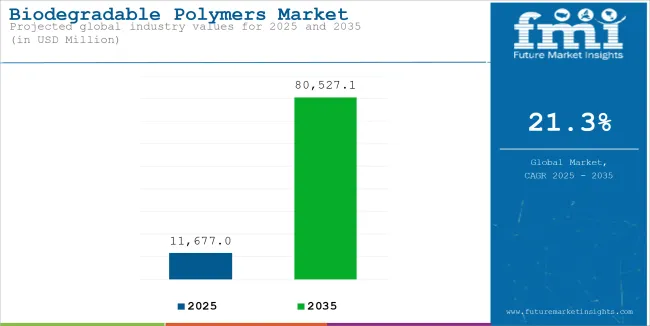

The global biodegradable polymers market is expected to be valued at USD 11.6 billion in 2025 and is projected to reach USD 80.5 billion by 2035, with a CAGR of 21.3% over the forecast period. Market growth is being driven by increased demand for sustainable alternatives to conventional plastics across packaging, healthcare, consumer goods, and environmental remediation applications.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 11.6 billion |

| Industry Value (2035F) | USD 80.5 billion |

| CAGR (2025 to 2035) | 21.3% |

Biodegradable polymers are being adopted in medical devices, personal care, and food-grade applications due to their environmental compatibility, safe degradation pathways, and ability to meet end-of-life criteria under controlled conditions. These materials are being designed to break down into non-toxic components under industrial composting or specific environmental triggers, supporting regulatory compliance and circular economy objectives.

In the medical sector, demand is being reinforced by the deployment of bioresorbable materials in implants, surgical sutures, and drug delivery systems. In early 2024, Evonik expanded its production capacity for RESOMER®, a medical-grade biodegradable polymer, through investment in solvent-free micronization technology. Adherence to ISO 13485 and GMP protocols has supported application precision, particularly in orthopedic and minimally invasive devices.

In the cosmetics and personal care segment, the introduction of biodegradable polymer beads by MIT researchers in late 2024 marked a response to regulatory action on microplastics. These biodegradable alternatives, which degrade into sugars and amino acids, are being positioned to replace synthetic microbeads in exfoliants and rinse-off products. This trend has been supported by legislative measures such as the USA Microbead-Free Waters Act and subsequent enforcement actions by multinational consumer goods brands.

Packaging and food-contact applications are incorporating customizable polymer grades, such as those under Evonik’s RESOMER® portfolio, which offer tunable degradation rates and particle sizes. These features are being used to develop compostable cosmetic containers, packaging films, and single-use serviceware.

Growth in Europe and North America is being supported by stringent biodegradability criteria and mandatory labeling standards. Industry responses are being shaped by public procurement preferences and environmental certification requirements.

The biodegradable polymers market is expected to maintain momentum through 2035, supported by regulatory mandates, industrial innovation, and a growing preference for low-impact material alternatives across consumer and industrial sectors.

Starch-based polymers are estimated to account for approximately 38% of the global biodegradable polymers market share in 2025 and are projected to grow at a CAGR of 21.5% through 2035. Derived from renewable feedstocks such as corn, potato, and cassava, these polymers are widely used in short-lifecycle packaging, bags, and agricultural films.

Their biodegradability in both home and industrial composting settings makes them ideal for single-use applications. The segment is gaining traction as governments in Europe, North America, and parts of Asia enforce bans on conventional plastic bags and mandate compostable packaging for food and retail sectors. Manufacturers are also blending starch with other biodegradable resins like PLA to improve mechanical performance while maintaining compostability.

The packaging segment is projected to hold approximately 52% of the global biodegradable polymers market share in 2025 and is expected to grow at a CAGR of 21.6% through 2035. Single-use containers, films, wrapping materials, and cutlery made from biodegradable polymers are increasingly replacing petroleum-based plastics in food and beverage packaging, e-commerce parcels, and retail carry bags.

Rising environmental awareness and consumer demand for plastic-free alternatives are pushing brand owners to adopt bio-based, compostable packaging solutions. Legislative actions such as the EU Single-Use Plastics Directive, California’s compostable packaging mandates, and extended producer responsibility (EPR) framework are reinforcing the momentum. As the circular economy model gains global traction, biodegradable packaging remains the leading application driving volume and innovation in this fast-growing market.

High Production Costs: Challenges in Scaling Biodegradable Polymers

The major obstacle in overcoming the high production costs and developing biodegradable polymers is not only the value of production but the fact that they are more expensive than traditional plastics.

The raw materials that go into producing biodegradable polymers such as cornstarch, sugarcane, and other plant-derived materials are usually more expensive than petroleum-based ones. On top of that, the manufacturing equipment and processes for these materials are more sophisticated, adding to the overall cost of production. The source industry report indicates that the production of biodegradable plastics is from 20-50% more than that of traditional plastics.

Because of this price difference, the use of biodegradable plastics is not yet very common, especially in sectors like packaging, where new technologies are often the solution to problems associated with high costs. Thus, even though the issue of the price is still present, it remains the priority for the company to work on this.

Limited Biodegradability in Certain Environments: Environmental Concern

The applications of compostable plastics are limited, relative to biodegradable materials, since they can only degrade in certain environments and not all of them are available.

These polymers are, however, handling waste in the most efficient way since composting facilities are the only places that these polymers break down effectively in. Some of the biodegradable plastics, on the other hand, such as those found in oceans, landfills, or soil cannot be degraded at all.

The European Commission claims that approximately 15% of biodegradable plastics get recycled or composted properly while the others are in the environment. The inconsistency of breaking down materials in different environments leads to the idea whether these materials cause environmental damage at all.

The fact that they cannot fully decompose in marine environments, for instance, adds to plastic waste in our oceans and so they cannot be used back in nature. Hence, understanding the functioning of biodegradable polymers through multiple environments is necessary for their breakthrough.

Rising Demand for Sustainable Packaging: A Growing Market Opportunity

The biodegradable polymers market is set to increase, driving by the high demand for EVA and SPI, which are widely used in everyday packaging. As consumers become more aware of the environmental impact, businesses are increasingly utilizing biodegradable materials, primarily in the food and beverage, cosmetics, and e-commerce sectors, to accommodate consumer preferences and government mandates.

The global biodegradable plastic market in the packaging segment is expected to be valued at USD 6.5 billion by 2027, with a compound annual growth rate (CAGR) of 15.5%. Consequently, the biodegradable polymers sector has the potential to be a perfect cooperation partner for the shift in production and the innovation of new packaging models that are both cost-effective and functional.

Notably, the usage of plant-based materials along with compostable alternatives in the fight against plastic pollution has been witnessed, in conjunction with this, the progressive demand for environmentally friendly, biodegradable polymers that not only achieve sustainability goals but also satisfy industry requirements.

Government Regulations and Incentives: A Catalyst for Market Growth

Government regulations and incentives work as the main force for the acceleration of the production and consumption of biodegradable polymers. Artificial beaches and wetlands are one of the many reasons that the western part of the European continent is one of the most attractive to live in, according to many people.

In their fight against single-use plastics, many countries have started making moves towards the use of biodegradable materials more frequently. For instance, the EU has outrightly banned single-use plastics, thus propelling the switch to biodegradable alternatives. In addition, different countries are providing tax breaks along with subsidies and grants for businesses that invest in not only environmentally friendly products but also those that use biodegradable polymers.

Thus, with such regulatory support, the global market for biodegradable plastic is set to triple in the coming years. The actions of the government officials, which are supportive of the development of new technologies and benign business environments, as well as their influence in determining the direction of investor activities, are of utmost significance to the industry sprite.

The United States' biodegradable polymers market will likely witness a remarkable 22.0 percent increase in a compound annual growth rate (CAGR) from the year 2025 to 2035, standing slightly above the global increase of 21.3%.

The demand for sustainable products has been on the rise in the USA, notably in the packaging and food sectors. Regulations dealing with plastic waste, which have become stricter, in conjunction with a lift in environmental awareness, are being the reasons that people have started to use biodegradable materials more.

The increase in environmentally responsible consumer choices, along with the creation of new polymeric materials with PLA and PHA as the base, is thought to adequately level up the growth rate in the USA market and make it a strong participant in the worldwide movement.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 20.4% |

It is expected that the biodegradable polymers market in the United Kingdom will have a CAGR of 20.8% between 2025 and 2035, which consequently means that there will be a very strong increase that is similar to the global trend. The demand for biodegradable alternatives has therefore been boosted by the introduction of the UK to stringent plastic reduction policies like single-use plastic bans.

In addition to the government’s drive towards sustainability, the sector's development is also a result of the increasing number of people living sustainably, which has a positive impact on food packaging, agriculture, and textile sectors. The manufacturing industry's greater emphasis on sustainability will be a key factor for the increase in the use of biodegradable polymers.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 19.6% |

The biodegradable polymers market in the EU is likely to witness a remarkable growth of 21.5% CAGR from 2025 to 2035, which is a bit higher than the global growth rate. The EU has been leading the way with the introduction of various regulatory mechanisms aimed at tackling plastic waste, such as the European Strategy for Plastics and the Single-Use Plastics Directive.

The regulations coupled with the rise in environmental consciousness and the investment in R&D for alternative materials are the forces behind the demand for biodegradable polymers in various sectors like packaging, automotive, and agriculture. The EU's focus on a closed-loop economy and waste management solutions will be the key drivers of market expansion in this area.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 18.3% |

The biodegradable polymers market segment in Japan will flourish at 17.9% CAGR during 2025 to 2035, corresponding to a small percentage that it is slightly below the global average. The country is the denominator of the sustainability wheel and is the cutting technology innovator, material wise.

The demand for these biodegradable alternatives, especially in the areas of packaging and consumer goods, is the result of the Japanese government's actions aimed at environmental protection and the restrictions imposed on plastic waste. The practical accomplishments of Japan in the field of material science are key to the growth of biodegradable polymer solutions, although the market is influenced by the higher starting costs of production in comparison to traditional plastics.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 16.9% |

The market for biodegradable polymers in South Korea is anticipated to display a remarkable growth rate of 20.0% from the period of 2025 to 2035, the key driver being high demand in the areas of packaging, food, and agriculture. With the vibrant implementation of green initiatives, such as waste reduction and plastic recycling programs, South Korea becomes an attractive place for biodegradable polymers to be promoted.

The government's rising focus on environmental sustainability and the establishment of eco-friendly manufacturing processes is the main reason for the innovation and the creation of new trends for these polymer solutions. Besides this, the advanced manufacturing infrastructure of South Korea will also play an important role in the progress of this market, especially when the industries will start using more sustainable packaging materials and technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 22.6% |

The biodegradable polymers market is experiencing strong competition as global players invest in capacity expansions, vertical integration, and R&D for next-generation materials. Companies are focusing on bio-based feedstocks, enhanced barrier properties, and accelerated biodegradability across various disposal environments (compost, marine, soil). Strategic alliances with FMCG brands and packaging converters are creating long-term off-take agreements.

Start-ups are gaining traction through proprietary fermentation and polymerization technologies. As price parity with conventional plastics improves and regulations tighten, biodegradable polymers are expected to gain deeper penetration in mainstream applications.

Packaging, Textile, Agriculture, Healthcare, Consumer Goods, Others

Starch-based Polymers, Polylactic Acid (PLA), Polyhydroxy Alkanoates (PHA), Polyesters, Others

North America, Latin America, Eastern Europe, Western Europe, Asia Pacific, The Middle East and Africa

The Biodegradable Polymers Market is estimated to reach USD 11.6 billion by the end of 2025.

The market is projected to exhibit a CAGR of 21.3% over the assessment period.

By the end of 2035, the market is expected to reach a value of USD 80.5 billion.

Major companies operating in the Biodegradable Polymers market include Cargill, Incorporated, Mitsubishi Chemical Corporation, Toyota Tsusho Corporation, Danimer Scientific.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biodegradable Bone Graft Polymers Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Film Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Disposable Tableware Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Paper and Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyester Fiber Market Forecast and Outlook 2025 to 2035

Biodegradable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Insulated Panel Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyamide Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Agricultural Films Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biodegradable Glitter for Cosmetics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biodegradable Meal Trays Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Gloves Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Lidding Films Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Stretch Films Market - Analysis Size, Share, and Forecast 2025 to 2035

Biodegradable Food Packaging Market Size, Share & Forecast 2025 to 2035

Biodegradable Baby Diapers Market Analysis – Trends, Growth & Forecast 2025-2035

Biodegradable Microbeads Market Growth – Trends & Forecast 2025 to 2035

Competitive Breakdown of Biodegradable Lidding Films Providers

Competitive Landscape of Biodegradable Packaging Providers

Biodegradable Lids Market Analysis - Demand, Trends & Outlook 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA