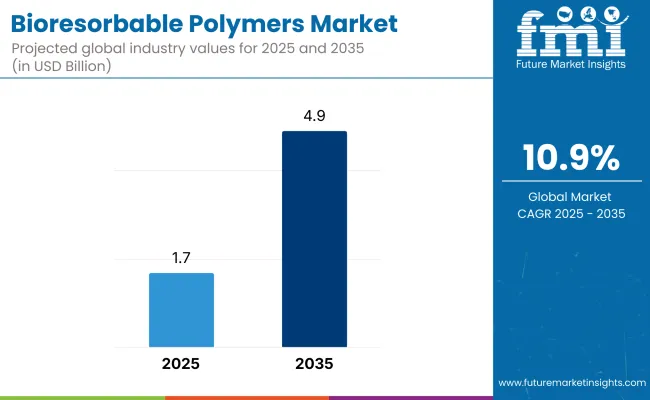

The bioresorbable polymers market is projected to grow significantly from USD 1.7 billion in 2025 to USD 4.9 billion by 2035, reflecting a robust CAGR of 10.9% over the forecast period. This substantial growth trajectory highlights the expanding relevance of biodegradable solutions in the healthcare sector, particularly in the development of medical implants and drug delivery systems.

With the increasing global focus on minimizing surgical interventions and reducing post-operative complications, bioresorbable polymers offer an ideal alternative to permanent implants, making them increasingly favorable in modern clinical settings.

The market is experiencing transformative shifts due to rapid advancements in polymer chemistry and material science. These innovations are enabling the creation of polymers with tailored degradation rates and improved mechanical properties, making them more suitable for complex medical procedures.

The post-2024 period has seen a rise in regulatory clearances and commercialization of sophisticated bioresorbable products across North America, Europe, and emerging Asia-Pacific economies. These approvals have not only validated the safety and efficacy of these materials but have also expedited their integration into mainstream healthcare practices, allowing broader acceptance by both practitioners and patients.

One of the key drivers of this market's growth is the global trend toward minimally invasive and personalized healthcare. As chronic conditions such as osteoporosis and cardiovascular diseases become more prevalent due to aging populations, demand for effective and low-risk treatment solutions is rising. Bioresorbable polymers fulfill this need by eliminating the necessity for follow-up surgeries to remove implants, thus lowering healthcare costs and improving patient outcomes.

Additionally, increasing healthcare investments in emerging markets and favorable regulatory environments are enabling faster adoption and innovation, positioning the market for sustained expansion over the next decade.

The bioresorbable polymers market, by product, includes polysaccharides, bioresorbable proteins, polylactic acid, polyglycolic acid, polycaprolactone, and others. Based on application, the market is segmented into drug delivery, orthopedics, and others. Regionally, the market is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia, and Pacific, East Asia, the Middle East, and Africa.

Polylactic acid (PLA) is expected to record the highest CAGR of 11.8% from 2025 to 2035 due to its broad utility, well-established biocompatibility, and regulatory approvals. PLA is particularly favored in orthopedic implants, sutures, and drug delivery systems where a predictable degradation profile and moderate mechanical strength are essential. It degrades into lactic acid, a naturally metabolized compound in the human body, eliminating the need for secondary surgeries. Its widespread applicability and cost-effectiveness make it a cornerstone of the bioresorbable polymers market.

Polyglycolic acid (PGA) is another vital segment, offering higher tensile strength and faster degradation compared to PLA. It is often used in absorbable sutures, bone fixation devices, and mesh structures. PGA is typically blended with PLA or other polymers to achieve specific performance characteristics, such as accelerated absorption or improved load-bearing capability.

Polycaprolactone (PCL) has a slower degradation profile and greater flexibility, making it suitable for soft tissue engineering, long-term drug release, and dental applications. PCL is often used in combination with PLA or PGA to adjust the overall degradation rate and mechanical flexibility.

Proteins bioresorbable, such as collagen or gelatin, are naturally derived and show excellent cellular interaction, making them suitable for wound care, drug delivery, and tissue scaffolds. However, their lower mechanical strength limits their use in structural applications. Similarly, polysaccharides, including chitosan and alginate, are valued for their biodegradability and biocompatibility in topical and injectable formats but are less suitable for load-bearing applications due to their fragility.

The other segment includes innovative bioresorbable polymers under development, such as polydioxanone and polyhydroxyalkanoates (PHAs), which are being tailored for emerging medical needs. While these materials are not yet mainstream, ongoing R&D efforts aim to unlock their potential in high-performance bioabsorbable medical devices.

| Product | CAGR (2025 to 2035) |

|---|---|

| Polylactic acid (PLA) | 11.8% |

Drug delivery is projected to be the fastest-growing application segment, registering a CAGR of 12.1% from 2025 to 2035. This growth is driven by rising demand for controlled-release formulations, where bioresorbable polymers serve as carriers that gradually release active pharmaceutical ingredients while naturally degrading in the body.

These materials eliminate the need for surgical removal and improve patient compliance in chronic therapies. Applications such as cancer treatment implants, localized antibiotic delivery, and hormone release systems are increasingly relying on polymers like PLA, PCL, and their copolymers to enhance therapeutic outcomes and minimize side effects.

Orthopedics remains the largest application segment due to the extensive use of bioresorbable polymers in fracture fixation devices such as screws, pins, and plates. These polymers provide essential mechanical support during bone healing and gradually degrade, removing the need for secondary removal surgeries.

Their compatibility with bone tissue, customizable degradation profiles, and radiolucency make them ideal for orthopedic reconstruction, trauma care, and sports injury management. Although their mechanical strength still poses limitations for load-bearing implants, continuous innovation in composite materials is addressing this challenge.

The other segment includes a range of applications such as wound healing, dental care, stents, and tissue engineering, where bioresorbable polymers provide functional support and biocompatibility. In wound healing, these polymers are used in absorbable dressings and scaffolds that promote cell growth and tissue regeneration.

In dental applications, they are used in guided tissue regeneration membranes and absorbable sutures. While this category currently represents a smaller share, it holds growing importance as healthcare providers seek sustainable, low-intervention treatment options across various specialties.

| Application | CAGR (2025 to 2035) |

|---|---|

| Drug Delivery | 12.1% |

Technology Advances: Further research will more than likely create polymers with tailored degradation patterns, increasing their application in regenerative medicine and tissue engineering.

Regulatory Incentives: Efficient regulatory pathways are likely to accelerate approval for new bioresorbable materials, facilitating entry and innovation.

Market Penetration: Greater use of this products by various fields in medicine, including wound healing and drug delivery, is most likely to drive expansion.

Sustainability Emphasis: Sustainability emphasis on the environment in medical materials can also drive the adoption of bioresorbable polymers, supporting global sustainability objectives.

A recent survey by Future Market Insights captured information from influential stakeholders in the industry, such as medical device manufacturers, healthcare providers, and regulatory specialists. Results indicated an emerging consensus on the growing application of bioresorbable materials, particularly in orthopedic and cardiovascular applications.

Survey participants stressed that the principal driving forces behind the trend are lower demand for repeat surgeries, enhanced patient outcomes, and advancements in polymer technology for enhanced material strength and degradation control.

One more key finding of the survey was increasing need for custom bioresorbable polymer formulations for a particular medical purpose. Medical professionals emphasized the need for tightly controlled material degradation timetables to accommodate the body's healing mechanism.

Many producers are putting R&D money into creating next-generation polymers with increased biocompatibility and strength to open the doors to broad uses in tissue engineering and regenerative medicine.Since the business is rapidly changing, it is vital for firms in the industry to keep track of existing trends, new technologies, and regulatory updates.

Government regulations and mandatory certifications play a pivotal role in shaping the indsutry across various countries. Below is a table summarizing the impact of these policies and the required certifications by country:

| Countries/Region | Government Regulations and Mandatory Certifications |

|---|---|

| United States | The USA Department of Agriculture (USDA) oversees the BioPreferred® Program, established under Section 9002 of the Farm Security and Rural Investment Act. This program mandates federal agencies and contractors to prioritize biobased products, including bioresorbable polymers, in their procurement processes. Products must meet specific biobased content standards to qualify for mandatory federal purchasing. |

| European Union | The EU enforces stringent regulations on biodegradable plastics, which encompass bioresorbable polymers. Compliance with standards such as EN 13432 is mandatory, ensuring that products meet criteria for biodegradability, compostability, and eco-toxicity. Additionally, certifications like "OK Biodegradable Marine," based on ASTM D7081, require at least 90% biodegradation within six months, though this certification is considered premature by some stakeholders. |

| Germany | Germany adheres to EU regulations and has implemented additional national policies promoting the use of biobased and biodegradable plastics. The country supports certifications under the International Sustainability and Carbon Certification (ISCC) system, which evaluates ecological and social sustainability, compliance with laws, greenhouse gas emissions, and good management practices. |

| Netherlands | The Netherlands has explored implementing mandatory requirements for recycled or biobased plastic content in products. Studies have assessed the feasibility and environmental impacts of such mandates, focusing on increasing the percentage of recyclate or biobased materials in new products. |

| Global | International standards, such as ISO 14001, provide a framework for environmental management systems applicable to manufacturers of bioresorbable polymers. Certifications under this standard demonstrate a commitment to environmental sustainability and compliance with relevant regulations. |

These regulations and certifications ensure that product meet environmental and safety standards, facilitating their acceptance and use in various applications worldwide.

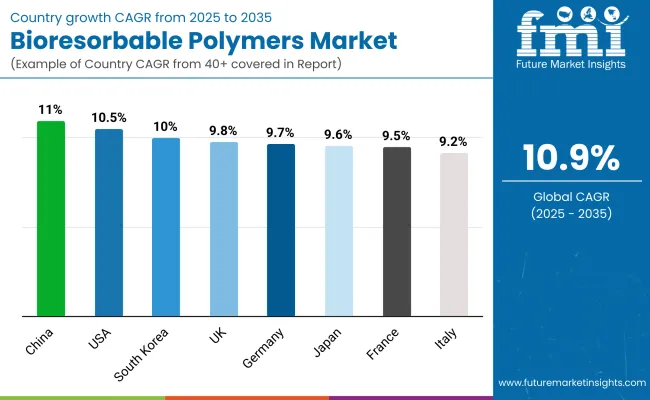

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 10.5% |

| UK | 9.8% |

| France | 9.5% |

| Germany | 9.7% |

| Italy | 9.2% |

| South Korea | 10.0% |

| Japan | 9.6% |

| China | 11.0% |

The USA is likely to experience a CAGR of about 10.5% during the period of 2025 to 2035 in the industry. This is due to the advanced healthcare facilities in the country, rising usage of bioresorbable materials in the medical sector, and high research and development investments.

The USA dominates in the creation and commercialization of medical devices using bioresorbable polymers, especially in orthopedic and cardiovascular industries. The availability of key market players and supportive regulatory guidelines further enhance market growth. Moreover, increased awareness among patients and healthcare professionals regarding the advantages of bioresorbable implants also supports the positive growth of the industry.

The United Kingdom’s industry is expected to grow at a CAGR of approximately 9.8% for the forecast period. The UK's aggressive focus on healthcare innovation and rising use of sophisticated medical technologies make this growth possible.

Government support for biomedical research and development, as well as partnerships between academic institutions and industry leaders, strengthen the environment. The National Health Service's (NHS) commitment to enhancing patient outcomes through sophisticated medical solutions also fuels the need for product across different applications, such as drug delivery and orthopedic implants.

France is expected to have a CAGR of around 9.5% in the industry during 2025 to 2035. Its well-developed healthcare infrastructure and robust pharmaceutical sector are responsible for the uptake of bioresorbable materials. French research organizations and industries are also intensively involved in creating new bioresorbable polymer-based medical devices.

Support from the government for medical research and emphasis on minimally invasive procedures further support industry growth. The growing incidence of chronic diseases requiring surgical procedures also increases the demand for bioresorbable implants and devices.

The industry in Germany is anticipated to expand at a CAGR of approximately 9.7% over the forecast period. The strong medical device sector in the country and focus on healthcare technology advancements drive this growth. German firms are leaders in the development of high-quality bioresorbable polymer products, especially for orthopedic and cardiovascular applications.

The use of bioresorbable polymers in medical devices fits the focus of Germany on precision medicine and patient-individualized treatment solutions. Also, partnerships between industry and research centers allow ongoing innovation in this field.

Italy is expected to experience a CAGR of around 9.2% in the bioresorbable polymers during 2025 to 2035. The expanding healthcare industry and rising investments in medical research in the country drive growth. Italian firms are investigating the application of bioresorbable polymers in different medical applications, such as tissue engineering and regenerative medicine.

Advanced healthcare technologies are encouraged by government initiatives and partnerships with global research organizations, which drive the development and implementation of bioresorbable polymer-based solutions.

Bioresorbable polymers in South Korea is forecast to expand with a CAGR of approximately 10.0% over the forecast period. South Korea's highly developed technology infrastructure and substantial focus on biomedical research drive growth.

The active adoption of high-tech medical technology by the nation, coupled with government support through research and development incentives, propels innovation within bioresorbable polymers. South Korean firms actively work on the development of bioresorbable medical devices, especially orthopedic and drug delivery systems.

Japan will grow at a CAGR of around 9.6% in the industry for bioresorbable polymers between 2025 and 2035. Japan's high rate of chronic disease incidence and aging population propel the demand for innovative medical solutions, such as bioresorbable implants.

The robust pharmaceutical and medical device industries of Japan are placing investments in bioresorbable polymer technologies. Government policies to encourage healthcare innovation and the implementation of minimally invasive surgical techniques also contribute to the growth in the industry.

China's bioresorbable polymers is expected to expand at a strong CAGR of approximately 11.0% over the forecast period. The growth is fueled by the country's growing healthcare infrastructure and rising investments in medical R&D.

Chinese firms are quickly embracing bioresorbable polymers in different medical applications, aided by government support for cutting-edge healthcare technologies. The vast patient base and growing awareness of the advantages of bioresorbable medical devices also support industry growth.

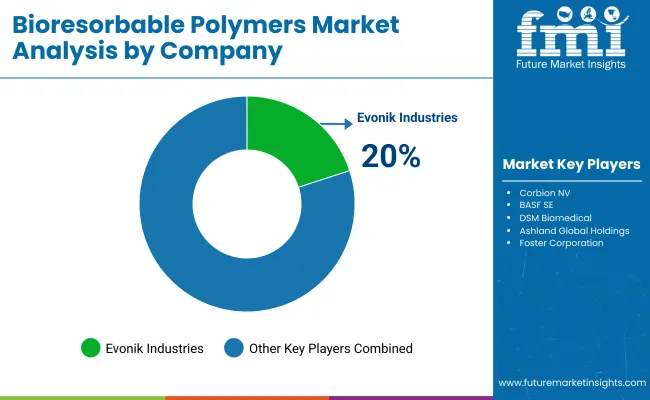

In 2024, the bioresorbable polymers saw substantial advancements as top companies introduced strategic measures to improve their positions. Evonik Industries AG, a major player in the industry, increased the production capacity for polylactic acid (PLA) to address the increased demand for the material in medical applications. This increase was aimed at increasing the company's capability to deliver quality bioresorbable materials to be used in orthopedic implants and drug delivery systems.

Corbion NV emphasized innovation with the launch of a new family of polyglycolic acid (PGA) products specifically engineered for surgical sutures and tissue engineering. These products were conceived to provide better biocompatibility and controlled rate of degradation in response to needs in surgical use. The ability of the company to invest in research and development allowed it to respond to changing needs of the medical community.

Foster Corporation, which deals in biomedical polymers, introduced a line of proprietary polymer blends in 2024. The blends were designed to maximize mechanical properties and degradation profiles, which made them ideal for use in a range of medical applications, such as cardiovascular stents and wound healing devices. By working closely with medical device companies, Foster Corporation sought to provide materials that meet the industry's high standards.

Poly-Med Inc., which specializes in bioresorbable materials, partnered with a prominent medical devices company on a strategic collaboration to co-design next-generation bioresorbable vascular scaffolds. The alliance aimed at merging Poly-Med's material science expertise with the partner's clinical know-how to put novel solutions in the marketplace. The alliance highlighted the value of cross-industry collaboration in the development of medical technologies.

The bioresorbable polymers is a subset of the wider biomedical materials and advanced polymers category, which is a subset of the global healthcare and materials science sectors. The industry is subject to significant macroeconomic influences including healthcare expenditure, regulatory measures, technological innovation, and population trends.

At the macroeconomic level, the increasing global healthcare spending is a major growth driver. Governments and private healthcare systems are investing more in sophisticated medical technologies, such as bioresorbable materials, to enhance patient outcomes and lower long-term treatment costs. The trend toward minimally invasive procedures and biodegradable implants follows this pattern, as bioresorbable polymers obviate the need for follow-up procedures to remove implants.

Furthermore, the growing ageing population across the globe is generating chronic demand for orthopedic, cardiovascular, and drug delivery use cases, where bioresorbable materials are the key. Growth of Asia-Pacific and Latin America are experiencing increased rates of adoption with rising healthcare infrastructure and increasing disposable incomes.

But macroeconomic issues like inflation, supply chain disruptions, and regulatory complexity could affect industry growth. Raw material costs and compliance with rigorous FDA and EU regulations drive product pricing and industry entry strategies. Despite these, ongoing R&D spending and technological innovations will keep fueling this growth.

Expansion in Emerging Markets

Though North America and Europe lead the bioresorbable polymers today, Asia-Pacific and Latin America offer high-growth potential. China, India, and Brazil are making growing investments in healthcare infrastructure and biomedical research, making them key targets for expansion.

Strategic Recommendation: Local partnerships with hospitals and medical device manufacturers should be formed by stakeholders, taking advantage of government incentives for local production to decrease dependence on imports and regulatory hurdles.

Innovation in Products in Orthopedics and Cardiovascular Applications

The orthopedic and cardiovascular sectors represent the most significant application for bioresorbable polymers. With the increasing requirement for patient-tailored resorption rates matching the individual-specific healing schedules, a greater need arises for adaptive degradation rates for implants and scaffolds.

Strategic Suggestion: Business entities would benefit from marketing hybrid polymer mixes (such as PLA-PGA blends) which can provide tuneable mechanical performances and controlled levels of resorption for enhanced outcomes and fewer complications for patients.

Leveraging 3D Printing for Personalized Medical Devices

3D printing is transforming patient-specific implants and drug delivery devices. 3D-printable bioresorbable polymers offer tremendous benefits in precision medicine. Strategic Recommendation: Bio-printing partnerships with research centers should be invested in by stakeholders in order to create personalized scaffolds, stents, and tissue engineering products in a way that better matches the patient and heals faster.

Evonik Industries

Corbion NV

BASF SE

DSM Biomedical

Ashland Global Holdings

Poly-Med, Inc.

Foster Corporation

Durect Corporation (Lactel Absorbable Polymers)

Mitsubishi Chemical Corporation

Teijin Limited

With respect to product, the market is classified into polysaccharides, proteins bioresorbable, polylactic acid, polyglycolic acid, polycaprolactone, and others.

In terms of application, the market is divided into drug delivery, orthopedics, and others.

In terms of region, the market is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, and MEA.

Bioresorbable polymers have a broad range of applications in orthopedic implants, cardiovascular stents, drug delivery systems, wound healing devices, and tissue engineering. The materials progressively break down in the body, thus avoiding the need for surgical extraction and minimizing post-surgery complications.

Polylactic acid (PLA), polyglycolic acid (PGA), polycaprolactone (PCL), and polydioxanone (PDO) are the most widely applied bioresorbable polymers. Their biocompatibility and controllable degradation rates make them suitable for biomedical applications.

The increasing demand for minimally invasive procedures, rising incidence of orthopedic and cardiovascular diseases, polymer technology advancements, and regulatory clearances for bioresorbable medical devices are key drivers of adoption.

Regulatory challenges, high cost of production, inconsistency in degradation rates, and low mechanical strength for load-bearing applications are some of the challenges. Firms are actively engaged in enhancing polymer formulations to overcome these challenges.

Because the polymers can naturally degrade within the body, they minimize medical waste as well as secondary surgeries. Also, most bioresorbable polymers are made from renewable resources, which makes them a more environmentally friendly choice over having a permanent implant.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Product, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Product, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bioresorbable Coronary Scaffolds Market

Biopolymers Market Size and Share Forecast Outlook 2025 to 2035

Cast Polymers Market Size and Share Forecast Outlook 2025 to 2035

Fluoropolymers in Healthcare Market Insights - Size, Trends & Forecast 2025 to 2035

Sulfone Polymers Market Growth - Trends & Forecast 2025 to 2035

Emulsion Polymers Market Size and Share Forecast Outlook 2025 to 2035

Drilling Polymers Market Analysis, Growth, Applications and Outlook 2025 to 2035

Acetal Copolymers Market Growth - Trends & Forecast 2025 to 2035

Specialty Polymers Market Size and Share Forecast Outlook 2025 to 2035

Antiviral Polymers for Packaging Market

Cellulosic Polymers Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymers Market Size and Share Forecast Outlook 2025 to 2035

Ethylene Copolymers Market Analysis by Various Materials, Thickness Capacity Type Through 2035

Polyguanidine Polymers Market Size and Share Forecast Outlook 2025 to 2035

UV-Protecting Polymers Market Size and Share Forecast Outlook 2025 to 2035

Piezoelectric Polymers Market Size and Share Forecast Outlook 2025 to 2035

Cyclic Olefin Polymers (COP) Polymer Syringes Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polymers Market Growth 2025 to 2035

Biocompatible Polymers Market Trend Analysis Based on Product, Polymer, Application, and Region 2025 to 2035

Market Share Distribution Among Cyclic Olefin Polymers Suppliers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA