The bioenzyme fertilizer market is valued at USD 0.94 billion in 2025 and is expected to reach USD 1.79 billion by 2035, advancing at a 6.6 % CAGR throughout the forecast period.

The United States remains the most lucrative country in 2025 thanks to Farm-Bill incentives and a thriving organic-produce sector, while India is poised to be the fastest-growing national market as Paramparagat Krishi Vikas Yojana subsidies expand bio-input use across smallholder farms.

Heightened consumer demand for chemical-free food, combined with government curbs on nitrate runoff, is reshaping the bioenzyme fertilizer market. Growers prize protease- and phosphatase-rich formulations that unlock bound nitrogen and phosphorus, boosting yields by up to 12 % in depleted soils.

Raw-material volatility and higher upfront prices still restrain adoption in cost-sensitive regions, yet technology advances-precision fermentation, spore-encapsulation, and cold-chain sachets-are shrinking per-hectare costs. Key trends include on-farm bioreactors, carbon-credit stacking for soil-health projects, and direct-to-farmer e-commerce channels that bypass legacy distributors.

Looking ahead, the market will pivot from single-function inoculants to custom multi-enzyme biostimulant platforms. By 2030, AI-designed enzyme cocktails are expected to target crop-specific microbiomes, delivering 20 % faster nutrient cycling and measurable carbon sequestration.

Granular, slow-release carriers that pair enzymes with mycorrhizal fungi will gain share in semi-arid zones, while liquid concentrates fortified with nanoclay encapsulants will dominate high-value greenhouse crops. Suppliers that offer region-tuned blends, verifiable soil-carbon dashboards, and agronomy-as-a-service bundles are set to capture outsized growth through 2035.

| Attributes | Key Insights |

|---|---|

| Estimated Size (2025 E) | USD 0.94 billion |

| Projected Value (2035 F) | USD 1.79 billion |

| Value-based CAGR (2025 to 2035) | 4.8% |

Among bioenzyme fertilizer categories, multi-enzyme blends are sprinting ahead as the market’s growth engine. These cocktails typically combine protease, phosphatase, cellulase and trace chitinase, enabling simultaneous mineralisation of proteins, release of locked-up phosphorus, and breakdown of stubborn cellulose residues.

Field trials in Iowa soybeans and Punjab wheat show yield lifts of 10-14 % over single-enzyme benchmarks, while soil-organic-matter readings climb almost one %age point after just two seasons. Fermented in flexible bioreactors and concentrated via membrane filtration, formulators can tweak ratios for alkaline, acidic, or saline soils without re-tooling-a versatility investors prize.

The same platform now accommodates CRISPR-tuned microbes, positioning suppliers to bolt on next-gen nitrifying and carbon-sequestering enzymes as regulations tighten. As adoption broadens and costs fall, multi-enzyme SKUs are expected to shift from premium niche to mainstream staple well before 2030.

| Leading Product Segment | CAGR (2025 to 2035) |

|---|---|

| Multi-enzyme blends | 7.3% |

Liquid-concentrate bioenzyme fertilizers dominate application maps because they marry perfectly with drip lines, centre-pivot rigs and even smallholder knapsack sprayers. Each litre packs c.10¹¹ viable spores plus stabilised free enzymes buffered to pH 6.5, activating the moment they meet moist soil.

That density lets growers treat a hectare with under two kilograms of active material, slashing freight costs and plastic waste versus granules. Liquids also enable split dosing during vegetative growth, flowering and grain-fill, ensuring the rhizosphere never runs short of catalytic power.

Suppliers are embedding trehalose and nanoclay encapsulants that keep activity above 90 % after six months in tropical depots; cooperatives in Brazil and Vietnam report 30 % inventory-loss cuts. While powders remain popular for base dressing, the precision-irrigation boom means liquids will keep capturing incremental share wherever fertigation pipes reach.

| Leading Form | CAGR (2025 to 2035) |

|---|---|

| Liquid concentrates | 6.8% |

Commercial crop producers-row-crop farms, plantation estates and corporate orchards-absorb the lion’s share of bioenzyme fertilizers and will keep setting the pace. Every %age-point uptick in nutrient-use efficiency translates into millions of dollars saved on synthetic inputs and measurable carbon-credit revenue.

Corn-belt growers report trimming 30 kg of urea per hectare after adopting protease-rich blends, while sugar-cane estates in Maharashtra cut ratoon-cycle time thanks to faster trash decomposition. Large operations already own cold storage and in-furrow injection gear, making enzyme adoption operationally seamless.

Crucially, food-multinational supply contracts now carry Scope-3 emission clauses that effectively mandate regenerative inputs; the compliance pressure cascades down to contract growers across Latin America and Sub-Saharan Africa. What began as a voluntary sustainability gesture is fast becoming a hard procurement requirement-cementing commercial producers’ status as the market’s growth anchor through 2035.

| Leading End-use Segment | CAGR (2025 to 2035) |

|---|---|

| Commercial crop producers | 6.5% |

Stakeholders such as farmers, agronomists, fertilizer producers, and policymakers provided data for the Future Market Insights (FMI) survey. Finally, the industry trend predicted that over three-quarters of the respondents preferred bioenzyme fertilizers to traditional ones in terms of long-term soil health. Farmers cited better crop yields and improved soil health as the two primary reasons for this switch.

On the production and distribution side, 65% of the participants reported increasing investment in R&D for more efficient bioenzyme products owing to positive industry expansion. The majority are also seeking to build their distribution channels specifically in developing regions like Asia-Pacific and Latin America, where interest in organic farming is on the rise. However, high production costs and insufficient farmer’s education continue to challenge mass adoption.

Industry forces were largely driven by government policy and regulation. Approximately 70% of policymakers emphasized the need for increased subsidies and incentives to accelerate bio-based fertilizer adoption. Stakeholders also noted that the sustainability of bioenzyme fertilizers will be bolstered by continued adoption in the agriculture industry, driven by industry demand for organic products.

| Countries | Regulations & Policy Impact |

|---|---|

| United States | Standards are provided by the USDA's National Organic Program (NOP) for bio-based fertilizers. Microbial products are regulated by the EPA under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA). Farm Bill incentives are available to promote sustainable agriculture. |

| United Kingdom | Regulated under Organic Production Standards and Fertilizer Regulation 2019. The UK government is encouraging low use of synthetic fertilizers under the Sustainable Farming Incentive (SFI) scheme. |

| France | Regulated by the ANSES (French Agency for Food, Environmental, and Occupational Health & Safety), bioenzyme fertilizers need to adhere to NF-U 42-001 standards. France encourages biofertilizer use under its Ecophyto Plan. |

| Germany | The Federal Fertilizer Ordinance (DüMV) regulates bioenzyme fertilizers. Businesses are required to follow the EU Fertilising Products Regulation (EU 2019/1009) for sales. Subsidies for organic farming are given under the German Organic Farming Scheme. |

| Italy | The Italian Ministry of Agricultural, Food, and Forestry Policies (MIPAAF) regulates fertilizers in accordance with EU organic agriculture rules. Italy encourages biofertilizers under its National Rural Development Program (NRDP). |

| South Korea | The Fertilizer Control Act regulates bio-based fertilizers. The government provides subsidies for organic agriculture under the Green Growth Strategy, with a focus on adopting biofertilizers. |

| Japan | Subject to the Japan Fertilizer Control Act, bioenzyme fertilizers are approved by the Ministry of Agriculture, Forestry, and Fisheries (MAFF). Organic fertilizer use on certified farms must comply with Japan's Organic JAS Certification. |

| China | Fertilizers are regulated by the Ministry of Agriculture and Rural Affairs (MARA). Businesses need to conform to GB 20287 to 2006 biofertilizer standards. China's Five-Year Agricultural Green Development Plan promotes the use of biofertilizers. |

| Australia & New Zealand | Australia adheres to the Australian Fertilizer Regulations (AFR) and Australian Certified Organic (ACO) for biofertilizers. New Zealand requires BioGro certification for organic application. Both nations encourage biofertilizers under sustainable agriculture grants. |

| India | The Fertilizer Control Order (FCO), 1985, regulates bioenzyme fertilizers. Organisations are required to be certified by the Indian Council of Agricultural Research (ICAR). The Paramparagat Krishi Vikas Yojana's (PKVY) scheme encourages organic fertilizers. |

The bioenzyme fertilizer industry in the United States is projected to grow at a CAGR of 7.8% from 2025 to 2035, driven by increased organic cultivation and government support through the Farm Bill. The USDA National Organic Program (NOP) oversees bio-based fertilizers, while the EPA's FIFRA regulates microbial formulations.

Soil erosion and water contamination from synthetic fertilizers are increasingly raising concerns and driving uptake. Bioenzymes are experiencing growing demand in key farming states like California and Iowa. Leading manufacturers' focus on R&D of high-efficiency biofertilizers and proprietary policies orientated towards regenerative agriculture are the main drivers of the upward trend.

The UK bioenzyme fertilizer industry is expected to grow at a 7.2% CAGR, driven by strong government incentives for sustainable farming. The Fertilizer Regulation 2019 and the Sustainable Farming Incentive (SFI) scheme incentivize the use of organic and bio-based fertilizers. Post-Brexit reforms allowed the UK to introduce independent regulatory systems and encourage the use of biofertilizers versus chemical fertilizers.

The cost of synthetic fertilizers is increasing, and farmers are turning to bioenzyme fertilizers and soil health demand, particularly in England and Scotland. It is robust, as a growing understanding of soil microbiomes and organic nutrient management practices drives its growth over the long term.

The bioenzyme fertilizer industry in France is projected to expand at a CAGR of 7.5%, with restrictive environmental conditions contributing to the growth of the organic farming industry. Professional farmers may not use biofertilizers very much because they have to obey the rules set by ANSES in NF U 42-001 for quality control.

The Ecophyto Plan aims to reduce the use of chemical fertilizers by promoting bio-based products. France's large-scale organic cereal farming industry primarily drives the public's interest in bioenzyme fertilizers. Industry growth is being driven by subsidies to farmers for organic farming and increasingly popular regenerative agriculture, and local producers are expanding their range to include microbe-based fertilizers.

Germany's bioenzyme fertilizer industry is projected to grow at a CAGR of 7.6%, supported by stringent regulations under the Federal Fertilizer Ordinance (DüMV) and the EU Fertilizing Products Regulation (EU 2019/1009), which promote the adoption of sustainable fertilization practices. The requirements for bioenzyme fertilizers are accelerating, as Germany is at the forefront of organic agriculture and sustainable efforts.

According to him, the government has announced subsidies for farmers adopting bio-based solutions as part of the Organic Farming Scheme. Industry growth can be attributed to precision agriculture technology and collaborations between biotech companies and agricultural businesses. Leading regions such as Bavaria and Baden-Württemberg are experiencing high levels of take-up with support from the government.

Supported by policies from the Italian Ministry of Agricultural, Food, and Forestry Policies (MIPAAF), the bioenzyme fertilizer industry in Italy is anticipated to be at a 7.4% CAGR through 2030. The National Development Program (NRDP) promotes bio-based fertilizers in areas with a high concentration of vineyards, like Tuscany and Piedmont.

Italy has a well-developed organic agricultural sector, while the demand for bioenzymatic fertilizers is increasing as farmers look for environmentally safe alternatives to chemical fertilizers. Intensified R&D spending by local farming companies is significantly enhancing the efficacy of the products offered, which, paired with added support from the European Union for green farming in the coming period, is brightening industry prospects.

The South Korean bioenzyme fertilizer industry is expected to grow at a rate of 7.1% CAGR from 2025 to 2035, due to policies laid out by the government under the Green Growth Strategy and the Fertilizer Control Act. The long-term sustainability strategy gives priority to organic farming, and the government is providing incentives to use biobased fertilizers.

The growing consumer demand for organic food has significantly increased the demand. South Korea is upgrading its farming technology to optimize bioenzyme fertilizer performance. Industries are expanding in high-value agriculture hubs such as Jeollanam-do and Gyeongsangbuk-do.

The bioenzyme fertilizer industry in Japan is anticipated to grow at a CAGR of 7.0%, driven by stringent agricultural regulations under the Japan Fertilizer Control Act and organic JAS certification requirements. Bioenzyme fertilizers are one type that Japanese farmers use, as they hope to enhance the biome of their soil and make their crops grow more.

Government initiatives promoting sustainable agriculture, particularly in the rice and tea farming sector, primarily drive industry growth. With R&D at its core, Japanese corporations manufacture biofertilizer formulations to ensure more effectiveness. Retailers and farmers are compelled to embrace sustainable farming practices as a result of the growing consumer demand for organic food.

China is projected to witness the fastest growth, with the bioenzyme fertilizer industry recording a CAGR of 8.2% from 2025 to 2035. The Ministry of Agriculture and Rural Affairs (MARA) has implemented strict GB 20287 to 2006 standards for biofertilizers on a large scale.

Government initiatives, such as the five-year agricultural green development plan, are positively impacting bio-based fertilizers amid overall sustainability initiatives. China’s massive agricultural sector, particularly in provinces like Sichuan and Shandong, is witnessing rapid biofertilizer adoption. Investments in local manufacturing and overseas partnerships with biotech companies are additionally driving the industry, with China becoming a major growth hub.

The bioenzyme fertilizer industry in Australia and New Zealand is projected to expand at a 7.3% growth rate during the forecast period. In Australia, the Australian Fertilizer Regulations (AFR) and Australian Certified Organic (ACO) requirements govern the application of these fertilizers, while in New Zealand, their usage is regulated through BioGro certification.

The Bioenzyme fertilizers enhance soil health, leading to their increasing adoption by farmers in both countries. Governments subsidise sustainable farming when there is considerable consumer demand for organic produce. The growth of the industry is further complemented by an increase in farm exports and a continued emphasis on microbial formulations.

The industry for bioenzyme fertilizers in India is expected to grow at a CAGR of 8.0%, driven by regulation by the Fertilizer Control Order (FCO), 1985, and ICAR certification norms. The Paramparagat Krishi Vikas Yojana (PKVY) scheme promotes organic farming, further driving up demand for biofertilizers.

So the soil erosion problems with the negative effect of chemical fertilizers are driving Indian farmers towards bioenzyme-based products. Key agricultural states such as Maharashtra, Punjab, and Tamil Nadu are witnessing increased adoption of bioenzyme-based products due to government support and soil health concerns. Government subsidies, growing farmer awareness, and the development of microbial technology augment industry growth.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Awareness of bioenzyme fertilizers had not been widespread yet and fell in the early adoption phase of industry expansion. | Mass adoption of bioenzyme fertilizer technology and a significant growth path led by regulatory stimulants and technological innovation. |

| Regulatory systems were also emerging with various degrees of acceptance across diverse geographical areas. | Governments worldwide are implementing stringent environmental regulations and providing incentives to accelerate adoption globally. |

| There was little product innovation, except for single-enzyme fertilizers. | Increased R&D efforts towards developing multi-enzyme blends for improved efficiency and a longer duration of action. |

| The need for costly production and low consumer awareness, however, has stunted industry growth. | Economies of scale and improved technology are expected to lower costs and increase accessibility. |

| Organic farming was once a niche industry, but growing consumer demand for chemical-free produce has driven its expansion. | The rise of organic and regenerative farming, along with the continued rise and demand for bioenzyme fertilizers, is a significant trend. |

| In developed countries with strong regulatory support, adoption was high. | Adoption of sustainable agriculture is set to increase. |

| They relied on specialist agrochemical suppliers to expand distribution channels. | Industry players have expanded distribution networks, leveraging e-commerce outlets and direct-to-farmer models. |

| The COVID-19 impact also brought down supply chains and delayed growth (in the short-term industry). | The recovery from the pandemic and climate problems is intensifying investment in sustainable farming solutions. |

The bioenzyme fertilizer industry is positioned within the context of a wider shift to sustainable agriculture driven by global concerns about soil degradation, climate change, and food security. Environmental goals set by the government around the globe, like the ban or restrictions on chemical fertilizers, are pushing farmers towards bio-based solutions. Consumer demand for organic and non-GMO foods is influencing farmers to shift towards sustainable fertilizers.

Demand is also being driven by the economic growth of emerging industries, in particular Asia-Pacific and Latin America, as countries within those areas invest in growing their agricultural industry. The high prices of synthetic fertilizers, supply chain interruptions, and geopolitical tensions are also attracting a demand for bioenzyme fertilizers as an alternative and preferred choice.

Growing investment in microbial research and agricultural biotechnology is also stimulating industry growth, with companies developing high-efficiency enzyme formulations. At the same time, digital agricultural platforms and supply chain improvements are increasing access for small farmers. Over the coming decade, as economies expand, the drop in production costs, which will lower the price of bioenzyme fertilizers and accelerate their global adoption.

Pricing strategies, research and development, strategic alliances, and geographic reach are all factors on which leading firms compete in the bioenzyme fertilizer industry. Others spend heavily on R&D to develop high-end multi-enzyme products, while some focus on low-cost products that appeal to the mass industry.

Companies like Novozymes and BASF lead in terms of biotechnological innovations, while companies like Syngenta and Corteva Agriscience are involved in acquisitions and partnerships to strengthen their product offerings. One of its main growth strategies is expansion in emerging economies, more prominently in the Asia-Pacific and Latin American regions. In addition, the companies are collaborating with organic farming organizations and adopting digital agriculture platforms to increase their industry share and reach customers.

Novozymes A/S

Industry Share: ~25-30%

Novozymes is a global leader in bioenzyme production and holds the top position in the bioenzyme fertilizer industry. Novozymes has strong R&D ability and outstanding microbial innovations. It focuses on eco-friendly agrophenomena and has a strong foothold in North American, European, and Asia-Pacific industries.

BASF SE

Industry Share: ~20-25%

BASF Operations is a global producer of bioenzyme fertilizers, leveraging its portfolio of chemical and biological solutions. BASF has been diversifying into more environmentally friendly types of fertilizer and is targeting brain-focused agriculture industries throughout the world.

Syngenta AG

Industry Share: ~15 to 20%

Due to its focus on integrated crop solutions and sustainable agriculture, Syngenta is a well-established player in the bioenzymes fertilizers industry segment. Syngenta has been making significant investments into bioenzyme-based products for both soil and crop health applications.

UPL Limited

Industry Share: ~10-15%

UPL is one of the best players in the bioenzymes fertilizers section, particularly in the emerging marketplaces of India, Latin America, and the United States. UPL has focused on the development of affordable bioenzyme products for small and medium-scale farmers.

Koppert Biological Systems

Industry Share: ~5-10%

Koppert Biological Systems is a company that specializes in the development of biological solutions, including enzymes and fertilizers, with an emphasis on sustainable practices and organic farming. Koppert is expanding its product portfolio and geographical presence in 2024.

Certis USA LLC

Industry Share: ~5-10%

With a focus on cost-effective solutions for high-value crops, Certis USA is a leader in the bioenzyme fertilizer industry. On October 22, 2023, the company's focus turned to partnerships and collaborations to strengthen its foothold in the industry.

The bioenzymes fertilizer industry witnessed key strategic developments and technological changes in 2024. Synlogic Inc. In a new product launch, Novozymes A/S recently unveiled a new line of bioenzyme-based fertilizers that are designed to boost crop nutrient absorption in regions hit by drought. This move signals the company's intent to address climate challenges in agriculture.

BASF SE says it has entered into a strategic partnership with a leading agritech startup to develop next-generation bioenzyme fertilizers. The agreement brings together bioenzyme solutions and AI-based precision agriculture methods to make sure that the agricultural sector is as productive and environmentally friendly as possible. This initiative is expected to solidify BASF's industry presence in North America and Europe.

Syngenta AG made headlines with its acquisition of a local bioenzyme manufacturer in Brazil, further strengthening its dominant position in the Latin American industry. According to Syngenta's press release in March 2024, the takeover was to allow the company to tap into the surging demand for sustainable farm inputs within the region.

UPL's new bioenzyme fertilizer formulations for rice and wheat crops are available in India. UPL Limited. Following its launch, UPL Limited implemented a comprehensive farmer education program to educate farmers on the advantages of bioenzyme-based fertilizers. The acquisition will further increase UPL's industry share in the Indian subcontinent.

The demand for bioenzyme fertilizers is increasing, leading to the establishment of Koppert Biological Systems in Europe. It also sealed a distribution deal with a top European agricultural cooperative, solidifying its foothold in the region.

Certis USA LLC focused on the expansion of its product portfolio with the addition of bioenzymes to its biopesticides product line. The partnership will make it possible to add the Nexgen Crop solution, which is a full-spectrum crop insurance system that includes crop protection products and the nutritional supplements Mucid. The agreement will give growers in the high-value fruit and vegetable industries a one-stop solution for protecting crops and improving soil health.

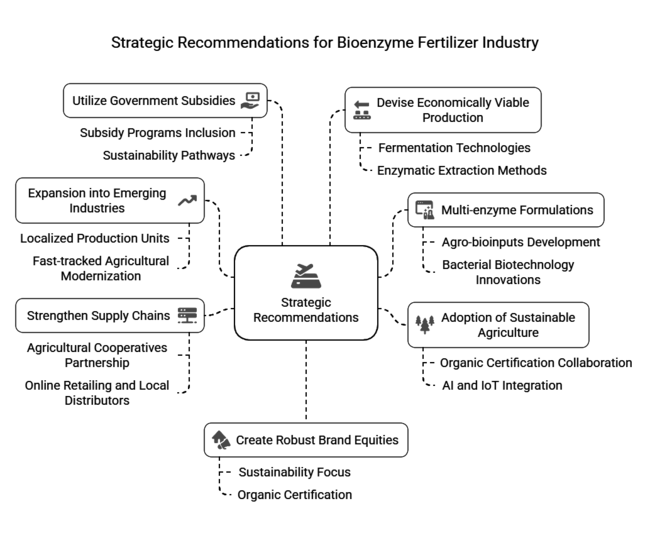

Expansion into Emerging Industries-Fast-tracked agricultural modernization in India, Brazil, and China presents significant opportunities for bioenzyme fertilizer adoption. Localized production units can reduce costs and improve accessibility.

Multi-enzyme formulations: Developing agro-bioinputs and inventions in bacterial biotechnology can help make fertilizers work better by giving people a choice of different types that can be used in different soils and climates. It emphasizes that companies should focus on research and development to develop custom solutions.

Adoption of Sustainable & Regenerative Agriculture-The bioenzyme fertilizers industry is expected to benefit from rising international support for organic and regenerative agriculture practices. Working with organic certification bodies can strengthen credibility and reach.

For a more precise approach to farming, using bioenzyme fertilizer can work together with AI-based soil analysis tools and IoT-based irrigation systems to make things run more smoothly and produce more.

the industry is segmented into protease-based, amylase-based, cellulase-based, phosphatase-based, chitinase-based, laccase-based, and multi-enzyme

it is segmented as liquid concentrates, powder, granules, and pellets

it is fragmented into crop producers, gardening & landscaping, nurseries, and DIY.

the sector is segmented among North America, Latin America, Europe, East Asia, South Asia, Oceania, the Middle East & Africa.

They help break down organic matter, which improves the soil's fertility and enzymatic activity. This makes it easier for plants to take in nutrients, which leads to plant growth.

Unlike synthetic fertilizers that provide instant micronutrients, bioenzyme fertilizers use natural enzymes that release nutrients slowly, improving the soil's's quality over time.

True, they work in different soil conditions, but efficiency hinges on things like microbial activity, water content, and organic matter levels.

Yes, because they promote soil biodiversity and nutrient use efficiency, greatly reducing the need for further chemical inputs.

We can limit soil erosion, reduce chemical runoff into bodies of water, and support sustainable agriculture.

Table 01: Global Market Size Volume (KT) and Value (US$ Million) Forecast By Product Type, 2018 to 2033

Table 02: Global Market Size Volume (KT) and Value (US$ Million) Forecast By Form, 2018 to 2033

Table 03: Global Market Size Volume (KT) Forecast By End Use, 2018 to 2033

Table 04: Global Market Size Volume (KT) and Value (US$ Million) Forecast By Region, 2018 to 2033

Table 05: North America Market Size Volume (KT) and Value (US$ Million) Forecast By Country, 2018 to 2033

Table 06: North America Market Size Volume (KT) and Value (US$ Million) Forecast By Product Type, 2018 to 2033

Table 07: North America Market Size Volume (KT) and Value (US$ Million) Forecast By Form, 2018 to 2033

Table 08: North America Market Size Volume (KT) Forecast By End Use, 2018 to 2033

Table 09: Latin America Market Size Volume (KT) and Value (US$ Million) Forecast By Country, 2018 to 2033

Table 10: Latin America Market Size Volume (KT) and Value (US$ Million) Forecast By Product Type, 2018 to 2033

Table 11: Latin America Market Size Volume (KT) and Value (US$ Million) Forecast By Form, 2018 to 2033

Table 12: Latin America Market Size Volume (KT) Forecast By End Use, 2018 to 2033

Table 13: Europe Market Size Volume (KT) and Value (US$ Million) Forecast By Country, 2018 to 2033

Table 14: Europe Market Size Volume (KT) and Value (US$ Million) Forecast By Product Type, 2018 to 2033

Table 15: Europe Market Size Volume (KT) and Value (US$ Million) Forecast By Form, 2018 to 2033

Table 16: Europe Market Size Volume (KT) Forecast By End Use, 2018 to 2033

Table 17: East Asia Market Size Volume (KT) and Value (US$ Million) Forecast By Country, 2018 to 2033

Table 18: East Asia Market Size Volume (KT) and Value (US$ Million) Forecast By Product Type, 2018 to 2033

Table 19: East Asia Market Size Volume (KT) and Value (US$ Million) Forecast By Form, 2018 to 2033

Table 20: East Asia Market Size Volume (KT) Forecast By End Use, 2018 to 2033

Table 21: South Asia Pacific Market Size Volume (KT) and Value (US$ Million) Forecast By Country, 2018 to 2033

Table 22: South Asia & Pacific Market Size Volume (KT) and Value (US$ Million) Forecast By Product Type, 2018 to 2033

Table 23: South Asia & Pacific Market Size Volume (KT) and Value (US$ Million) Forecast By Form, 2018 to 2033

Table 24: South Asia & Pacific Market Size Volume (KT) Forecast By End Use, 2018 to 2033

Table 25: Middle East & Africa Market Size Volume (KT) and Value (US$ Million) Forecast By Country, 2018 to 2033

Table 26: Middle East & Africa Market Size Volume (KT) and Value (US$ Million) Forecast By Product Type, 2018 to 2033

Table 27: Middle East & Africa Market Size Volume (KT) and Value (US$ Million) Forecast By Form, 2018 to 2033

Table 28: Middle East & Africa Market Size Volume (KT) Forecast By End Use, 2018 to 2033

Figure 01: Global Market Historical Volume (KT), 2018 to 2022

Figure 02: Global Market Current and Forecast Volume (KT), 2023 to 2033

Figure 03: Global Market Historical Value (US$ Million), 2018 to 2022

Figure 04: Global Market Current and Forecast Value (US$ Million), 2023 to 2033

Figure 05: Global Market Incremental $ Opportunity (US$ Million), 2023 to 2033

Figure 06: Global Market Share and BPS Analysis By Product Type- 2023 & 2033

Figure 07: Global Market Y-o-Y Growth Projections By Product Type, 2023 to 2033

Figure 08: Global Market Share and BPS Analysis By Form- 2023 & 2033

Figure 09: Global Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 10: Global Market Attractiveness Analysis By Form, 2023 to 2033

Figure 11: Global Market Share and BPS Analysis By End Use- 2023 & 2033

Figure 12: Global Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 13: Global Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 14: Global Market Share and BPS Analysis By Region- 2023 & 2033

Figure 15: Global Market Y-o-Y Growth Projections By Region, 2023 to 2033

Figure 16: Global Market Attractiveness Analysis By Region, 2023 to 2033

Figure 17: Global Market Absolute $ Opportunity by North America Segment, 2018 to 2033

Figure 18: Global Market Absolute $ Opportunity by Latin America Segment, 2018 to 2033

Figure 19: Global Market Absolute $ Opportunity by Europe Segment, 2018 to 2033

Figure 20: Global Market Absolute $ Opportunity by East Asia Segment, 2018 to 2033

Figure 21: Global Market Absolute $ Opportunity by South Asia Pacific Segment, 2018 to 2033

Figure 22: Global Market Absolute $ Opportunity by Segment, 2018 to 2033

Figure 23: North America Market Share and BPS Analysis By Country, 2023 & 2033

Figure 24: North America Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 25: North America Market Attractiveness Projections By Country, 2023 to 2033

Figure 26: North America Market Share and BPS Analysis By Product Type- 2023 & 2033

Figure 27: North America Market Y-o-Y Growth Projections By Product Type, 2023 to 2033

Figure 28: North America Market Attractiveness Analysis By Product Type, 2023 to 2033

Figure 29: North America Market Share and BPS Analysis By Form- 2023 & 2033

Figure 30: North America Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 31: North America Market Attractiveness Analysis By Form, 2023 to 2033

Figure 32: North America Market Share and BPS Analysis By End Use- 2023 & 2033

Figure 33: North America Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 34: North America Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 35: Latin America Market Share and BPS Analysis By Country, 2023 & 2033

Figure 36: Latin America Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 37: Latin America Market Attractiveness Projections By Country, 2023 to 2033

Figure 38: Latin America Market Share and BPS Analysis By Product Type- 2023 & 2033

Figure 39: Latin America Market Y-o-Y Growth Projections By Product Type, 2023 to 2033

Figure 40: Latin America Market Attractiveness Analysis By Product Type, 2023 to 2033

Figure 41: Latin America Market Share and BPS Analysis By Form- 2023 & 2033

Figure 42: Latin America Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 43: Latin America Market Attractiveness Analysis By Form, 2023 to 2033

Figure 44: Latin America Market Share and BPS Analysis By End Use- 2023 & 2033

Figure 45: Latin America Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 46: Latin America Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 47: Europe Market Share and BPS Analysis By Country, 2023 & 2033

Figure 48: Europe Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 49: Europe Market Attractiveness Projections By Country, 2023 to 2033

Figure 50: Europe Market Share and BPS Analysis By Product Type- 2023 & 2033

Figure 51: Europe Market Y-o-Y Growth Projections By Product Type, 2023 to 2033

Figure 52: Europe Market Attractiveness Analysis By Product Type, 2023 to 2033

Figure 53: Europe Market Share and BPS Analysis By Form- 2023 & 2033

Figure 54: Europe Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 55: Europe Market Attractiveness Analysis By Form, 2023 to 2033

Figure 56: Europe Market Share and BPS Analysis By End Use- 2023 & 2033

Figure 57: Europe Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 58: Europe Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 59: East Asia Market Share and BPS Analysis By Country, 2023 & 2033

Figure 60: East Asia Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 61: East Asia Market Attractiveness Projections By Country, 2023 to 2033

Figure 62: East Asia Market Share and BPS Analysis By Product Type- 2023 & 2033

Figure 63: East Asia Market Y-o-Y Growth Projections By Product Type, 2023 to 2033

Figure 64: East Asia Market Attractiveness Analysis By Product Type, 2023 to 2033

Figure 65: East Asia Market Share and BPS Analysis By Form- 2023 & 2033

Figure 66: East Asia Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 67: East Asia Market Attractiveness Analysis By Form, 2023 to 2033

Figure 68: East Asia Market Share and BPS Analysis By End Use- 2023 & 2033

Figure 69: East Asia Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 70: East Asia Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 71: South Asia Pacific Market Share and BPS Analysis By Country, 2023 & 2033

Figure 72: South Asia Pacific Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 73: South Asia Pacific Market Attractiveness Projections By Country, 2023 to 2033

Figure 74: South Asia & Pacific Market Share and BPS Analysis By Product Type- 2023 & 2033

Figure 75: South Asia & Pacific Market Y-o-Y Growth Projections By Product Type, 2023 to 2033

Figure 76: South Asia & Pacific Market Attractiveness Analysis By Product Type, 2023 to 2033

Figure 77: South Asia & Pacific Market Share and BPS Analysis By Form- 2023 & 2033

Figure 78: South Asia & Pacific Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 79: South Asia & Pacific Market Attractiveness Analysis By Form, 2023 to 2033

Figure 80: South Asia & Pacific Market Share and BPS Analysis By End Use- 2023 & 2033

Figure 81: South Asia & Pacific Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 82: South Asia & Pacific Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 83: Middle East & Africa Market Share and BPS Analysis By Country, 2023 & 2033

Figure 84: Middle East & Africa Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 85: Middle East & Africa Market Attractiveness Projections By Country, 2023 to 2033

Figure 86: Middle East & Africa Market Share and BPS Analysis By Product Type- 2023 & 2033

Figure 87: Middle East & Africa Market Y-o-Y Growth Projections By Product Type, 2023 to 2033

Figure 88: Middle East & Africa Market Attractiveness Analysis By Product Type, 2023 to 2033

Figure 89: Middle East & Africa Market Share and BPS Analysis By Form- 2023 & 2033

Figure 90: Middle East & Africa Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 91: Middle East & Africa Market Attractiveness Analysis By Form, 2023 to 2033

Figure 92: Middle East & Africa Market Share and BPS Analysis By End Use- 2023 & 2033

Figure 93: Middle East & Africa Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 94: Middle East & Africa Market Attractiveness Analysis By End Use, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fertilizer Packaging Market Forecast and Outlook 2025 to 2035

Fertilizer Tester Market Size and Share Forecast Outlook 2025 to 2035

Fertilizer Value Added Coatings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fertilizer Applicators Market Size and Share Forecast Outlook 2025 to 2035

Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Fertilizer Bags Market Growth - Demand & Forecast 2025 to 2035

Fertilizer Additive Market Report – Growth, Demand & Forecast 2025 to 2035

Fertilizer Injection Pumps Market

Biofertilizers Market Size and Share Forecast Outlook 2025 to 2035

NPK Fertilizers Market Analysis - Size, Share, and Forecast 2025 to 2035

Wet Fertilizer Spreaders Market

Nano Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Green Fertilizer Market Growth – Trends & Forecast 2024-2034

Market Share Distribution Among Liquid Fertilizer Providers

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Starter Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Silicon Fertilizer Market Analysis - Size, Growth, and Forecast 2025 to 2035

Organic Fertilizer Industry Analysis in North America Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Biochar Fertilizer Market Outlook – Growth, Demand & Forecast 2025 to 2035

Nitrogen Fertilizer Additives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA