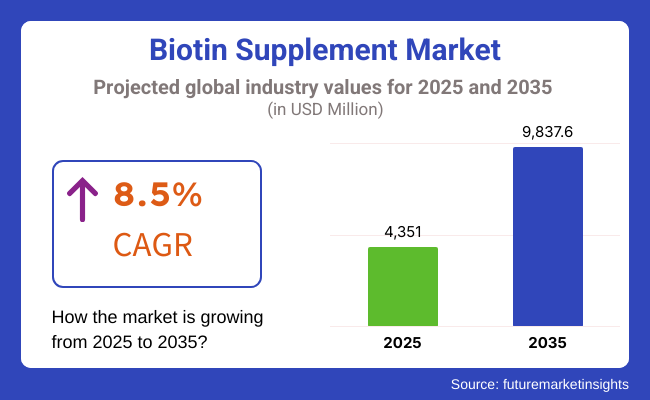

The global market for biotin supplement is forecasted to attain USD 4,351.0 million by 2025, expanding at 8.5% CAGR to reach USD 9,837.6 million by 2035. In 2024, the revenue of biotin supplement was around USD 4,010.2 million.

Access to biotin supplements through the Internet is also at an all-time high, and the health and wellness trend is also on the rise. In the meanwhile, with new research revelations on the role of biotin in metabolism and energy production and its impact on mental processes, demand for biotin supplements has also increased.

However, regulatory attention, product quality issues, and potential side effects that arise due to overdosage can slow down market expansion. Brands are becoming creative in response to customer demand with new products like biotin-filled beverages and gummies that contribute to improving the supplementation experience as a whole.

In this case, biotin certainly has become a daily must-have supplement along with the rest for many, with its popularity shooting through the roof among consumers in the age where holistic health and functional nutrition are being adopted by the masses.

The industry of biotin supplements has been increasing progressively from 2020 to 2024 with the main boost coming from health knowledge among customers about benefits attached to biotin, but with a concentration on beauty, wellness, and functional nutrition.

The COVID-19 pandemic situation in 2020 generated one of the highest drivers of increased demand as shoppers became more engaged with health concerned with immunity, hair and skin, and in general, welfare. Online sales increased during this time, with online stores expanding their product lines and introducing biotin supplements to the international market.

At this time, a flurry of new product launches started filling the market, including gummies, drinks, and combination supplements fortified with biotin for hair growth, nail hardness, and metabolic wellness. Endorsements by beauty-and-wellness professionals and influencer marketing also helped generate consumer engagements, especially among young consumers.

Regulatory issues and debates regarding the putative danger of biotin overconsumption raised the levels of scrutiny against a few of the markets. In spite of this, the growth of biotin continued through brands promoting transparency, quality control, and scientific formulation.

With the rising trends in holistic health practicing and biotin inclusion in functional foods and customized nutrition plans, the supplement has really established itself as a staple in mainstream health practice in day-to-day routine.

Explore FMI!

Book a free demo

North America will dominate the biotin supplement market because of high consumer expenditure in health and wellness products. Currently, biotin is being hailed even more by social media influence and even endorsements by celebrities while the existing channels of distribution make high-quality supplements readily available.

Strong regulations directly correlate to product safety and efficacy while giving consumers confidence to buy something. As became even more popular natural and organic health remedies, so the popularity of the plant-based biotin also grew. Major supplement firms and direct-to-consumer players, however, are expanding their horizon through novel products catering to the mass base.

The European market for biotin supplements is on a steady rise since almost everyone in Europe prefers clean-label items, such improvements in legislation favouring dietary supplements, alongside increasing incomes. Biotin is now a significant aspect in holistic wellbeing adopted by many countries such as Germany, France, and the UK, which puts it in their beauty care and nutrition plans.

Stringent food safety requirements compel companies to formulate scientifically justified, high-strength supplements that reaffirm customers' trust. Similarly, the trend towards personalized nutrition is gaining popularity as a good number of people opting for supplement use that is tailored to their own health objectives, thus further escalating market growth.

Based on the adoption, this region is currently growing fast with a rising demand for biotin supplements attributed to high disposable incomes coupled with a growing middle-class population. The countries of China, Japan, and India are busy increasing the number of health-conscious consumers that actively search for quality supplements.

Furthermore, biotin is bringing popular assays that have been utilized in traditional herbal medicine formulations. Governments are intervening with programs to encourage nutritional health and wellness education, raising awareness and bringing supplements into the mainstream. As a result, more and more people are adding biotin to their daily lives to improve health overall.

Complications Related to the Biotin Supplement Hinders the Market

As many of consumers were found mired in misunderstandings coupled with stringent regulations, ambiguous dosage recommendations, and deceptive marketing by some brands that complicate matters, they suffer more from issues like ineffectiveness, counterfeits, or low-quality products.

Continued controversy as to whether biotin does any good for patients beyond deficiency treatment causes reluctance. Very high prices for highly valued plant-made or organic biotin supplements also reduce availability in some areas. Opportunities: Biotin-enriched functional foods and beverages are creating new markets.

Increasing Demand for Organic and Environment Friendly Supplements Expands the Opportunities in the Market

Firms are now investing heavily in research and development to produce better, more convenient supplements based on health needs. Brands are now responding to consumers' growing awareness of sustainability and ingredient transparency by offering biotin from organic and environmentally friendly sources.

Those investing in clinical research and collaborating with health care providers build trust with consumers and differentiate from others. Meanwhile, biotin blends with synergistic vitamins and minerals are gaining traction, as more consumers want all-in-one supplements for overall health.

Plant-based Formulation

Increased demand for cruelty-free and sustainable supplements has encouraged manufacturers to produce plant-based biotin from organic sources. Vegan options derived from natural sources such as sunflower and algae are being more sought after. This trend fits into the larger clean-label movement whereby consumers are looking into products that are ethically sourced, free from chemicals, and sustainable from the environment viewpoint.

Subscription-based Supplement Model

Personalized supplement plans are emerging as a preferred option, whilst subscriptions have made it easier for consumers to adhere to their health regimes. Brands that offer customized biotin supplements according to individual health needs and lifestyles are experiencing heightening demand.

The companies that are engaged in AI health assessments to create personalized supplement packs are gaining momentum in the market. As convenience for wellness routines continues to be a huge catchphrase, offering automated refill services is gaining traction for direct-to-consumers.

People interested in better hair, skin, and nail health began utilizing biotin supplements, and this interest made the biotin supplement market grow rapidly. Social media trends, endorsement from celebrities, and e-commerce-enabled accessibility made it easier for consumers to access biotin products.

Brands have also launched plant-based and vegan-friendly options to embrace a wider audience. However, this also raised safety concerns about misleading health claims, biotin's potential interference with lab tests, and the oversaturation of the market, which all added to regulations and calls for further scientific research to back claims by products.

The prospective advancements of personalized nutrition will include the market being developed into one that has more bioavailable biotin formulas and AI-driven applications to track supplement effectiveness. Regulatory agencies will tighten the reins with labels and marketing claims about products.

That will ensure transparency and consumer trust. On their part, sustainability will take center stage, with brands adopting plant-based biotin, biodegradable packaging, and eco-friendly production processes.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | FDA and EU regulations focused on supplement labeling and dosage safety. Growing concerns over biotin’s interference with medical tests. |

| Technological Advancements | Introduction of high-dose biotin supplements in capsules, gummies, and liquid forms. Focus on multi-vitamin blends for hair and skin health. |

| Consumer Demand | Strong demand fueled by beauty-conscious consumers, influencers, and online sales. Vegan and organic biotin supplements gained popularity. |

| Market Growth Drivers | Expansion of e-commerce and direct-to-consumer brands. Rising interest in natural beauty and holistic wellness trends. |

| Sustainability | Some brands introduced plant-based and non-GMO biotin sources. Recyclable packaging initiatives emerged. |

| Supply Chain Dynamics | Heavy reliance on synthetic biotin production, mainly sourced from China and India. Market volatility due to raw material costs. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter regulations on health claims and efficacy validation. Standardized clinical guidelines ensure responsible supplement use. |

| Technological Advancements | Bioavailable, slow-release biotin formulations for enhanced absorption. AI-driven personalized nutrition solutions recommend optimal biotin intake. |

| Consumer Demand | Growth in functional and medical-grade biotin for cognitive and metabolic health. Increased preference for sustainable, science-backed supplements. |

| Market Growth Drivers | Increased focus on clinically proven benefits of biotin beyond beauty. Growth in biotin-infused functional foods and beverages. |

| Sustainability | Widespread adoption of biodegradable packaging and carbon-neutral production. Development of lab-grown biotin for eco-friendly sourcing. |

| Supply Chain Dynamics | Diversification of biotin sourcing with a shift toward plant-based and fermented biotin. Regional production hubs enhance supply chain resilience. |

Market Outlook

With more people in the USA focusing on health and wellness, especially with regard to hair, skin, and nail care, the USA market for biotin supplements is growing rapidly. The increasing awareness of biotin deficiency and rising interest in dietary supplements are driving many consumers to integrate biotin into their daily routines.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.3% |

Market Outlook

Germany's market for biotin supplements is thriving as a result of a robust healthcare system and a population passionate about nutrition health. Many incorporate biotin into their everyday lives with a preventive healthcare regimen and a trend toward the use of natural products.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 5.8% |

Market Outlook

India's biotin supplements industry is booming due to growing health awareness and growing disposable incomes. As individuals are now inclined towards perceiving well-being as an important aspect, the growing middle-class get exposure to receive health knowledge and biotin supplements have emerged as a dominant factor.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.5% |

Market Outlook

The Japanese biotin supplement market is booming based on its advanced healthcare technology and robust preventive health system. People are relying on biotin supplements to help with well-being, given the aging population and high medical standards.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.0% |

Market Outlook

With rising healthcare services and increased awareness of health and wellness, Brazil's market for biotin supplements is gradually claiming a huge space. With increasing awareness regarding beauty and self-care trends, biotin supplements have become popular with people looking to support their hair, skin, and health in general.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 5.0% |

Capsules Are Leading the Market As They Are Convenient for Precise Dosing

Capsules, as a dosage form, hold a significant market share in the biotin supplement market because of their convenience, availability of precise dosages, and longer shelf life. Biotin capsules are favored for their hair, skin, and nail care as well as their high potential for metabolic and neurological activity. Increased realization about the application of biotin in stimulating hair growth and fortifying nails, particularly among females, is spearheading driving demand.

Furthermore, the new release of plant and vegan capsules would be attracting health-aware consumers attention. North America and Europe are taking the lead with a solid dietary supplement culture and substantial consumer expenditure on well-being products. Nevertheless, regulatory control on supplement labeling and ingredient disclosure still pose significant threat to the manufacturers.

Gummies are prominent product type in the market as they are being widely adopted by millennials.

The evolution of the biotins supplement market has seen growth in the popularity of gummies among millennials and other age sectors that prefer chewable and tasty supplements to antediluvian pills. With the growing trend of fun and functional nutrition, the demand for biotin-infused gummies-once promoted for the health benefits of hair, skin, and nails-has taken a slight turn.

Several brands are now producing sugar-free, organic, and vegan-friendly gummies to cater to the health-conscious. The high convenience and flavorful combinations of gummies made acceptance very easy, especially in North America and Europe. E-commerce and social media marketing boost these sales as beauty and wellness influencers endorse these products even more.

The Asia-Pacific market also shows remarkable growth due to increasing awareness regarding personal care supplements and an increase in disposable income. However, problems concerning manufacturers continue with high sugar content found in some formulas and dosage limits in comparison to capsules and tablets.

Supermarkets and hypermarkets Dominating the Market Due To Their Extensive Reach, Affordability, And Convenience.

Hypermarkets and supermarkets-major channels through which biotin supplements are distributed because they offer this pretty much comprehensive convenience and affordability. At these one-stop mega retailers, users are spoiled for choice with regards to brands of biotin supplements as they can compare prices, dosages, and formulations before making a decision.

Their distribution channel is very well developed in order to ensure availability while continuous promotions, discounts, and loyalty programs add more attraction to customers. The increasing focus on health and wellness segments in these retailers makes the space more significant for dietary supplements including biotin while targeting a broader customer base.

In addition, people feel much better purchasing biotin supplements from supermarkets and hypermarkets because of the trusted brandiness of these retailers and the touch-and-feel opportunity before making a purchase. A more significant preference for consumers to care for and better themselves, and still the convenience of one-stop shopping or a supermarket, keeps hypermarkets and supermarkets well ahead amongst such in the market.

Pharmacies are Emerging Segment as it is Expanding due to its Biotin Supplements with Expert Guidance

Pharmacies still stand as a channel-of-choice for biotin supplement-selling, especially so for consumers seeking recommendations from pharmacists or healthcare providers. This segment stands to benefit from the increased awareness of biotin in overall health, hence fueling demand for pharmaceutical-grade and clinically backed formulations.

Many pharmacies sell both OTC biotin supplements and prescription-based formulations for persons diagnosed with biotin deficiency. North America and Europe are leading this segment due to veteran pharmacy chains well known by the consumer. The Asia-Pacific region is also witnessing some growth as pharmacies continue to diversify their offering in health and wellness products.

Supplementing such growth with digital health services like online pharmacy platforms and teleconsultation-driven supplement recommendations is fostering market penetration. Nevertheless, the high pricing of pharmacy-bought supplements compared to online options and limited product variety in some regions may act as restraints of growth for this channel.

Biotin supplements have highly competitive markets that are creating an environment for innovation and growth by both global players and regional manufacturers. The growing consumer emphasis on health and wellness, especially in the area of hair, skin, and nail health, is acting as a pull factor for biotin supplements.

Companies are competing with various formulations, clean-label ingredients, and innovative applications. The competitive market is ever-changing, shaped by reputed nutraceutical companies and fledgling brands working together to redefine biotin supplementation.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Sports Research | 8.5% |

| The Nature's Bounty Co. | 21.4% |

| Solgar | 5.8% |

| Natrol LLC | 14.5% |

| NOW Foods | 11.2% |

| Others (Combining all) | 38.7% |

| Company Name | Nature’s Bounty |

|---|---|

| Year | 2025 |

| Key Developments/Activities | Offers a variety of biotin supplements in different forms, including capsules and gummies, focusing on quality and affordability. |

| Company Name | Natrol |

|---|---|

| Year | 2024 |

| Key Developments/Activities | Provides high-potency biotin tablets aimed at supporting healthy hair, skin, and nails, emphasizing rapid dissolution formulas. |

| Company Name | NOW Foods |

|---|---|

| Year | 2024 |

| Key Developments/Activities | Develops biotin supplements in various dosages, catering to diverse consumer needs, with a focus on natural and non-GMO ingredients. |

| Company Name | Sports Research |

|---|---|

| Year | 2024 |

| Key Developments/Activities | Specializes in biotin soft gels infused with coconut oil to enhance absorption, targeting fitness enthusiasts and health-conscious consumers. |

| Company Name | Solgar |

|---|---|

| Year | 2025 |

| Key Developments/Activities | Offers biotin capsules that are free from gluten, wheat, and dairy, appealing to consumers with dietary restrictions. |

Key Company Insights

Nature's Bounty (21.4%)

Nature's Bounty is a company in the supplement industry globally with a line of biotin products that caters to nearly all consumer choices while keeping up its brand of quality and price.

Natrol (14.5%)

Natrol offers very strong biotin supplements and is found to be effective in maintaining the well-being of nails, skin, and hair using the technology for rapid dissolution which ensures highest effect.

NOW Foods (11.2%)

NOW Foods advocates for natural ingredients with various choices available in its portfolio of biotin supplements that are most ideal for consumers who want non-GMO and allergen-free choices.

Sports Research (8.5%)

While after a health-focused audience, Sports Research brings together biotin and coconut oil in the soft gel formula for better absorption of nutrients and the appeal to the fitness-conscious group.

Solgar (5.8%)

Solgar biotin supplements focus on purity and are free from coeliac, nut, and dairy allergens, thereby catering to the consumers with special dietary needs.

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

The overall market size for biotin supplement market was USD 4,351.0 million in 2025.

The Biotin Supplement Market is expected to reach USD 9,837.6 million in 2035.

The widespread availability of biotin supplements across supermarkets, pharmacies, online platforms, and specialty stores is making them more accessible to a larger consumer base.

The top key players that drives the development of biotin supplement market are Sports Research The Nature's Bounty Co., Solgar, Natrol LLC and NOW Foods

Capsules in product type of biotin supplement market is expected to command significant share over the assessment period.

Cell Dissociation Market Analysis by Product, Type, End User and Region: Forecast for 2025 to 2035

Dyspnea Treatment Industry Analysis by Treatment, Route of Administration, End-User, and Region through 2035

Congenital Adrenal Hyperplasia Treatment Market Analysis and Forecast by Type, Treatment, End User, and Region through 2035

Medical Cleaning Devices Market Overview - Trends & Forecast 2025 to 2035

Esophagoscopes & Gastroscopes Market is segmented by product, and end user from 2025 to 2035

Halal Nutraceuticals and Vaccines Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.