indoor climate control.

While in recent years the luxury blackout fabric collection has expanded to include velvet-textured finishes, silk-blend compositions and decorative woven patterns, the market demand has remained, with a greater need to align with contemporary hospitality interior design trends.

Moreover, the adoption of smart blackout fabric technologies - such as automated light control systems, AI-powered room temperature regulation, and voice-activated curtain systems, has helped further penetration by ensuring great convenience and operational efficiency for the guest.

Antimicrobial and stain-resistant blackout fabric solutions, with moisture-wicking treatments, door-neutralizing coatings and dust-repellent fibre compositions, have enhanced market growth, enabling better hygiene and fabric longevity in hospitality settings.

As the eco-friendly blackout textiles featuring organic cotton weaves, low-impact dyeing and biodegradable fibre blends, compliance with the global sustainability initiatives and green building certifications is supporting market growth.

Although it provides benefits such as enhancing the aesthetic value and comfort of guests and aiding energy efficiency, the hospitality blackout fabric segment faces challenges such as increased cost of fabric maintenance, seasonal preferences in design, and lower compatibility of early establishments with automated shading systems.

Nevertheless, novel innovations within areas such as AI-powered fabric durability testing solutions, smart-textile-integrated blackout systems, and ultra-lightweight heat-resistant blackout materials are enhancing user experience, personalize options, and long-term capital investment returns, securing the market growth of blackout fabrics in the hospitality sector globally.

The market shares with 2-3 Ply, 3 Ply and Above 3 Ply continue to grow in the Blackout Fabric market owing to the advantage that consumers and businesses are increasingly spending on multi-layered fabrics for greater control of light, insulation and durability. Such categories of fabric thickness contribute toward energy efficiency, soundproofing, and comfort in general.

2-3 ply blackout fabrics are well accepted in the market and found to be the best choice for price-performance ratio when it comes to light blocking and insulation properties. 2-3 ply blackout fabrics (unlike single-layer fabrics) block light effectively, which is why they are widely used for residential, hospitality, as well as office spaces.

Growth in demand for mid-range blackout fabric solution, especially in residential and commercial spaces, is spurring adoption. According to various studies conducted, more than 70% of homeowners and office interior decorators trust 2-3 ply blackout fabrics because they are relatively thicker, which makes them more effective in blocking the light.

The diversification of decorative 2-3 ply blackout drapery collections with texture weaves, two-tone fabric layering, and fade-resistant colour treatments, has strengthened this market demand by ensuring broader design compatibility and aesthetic appeal.

While the 2-3 ply blackout fabric segment offers benefits in terms of cost-effectiveness, light control efficiency, and aesthetic adaptability, it is hindered by moderate heat insulation capacity, susceptibility to fabric degradation with time, and limited suitability for high-noise environments. Nevertheless, new advancements in AI-enhanced textile reinforcement, eco-friendly multi-layer weave technology, and intelligent-responsive blackout fabrics are enhancing durability, sustainability, and performance leading to the future growth of 2-3 ply blackout fabric market across the globe.

3 ply blackout fabrics are in demand worldwide as industries and commercial sectors are showing a preference for better insulation, superior durability, and improved noise reduction by using these above 3 ply blackout fabrics. The above 3 ply fabric is far more effective than lightweight blackout material alternatives which contain only a single layer of protective material, and provide little assistance in the quest for optimal soundproofing, thermal insulation, or total blackout.

Adoption has also been driven by the growing need for high-density blackout solution systems in theatres, recording studios, and high-end residential areas. Above 3 ply blackout fabrics are used in over 65% of professional acoustic treatment applications due to better sound absorption and noise blockage characteristics.

The above 3 ply blackout fabric segment although offering extreme light control, sound-proofing, and superior energy efficiency, is restrained by higher production costs, higher fabric handling bulk, and lower breathability. Nonetheless, emerging innovations around ultra-light multi-ply blackout composites, AI-optimized thermal barrier fabric construction methods, and sustainable heavy-duty blackout materials are improving its usability, cost efficiency, and environmental compliance, and paving the way for continued expansion for above 3 ply blackout fabrics to achieve better performance globally.

Textile Blackout Fabric Market: The Blackout Fabric Market is influenced by increased energy efficiency window solution demand, emerging applications in residential and commercial spaces, and technology advancement in fabric. The market's significant growth is leveraging the increasing trend towards smart homes and the adoption of sustainable living. Some of the major trends influencing the growth of the market are innovations in sustainable fabric, improved UV protection, and incorporation of blackout fabrics in smart shading solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Hunter Douglas | 12-16% |

| Springs Window Fashions | 10-14% |

| The Window Outfitters | 8-12% |

| Louvolite | 6-10% |

| Mermet Corporation | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Hunter Douglas | Develops high-quality blackout fabric solutions integrated with smart home automation. |

| Springs Window Fashions | Specializes in energy-efficient blackout curtains and shades for residential and commercial applications. |

| The Window Outfitters | Offers custom blackout fabric solutions with enhanced thermal insulation properties. |

| Louvolite | Manufactures innovative blackout roller blind fabrics with UV protection and flame resistance. |

| Mermet Corporation | Focuses on eco-friendly, durable blackout fabric solutions for architectural and interior design applications. |

Key Company Insights

Hunter Douglas (12-16%) Hunter Douglas leads in blackout fabric technology, integrating automation and energy efficiency into its product range.

Springs Window Fashions (10-14%) Springs Window Fashions specializes in high-performance blackout shades, catering to both residential and commercial needs.

The Window Outfitters (8-12%) The Window Outfitters focuses on customized blackout fabric solutions with superior thermal insulation properties.

Louvolite (6-10%) Louvolite is known for its innovative blackout roller blind fabrics, featuring UV protection and flame-resistant properties.

Mermet Corporation (4-8%) Mermet Corporation emphasizes sustainable blackout fabric production, ensuring durability and efficiency in light control.

Other Key Players (45-55% Combined) Several fabric manufacturers and suppliers contribute to the growing blackout fabric market. These include:

The overall market size for the Blackout Fabric market was USD 1.2 Billion in 2025.

The Blackout Fabric market is expected to reach USD 2.1 Billion in 2035.

The demand for blackout fabric will be driven by increasing adoption in residential and commercial spaces, rising demand for energy-efficient window treatments, growth in the hospitality industry, and advancements in smart textile technologies.

The top 5 countries driving the development of the Blackout Fabric market are the USA, China, Germany, Japan, and the UK.

The Industrial Use Blackout Fabric segment is expected to command a significant share over the assessment period.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.