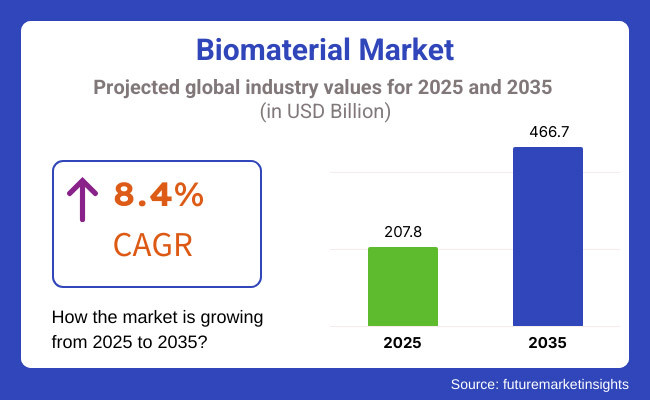

The biomaterials market is poised for significant expansion between 2025 and 2035, driven by increasing demand for biocompatible materials, advancements in medical technology, and the rising prevalence of chronic diseases. The market is projected to reach USD 207.8 billion in 2025 and expand to USD 466.7 billion by 2035, reflecting a compound annual growth rate (CAGR) of 8.4% over the forecast period.

The biomaterials market is accelerating, with increasing uses in orthopedics, cardiovascular devices, wound healing, and tissue engineering. Also, the rising prevalence of chronic diseases on the back of advancements in medical technology is further driving the demand for these novel biomaterials which improve patient outcomes. Integration of smart polymers, bioactive glass, and nanomaterials as next-generation materials for biocompatibility, durability, functionality, and utility supremeness are essential elements of next-generation implications in healthcare.

Increasing investments in biotech innovation, government funds, and collaborations between various biotech companies and research institutions are speeding up innovation in the field. Emerging manufacturing technologies such as 3D bio printing and nano-technology enable complex programs of personalized implant types and tissue architecture scaffolds. Moreover, the industry is trending towards sustainable and biodegradable biomaterials which create lesser long-term effects on environment, thus boosting the market.

While this recent growth is promising, numerous challenges such as high production costs, regulatory complexities, and biocompatibility issues continue to be barriers to market penetration. Companies are tackling these problems with strategic partnerships, advances in materials and initiatives to expedite regulatory approvals. The biomaterials market will significantly enhance medical treatments and improve patient care, paving the way for the future of regenerative medicine, with ongoing innovations and increasing investments.

Explore FMI!

Book a free demo

The biomaterials market is led by North America, ascribed to robust R&D activities, growing healthcare investments, and high demand for advanced medical implants and involvement of tissue. The United States and Canada dominate the region, as the majority of the prominent companies emphasize their attention to innovative biomaterials such as bioresorbable polymers, collagen scaffolds, and smart biomaterials.

Nevertheless, the increasing incidence of chronic diseases, along with an increase in population age (elderly population), and development of regenerative medicine further stimulate the growth of the market. Furthermore, government initiatives backing biocompatible materials and strict regulations of FDA ensure the development of high-quality products. High production costs and complex regulatory approval processes, however, are among the challenges. To increase market scalability and accessibility, companies are conducting cutting-edge forms of manufacturing, investing in bioengineered materials and more.

The major contributors in Europe include Germany, France, and the United Kingdom, among others, owing to flourishing academic research and biotechnology innovations, which are supported by government funding pursuing healthcare advancements in order to hold notable share of the biomaterial market. The growing acceptance of biodegradable implants, tissue scaffolds, and orthopedic biomaterials boost market growth.

While stringent EU regulations on medical devices and biomaterials guarantee high product safety standards, they may also prolong approval processes. Sustainability trends and the demand for eco-friendly biomaterials inform the industry as well. Yet, fluctuations in the economy and increasing prices for raw materials are the hurdles. To respond to a rapidly evolving healthcare landscape, firms are pursuing next-generation biomaterials, such as nanostructured materials and 3D-printed biopolymers.

Region-wise, biomaterial market in Asia-Pacific is the fastest growing, which is attributed towards rising healthcare expenditure, growing medical tourism and expanding biomedical research in countries such as China, India, Japan, and South Korea. The demand for advanced biomaterials is increasing due to Population ageing, increasing occurrences of orthopedic disorders and technological advancements in wound healing and drug delivery systems.

Additionally, initiatives by government promoting domestic biomedical industries and foreign investments in healthcare infrastructure further drives the market. Regulatory inconsistencies, intellectual property concerns and cost barriers, among others, could affect market penetration. To capitalize the growing demand, companies are concentrating on localized production, strategic partnerships, and economical biomaterial inventions.

Challenge

Regulatory Hurdles and Biocompatibility Concerns

The biomaterial market encounters challenges concerning strict regulatory requirements and queries surrounding biocompatibility. In the medical field, the approval process of new biomaterials involves significant efforts to demonstrate both safety and efficacy, resulting in long product development timelines. Moreover, due to the variable patient response to biomaterials, there is also risk for the widespread adoption of these innovations, demanding that material design is a continuously improving process.

Opportunity

Advancements in Regenerative Medicine and Bioengineering

There is a huge potential in the growing need for biomaterials in regenerative medicine, 3D bioprinting, and implantable medical devices. Next-generation materials for tissue regeneration, wound healing, and prosthetics are powered by advances in bioengineered materials, nanotechnology, and intelligent biomaterials. Additionally, rising investments in environment-friendly and biodegradable biomaterials are in accordance with the global trend to environment-friendly medical application.

The market extended for biomaterials used in medical implants, drug delivery systems, and tissue engineering between 2020 and 2024. But innovation was hampered by regulatory challenges and material performance limitations. Manufacturers working on property enhancement, durability, and bio compatibility as per market requirement.

From 2025 to 2035, with further growth in synthetic biology, machine learning enabled material design, and bio fabrication techniques, there will be a successful transformation of the biomaterial market. The field will also get boost from the use of smart biomaterials with real-time monitoring systems, biodegradable implants, and personalized medicine applications. Moreover, the growing use of biomaterials outside the healthcare sector, such as in packaging, automotive, and electronics, will create new opportunities for market growth.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stringent approval processes and compliance challenges |

| Technological Advancements | Increased use in medical implants and drug delivery |

| Industry Adoption | Growth in tissue engineering and prosthetics |

| Supply Chain and Sourcing | Dependence on petroleum-based synthetic materials |

| Market Competition | Heavily controlled by med device cos |

| Market Growth Drivers | Market for advanced wound care and implant materials |

| Sustainability and Energy Efficiency | Early uptake of biodegradable biomaterials |

| Consumer Preferences | Integrate tendency towards hard-wearing and much heavier devices |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Streamlined regulations with AI-driven safety assessments |

| Technological Advancements | AI-driven biomaterial design, bio fabrication, and nanotechnology integration |

| Industry Adoption | Expansion into biodegradable packaging, automotive, and electronics applications |

| Supply Chain and Sourcing | Shift toward bio-based and sustainable biomaterial alternatives |

| Market Competition | Biotech companies, nanotech companies, and Material Science start-ups |

| Market Growth Drivers | Emergence of gene therapy, three-dimensional (3D) bioprinting, personalized biomaterials |

| Sustainability and Energy Efficiency | Production of biodegradable and self-repairing composite materials on a commercial scale |

| Consumer Preferences | Growing demand for sustainable, customized, and multifunctional biomaterials |

The USA biomaterials market is expected to grow due to its various applications in regenerative medicine (eg: tissue-engineering for Alzheimer's and others), orthopedics, wound healing, and drug delivery [3] and [4]. The increasing popularity of biomaterials and the rapid growth and development of biotechnology and nanotechnology, having large investments in R&D, has fuelled the demand for innovative biomaterials. Moreover, the geriatric population and increasing incidence of chronic disorders such as osteoporosis and cardiovascular diseases have resulted in increased demand for bio implants and tissue engineering products. Ongoing supportive market growth drivers include the prevalence of key industry stakeholders, established healthcare infrastructure, and progressive regulatory policies.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 8.1% |

The UK biomaterials market is growing moderately, aided by the growing prevalence of medical implants, prosthetics, and wound treatment based on biomaterials. Government programs to improve healthcare technology, as well as the increase in research funding in the field of bioengineering, have propelled the market.

Moreover, partnerships between academic institutions and biotech firms are resulting in the development of novel biodegradable and bioresorbable materials. There is also growing emphasis on 3D-printed implants and personalized medical solutions supported by rising demand for sustainable & biocompatible materials specifically in medical applications influencing the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.7% |

The European biomaterial market is being driven by increasing demand for bio-based medical solutions for orthopedic, cardiovascular, and dental applications. 94% of the world's biomaterial innovators are based in Germany, France and Italy with many receiving considerable funding from their governments, research institutes or have been partnered with a biotech company.

Increasing adoption of biodegradable polymers, metallic biomaterials, ceramic-based implants and others has added to the growth. Also, made by the improvements in science as well as technologies, the stringent EU policies favouring the use of safe and sustainable biomaterials aided the advancements in bioengineering as well as regenerative medicine.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.9% |

Japan biomaterials market is rapidly growing due to the large amount of technology based on regenerative medicine, tissue engineering and medical implants in the country. Increasing demand is due to the aging population and the use of biomaterials for joint replacements and dental implants, as well as in the field of wound healing. Moreover, the well-established healthcare sector and the Japanese government’s initiative to support biomaterial research have driven innovations in the development of bioresorbable polymers and nanomaterials. The growing partnership of medical institutions with various biotechnology firms is augmenting the market even more.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.8% |

As bioengineering and medical device technology develop, the biomaterial market grows rapidly in South Korea. A solid research ecosystem develops innovative biomaterials, such as bio ceramics, bioactive glass, and biodegradable polymers.

Rising orthopedic disorders and cardiovascular diseases, as well as an aging population, are expected to drive demand for biomaterial-based implants and prosthetics. Moreover, advancing investment by the South Korean government in medical technology and bio fabrication bolsters the country in the global biomaterials industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.0% |

The demand for biocompatible based durable and high-performance materials for medical, dental and orthopedic applications is anticipated to boost the Biomaterial Market growth in forecast period. Abstract the increasing need of next generation biomaterials for tissue regeneration, implant integration and biocompatibility have been along in part with the rapid growth of the healthcare and biomedical industry. At the same time, the rise in geriatric population, prevalence of chronic diseases and orthopedic disorders has augmented the demand for biomaterials (used in applications such as bone grafting, prosthetics, dental implants, regenerative medicine). The biomaterial industry will keep booming and innovating, as technology improves, research funding continues, and medical institutions collaborate with material scientists.

The Resorbable/Biodegradable biomaterials segment is witnessing higher demand owing to their ability to blend with biological tissues and dissolve after the property to serve its purpose. These materials are mainly employed in tissue engineering, drug delivery system and as temporary implants when a second extraction operation for the removal of the implant is required to avoid. Among them, Calcium Aluminate and Calcium Phosphate biomaterials are very widely used methods in regenerative medicine, such as orthopedic scaffolds and dental applications, due to their bioactivity, osteo conductivity, and structural compatibility with human bone tissue.

New types of implant materials, including biodegradable polymers, lactides, natural bio ceramics, and bioresorbable composites are increasingly in the market to satisfy the needs of long-term bioresorbable, biocompatible, biodegradable, bioactive implants. Additional research in nanostructured biomaterials and bioactive coatings would hasten the development of next-generation resorbable implants that both stimulate tissue healing and foster cellular integration. With the continued development of personalized medicine and regenerative therapies, biomaterial as biodegradable will more and more extended to the applications in orthopedics, dental and soft tissue, almost all these area are continued to develop in the next few years.

The surface reactive/bioactive biomaterials segment is trending as they provide better interaction with biological tissues, allowing better bonding and faster healing in medical applications. Glass Ceramic biomaterials are mainly used for their mechanical strength, aesthetic appearance and capacity for direct chemical bonding with bone tissues, which can be considered for dental restoration, orthopedic implants and bone graft substitutes. Moreover, Hydroxyapatite, the classic and most commonly used bioactive ceramic, contributes significantly to bone and dental regeneration by mimicking the natural bone mineral content and facilitating osteo integration and long-term fixation of implants.

This has led to a lot of focus on bioactive coatings for implants, 3D-printed biomaterial scaffolds, and surface modifications using nanotechnology, which is increasing the need for surface-reactive biomaterials. This type of materials are widely used in the development of biomedical coatings, artificial joints, prosthetic implants, as well as for the preparation of drug-loaded biomaterials systems to improve the recovery and decrease of post-surgical complications. In addition, the development of novel synthetic bioactive ceramics and glass-ceramic composites are leading to tailored, patient-specific implants and smart biomaterial applications.

We expect trends in the future market of biomaterials to be dependent on elements such as biocompatibility and bioactivity, as well as sustainability. Biodegradable, resorbable, and surface-reactive biomaterials are increasingly being used to transform medical device fabrication, regenerative medicine, and tissue engineering, leading to better patient outcomes and sustained therapeutic success. The Ongoing advancements in biomaterial research, smart biomaterial solutions as well as hybrid biomaterial solutions will act as booming market and boosts overall clinical ecosystem.

The industry is expanding quickly due to enhanced applications in medical implants, tissue engineering, and regenerative medicine. The increasing prevalence of chronic diseases, technological advancements in biotechnology, and the increasing investments in healthcare infrastructure are some of the major drivers fuelling the growth of the market. On the other hand, the companies in this sector are emphasizing biocompatibility, novel biodegradable materials & nanotechnology-based biomaterials that will be used to improve medical results and sustainability. Furthermore, growing awareness regarding biomaterial based medical devices most likely to support market growth, along with government initiatives for biomaterial research will also contributes to market growth.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Medtronic | 18-22% |

| Johnson & Johnson | 12-16% |

| Stryker Corporation | 10-14% |

| Zimmer Biomet | 8-12% |

| Evonik Industries | 5-9% |

| Other Industry Players (Combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Medtronic | Creates high-tech biomaterials for use in medical implants, tissue repair, and drug delivery systems. |

| Johnson & Johnson | Focuses on developing and characterizing biocompatible biomaterials for the surgical and orthopedic implant market. |

| Stryker Corporation | Develops bioresorbable materials and coatings for implantable medical devices. |

| Zimmer Biomet | Orthopedic biomaterials development, bone graft substitutes and bioactive coatings. |

| Evonik Industries | Biodegradable and high-performance polymers for medical and pharmaceutical uses. |

Key Company Insights

Medtronic (18-22%)

Medtronic is one of the top global companies in the biomaterials field, providing innovative biomaterials for medical implants and regenerative medicine. The company also focuses on investing in next-generation biocompatible R&D materials construction to optimize the patient's end results.

Johnson & Johnson (12-16%)

With a strong background in medical devices and pharmaceuticals, Johnson & Johnson utilizes its expertise in biomaterials to create innovative surgical and orthopedic products that improve durability while prioritizing microbiological safety.

Stryker Corporation (10-14%)

It specializes in R&D of bioresorbable materials and surface coatings for implants, which help improve the functionality of the implants and minimize post-surgery complications while improving tissue integration.

Zimmer Biomet (8-12%)

Zimmer Biomet focuses on orthopedic biomaterials, offering advanced solutions for patients needing joint replacement, dental implants, and spinal surgeries. Its biomaterial innovations improve the regeneration and strength of bones.

Evonik Industries (5-9%)

As a leader in high-performance polymer manufacturing, Evonik Industries specializes in developing bioresorbable materials for drug delivery and implant applications with a focus on sustainability and precision.

Other Key Players (35-45% Combined)

The Biomaterial Market is encompassing with various provincial and universal players, which anticipates for developing survey and advancement in the market. Notable brands include:

The overall market size for the biomaterial market was USD 207.8 billion in 2025.

The biomaterial market is expected to reach USD 466.7 billion in 2035.

The biomaterial market is expected to grow at a CAGR of 8.4% during the forecast period.

The demand for the biomaterial market will be driven by advancements in medical technologies, increasing applications in tissue engineering and regenerative medicine, rising prevalence of chronic diseases, growing demand for biocompatible materials in implants, and ongoing research and development initiatives.

The top five countries driving the development of the biomaterial market are the USA, Germany, China, Japan, and France.

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.