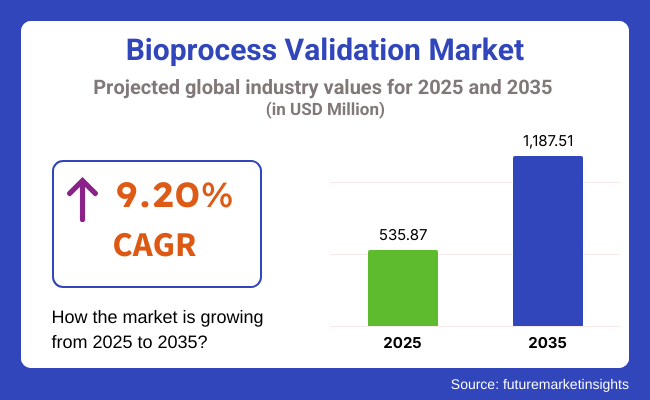

The bioprocess validation industry will be valued at USD 535.87 million by 2025 end. As per FMI's analysis, bioprocess validation will grow at a CAGR of 9.20% and reach USD 1,187.51 million by 2035.

In 2024, the industry experienced the rapid adoption of single-use equipment and modular biomanufacturing as pharma manufacturers sought flexibility and cost savings.

Regulatory bodies (FDA, EMA) increased data integrity demands, compelling companies to invest in digital validation software (e.g., AI-based analytics). The trend towards outsourcing accelerated, with CMOs adding validation services to address the demand for mRNA therapies and biosimilar. Most significantly, Asia-Pacific saw the rise as a hotspot destination with India and China investing in local validation facilities to cut on Western CMOs. The industry will reach beyond USD 535.87 million by 2025, propelled by:

By 2035, the industry will be close to USD 1.2 billion in revenues, with customized medicines and decentralized production requiring real-time validation solutions. Digital transformation laggards risk non-compliance since regulators will focus on live monitoring as opposed to retrospective checks.

(Q4 2024, n=500 stakeholders such as biopharma companies, CMOs, regulatory consultants, and CDMOs in the US, Western Europe, Japan, and South Korea)

Regional Variance:

ROI Perspectives:

Pain Points:

High Consensus:

Key Divergences:

Strategic Insight:

Final Takeaway:

| Countries /Regions | Key Policies, Regulations , & Mandatory Certifications |

|---|---|

| USA | 21 CFR Part 11 (Electronic Records Compliance) FDA Process Validation Guidance (2011) - Requires lifecycle approach (Stage 1-3) cGMP (21 CFR 210/211) - Mandatory for drug manufacturing PAT (Process Analytical Technology) Framework - Encourages real-time validation USP <1225> - Mandatory for analytical method validation |

| European Union | EU GMP Annex 1 (2023) - Strict sterile manufacturing rules EMA Process Validation Guidelines - Aligns with FDA but emphasizes risk-based approaches ISO 13485 - Required for medical device validation EudraLex Vol. 4 - Mandatory GMP compliance for biologics EU MDR (2017/745) - Impacts combination product validation |

| Japan | PMDA Validation Guidelines - Follows ICH Q7/Q8/Q9/Q10 JP GMP - Mandatory for local manufacturing Pharmaceuticals and Medical Devices Act (PMD Act) - Requires validation for biologics approval . ISO 9001 Certification - Often required for suppliers |

| China | China GMP (2010 Rev.) - Aligns with WHO/PIC/S NMPA Validation Guidelines - Requires 3-stage process validation GB/T 19001 (ISO 9001) - Mandatory for domestic manufacturers New Biologics Regulation (2023) - Stricter process control for biosimilars |

| South Korea | K-GMP - Mandatory for all drug manufacturers MFDS Validation Guidelines - Follows ICH & FDA standards ISO 13485 - Required for medical device validation MFDS Advanced Therapy Guidelines (2024) - Special validation for cell/gene therapies |

| India | Schedule M (GMP) - Mandatory for pharma/biotech firms WHO-GMP Certification - required for exports CDSCO Process Validation Guidelines - Follows US/EU standards Biologics License (BLA) - Requires full process validation . |

Biopharma companies and tech-savvy CMOs stand to gain the most, while falling behind traditional manufacturers face compliance setbacks and lost orders. The USA and Europe are the leaders in innovation, with Asia lagging in adopting cost pressure, thus creating a two-speed industry.

Drive AI & Digital Validation Adoption

Action: Leverage AI-based process analytics (e.g., real-time monitoring, predictive sterility assurance) and cloud validation platforms to reduce compliance timelines by 30-50%. Give highest priority to collaboration with FDA/EMA-conformant digital validation partners (e.g., Synthace, Sartorius) to future-proof your operations.

Dominate Outsourcing with Hybrid CMO Partnerships

Action: Partner with high-compliance US/EU CMOs/CDMOs strategically to capture demand for biologics while negotiating cost-optimized Asian partners for modular validation. Create validation-as-a-service (VaaS) models to trap mid-tier biotechs circumventing in-house expenses.

Succeed in Sustainability-Driven Validation

Action: Leader in green validation technology (i.e., paperless process control, low-power cleanroom monitoring) to address EU carbon regulations and secure ESG-driven customers. Invest in sustainable single-use system (SUS) validators or forfeit share to environmentally certified competitors.

| Risk | Probability/Impact |

|---|---|

| Regulatory Non-Compliance Due to Evolving Standards (e.g., FDA/EMA updates, new Annex 1 enforcement) | High |

| AI/Data Integrity Failures in Digital Validation (e.g., flawed algorithms, cybersecurity breaches) | Medium |

| Supply Chain Disruptions for Single-Use Systems (SUS) (e.g., material shortages, geopolitical delays) | Medium |

| Priority | Immediate Action |

|---|---|

| Deploy AI-Driven Validation Pilots | Partner with Sartorius/ Synthace to implement 2 - 3 AI-powered validation pilots (e.g., real-time sterility monitoring) by Q2 2025. Target 15% faster release times for high-value biologics. |

| Secure Strategic CMO Alliances | Negotiate exclusive validation partnerships with top-tier CMOs (e.g., Lonza , Catalent ) by Q3 2025, focusing on mRNA/cell therapy clients. Include shared-risk pricing models to lock in contracts. |

| Launch Green Validation Initiative | Develop sustainability-certified validation protocols (e.g., paperless workflows, low-energy cleanrooms) and pilot with 3 EU biotech’s by Q4 2025 to meet EMA Annex 1 eco-requirements. |

To stay ahead, companies to leverage the USD 1.2B industry opportunity through 2035, shift now to AI-facilitated validation-as-a-service (VaaS)-collaborating with CMOs to provide turnkey, FDA/EMA-governance compliant platforms cutting time-to-market for gene therapies and biosimilar.

Differ by including sustainability audits (e.g., carbon-free validation processes) in order to satisfy EU Annex 1 and USA ESG investor requirements while acquiring niche players in single-use system validation in order to control supply chains.

Redirect 20% of R&D into predictive analytics or risk losing market share to tech-first competitors such as Sartorius. This transforms your 3-year plan from a tools vendor to a compliance-to-commercialization enable with 30% higher margins.

Extractable & Leachable (E&L) Testing is the most common of these tests, especially in the biopharmaceutical and medical device sectors. This is due to the fact that E&L testing is required for regulatory purposes and is essential for patient safety-it detects harmful chemical impurities that can leach from packaging, single-use systems, or manufacturing equipment into drugs.

With the rapid adoption of single-use bioprocessing technologies (e.g., disposable tubing, bags), E&L testing demand has increased, as trace impurities may either destabilize a drug or initiate toxicological risks. Though viral clearance and residual testing are needed for certain biologics, E&L is needed across the board, from mRNA vaccines to monoclonal antibodies, making it a non-negotiable, high-growth segment.

Process Qualification (PQ) is the most prevalent step in bioprocess validation, being the pivotal link between theoretical design and operational practice. It takes center stage in industry attention due to the fact that PQ gives the ultimate proof that a manufacturing process reliably yields products with predetermined quality characteristics-a requirement non-negotiable for FDA/EMA approvals. In contrast to Process Design (upstream R&D) or Continued Process Verification (real-time monitoring), PQ gives the actionable information necessary for regulatory filing and commercialization.

Outsourced bioprocess validation is more prevalent than in-house validation, especially amongst small-to-midsize biotech’s as well as large pharma firms, because of its capacity for delivering regulatory savvy, cost effectiveness, and scale without requiring expensive capital investments into specialized infrastructure and staff.

The rigorous and dynamic compliance demands of agencies such as the FDA and EMA render outsourcing to specialized CROs/CDMOs a strategic decision, as these collaborators provide up-to-date validation protocols, quicker turnaround times (essential for speeding drug approvals), and access to cutting-edge technologies such as AI-based analytics.

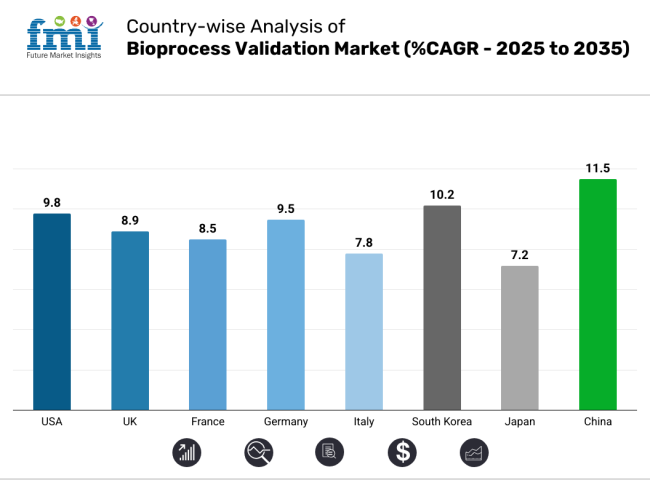

The USA industry is expected to grow at 9.8% CAGR, which is at the forefront globally because of the strict FDA regulations and sophisticated biologics manufacturing.

The industry is challenged by high compliance costs and a shortage of skilled labor but retains dominance in cutting-edge therapies such as gene editing and mRNA vaccines. Growth is driven by ongoing process validation adoption and the growing biosimilars industry, making the USA the standard for worldwide validation guidelines.

The UK industry is expected to grow at 8.9% CAGR, reconciling post-Brexit MHRA rules with global standards. Cell therapy validation, particularly viral clearance testing, is a driver of demand backed by companies such as Oxford Biomedica. Environmentally friendly validation protocols are gaining ground, but regulatory ambiguity and funding constraints limit expansion versus EU counterparts.

The UK continues to be a center for cutting-edge therapies but is increasingly subject to competition from European CMOs. Strategic prioritization areas are ATMPs and digital validation tools to keep pace in the international biologics industry.

Germany's industry is expected to grow at 9.5% CAGR, succeeding on the strength of its strong CDMO network and EMA-compliant regulatory environment. As Europe's validation leader, it is a champion in mRNA vaccine manufacturing (BioNTech) and Industry 4.0 applications, such as IoT-based validation. The industry enjoys robust government-academia-industry collaboration but is impacted by single-use system supply chain disruption.

Germany leads the world in continuous manufacturing validation and remains a leader in advanced therapy validation, especially for EU approval. Future expansion is based on digital transformation and sustainable validation practices.

France's industry is expected to grow at 8.5% CAGR, which is powered by its robust vaccine and biosimilar industry (Sanofi, Valneva). Recent EU GMP Annex 1 updates have increased the demand for sterile process validation, favoring CMOs such as Eurofins. The industry excels in extractables/leachables testing but is behind Germany in digital adoption.

High labor and tax costs constrain outsourcing expansion, although government support aids biopharma innovation. France is a vital contributor to the validation of vaccines in Europe, with increasing scope in ATMPs and environmental validation technologies.

Italy's industry (7.8% CAGR) centers on biosimilars validation owing to national cost-containment measures. Companies such as MolMed outsource EU CMOs for sophisticated testing because of low domestic capacity. Inefficient regulatory reforms and insufficient R&D spending limit industry development, though prospects are present in sterile manufacturing validation.

The industry is niche but enjoys EU harmonization activities. Growth opportunities in the future reside in specialized therapy validation and government incentives for biopharma research.

South Korea's industry is expected to register 10.2% CAGR during the forecast period, which is driven by biologics export (Samsung Biologics) and cutting-edge automation. Public sector initiatives such as Biovision 2025 drive innovation, but there are shortages of talent among smaller companies. The market is a leader in biosimilar validation and is increasingly embracing continuous manufacturing strategies.

Areas of strategic emphasis involve digital validation software and growing global CMO collaborations to solidify its rank as Asia's second-largest center after China.

Japan's industry is expected to grow at 7.2% CAGR, which is one of the conservative regulatory strategies and high in-house validation favorability. The slow uptake of digitalization by the PMDA and an aging workforce place limitations on growth, although cell/gene therapy validation (CAR-T therapies) is a growth opportunity. Hybrid validation models merging conventional GMP with new technologies are appearing. Cost forces some to outsource to Korean CMOs, yet all major pharma (Takeda, Astellas) have in-house capacity for IP protection.

The industry in China is expected to register 11.5% CAGR, which drives world growth via NMPA reforms and biologics growth (WuXi Biologics). The booming demand for mRNA and biosimilar qualification is building a $500M+ domestic industry, although IP issues discourage some foreign collaborations. Government programs such as "Made in China 2025" are driving single-use system growth.

The industry is challenged by talent shortages but is quickly becoming the world center for biosimilar qualification. Strategic alliances with Western companies are propelling technology transfer and quality enhancement.

With respect to the testing type, it is classified into extractable & leachable testing, bioprocess residuals testing, viral clearance testing, filtration & fermentation systems testing, and others.

In terms of stage, it is divided into process design, process qualification, and continued process verification.

In terms of mode, it is divided into in-house and outsourced.

In terms of region, it is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, and MEA.

The market is anticipated to reach USD 535.87 million in 2025.

The market is predicted to reach a size of USD 1,187.51 million by 2035.

Prominent players include Eurofins Scientific, Inc., Sartorius AG, Merck KGaA, Thermo Fisher Scientific Inc., Lonza, Danaher Corporation, Charles River Laboratories, SGS S.A., Toxikon Corporation, Cobetter Filtration Equipment Co., Ltd., and others.

Extractable & leachable testing is being widely used.

China, expected to grow at 11.5% CAGR during the study period, is poised for the fastest growth.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Testing Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Stage, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Mode, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Testing Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Stage, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Mode, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Testing Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Stage, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Mode, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Testing Type, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Stage, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Mode, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Testing Type, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Stage, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Mode, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Testing Type, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Stage, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Mode, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Testing Type, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Stage, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Mode, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Testing Type, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Stage, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by Mode, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Testing Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Stage, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Mode, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Testing Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Testing Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Testing Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Stage, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Stage, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Stage, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Mode, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Mode, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Mode, 2023 to 2033

Figure 17: Global Market Attractiveness by Testing Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Stage, 2023 to 2033

Figure 19: Global Market Attractiveness by Mode, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Testing Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Stage, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Mode, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Testing Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Testing Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Testing Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Stage, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Stage, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Stage, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Mode, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Mode, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Mode, 2023 to 2033

Figure 37: North America Market Attractiveness by Testing Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Stage, 2023 to 2033

Figure 39: North America Market Attractiveness by Mode, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Testing Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Stage, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Mode, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Testing Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Testing Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Testing Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Stage, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Stage, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Stage, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Mode, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Mode, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Mode, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Testing Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Stage, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Mode, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Testing Type, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Stage, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Mode, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Testing Type, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Testing Type, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Testing Type, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Stage, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Stage, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Stage, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Mode, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Mode, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Mode, 2023 to 2033

Figure 77: Europe Market Attractiveness by Testing Type, 2023 to 2033

Figure 78: Europe Market Attractiveness by Stage, 2023 to 2033

Figure 79: Europe Market Attractiveness by Mode, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Testing Type, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Stage, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by Mode, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Testing Type, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Testing Type, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Testing Type, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Stage, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Stage, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Stage, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Mode, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Mode, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Mode, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Testing Type, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Stage, 2023 to 2033

Figure 99: South Asia Market Attractiveness by Mode, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Testing Type, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Stage, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by Mode, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Testing Type, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Testing Type, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Testing Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Stage, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Stage, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Stage, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Mode, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Mode, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Mode, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Testing Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Stage, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Mode, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Testing Type, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Stage, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Mode, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Testing Type, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Testing Type, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Testing Type, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Stage, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Stage, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Stage, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Mode, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Mode, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Mode, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Testing Type, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Stage, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Mode, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Testing Type, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Stage, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by Mode, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Testing Type, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Testing Type, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Testing Type, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Stage, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Stage, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Stage, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by Mode, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by Mode, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Mode, 2023 to 2033

Figure 157: MEA Market Attractiveness by Testing Type, 2023 to 2033

Figure 158: MEA Market Attractiveness by Stage, 2023 to 2033

Figure 159: MEA Market Attractiveness by Mode, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bioprocess Fermentation Monitoring Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bioprocess Technology Market Size and Share Forecast Outlook 2025 to 2035

Bioprocessing Analytics Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bioprocessing Supplies Market Size and Share Forecast Outlook 2025 to 2035

Bioprocess Integrity Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Bioprocess Containers & Fluid Transfer Solutions Market – Trends & Forecast 2025 to 2035

Bioprocessing Systems Market

Portable Bioprocessing Bioreactors Market Size and Share Forecast Outlook 2025 to 2035

Upstream Bioprocessing Equipment Market - Growth, Trends & Forecast 2025 to 2035

Real-time Bioprocess Raman Analyzer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Single-use Bioprocessing Probes and Sensors Market - Growth & Trends 2024 to 2034

Demand for Upstream Bioprocessing Equipment in USA Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Cleaning Validation Market Size and Share Forecast Outlook 2025 to 2035

Product Design Verification And Validation Solution Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA