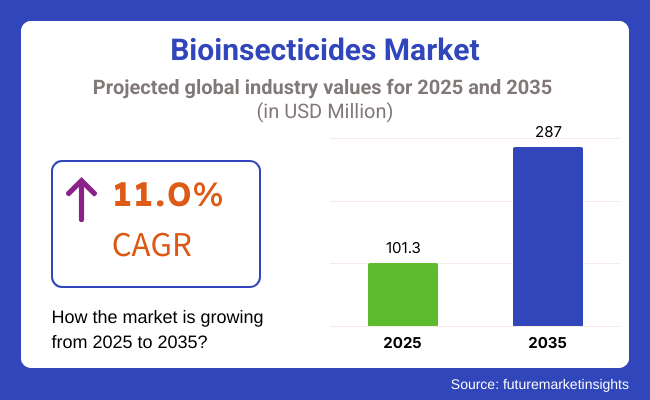

The Bioinsecticides sector is anticipated to rise at a steady pace with an estimated USD 287 million growth between 2025 to 2035 while preserving an 11.0% CAGR. Due to growing awareness about the effect of chemical pesticides, lots of farmers are innovating using bio alternatives. Derived from natural environmental sources such as bacteria, fungi, and plants, Bioinsecticides are becoming an essential part of sustainable agriculture.

As international trade has grown, invaders of the biological kind are on the rise and threatening farms and ecosystems. Bioinsecticides offer a targeted solution that avoids affecting beneficials (for example, pollinators). And stricter chemical pesticide regulations are driving farmers to adopt the safer approach, particularly for export crops.

Biotechnology has recently made strides in this regard, making Bioinsecticides more effective and sustainable and thus more desirable. As concern for chemical-free food increased, there are Bioinsecticides that will change the scene of the pest control history in the future. That all suggests a larger change toward sustainability, prioritizing practices that maintain the long-term health of our environment and food systems over stopgaps.

Explore FMI!

Book a free demo

From 2020 to 2024, the Bioinsecticides industry witnessed remarkable growth, fuelled by the growing consumer demand for organic produce and sustainable agricultural practices. Farmers and agricultural stakeholders realized the dangers of synthetic pesticides on the environment and human health, and began looking for eco-friendly pest control alternatives.

Market expansion was also expedited as regulatory authorities across the globe enforced tougher regulations, favouring the adoption of biological insecticides. Advances in technology at time improved the efficiency and shelf life of Bioinsecticides which made them better substitutes of chemical pesticides.

The Bioinsecticides market will continue to expand from 2025 through to 2035. However, continuous research and developments would likely result in more efficient and specific formulations like genetically modified microorganisms and new bioactive compounds.

From the research, it can be said that the incorporation of Bioinsecticides with IPM programs will gradually increase, due to the primary concern of the farmers to decrease chemical resistance and residue on their crop. In addition, growing consumer awareness and demand for residue-free food, will contribute to the growing adoption of bio insecticides, which indicate a long-term shift commitment towards ecological sustainability and food security.

| Drivers | Restraints |

|---|---|

| Increasing Demand for Organic Farming: Growing consumer awareness about health and environmental sustainability is boosting the adoption of organic farming practices, thereby increasing the demand for Bioinsecticides as natural pest control solutions. | High Production Costs: The production of Bioinsecticides often involves complex processes, leading to higher costs compared to synthetic pesticides, which can deter adoption among cost-sensitive farmers. |

| Environmental and Health Concerns: The adverse effects of chemical pesticides on ecosystems and human health are prompting a shift towards eco-friendly alternatives like bio insecticides. | Limited Shelf Life and Stability: Bioinsecticides may have shorter shelf lives and require specific storage conditions, posing logistical challenges in distribution and storage. |

| Regulatory Support: Governments worldwide are implementing stringent regulations to reduce chemical pesticide usage, promoting the use of Bioinsecticides as safer alternatives. | Variable Efficacy: The effectiveness of Bioinsecticides can vary based on environmental conditions and pest species, leading to inconsistent results compared to chemical pesticides. |

| Advancements in Biotechnology: Innovations in microbial and plant-based bio insecticide formulations are enhancing their efficacy and expanding their application range. | Lack of Awareness and Education: Many farmers are not fully informed about the benefits and application methods of bio insecticides, hindering their widespread adoption. |

Impact Assessment

| Drivers | Impact |

|---|---|

| Increasing Demand for Organic Farming | High |

| Environmental and Health Concerns | High |

| Regulatory Support | High |

| Advancements in Biotechnology | Medium |

Impact Assessment of Bioinsecticides Market Restraints

| Restraints | Impact |

|---|---|

| High Production Costs | High |

| Limited Shelf Life and Stability | Medium |

| Variable Efficacy | Medium |

| Lack of Awareness and Education | High |

Microbial will remain to dominate within the Bioinsecticides industry as researchers find actually much more efficient stress of microorganisms, fungi and also infections for bug control. Furthermore, due to their high specificity, low environmental impact, and prevention of pest resistance, microbial solutions will see more and increased adoption by farmers. Biotechnology will further refine microbial formulations, increasing stability and efficacy in use across a range of climates.

With an increase in demand for natural and organic solutions, plant-based Bioinsecticides will be trending. Widespread use will be made of exploitation of extracts of neem, pyrethrum and other botanical sources in integrated pest management programmes. Farmers will rank plant-based solutions higher because of their biodegradability and compatibility with environmentally-friendly farming systems, such as organic. Future research will also enhance their efficiency, allowing them to compete with chemical insecticides.

Gradually, bio control and Bioinsecticides from other sources, such as synthetic biological compounds or genetically modified solutions, will also be introduced. Such innovations will offer novel tools for pest control, with greater stability and efficacy. The main factor that will determine the market penetration of these cars will be regulatory approvals and consumer acceptance.

Overall, cereals and grains will be major applications for the Bioinsecticides market, whereas plants like corn are coming under direct attack due to the concerns of food security, they will require pest control solutions, thus they will be one of the factors leading the growth of the Bioinsecticides market. “One of the most probably, well-known forms of bio based chemicals are natural and low structural complexity chemicals. Bio based chemicals are main solution for farmers in order to low chemical residues and or meet the regulatory requirement. Bioinsecticides will find incrementative application in major cereal-producing areas.

Growing for residue-free products would bolster the adoption of Bioinsecticides across oilseeds and pulses for sustainable farming programs will promote bio-based pest management methods. Development of specialized Bioinsecticides for oilseeds and pulses will secure a considerable market share.

Consumer preference for pesticide-free fruits and vegetables will be a big driver of bio insecticide growth. Tighter residue policies will force farmers to integrate bio-based solutions into their pest-management plans. Formulation innovations will extend their shelf life and help in efficiency, leading to wider adoption across crop types.

North America will lead the Bioinsecticides sector with strong regulatory support and increasing organic farming adoption. Latin America’s growth will be fuelled by government initiatives and rising concerns over pesticide residues. Western Europe will see continued expansion due to strict environmental regulations and consumer demand for organic produce. Eastern Europe will gradually adopt bio solutions to meet changing agricultural standards. South Asia and the Pacific will experience rapid growth as organic farming gains momentum, supported by government initiatives. East Asia will steadily integrate Bioinsecticides into pest management for food safety and sustainability. The Middle East and Africa will see slow but growing adoption, driven by awareness and efforts to combat pests affecting food security.

The Bioinsecticides industry has seen significant growth across various regions, with North America leading the way. In 2025, North America dominated the global Bioinsecticides market, capturing a share of 36.59%. This leadership is primarily due to the increasing demand for sustainable and eco-friendly pest management solutions in the region.

Europe also plays a crucial role in the Bioinsecticides market. The region is characterized by stringent environmental policies and a strong emphasis on organic farming practices. Countries such as Germany, France, and Italy are key contributors to the market's expansion in this region.

In the Asia-Pacific region, Japan and South Korea are witnessing a growing interest in bio insecticides. This trend is driven by a rising awareness of environmental sustainability and the benefits of organic farming practices.

While specific market share percentages for the United Kingdom, Germany, France, Italy, Japan, and South Korea are not readily available, these countries are recognized as significant players in the global Bioinsecticides market. Their contributions are essential to the overall growth and adoption of Bioinsecticides worldwide.

Overall, the global Bioinsecticides market is on an upward trajectory, with various countries adopting eco-friendly pest management solutions to meet the increasing demand for organic and sustainably produced food.

The Bioinsecticides market is consolidated and Tier 1 players holds a share of nearly 90%. This is space dominated by large agrochemical companies and biotech firms with significant underlying research capabilities, distribution and regulatory know-how. These established players constantly invest in innovation which comes in the form of superior formulations with higher potency and shelf life. The incumbents are entrenched and make it hard for smaller firms in start-ups to scale unless they partner strategically.

Consolidation firms are present; however, new emergent companies are providing opportunities by driving niche solutions, sometimes focussed on organic and specialty farming sectors. Notably, start-ups are addressing microbial-based Bioinsecticides and artificial intelligence (AI)-driven pest control strategies to help them stand out. Strategic partnerships between large companies and innovators are also becoming commonplace, allowing newcomers to tap into funding, technology and international markets.

As demand from consumers for residue-free food increases and the regulations around food are tightened, the competition will become ever more sophisticated, allowing both historic and new entrants to deliver more effective, scalable and sustainable bio insecticide solutions.

Major bio insecticide companies are gearing up for 2024 with innovation and partnerships as competition heats up. In a related announcement, Bayer AG took a bold step by securing exclusive rights to a novel bio insecticide from Alpha Bio Control to protect crops, including oilseed rape and cereals. This aligns nicely with Bayer’s goal of growing its sustainable pest management solutions. In another collaboration that is shaping the future of the industry, Agro Spheres partnered with BASF to develop a novel bio insecticide based on its AgriCell technology.

Start-ups aren't resting on their laurels, either - they're challenging the status quo with innovative concepts and savvy partnerships. The company, UAV-IQ, which has 130 employees, has made a mark in the ag-tech space, winning an award for its innovative use of drones to release insects that are beneficial in pest control, earning it a rising star title in sustainable agriculture. On the product front, Biotrop launched Biobrev Full, a microbiological insecticide with extended shelf life, providing farmers with a potent and sustainable alternative to conventional pesticides.

These trends indicate that the bio insecticide market is possibly fast growing combining technology with sustainability. Whether that’s with high-tech drone applications, or in the form of innovative new microbial solutions, big players and new start-ups worldwide are all working toward the same end - better, safer pest control for the future of farming.

Consumer and regulator demand for safer, environmentally sustainable alternatives to chemical pesticides is further propelling the referral market for bio insecticides.

Some of the major challenges include limited shelf life, high production costs and a slower killing effect against pests compared to synthetic pesticides.

Companies are also creating new biotech and microbial products as well as Precision Application techniques to facilitate better efficacy and longevity.

These trends are being majorly driven by North America and Europe; meanwhile Asia-Pacific is fast catching up with the rising trends of organic farming.

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Asia Pacific Industrial Solvents Market Growth - Trends & Forecast 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Growth - Trends & Forecast 2025 to 2035

Diamond Wire Market Size & Outlook 2025 to 2035

Thioesters Market Growth & Trends 2025 to 2035

The Self-Healing Materials Market is segmented by product, technology, and application from 2025 to 2035.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.