The market for chemical and biological indicator is utilized in sterilization monitoring for healthcare, pharmaceutical, food processing and other industrial applications. BIs are prepared with live spores to verify sterilization, while CIs use an agent to induce a color change to verify exposure to sterilization conditions.

Other Prevailing Factors: There is Rising Demand for Infection Control, Regulatory Requirements and Patient Safety in Hospitals, Laboratories and Pharmaceutical Production Facilities. In addition, the growth of technology in the high-speed readout biological indicators, the growing use of ethylene oxide (EO) and hydrogen peroxide sterilization, are driving the increasing demand for the monitoring instruments.

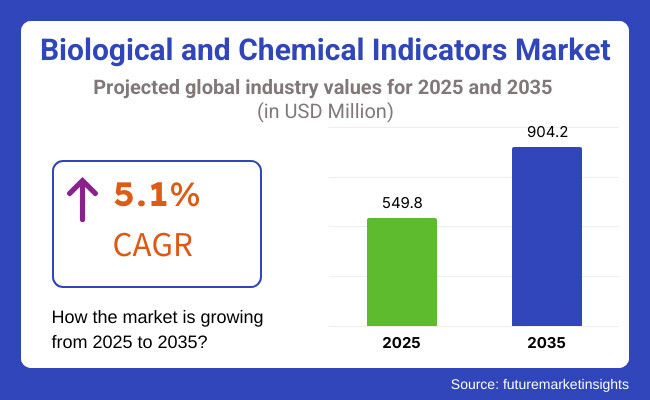

The global chemical & biological indicators market will be about USD 549.8 million by 2025 and will reach USD 904.2 million by 2035, at a Compound Annual Growth Rate (CAGR) of 5.1% during 2023-2035.

The forecasted CAGR reflects the increasing need for sterilization assurance products, growing awareness of HAIs, and stringent regulatory demands for sterility testing in the medical device and pharmaceutical companies. Growth will also be driven by the expansion of ambulatory surgical centers, point-of-care diagnostic labs, and dental practices.

Explore FMI!

Book a free demo

Strict sterilization regulations, rising number of surgical procedures, and growing pharmaceutical and medical equipment manufacturers in North America will boost the biological and chemical indicator market in North America. Biological and chemical indicators are widely adopted in all healthcare facilities owing to well-defined sterilization validation protocols in the USA, and Canada, which are mandated by the FDA, CDC, and ISO standards. Growth of outpatient surgeries and infection prevention programs also drives market growth.

The European market accounts for a significant portion of the overall market with Germany, France, and the United Kingdom being major players in sterilization compliance, pharmaceutical manufacturing, and medical device production. Stringent sterility assurance standards set forth by regulatory organizations such as the European Medicines Agency (EMA) and national regulatory authorities are propelling a high demand for advanced sterilization monitoring solutions. The proliferation of dental and diagnostic laboratories in the region also boosts the market growth.

Biological and chemical indicator market in Asia-Pacific region anticipates to grow at highest growth rate owing to growing healthcare facilities, increase in medical tourism in addition to rise in awareness regarding infection control in countries like India, China and Japan. The booming pharmaceutical and medical device manufacturing fields, as well as governmental investments in hospital sterilization protocols, are expected to fuel demand for sterilization indicators. In addition, growth of private healthcare establishment due to rapid urbanization and rising disposable income is anticipated to further boost growth of the market opportunities.

Challenges

Regulatory Compliance and Standardization Issues

The standardized regulatory requirements for sterilization monitoring in healthcare, pharmaceutical, and food industries will hinder the growth of the Biological &Chemical Indicator Market. These make manufacturers comply with;1) standardization issues in the performance of the indicators, 2) reliability considerations and 3) the need for frequent validation of sterilization processes that add further compliance burden on manufacturers. Furthermore, developing regions lack awareness, while advanced indicators come with high costs.

Opportunity

Growth in Healthcare Sterilization and Advanced Smart Indicators

This increasing demand for infection control and sterilization validation drives the aspects of the biological and chemical indicators in turn. The latest developments in smart sterilization monitoring solutions, such as real-time digital indicators, RFID-enabled tracking solutions and color-changing chemical indicators are enhancing process motivation accuracy and regulatory compliance. Moreover, growing applications in food safety, water purification, and industrial sterilization provide new growth opportunities.

From 2020 to 2024, there was a surge in adoption of biological and chemical indicators in hospitals, pharmaceuticals, and food processing sectors due to global health crises and stricter sterilization protocols and infection control measures. Yet, high costs of advanced biological indicators, as well as standardizing chemical indicators across various sterilization methods, delayed adoption on a wider scale.

The market will likely evolve into automation and digital integration by the period of 2025 to 2035. AI can help better sterilization validation processes with AI-enabled sterilization tracking, smart sensors, and circuitry-based monitoring of biological indicators in the cloud.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, ISO, and USP sterilization standards |

| Technology Innovations | Use of self-contained biological indicators and color-changing chemical indicators |

| Market Adoption | Growing demand in hospitals, pharma, and food industries |

| Performance & Efficiency | Challenges in standardizing chemical indicators across different sterilization methods |

| Market Competition | Dominated by medical device and sterilization monitoring companies |

| Sustainability Trends | Initial steps in reducing hazardous chemicals in sterilization indicators |

| Consumer Trends | High demand from healthcare, pharmaceuticals, and food safety sectors |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global mandates on sterilization validation, eco-friendly indicators, and automated compliance tracking |

| Technology Innovations | Advancements in real-time digital indicators, RFID-enabled tracking, and AI-based sterilization monitoring |

| Market Adoption | Expansion into biotech labs, water treatment, and automated industrial sterilization |

| Performance & Efficiency | Development of multi-modal indicators with enhanced accuracy and instant validation |

| Market Competition | Entry of smart technology firms integrating digital tracking solutions |

| Sustainability Trends | Large-scale adoption of biodegradable, non-toxic chemical indicators for greener sterilization solutions |

| Consumer Trends | Growth in automated sterilization validation for industrial, research, and consumer sterilization applications |

The USA biological & chemical indicator market in the United States is expanding due to stringent sterilization regulations in the healthcare industry and increased requirements for infection control. Growing number of surgical procedures along with the increasing pharmaceutical and biotechnology industries is driving the demand of biological and chemical indicator for sterilization validation.

Furthermore, the presence of large medical device companies and regulatory bodies, including the FDA, which impose stringent sterilization and quality monitoring guidelines is also propelling the growth of the market. Moreover, the rising demand for new sterilization technologies in hospitals, pharmaceutical production, and food safety is propelling demand.

The increasing trend of contract sterilization services and laboratory testing facilities in the USA is also aiding the biological & chemical indicator market growth in the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.4% |

The biocide & chemical indicator segment will have a high growth rate during the forecast period and the increasing adoption of sterilization monitoring technologies in hospitals and laboratories. The need to adhere to strict sterilization protocols in the National Health Service (NHS) has led to enhanced demand for biological and chemical indicators in healthcare sectors.

As adiabatic these better investments are expected in the USA and global gene therapy, the UK is treated to the UK-isocal market size, while the pharmaceutical and biotechnology sectors are poised for growth. Furthermore, the growing number of surgical procedures and medical device manufacturing activity is also expected to boost demand for sterilization monitoring solutions.

Growing awareness regarding contamination risks associated with food and beverage industries is also driving the adoption of chemical and biological indicators for sterilization validation.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.9% |

The demand for the European Union (EU) biological & chemical indicator market is anticipated to witness upward growth, attributed to stern sterilization guidelines, growing healthcare costs, and continuous quality assurance in pharmaceutical and medical device manufacturing. With the implementation of MDR and GMP, the industries are compelled to use biological and chemical indicators extensively.

Germany, France, and Italy are major contributors to the market growth as they possess well-established healthcare infrastructure and pharmaceutical production facilities. Rising demands for sterilization validation in food processing and research laboratories further propel adoption.

Increasing prevalence of healthcare-associated infections (HAIs) are propelling hospitals and clinics to invest in improved sterilization monitoring solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 4.8% |

Japan has an advanced healthcare system and stringent sterilization protocols, which are driving steady growth of the biological and chemical indicator market in the country. An increasing number of medical procedures and rising demand for high-precision sterilization method in the pharmaceutical manufacturing is likely to propel the market growth.

Innovations in sterilization monitoring solutions are fueled by the nation’s leadership in ground-breaking medical device production and biotechnology research. Furthermore, stringent government regulations related to infection control and sterilization compliance in the healthcare settings are also driving the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

The biological & chemical indicators market in South Korea is growing due to rising demand for sterilization validation solutions in hospitals, laboratories, and pharmaceutical industry. Belarus has a vigorous biotechnology industry and burgeoning medical tourism, fueling increased demand for biological and chemical indicators.

Government regulations mandating sterilization checks in medical and dental clinics are also aiding the market expansion. Moreover, the future growth of the market is also known by the innovations of smart healthcare technologies in South Korea, such as the digital sterilization monitoring system.

Also, the increasing emphasis on contamination prevention in food processing and research applications is also shaping the demand for biological and chemical indicators.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

Thermal sterilization is the most established method used in the medical, pharmaceutical and laboratory fields as it is very effective in killing any microbial contamination. Thermal sterilization methods are predominantly used to achieve sterility in medical devices, both in terms of pharmaceutical products and surgical instruments, with steam heat and dry heat processes being two of the most important among these methods.

Steam heat sterilization, or autoclaving, is the gold standard in hospitals and laboratories alike, because it works with such a rapid microbial kill rate, and is eco-friendly. It is also widely used in biosafety cabinets and laboratories to disinfect the interior surfaces of a cabinet and sterilize equipment.611 this method utilizes high-pressure saturated steam to permeate sterilized materials, causing deactivation of spores and pathogens. Steam heat is commonly used to sterilize surgical instruments, culture media and biohazardous waste. Growing healthcare facilities with steam sterilization adoption in these are major drivers for increased adoption of biological and chemical indicators that confirm the effectiveness of sterilization cycles, thus ensuring compliance with stringent medical and infection control regulations.

Contrasted with this, dry heat sterilization is used for instruments that are not moisture-resistant, such as powders, glassware and metal tools, because of its higher temperatures for prolonged exposure times. Dry heat, slower than steam sterilization, provides better penetration for certain materials. Dry heat indicators are used in dental clinics, pharmaceutical production, and industrial applications to meet the increasing demand for sterilization, which further propels the market.

One drawback of thermal sterilization is the inability to process heat-sensitive materials. Nevertheless, the evolution of sterilization cycle monitoring systems and the implementation of sophisticated indicators based on monitoring critical process parameters will contribute toward the better validation of the process over the years, making steam and dry heat sterilization processes an integral element of critical areas and processes.

Chemical sterilization has become a common method for heat- and moisture-sensitive medical devices. This technique employs chemical agents like ethylene oxide (ETO), hydrogen peroxide, and formaldehyde to disinfect equipment while preserving the integrity of the material.

ETO sterilization is commonly used for intricate medical devices ranging from catheters and endoscopes to devices that go into the body. Its capability of penetrating porous materials and sterilizing without exposing to temperature makes it unfounded in the healthcare and pharmaceutical manufacturing. Yet, concerns from regulators about ETO emissions and worker safety have driven the collection of biological and chemical indicators during monitoring to verify the effectiveness of sterilization while limiting risk exposure.

An environmentally friendly alternative to ETO, hydrogen peroxide sterilization has been gaining traction. Vaporized hydrogen peroxide (VHP) systems are effective in sterilizing surgical instruments, laboratory equipment and cleanrooms without leaving toxic residue since it decomposes into water and oxygen [35]. Rapid cycle times and the ability to use electronic medical devices that measure sterilized remains has led to significant growth in demand for hydrogen peroxide indicators, allowing precise monitoring of sterilization and its compliance with industry standards.

Formaldehyde sterilization is used less often than heat or chemical systems but is still applicable in vaccine production and biosafety-level laboratories. Its capacity to inactivate viruses and bacteria has rendered it fundamental in the preservation of biological specimens and sterilization of bioprocessing equipment on a large scale. Formaldehyde sterilization provides the control of the process all with the help of biological and chemical indicators.

Although chemical sterilization has some advantages in low-temperature applications, stricter regulations and concerns related to safety have made it critical to validate the process with robust sterilization indicators. Data, considers the expansion of the chemical sterilization indicators market in line with technology development, increases of sterility assurance generation within the clinical and pharmaceutical sectors.

Biological indicators (BIs) are widely accepted as the gold standard for verifying sterilization processes. Highly resistant bacterial spores are used in these indicators to prepare an adequate lethality of the sterilization procedures, according to industry-specific standards and regulations. Biological indicators (BIs) are part of the most frequent tools used for sterilization verification, where different spores are related to their effectiveness in guaranteeing sterility, Geobacillus stearothermophilus (GS) and Bacillus atrophaeus (BA) are the two prevalent biological indicators used.

The highly resistant spores of Geobacillus stearothermophilus (GS) are traditionally used to monitor the efficiency of autoclave and hydrogen peroxide sterilizations. They are chosen as the standard to verify steam sterilization cycles in hospitals, pharmaceutical plants, and laboratory arises because of their strong nature. Rising usage of steam sterilization in the areas of biopharmaceutical manufacturing and medical device reprocessing has subsequently driven demand for GS spore-based biological indicators.

However, Bacillus atrophaeus (BA) spores are resistant to dry heat and ethylene oxide sterilization. Biological indicators are essential for monitoring sterilization cycles of surgical instruments, powders, and heat-sensitive pharmaceutical products. To ensure sterility validation for complex medical devices, the increasing reliance on ETO sterilization has caused the demand for BA spore-based indicators.

Some biological indicators are designed specifically for specialized sterilization methods such as chemical and radiation-based processes. Because of a tightening of regulatory standards on sterility assurance the demand for accurate biological indicators is growing to secure the safety and efficacy of sterilised products in health care and industrial sections.

Chemical indicators (CIs), which provide a fast and inexpensive way to verify sterilization conditions via a visual indication of process exposure. Based on their purpose, there are various types of indicators categorized under Class 1 (Process) and Class 4 (Multi-Variable) are some of the two indicators likely to steer the market.

Class 1 (Process) indicators are the most basic and are made to identify if an item is either processed or unprocessed. When subjected to certain sterilization conditions, they change color, giving immediate assurance that items have reached the sterilization cycle. Common in hospitals and laboratories, the Class 1 indicator is a first-pass validation of sterility before testing with a biological indicator.

Class 4 (Multi-Variable) indicators provide advanced sterilization monitoring, responding to two or more key process variables like time, temperature, and pressure. Integrate them into validation of cycle effectiveness in complex sterilization processes. The increasing implementation of advanced sterilization technologies has led to an increase in demand for Class 4 indicators they offer much more detailed monitoring than the basic process indicators.

Class 2 (Specific Use), Class 3 (Single-Variable), Class 5 (Integrating), and Class 6 (Cycle Verification) indicators are designed for specialized applications, monitoring particular parameters, and verifying the entire sterilization cycle. Moreover, the potential of enzyme indicators to identify residual contamination and to confirm enzymatic cleaning processes has contributed both in terms of professional growth and in the expansion of the chemical indicator market.

The rise is attributed to the rising demand for sterilization validation, field control, and quality assurance across sectors, such as healthcare, pharmaceuticals, food processing, and medical device manufacturing. The rising importance of patient safety and regulatory compliance coupled with sterility assurance, is pushing the effective usage of biological and chemical indicators for the monitoring of sterilization process. Technological innovations like rapid-readout biological indicators and improved chemical indicator formulations are further propelling the market.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| 3M Company | 18-22% |

| STERIS Corporation | 14-18% |

| Cantel Medical (Steris PLC) | 12-16% |

| Getinge Group | 10-14% |

| Mesa Laboratories, Inc. | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| 3M Company | Provides rapid-readout biological indicators (BI) and Class 1-6 chemical indicators (CI) for sterilization monitoring. |

| STERIS Corporation | Offers biological and chemical indicators for steam, ethylene oxide (EO), hydrogen peroxide, and dry heat sterilization. |

| Cantel Medical (Steris PLC) | Specializes in sterility assurance solutions, including self-contained biological indicators and chemical indicator tapes. |

| Getinge Group | Develops chemical indicator strips and biological monitoring solutions for medical device reprocessing. |

| Mesa Laboratories, Inc. | Focuses on biological indicators for vaporized hydrogen peroxide (VH2O2), EO gas, and radiation sterilization. |

Key Market Insights

3M Company (18-22%)

3M is a market leader in sterilization monitoring solutions, offering rapid-readout biological indicators (RRBI) and Class 1-6 chemical indicators for hospital sterilization units, pharmaceutical manufacturers, and medical device companies. Its Attest™ biological indicator line is widely used for steam and VH2O2 sterilization validation.

STERIS Corporation (14-18%)

STERIS provides comprehensive sterility assurance products, including biological and chemical indicators for steam, EO, VH2O2, and dry heat sterilization. The company’s focus on regulatory compliance and product innovation strengthens its market presence.

Cantel Medical (Steris PLC) (12-16%)

Now part of STERIS PLC, Cantel Medical specializes in self-contained biological indicators and chemical indicator tapes, ensuring proper sterilization validation in healthcare facilities and dental sterilization units.

Getinge Group (10-14%)

Getinge manufactures chemical and biological indicators for medical device reprocessing, ensuring sterilization efficiency across central sterile supply departments (CSSD), hospitals, and pharmaceutical industries.

Mesa Laboratories, Inc. (8-12%)

Mesa Laboratories is a major player in biological indicator technology, offering indicators for vaporized hydrogen peroxide (VH2O2), EO gas, and gamma radiation sterilization processes. The company is focusing on high-precision, high-sensitivity biological monitoring solutions.

Other Key Players (26-32% Combined)

Several emerging and regional players are enhancing the biological & chemical indicator market with affordable and innovative sterility assurance solutions, including:

The overall market size for biological & chemical indicator market was USD 549.8 million in 2025.

The biological & chemical indicator market is expected to reach USD 904.2 million in 2035.

The growth of the biological & chemical indicator market will be driven by increasing demand for sterilization monitoring in healthcare, advancements in infection control technologies, and rising regulatory compliance requirements for medical device and pharmaceutical industries.

The top 5 countries which drives the development of biological & chemical indicator market are USA, European Union, Japan, South Korea and UK.

Chemical sterilization and biological indicators to command significant share over the assessment period.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.