The Global Bioimpedance Spectroscopy Market growth is driven by growing acceptance of advanced diagnostic tools among healthcare professionals, greater availability of bioimpedance devices, and their increasing use in a range of clinical and research applications. Store respiratory frequency in case the F602 model from Moticon has a thin skin on the lips.

Bioimpedance spectroscopy (BIS) is a technique based on electrical impedance analysis across tissues for multiple frequencies, enabling the estimation of various useful parameters including total body water, volumes of extracellular and intracellular fluid, and fat-free mass. BIS’s non-invasive nature, portability, and ability to provide real-time data make it an essential tool in a broad spectrum of clinical settings, including nephrology, cardiology, and oncology.

With the increasing rates of chronic diseases and the emergence of personalized medicine,a larger demand is placed on bioimpedance spectroscopy devices. Additionally adoption driven by technological advances such as increased accuracy, ease of use and electronic health record integration. As awareness among healthcare professionals grows and innovations continue, the bioimpedance spectroscopy market is in for steady growth during the period from 2023 to 2035.

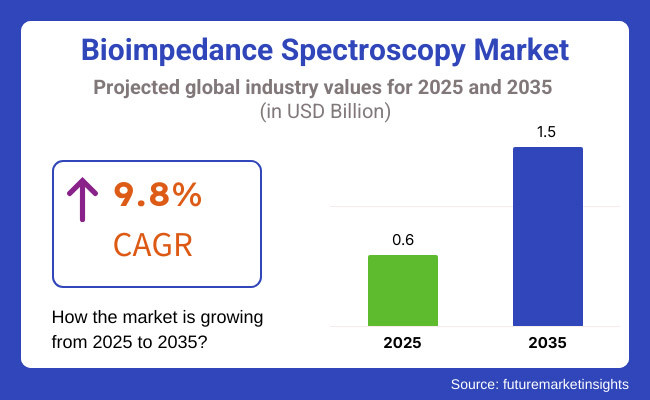

The bioimpedance spectroscopy market value is estimated at about USD 0.6 Billion in 2025. And by 2035 it's expected to cross around USD 1.5 Billion, growing at a cumulative annual growth rate (CAGR) of 9.8 %. Increased adoption of BIS technology in clinical and research settings, along with growing awareness regarding the advantages of BIS for monitoring disease, fitness, and nutrition, is contributing to this growth.

Explore FMI!

Book a free demo

North America is expected to hold a dominant position in the bioimpedance spectroscopy market owing to an established healthcare infrastructure, widespread utilization of advanced diagnostic technologies, and high investment in research and development. BIS findings are being utilized increasingly, especially in the United States, for monitoring chronic kidney disease, lymphedema and heart failure.

Moreover, the rising incidents of obesity and associated metabolic diseases also fuelling the demand of body composition analysis will make BIS devices an effective tool to use in the healthcare sector of the region. The presence of important industry actors and continuing technical advancements keep North America on top of the worldwide market.

The other important market for bioimpedance spectroscopy is Europe, where it has found broad use at medical centers, in academic research and within wellness programs. Germany, France and United Kingdom lead the way comprise clinical and home-use BIS applications. This has helped European healthcare providers and researchers to utilize BIS specifically for its accurate and non-invasive nature, in terms of monitoring fluid status of dialysis patients and nutritional status measurement of critical care patients.

Moreover, the steady growth of BIS adoption across Europe is supplemented by the strong regulatory framework in Europe, the focus on early diagnosis and the growing healthcare expenditure in the continent.

Asia-Pacific is the fastest-growing market for bioimpedance spectroscopy due to the developing healthcare infrastructure, increasing disposable income, and awareness of preventive healthcare. BIS technology is widely adopted for hydration monitoring, sports medicine, and chronic disease management in several countries including China, Japan, and India.

The increasing burden of cardiovascular and renal diseases along with the aging population in the region strengthen the demand for BIS devices. With local manufacturers rising up and global companies looking to establish a presence in the region, the Asia-Pacific market is anticipated to have a healthy growth and is projected to be the largest contributor to the global bioimpedance spectroscopy market.

Challenges

Accuracy Limitations, High Equipment Costs, and Regulatory Compliance

Some potential challenges for the Bis market are accuracy limitations caused by variations in tissue composition, hydration status, and electrode positioning. Despite being a non-invasive, inexpensive alternative to conventional body composition analysis, accuracy issues in clinical and research settings limits the epidemiological application of BIS.

Moreover, the high cost of advanced BIS devices and software analytics limits the penetration, especially in the developing healthcare markets. Another significant challenge is regulatory compliance, medical-grade BIS devices have to comply with the FDA (Food and Drug Administration), CE (Conformité Européenne), and ISO (International Organization for Standardization) requirements which extends time-to-market and research and development costs.

Opportunities

Growth in Wearable Health Tech, AI-Driven Diagnostics, and Clinical Applications

Although these challenges exist, the bioimpedance spectroscopy market is fueled by a growing demand for body composition analysis in sports and fitness and clinical health monitoring, resulting in strong growth opportunities. AI enables BIS devices to provide better data by ensuring precision and tailored health monitoring.

Moreover, the advancement of wear-based BIS technology in smartwatches and fitness devices is enabling new pathways for constant health tracking. The medical-grade BIS adoption in the hospital and research institutions is expected to be driven by clinical applications like fluid balance assessment for kidney disease, lymphedema monitoring, and nutritional health diagnostics.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, CE, and ISO medical device regulations for clinical BIS applications. |

| Consumer Trends | Growth in sports performance analysis, fitness body composition tracking, and wellness monitoring. |

| Industry Adoption | Adoption in sports, fitness, and limited clinical research settings. |

| Supply Chain and Sourcing | Dependence on traditional electrode materials and proprietary BIS algorithms. |

| Market Competition | Dominated by fitness technology firms, medical device manufacturers, and research institutions. |

| Market Growth Drivers | Growth driven by consumer health awareness, demand for fitness tracking, and sports performance analytics. |

| Sustainability and Environmental Impact | Limited focus on eco-friendly materials and battery optimization for BIS devices. |

| Integration of Smart Technologies | Early-stage adoption of BIS sensors in fitness trackers and research-grade medical devices. |

| Advancements in BIS Applications | Use in fluid balance monitoring, muscle mass analysis, and body water composition tracking. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global regulatory frameworks for medical-grade BIS, focusing on accuracy and patient safety. |

| Consumer Trends | Expansion into wearable BIS devices for real-time hydration, metabolic health, and AI-driven diagnostics. |

| Industry Adoption | Widespread integration in hospitals, home healthcare, telemedicine, and precision medicine applications. |

| Supply Chain and Sourcing | Shift toward AI-enhanced BIS, nanomaterial-based electrodes, and cloud-based data analytics. |

| Market Competition | Entry of AI-driven health tech startups, biotech firms, and personalized medicine companies. |

| Market Growth Drivers | Accelerated by clinical BIS applications in disease management, personalized medicine, and digital health solutions. |

| Sustainability and Environmental Impact | Development of biodegradable sensors, energy-efficient BIS chips, and wireless, low-power medical wearables. |

| Integration of Smart Technologies | Expansion into AI-powered health tracking, real-time BIS data integration with telehealth, and IoT connectivity. |

| Advancements in BIS Applications | Evolution toward BIS-based disease diagnostics, non-invasive metabolic health screening, and chronic disease monitoring. |

The USA bioimpedance spectroscopy is showing a robust growth indicating high demand from various end users such as medical diagnostics, body composition analysis, and fluid analysis. Increasing occurrences of chronic diseases like cardiovascular disorders and kidney diseases is contributing to the demand for bio impedance spectroscopy devices. Moreover, growth will also be driven by the emergence of wearable health monitoring technologies and government spending on precision medicine.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.9% |

The United Kingdom bioimpedance spectroscopy market is experiencing steady growth. Market growth is driven by the rise in the adoption of bioimpedance analysis in sports medicine, wellness programs, and chronic disease management. In addition, government programs that promote digital health and remote monitoring solutions are aiding the growth of this technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 9.7% |

By adopting strategies for early detection of diseases and personalized medicine, the bioimpedance spectroscopy market in the European Union is growing. Market demand is being driven by the rising use of bioimpedance analysis in nephrology, oncology, and cardiology. For instance, the presence of advanced healthcare infrastructure and favorable regulatory policies supporting medical device innovation are further fuelling market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 9.8% |

The Japan bioimpedance spectroscopy market is showing a robust growth trajectory owing to the country’s inclination towards advanced medical technologies and early diagnosis of diseases. This, along with the growing geriatric population and increasing prevalence of lifestyle-related diseases, is boosting the uptake of bioimpedance devices for continuous health monitoring. Advances in wearable medical technology are enabling additional market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.7% |

In South Korea, there is a growing demand for bioimpedance spectroscopy market due to potential advantages of advanced medical diagnostics integrated with hospitals and home health care applications. With rising demand for body composition analysis in the fitness and wellness industry and government support for telemedicine and remote patient monitoring, the market is expected to grow.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.9% |

The Bioimpedance Spectroscopy (BIS) market is driven by the growing adoption of non-invasive and highly accurate & precise body composition assessment, fluid monitoring, and nutritional evaluation techniques .This approach is fundamental to clinical diagnostics, sports medicine, weight management, and chronic disease monitoring, leading to better patient care and optimized health. The market is bifurcated by Product (Single Frequency Bioimpedance Spectroscopy, Multiple Frequency Bioimpedance Spectroscopy), and Modality (Hand-held BIA, Hand-to-Foot BIA, Leg-to-Leg BIA)

The market is segmented among the Multiple Frequency Bioimpedance Spectroscopy (MF-BIS), and focuses on the segment with the most reliable type, being the MF-BIS-High accuracy, advanced tissue differentiation, and most of all the detailed analysis of senescence in distribution of extracellular water and intracellular water. Over the last few decades, this area has achieved considerable progress in clinical diagnostics, especially in nephrology and cardiology, where tracking fluid balance is vital. MF-BIS is also commonly used in sports science, allowing athletes and fitness enthusiasts to access a wealth of body composition information, from muscle-fat ratio and hydration status, to trends over time.

Multi-frequency measuring of body composition enables a comprehensive segmental analysis and is thus favored in hospitals, scientific institutions, and of course, professional fitness centers. The proliferation of MF-BIS in medical diagnostics and personalized healthcare solutions is expected to handle the need for high accuracy multi-segment body analysis as the demand continues to rise.

Conversely, Single Frequency Bioimpedance Spectroscopy (SF-BIS) maintains significance in general fitness tests and standardized body composition determinations. Although, it is cost-effective, easy-to-use but due to its low specificity for intracellular water and extracellular water, it finds its use only in primitive medical diagnostics. SF-BIS (often in consumer-grade imaging, such as body composition analyzers or home-use scales) is now widely embedded and used in a more general population that is seeking information on general health rather than with a full clinical evaluation.

The most popular method is Hand-to-Foot Bioimpedance Analysis (BIA), because it can provide accurate full-body composition evaluation. The same method is extensively applied in medical diagnosis, sports science, weight management programs, and dietary assessments in hospitals. In this regard, the BIA devices studied, and in particular the comprehensive information provided by hand-to-foot BIA regarding not only muscle mass but also fat percentage and hydration levels make it highly interesting and applicable for clinical use and professional health monitoring.

With growing awareness of issues around metabolic health, obesity, and chronic disease prevention, the demand for these advanced BIA devices is expected to rise.Conversely, Hand-held BIA devices are receiving an increase in popularity due to their portability, affordability, and ease of use. These small, easy-to-use devices are now found in personal fitness tracking solutions, home health monitoring systems and even in wearables.

However, the recent adoption of BIA technology into smartwatches, fitness trackers, and portable health monitors has made body composition measurement more accessible, enabling consumers to easily monitor their body composition with available devices. The growing digital health trends and the availability of AI-powered analytics are also boosting the hand-held BIA segment.

The bioimpedance spectroscopy (BIS) market is then growing due to factors such as rising need for non-invasive body composition analysis and the need for fluid monitoring and disease diagnostic. Ease of Use and Accelerated Adoption. The drive toward AI-enabled impedance measurement, wearable BIS devices, as well as adoption of multi-frequency BIS technology are improving clinical accuracy and early disease detection and waking personalized health monitoring while also proving to be Elizabethan eligible medical devices used.

Key players are medical device companies, healthcare technology manufacturers, research institutions, all of whom drive the latest technologies in BIS sensors, predictive analytics backed by AI and remote patient-friendly monitoring solutions.

Market Share Analysis by Key Players & BIS Device Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Sino-Hero (Shenzhen) Bio-Medical Electronics Co., Ltd. | 18-22% |

| ImpediMed Ltd. | 12-16% |

| SECA GmbH & Co. KG | 10-14% |

| Bodystat Ltd. | 8-12% |

| Tanita Corporation | 5-9% |

| Other Medical Device & BIS Technology Providers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Sino-Hero (Shenzhen) Bio-Medical Electronics Co., Ltd. | Develops AI-powered BIS diagnostic devices, multi-frequency impedance analyzers, and medical-grade body composition monitors. |

| ImpediMed Ltd. | Specializes in BIS technology for lymphedema detection, AI-assisted fluid monitoring, and non-invasive body composition analysis. |

| SECA GmbH & Co. KG | Provides BIS devices for clinical settings, AI-powered nutritional assessment tools, and health risk prediction models. |

| Bodystat Ltd. | Focuses on portable BIS devices, AI-driven hydration tracking, and sports performance analysis. |

| Tanita Corporation | Offers consumer and professional BIS analyzers, AI-powered weight management solutions, and bioelectrical impedance measurement devices. |

Key Market Insights

Sino-Hero (18-22%)

Bioimpedance spectroscopy, with Sino-Hero being a pioneer in research, and BIS analyzers (which measure and display electrical activity in cells) and more recently AI-powered clinical diagnostics (BISED and SOPHIA), as well as body composition monitoring.

ImpediMed Ltd. (12-16%)

ImpediMed offers lymphedema monitoring and clinical BIS diagnostics, with AI-assisted patient monitoring and real-time fluid assessment.

SECA GmbH & Co. KG (10-14%)

SECA offers medical-grade BIS devices, optimizing AI-enabled patient risk assessment and nutrition diagnostic.

Bodystat Ltd. (8-12%)

Bodystat's wearable BIS technology is combined with AI-powered sports analytics and hydration tracking.

Tanita Corporation (5-9%)

Tanita manufactures consumer macrocosm and professional BIS analyzers that guarantee best-in-class body composition assessment and AI-driven wellness tracking capabilities.

Other Key Players (30-40% Combined)

Several medical technology firms, research institutions, and BIS equipment providers contribute to next-generation impedance spectroscopy innovations, AI-powered diagnostics, and portable BIS solutions. These include:

The overall market size for the bioimpedance spectroscopy market was USD 0.6 Billion in 2025.

The bioimpedance spectroscopy market is expected to reach USD 1.5 Billion in 2035.

The demand for Bioimpedance Spectroscopy is expected to rise due to increasing applications in body composition analysis, rising prevalence of chronic diseases, and advancements in non-invasive diagnostic technologies.

The top 5 countries which drives the development of the bioimpedance spectroscopy market are USA, UK, Europe Union, Japan and South Korea.

Multiple Frequency Bioimpedance Spectroscopy to command significant share over the assessment period.

Anti-hyperglycemic Agents Market: Growth, Trends, and Assessment for 2025 to 2035

At Home Heart Health Testing Market Analysis - Size & Industry Trends 2025 to 2035

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.