The increasing need for advanced packages, especially for sensitive drugs handling and delivery, is coupled with the growing demand for glass vials, prefilled syringes, ampoules, and specialized cold-chain packages, as most of the drugs are sensitive and require stringent packaging solutions to ensure stability, sterility, and shelf life.

Due to the increasing prevalence of chronic illnesses globally, an expanding pipeline of biologic products along with a transition to patient-centric drug delivery systems, there is growing evidence of the adoption of innovative packaging mechanisms.The convenience provided to patients by prefilled syringes and auto-injectors, along with reduced dosing errors with their use has made them in demand. In addition, serialization and tamper-evident laws are forcing companies to implement track-and-trace technologies to protect their supply chain and combat counterfeit drug problems.

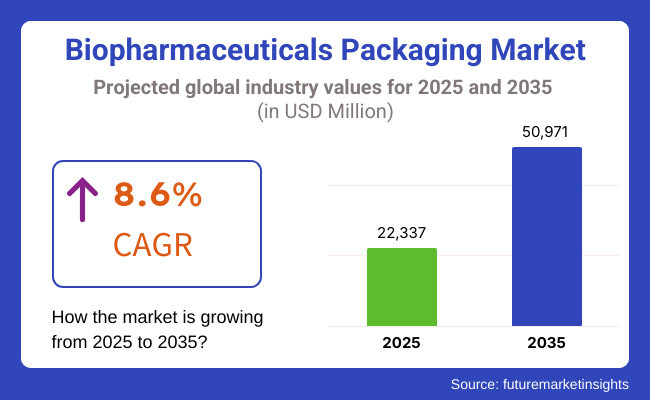

The report will also benefit from technological advances in packaging materials, increasing use of cold-chain logistics, and rising emphasis on sustainable and environmentally friendly packaging solutions, with an expected CAGR of 8.6% between October 2023 and 2030.

Key Market Metrics

As a result of its high chemical resistance and excellent barrier properties, glass remains the main biopharmaceutical packaging element, with borosilicate glass used in ampules and vials to preserve sterility and protect drug stability. Lightweight and high-impact resistance plastics, namely cyclic olefin copolymers (COC) and cyclic olefin polymers (COP), are becoming increasingly popular for prefilled syringes and flexible blister pack applications.

A growing market for cold chain packaging solutions such as insulated shipping containers, phase-change materials, temperature-controlled pouches, etc., has been established in this industry to fulfill the need for temperature-sensitive biopharmaceuticals and recent investments to construct cold chain infrastructure, which is in demand owing to the requirement for mRNA-derived vaccines and biologics, is fueling the growth in the apparels cold chain market.

Serialization and anti-counterfeiting technologies in biopharmaceutical package monitoring through RFID tags, QR codes, etc, are increasingly forming the core of biopharma package monitoring for both ensuring product authenticity and compliance with regulations. Sustainable Packaging: Reducing the Carbon Footprint There is a slow but steady transition towards more sustainable packaging materials, including biodegradable plastics, recyclable glass, and lighter packaging.

North America holds a dominant position in the biopharmaceuticals packaging market owing to the matured pharmaceutical industry presence in the region along with a strong regulatory environment and high level of biologics adoption. With the high-quality packaging needs of monoclonal antibodies, gene therapies, and biosimilars, the United States and Canada hold the pole position in biologics production.

Demand for prefilled syringes and drug-delivery devices is also growing with the rise of personalized medicine and self-administered therapies. The rapid increase of mRNA production facilities is also driving high demand for cold-chain packaging solutions.

Germany, France, and the United Kingdom have been at the forefront of biopharmaceuticals packaging in Europe, which is a standard market. Demand for advanced packaging solutions is driven by strict EU regulations on packaging integrity, tamper-evident features, and serialization.

Industry trends also point in the direction of rising demand for sustainable and recyclable packaging materials or alternative packaging solutions, with many companies pushing towards a more circular economy and responsible use of plastics. Moreover, the growing uptake of biosimilars in Europe is fuelling the growth of the market.

Due to the emerging economies, the biopharmaceuticals packaging market is expected to grow the most in China, India, and Japan (APAC). Along with this, the rising government funding accessible for biologics and vaccine construction is catering to market requirements for advanced packaging solutions that can cater to the forthcoming demands of the quickly evolving pharmaceutical fabricating industry in the domain.

The Indian biopharmaceutical sector is still on a rapid growth track, with independent Chinese companies actively exploring global markets and subsequently creating a greater demand for high-quality packaging solutions. Additional factors that are driving the growth of the market include the rising power of India in the vaccine manufacturing market as well as the interest of Japan in high-quality biologics packaging.

Brazil and Mexico, in particular, have proved active players as the Latin America biopharmaceuticals packaging market grows. Government initiatives supporting the pharmaceutical export sector, rising healthcare expenditures, and growth in biologics demand are prominent factors driving growth in the pharmaceutical packaging market.

The Middle East specialty packaging market is anticipated to grow at the fastest rate during the forecast period due to the rising cases of chronic diseases and the increasing number of biopharmaceutical manufacturing facilities in Gulf countries. There has also been growing demand in the region for modern cold-chain logistics to support the distribution of vaccines and exports of biological drugs.

Challenges

Stringent Regulatory Compliance and Packaging Integrity

The Biopharmaceutical packaging market is a difficult market due to stringent regulatory requirements and the requirements of packaging for product stability and sterility. Biopharma products such as vaccines, monoclonal antibodies, or gene therapies are sensitive to environmental factors (temperature, light, humidity).

But if the packaging quality goes wrong, it changes the product, and this becomes the reason medicines become useless or unsafe. Regulatory agencies such as the USA FDA and the European Medicines Agency (EMA) have strict limits on packaging materials, labelling, and serialization, resulting in a complex and expensive compliance process for manufacturers.

High costs for specific packaging solutions are one of the major challenges.Given these factors, high-barrier materials, tamper-proof closures, and sophisticated temperature-controlled packaging usage have also increased production costs. Biopharmaceutical manufacturers have been further challenged by disruptions in the global supply chain, such as shortages of pharmaceutical-grade plastics and glass. The growth in demand for the biologics segment is expected to drive the packaging industry, and the industry is focusing on providing an uninterrupted supply of quality packaging materials.

This means more investment in a greener process and designing more cost-effective and planet-friendly packaging for everything from biodegradable plastic to lab-grown protein. Further, the integrity of the package and compliance with regulatory mandates can be enhanced through advanced polymer technologies, smart packaging solutions, and improved cold-chain transportation logistics. Collaboration with regulatory agencies to ensure a faster approval process and to create improved compliance strategies can help accelerate the market growth.

Opportunity

Innovations in Smart and Sustainable Packaging Solutions

The demand for innovative and sustainable packaging solutions is redirecting growth opportunities in the biopharmaceuticals packaging market. Refined forms of smart packaging technology, including RFID-enabled tracking systems, temperature-sensitive indicators, and real-time monitoring sensors, are being used to improve biopharmaceutical product safety and traceability. Innovations like this help protect the integrity of sensitive biologics through continuous data on storage conditions and minimize the risk of damage or contamination.

Another important area to expand on these markets of opportunity is sustainability. Pharmaceutical manufacturers are progressively adopting biodegradable polymers, recyclable glass vials, and sustainable cold-chain solutions for eco-friendly packaging materials.

Companies are working to develop better alternatives to single-use plastic packaging without compromising on the high standards necessary for biopharmaceutical preservation. Implementing lightweight and low carbon footprint packaging materials can minimize environmental footprints and maximize cost-effectiveness in the supply chain.

Furthermore, the increase in personalized medicines and targeted therapies trend is further increasing the demand for customized biopharmaceutical packaging. As more and more biologics need to be patient-specific formulations, the packaging solution that can be tailored to different dosage forms, different methods of administration, and different storage requirements must be applied. In the future, modular and flexible packaging designs that adhere to specific treatment plans will continue to propel market growth.

The biopharmaceuticals packaging market was rapidly progressing between 2025 and 2035, driven by the growth of biologics, rising regulatory scrutiny, and demands for temperature-sensitive cold chain solutions. Some of these solutions have included serialization and track-and-trace capabilities, which ensure compliance with global anti-counterfeiting regulations. The sustainability push also accelerated, with alternatives to plastic-based packaging being explored by such companies.

With some forecasts predicting continued growth for paper labelling technologies, the industry is set for transformation between 2025 to 2035, with the integration of digital tracking technologies, automation in packaging processes, and increased eco-friendly solutions.

The burgeoning market for biosimilar and next-generation biologics will fuel demand for even more specialized packaging materials that provide enhanced protection and longer shelf-life. Companies will also be on the lookout for ways to cut back on packaging waste and carbon emissions, all while keeping up with evolving regulatory requirements.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Strengthened guidelines for biologics packaging and serialization |

| Technological Advancements | Growth of smart packaging with QR codes and RFID tracking |

| Industry Adoption | Increased investment in cold chain packaging for vaccines |

| Supply Chain and Sourcing | Dependence on pharmaceutical-grade plastics and glass |

| Market Competition | Dominance of established pharmaceutical packaging companies |

| Market Growth Drivers | Demand for COVID-19 vaccine packaging and biological drug delivery |

| Sustainability and Energy Efficiency | Focus on reducing plastic waste in packaging |

| Integration of Smart Monitoring | Implementation of tamper-proof labels and anti-counterfeiting measures |

| Advancements in Biologic Drug Delivery | Growth of prefilled syringes and single-dose vials |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of global harmonization in biopharmaceutical packaging regulations |

| Technological Advancements | Widespread adoption of AI-powered monitoring and digital tracking solutions |

| Industry Adoption | Development of temperature-sensitive biopharmaceutical packaging for advanced therapies |

| Supply Chain and Sourcing | Expansion of sustainable materials, biodegradable polymers, and recycled glass |

| Market Competition | Growth of specialized biotech packaging firms catering to personalized medicine |

| Market Growth Drivers | Rise of biosimilars, gene therapies, and patient-specific drug formulations |

| Sustainability and Energy Efficiency | Large-scale adoption of recyclable, compostable, and lightweight packaging solutions |

| Integration of Smart Monitoring | Development of block chain-based supply chain monitoring for biopharmaceutical security |

| Advancements in Biologic Drug Delivery | Expansion of smart injectors and biodegradable biopharmaceutical packaging innovations |

The United States biopharmaceutical packaging market is expanding rapidly in the region due to the establishment of the pharmaceutical industry and increasing demand for biologics, which is likely to boost the market in the area. The increasing use of advanced packaging solutions such as prefilled syringes, vials, and auto-injectors is supporting drug stability and shelf life. The FDA regulations on drug safety and traceability are becoming stricter, making way for innovations in smart packaging technologies such as serialization and tamper-evident solutions. Sustainable packaging investments, such as biodegradable and recyclable resources, are also shaping market types.

Cell and gene therapies are exploding in the USA, driving demand for packaging solutions designed for maintaining temperature-sensitive biologics. The local presence of prominent biopharmaceutical manufacturers and contract packaging organizations (CPOs) supports the advanced drug packaging supply chain. The demand for Wyeth's packaging during this period is driven not only by an unprecedented growth in manufacturing capacity but also by the increasing complexity of biologics manufacturing facilities being developed in states such as Massachusetts, California, and North Carolina.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.9% |

The biopharmaceutical packaging market in the United Kingdom has been expanding steadily, driven by the increasing investments in research and development (R&D) of biologics and biosimilars in the country. The increase in the use of single-use bioprocessing systems by biopharmaceutical companies is driving the demand for sterile packaging Formats such as Vials, Blister Packs, and Ampoules. The UK has a stringent regulatory framework in place, governed by the Medicines and Healthcare Products Regulatory Agency (MHRA), which ensures that packaging solutions meet very high safety and quality standards.

In turn, pharmaceutical companies are working to develop eco-friendly packaging options in relation to sustainability initiatives. The UK’s biopharmaceutical industry benefits from state-sponsored life sciences clinical innovation hubs, notably in the Oxford-Cambridge-London Golden Triangle. For example, technologies for digital packaging are being increasingly adopted, improving supply chain transparency and lowering counterfeiting threats. In addition, the surge of biosimilar production and collaborations with leading pharmaceutical companies are bolstering the demand for high-efficacy pharmaceutical packaging in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.5% |

Germany, France, and Italy account for the major share of the European biopharmaceuticals packaging market, owing to a well-established pharmaceutical infrastructure and stringent regulations from the European Medicines Agency (EMA). Growing demand for biologics, biosimilar, and personalized medicines is encouraging innovations in advanced packaging formats such as cold-chain solutions, high-barrier films, and smart labels. In Europe, you will also find different providers who focus on sustainable packaging materials with the aim of preventing environmental pollution through biodegradable and recyclable packaging.

Investments in the development of blockchain-based track-and-trace technologies are increasing across the European biopharmaceutical packaging market to ensure drug safety, reducing the chances for counterfeit drugs. Similarly, the proliferation of mass biopharma manufacturing hubs across Germany and France, as well as increasing vaccine and biosimilar production, will drive the turnout of high-performance packaging materials. The market landscape is also being bolstered by the ongoing research and development activities pertaining to the development of temperature-controlled and tamper-proof packaging solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 8.7% |

The biopharmaceutical packaging market in Japan is growing due to the country’s investment in regenerative medicine, cell therapy, and biosimilar development. Advancements in multilayer films and closure technologies are being driven by the increasing demand for high-barrier packaging solutions to stabilize biologics and injectable drugs. Japan's strict Good Manufacturing Practice (GMP) guidelines are causing pharmaceutical companies to adopt creative packaging. Also, QR-code-enabled authentication systems through smart packaging solutions are gaining traction in the Japanese market.

Demand for advanced packaging materials is being driven by Japan’s continued commitment to the development of novel pharmaceuticals, especially monoclonal antibodies and gene-based therapies. Automation and AI-driven quality control systems are taking a foothold in the country’s pharmaceutical packaging industry to improve efficiency and minimize contamination risks. As major biopharmaceutical companies expand production capacities, the Japanese market for specialized drug packaging solutions is about to grow even further.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.6% |

With its fast-growing biotech and pharmaceutical sectors, South Korea is becoming a hub for biopharmaceutical packaging. This growing focus on biologics, particularly in cell therapy and vaccine production, has translated into heightened demand for advanced packaging formats, including sterile vials, ampoules, and prefilled syringes. This growth is further boosted by government initiatives encouraging domestic biopharmaceutical production, such as tax incentives and R&D funding. South Korea’s position as a leader in digital healthcare packaging is facilitating the integration of smart packaging technologies for improved supply chain management.

The biopharmaceutical sector in South Korea is focusing on investing in ultra-low-temperature packaging solutions to facilitate the burgeoning demand for mRNA vaccines and gene therapies. The demand for specialized packaging is driven by the expansion of top biotech clusters like Songdo and Osong, both of which host significant biopharma manufacturing facilities. Furthermore, the country’s expertise in advanced material sciences is driving next-generation sustainable packaging solutions in line with international environmental goals.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.8% |

The rapid growth of the biopharmaceutical packaging market can be ascribed to the high demand for specialized primary packaging in order to ensure the stability of biological drugs and their potency. Compared with traditional pharmaceutical products, biopharmaceutical products are more sensitive to low temperature, light, and contamination, etc. This also increases the use of primary packaging materials such as vials, prefilled syringes, ampoules, cartridges, and bottles, which provide better barrier protection and ease of administration.

The largest subsegment of the report is primary packaging because vials and prefilled syringes are widely used for packaging monoclonal antibodies, vaccines, and gene therapies. Slightly moister lyophilized (freeze-dried) biologics that are more sensitive in nature require more sophisticated glass and polymer vials that should be able to pass a packaging resinify test, do not absorb moisture, and keep the drug stable.

Also, due to ease of use and minimal drug wastage, and the positive impact prefilled syringes have on patient compliance with self-administered therapies (insulin and autoimmune disorder therapies), they have been rapidly capturing the market.

In addition, cartridges are used in pen injectors for chronic disease management, as well as in wearable drug delivery devices. Ampoules are not very common because they break but they are used for some liquid biopharmaceuticals because they offer a relatively high level of sterility and protection. However, for primary packaging to ensure a drug's safety, several challenges, including material cost issues and compatibility challenges, remain.

While this characteristic is enticing, unique chemistries developed in cyclic olefin polymers (COP) and cyclic olefin copolymers (COC) are allowing manufacturers to implement translucent or transparent coating solutions that do not suffer the setbacks listed above, and with the added advantage of consistency, biocompatibility, and resistance.

As one of the most crucial parts of the biopharmaceuticals segment, secondary packaging ensures safe shipping, storage, and handling of biologics. The need for cartons, trays, labels, and tamper-evident packaging has been fuelled by growing complexities in biopharmaceutical supply chains and increasing regulatory demands.

The cartons and trays are critical types of secondary format that serve to group and protect the primary package units, especially in the case of multi-dose biologic therapies. Sustainable initiatives and regulatory pressures making secondary packaging eco-friendly and recyclable materials grow rapidly. This is the reason tamper-evident and serialization-enabled secondary packaging solutions are emerging as extremely potent battlefronts against counterfeiting and helping in product authenticity.

Such regulations [including the USA Drug Supply Chain Security Act (DSCSA) and the EU Falsified Medicines Directive (FMD)] have propelled the adoption of track-and-trace technologies, including barcodes, QR codes, and RFID-enabled packaging.

While Secondary Packaging serves an important function in logistics, high pricing and limited packaging innovation continue to persist. However, the development of lightweight designs, sustainable materials, and digital tracking technologies remain the key drivers of market growth.

Cold chain packaging is one of the largest segments of the biopharmaceuticals packaging industry, as most biologics require tight temperature controls to maintain their stability and efficacy. Insulated shipping containers, temperature-controlled packaging and phase change materials (PCMs) will play a crucial role in meeting the demand for the growing number of mRNA vaccines and monoclonal antibodies and, even more so, for cell and gene therapies.

Insulated shipping containers, including vacuum-insulated panels (VIPs) and expanded polystyrene (EPS) boxes, play an essential role in securing a product and its integrity over transport. Smart packaging technologies are also rising in the cold chain logistics context as temperature monitoring sensors, GPS tracking, and data loggers bring supply chain visibility. These technologies allow pharmaceutical companies to identify disruptions in real time to avoid spoilage of products.

Although cold chain packaging preserves biopharmaceuticals, challenges remain, including high costs and difficult logistics. Nevertheless, with developments in sustainable insulation materials, reusable cold chain packaging, and AI-based temperature monitoring systems, these concerns are being addressed, ensuring market growth momentum.

As the biopharmaceutical industry moves to become more sustainable, there is an increasing demand for these types of eco-friendly packaging solutions. More companies are investing in biodegradable polymers, recyclable materials and less-plastic alternatives. The emergence of plant-based bioplastics and water-soluble films will gain momentum and address environmental concerns.

The market is also witnessing intelligent packaging innovation such as connected packaging, NFC-enabled labels, temperature-sensitive inks, etc. These, in turn, help improve patient adherence, allow for greater transparency along the supply chain, and enable real-time monitoring of drug storage conditions. These systems, built on blockchain technology, provide robust security for products, mitigating counterfeiting possibilities and ensuring regulatory compliance.

Continued research on next-generation packaging technologies is likely to continue driving innovation despite existing challenges like high costs and regulations. The market would sustain its Liquid termination products through the integration of sustainable materials and digital tracking solutions in the industry, and the adoption of Liquid termination products will make the Liquid termination products future-proof against the changing industry's needs.

The advent of innovative and customized biopharmaceutical packaging solutions to propel the growth of the biopharmaceuticals packaging market which, for instance, is driven by growing consumption of biologics, vaccines, and gene therapies, making them be packaged using dedicated packaging to take care of product stability, sterility, delivery, appearance, and potency. Stringent regulatory requirements, advances in drug delivery systems, and the demand for temperature-controlled packaging adorning sensitive biologics help in the sector's growth.

Key areas of transformation comprise new prefilled syringes break-through, smart packaging with communications track-and-trace features, and sustainable biopharmaceutical packaging materials. Industries are concentrating on high-barrier materials along with child-resistant and tamper-proof designs and enhanced logistics for cold chain management.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Schott AG | 18-22% |

| Gerresheimer AG | 15-19% |

| West Pharmaceutical Services | 12-16% |

| Becton, Dickinson & Co. | 10-14% |

| Amcor Plc | 8-12% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Schott AG | World leader in high-quality pharmaceutical glass packaging technologies such as vials, ampoules, and prefilled syringes for biologics.. |

| Gerresheimer AG | Covers glass and plastic packaging solutions for biopharmaceutical products, emphasizing high-barrier materials and containers for injectable drugs. |

| West Pharmaceutical Services | Provides innovative elastomer components, vials, and self-injection systems, enhancing drug stability and patient safety. |

| Becton, Dickinson & Co. | Provides advanced prefilled syringes and drug delivery systems for biologics and injectable therapies. |

| Amcor Plc | Designs flexible and rigid packaging solutions, with a focus on sustainable packaging solutions and temperature-sensitive packaging for biologics. |

Key Company Insights

Schott AG (18-22%)

Market leader with Type I borosilicate glass vials and ampoules and high chemical resistance and compatibility with sensitive biologic drugs.

Gerresheimer AG (15-19%)

A leading provider of personalized primary packaging solutions, integrating smart packaging technologies for real-time monitoring of injectable drugs.

West Pharmaceutical Services (12-16%)

It specializes in tailored closures, seals, and injectable drug delivery solutions to improve biopharmaceutical stability and administration.

Becton, Dickinson & Co. (10 to 14%)

Broad portfolio of products in prefilled syringes, enhancing compatibility with biologics and vaccine delivery systems, increasing patient adherence.

Amcor Plc (8-12%)

Knowledge gained on new product developments, including glass and glass substitutes and specialty packaging solutions with an upgrade for the pharmaceutical industry.

Other Key Players (25-35% Combined)

The efforts in biopharmaceuticals packaging has come from several specialized and regional companies to ensure developments owing to sustainability, safety, and advanced drug delivery solutions. These include:

The overall market size for the Biopharmaceuticals Packaging Market was USD 22,337 million in 2025.

The Biopharmaceuticals Packaging Market is expected to reach USD 50,971 million in 2035.

The increasing demand for temperature-sensitive biologics, vaccines, and cell and gene therapies fuels the Biopharmaceuticals Packaging Market during the forecast period. The rising adoption of sustainable and advanced cold chain packaging solutions further accelerates market growth.

The top 5 countries driving the development of the Biopharmaceuticals Packaging Market are the United States, Germany, China, Japan, and India.

On the basis of application, Cold Chain Packaging is expected to command a significant share over the forecast period, driven by the increasing demand for secure, temperature-controlled packaging solutions in biologics transportation and storage.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Packaging Bins Market Trends - Growth & Demand 2025 to 2035

Packaging Inserts Market Insights - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA