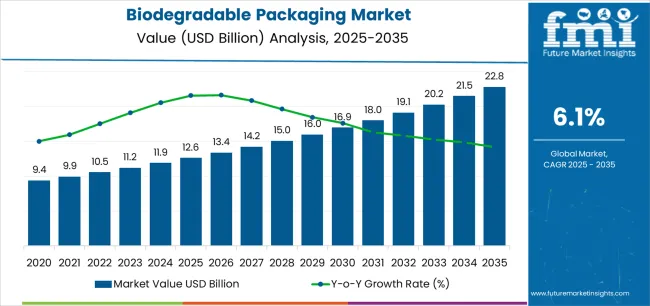

The biodegradable packaging market stands at the threshold of a decade-long transformation trajectory that promises to revolutionize packaging technology and environmental compliance solutions. The market's journey from USD 12.6 billion in 2025 to USD 22.8 billion by 2035 represents substantial growth, demonstrating the accelerating adoption of compostable materials and premium eco-friendly solutions across food packaging, consumer goods, and industrial applications sectors.

The first half of the decade (2025-2030) will witness the market climbing from USD 12.6 billion to approximately USD 17.2 billion, adding USD 4.6 billion in value, which constitutes 45% of the total forecast growth period. This phase will be characterized by the rapid adoption of plant-based packaging materials, driven by increasing regulatory compliance requirements and the growing need for circular economy solutions worldwide. Advanced biodegradation capabilities and compostable certification systems will become standard expectations rather than premium options.

The latter half (2030-2035) will witness continued growth from USD 17.2 billion to USD 22.8 billion, representing an addition of USD 5.6 billion or 55% of the decade's expansion. This period will be defined by mass market penetration of bio-based packaging technologies, integration with comprehensive waste management systems, and seamless compatibility with existing packaging infrastructure. The market trajectory signals fundamental shifts in how manufacturers approach environmental compliance and waste reduction, with participants positioned to benefit from growing demand across multiple material types and application segments.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | PLA-based flexible packaging | 38% | Food packaging, consumer goods wrapping |

| Starch-based rigid containers | 24% | Food service containers, trays | |

| Paper-based biodegradable packaging | 22% | E-commerce packaging, retail bags | |

| PHA-based specialty packaging | 16% | Premium applications, marine-safe products | |

| Future (3-5 yrs) | Advanced PLA composite films | 35-42% | Multi-layer barriers, enhanced durability |

| Molded fiber packaging systems | 20-25% | Electronics packaging, protective solutions | |

| Seaweed-based flexible packaging | 12-18% | Food contact applications, water-soluble films | |

| Mushroom-based protective packaging | 8-14% | Cushioning materials, insulation products | |

| Cellulose nanofiber composites | 10-15% | High-performance applications, barrier coatings |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 12.6 billion |

| Market Forecast (2035) | USD 22.8 billion |

| Growth Rate | 6.1% CAGR |

| Leading Technology | PLA (Polylactic Acid) Based Packaging |

| Primary Application | Food Packaging Segment |

The market demonstrates strong fundamentals with PLA-based packaging systems capturing a dominant share through advanced biodegradation capabilities and food safety optimization. Food packaging applications drive primary demand, supported by increasing regulatory compliance and premium eco-friendly packaging equipment adoption requirements. Geographic expansion remains concentrated in developed markets with established environmental regulations, while emerging economies show accelerating adoption rates driven by policy implementation and rising environmental awareness.

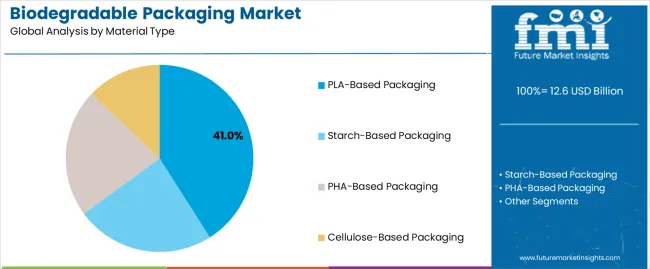

Primary Classification: The market segments by material type into PLA-based packaging, starch-based packaging, PHA-based packaging, and cellulose-based packaging, representing the evolution from petroleum-based materials to sophisticated bio-derived solutions for comprehensive environmental compliance optimization.

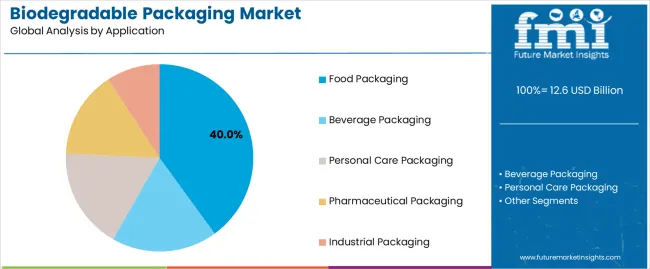

Secondary Classification: Application segmentation divides the market into food packaging, beverage packaging, personal care packaging, pharmaceutical packaging, and industrial packaging, reflecting distinct requirements for product protection, shelf life, and regulatory compliance standards.

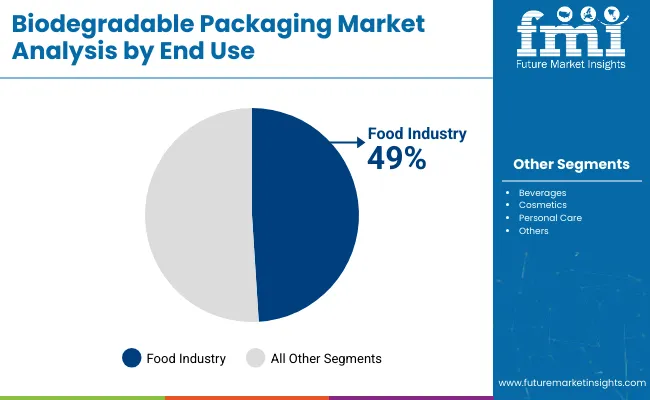

Tertiary Classification: End-use segmentation covers retail & consumer goods, food service industry, e-commerce & logistics, agriculture, and healthcare sectors, while biodegradation timeline spans home compostable (90-180 days), industrial compostable (60-90 days), and marine biodegradable (6-24 months) categories.

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa, with developed markets leading regulatory adoption while emerging economies show accelerating growth patterns driven by environmental policy implementation programs.

The segmentation structure reveals technology progression from basic bio-materials toward sophisticated eco-packaging systems with enhanced barrier properties and controlled biodegradation capabilities, while application diversity spans from food contact operations to industrial packaging establishments requiring precise environmental compliance solutions.

Market Position: PLA-Based Packaging systems command the leading position in the biodegradable packaging market with 41% market share through advanced bio-polymer features, including superior processability, food-safe characteristics, and environmental compliance optimization that enable manufacturers to achieve optimal product protection across diverse packaging and disposal environments.

Value Drivers: The segment benefits from manufacturer preference for proven bio-material systems that provide consistent processing performance, enhanced product protection, and regulatory optimization without compromising packaging integrity or affecting product presentation characteristics. Advanced polymer engineering enables transparency maintenance, heat resistance, and integration with existing packaging equipment, where processing performance and compliance consistency represent critical operational requirements.

Competitive Advantages: PLA-Based Packaging systems differentiate through proven biodegradation reliability, consistent processing characteristics, and integration with conventional packaging machinery that enhance operational efficiency while maintaining optimal food safety standards suitable for diverse consumer and industrial applications.

Key market characteristics:

Starch-Based Packaging systems maintain a 26% market position in the biodegradable packaging market due to their cost-effectiveness and rapid biodegradation advantages. These systems appeal to manufacturers requiring affordable eco-solutions with competitive pricing for diverse packaging applications. Market growth is driven by processor preference, emphasizing operational simplicity and versatile functionality through optimized starch modification.

PHA-Based Packaging systems capture 19% market share through marine biodegradable requirements in ocean-contact applications, specialty food packaging, and premium eco-conscious products. These applications demand advanced biodegradation systems capable of breaking down in marine environments while providing exceptional barrier properties and product protection.

Market Context: Food Packaging applications demonstrate the highest growth rate in the biodegradable packaging market 40% share, due to widespread adoption of eco-friendly food contact materials and increasing focus on regulatory compliance, waste reduction, and consumer demand optimization that maximizes environmental benefits while maintaining food safety standards.

Appeal Factors: Food packaging operators prioritize food safety, regulatory compliance, and integration with diverse food types that enables optimized packaging operations across multiple product categories. The segment benefits from substantial regulatory investment and consumer awareness programs that emphasize the acquisition of biodegradable materials for environmental optimization and brand differentiation applications.

Growth Drivers: Environmental regulation expansion programs incorporate biodegradable packaging as mandatory requirements for food contact applications, while consumer awareness increases demand for eco-friendly packaging capabilities that comply with safety standards and minimize environmental impact.

Market Challenges: Varying food requirements and shelf life demands may limit material standardization across different food categories or storage scenarios.

Application dynamics include:

Beverage packaging applications capture market share through liquid contact requirements in water bottles, juice containers, and single-serve packaging. These applications demand barrier packaging systems capable of operating with liquid filling equipment while providing effective moisture protection and structural integrity capabilities.

Personal care packaging applications account for market share, including cosmetic containers, toiletry packaging, and premium beauty products requiring advanced aesthetic capabilities for brand presentation optimization and consumer appeal.

Market Position: Retail & Consumer Goods applications command significant market position with a 35% share through growing consumer environmental awareness and retail chain adoption for eco-friendly packaging solutions.

Value Drivers: This application segment provides the ideal combination of consumer appeal and environmental compliance, meeting requirements for brand differentiation, regulatory adherence, and operational efficiency without compromising product protection.

Growth Characteristics: The segment benefits from broad applicability across retail chains, consumer product adoption, and established supply programs that support widespread material usage and operational convenience.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Environmental regulations & plastic waste reduction policies (single-use plastic bans, EPR schemes) | ★★★★★ | Government mandates eliminating conventional plastics create mandatory demand for biodegradable alternatives; compliance-driven market expansion across multiple industries. |

| Driver | Consumer environmental awareness & eco-conscious purchasing behavior | ★★★★★ | Growing consumer preference for eco-friendly products drives retail demand; brand differentiation through environmental positioning creates premium market opportunities. |

| Driver | Corporate environmental commitments & net-zero packaging goals (CSR initiatives, circular economy adoption) | ★★★★★ | Major brands adopting biodegradable packaging for ESG compliance; supply chain transformation drives bulk procurement and standardization requirements. |

| Restraint | Higher production costs & price premium compared to conventional packaging | ★★★★☆ | Bio-material production costs remain 2-4x conventional plastics; price sensitivity in cost-conscious markets limits adoption rate and market penetration. |

| Restraint | Performance limitations & barrier property constraints in demanding applications | ★★★☆☆ | Technical challenges in moisture barrier, shelf life extension, and high-temperature applications; performance gaps limit adoption in specific product categories. |

| Trend | Advanced bio-polymer development & enhanced barrier technologies (multilayer films, nano-cellulose integration) | ★★★★★ | Technical innovations improving performance parity with conventional materials; enhanced functionality enabling new application opportunities. |

| Trend | Home composting certification & consumer disposal education (clear labeling, composting guidelines) | ★★★★☆ | Infrastructure development supporting proper disposal; consumer education programs enhancing market acceptance and proper end-of-life management. |

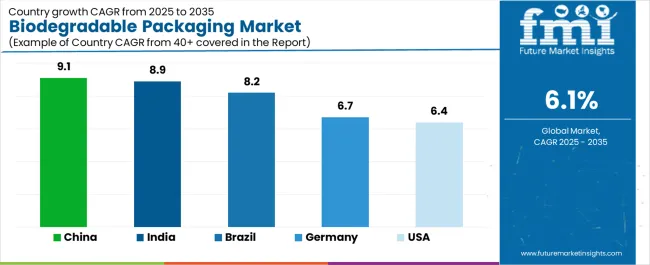

The biodegradable packaging market demonstrates varied regional dynamics with Growth Leaders including China (9.1% growth rate) and India (8.9% growth rate) driving expansion through regulatory implementation and manufacturing capacity growth initiatives. Steady Performers encompass United States (6.4% growth rate), Germany (6.7% growth rate), and developed regions, benefiting from established environmental regulations and consumer awareness adoption. Emerging Markets feature Brazil (8.2% growth rate) and developing regions, where regulatory modernization and packaging innovation support consistent growth patterns.

Regional synthesis reveals North American markets leading value generation through premium bio-material adoption and corporate environmental commitment culture, while Asian markets demonstrate highest volume growth supported by manufacturing capacity expansion and regulatory compliance trends. European markets show strong growth driven by comprehensive environmental legislation and circular economy integration.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 9.1% | Manufacturing scale; cost-effective bio-materials | Quality standardization; export compliance |

| India | 8.9% | Regulatory compliance; affordable premium solutions | Infrastructure development; supply chain gaps |

| United States | 6.4% | Corporate partnerships; performance innovation | Cost competitiveness; technical limitations |

| Germany | 6.7% | Regulatory leadership; premium positioning | Market saturation; price pressure |

| Brazil | 8.2% | Agricultural feedstock; regional manufacturing | Economic stability; logistics infrastructure |

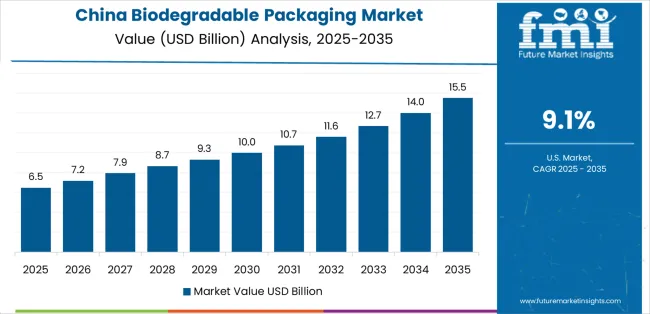

China establishes fastest market growth through comprehensive environmental policy implementation and massive manufacturing capacity development, integrating advanced biodegradable packaging as standard components in consumer goods and export operations. The country's 9.1% growth rate reflects explosive regulatory compliance adoption and domestic packaging industry transformation that mandates the use of bio-material systems in manufacturing and export facilities. Growth concentrates in major industrial centers, including Shenzhen, Shanghai, and Guangzhou, where packaging manufacturers showcase integrated bio-material systems that appeal to brands seeking advanced environmental compliance capabilities and export optimization applications.

Chinese manufacturers are developing domestically-produced biodegradable solutions that combine local agricultural feedstock advantages with functional performance features, including enhanced barrier properties and processing optimization capabilities. Distribution channels through manufacturing supply chains and export platform partnerships expand market access, while environmental regulation culture supports adoption across diverse consumer and industrial segments.

Strategic Market Indicators:

In Mumbai, Delhi, and Bangalore, manufacturers and packaging companies are implementing biodegradable packaging as standard materials for regulatory compliance and export market applications, driven by increasing environmental regulation investment and consumer awareness programs that emphasize the importance of eco-friendly packaging. The market holds an 8.9% growth rate, supported by regulatory policy expansion and industrialization programs that promote bio-material systems for manufacturing and consumer applications. Indian operators are adopting packaging solutions that provide consistent environmental performance and compliance features, particularly appealing in urban regions where regulatory enforcement and consumer awareness represent critical market drivers.

Market expansion benefits from growing industrial capacity and agricultural feedstock availability that enable widespread adoption of cost-effective bio-material systems for domestic and export applications. Technology adoption follows patterns established in pharmaceutical packaging, where regulatory compliance and performance drive procurement decisions and operational deployment.

Market Intelligence Brief:

The United States establishes market leadership through comprehensive corporate environmental programs and advanced consumer awareness development, integrating biodegradable packaging across consumer goods and food service applications. The country's 6.4% growth rate reflects established environmental consciousness patterns and mature bio-material technology adoption that supports widespread use of premium packaging systems in retail and manufacturing facilities. Growth concentrates in major consumer markets, including California, New York, and Texas, where environmental regulation culture showcases mature bio-material deployment that appeals to brands seeking proven environmental compliance capabilities and consumer appeal applications.

American manufacturers leverage established distribution networks and comprehensive product availability, including certified compostable materials and performance-enhanced bio-polymers that create brand differentiation and operational advantages. The market benefits from mature waste management infrastructure and consumer willingness to invest in premium eco-friendly materials that enhance brand positioning and environmental optimization.

Market Intelligence Brief:

Advanced environmental regulation market in Germany demonstrates sophisticated biodegradable packaging deployment with documented compliance effectiveness in consumer goods applications and manufacturing facilities through integration with existing packaging systems and regulatory infrastructure. The country leverages circular economy legislation and packaging waste standards to maintain a 6.7% growth rate. Industrial centers, including Bavaria, North Rhine-Westphalia, and Baden-Württemberg, showcase premium installations where biodegradable packaging integrates with comprehensive waste management platforms and compliance systems to optimize environmental performance operations and regulatory effectiveness.

German operators prioritize packaging compliance and environmental performance in material procurement, creating demand for certified products with advanced features, including industrial compostable certifications and enhanced barrier properties. The market benefits from established environmental infrastructure and willingness to invest in premium bio-materials that provide superior compliance benefits and adherence to circular economy standards.

Market Intelligence Brief:

Biodegradable packaging market expansion in Brazil benefits from diverse agricultural feedstock availability, including sugarcane-based materials in São Paulo and Rio de Janeiro, manufacturing development growth, and rising export demand that increasingly incorporate biodegradable packaging solutions for international market applications. The country maintains an 8.2% growth rate, driven by agricultural advantages and increasing recognition of bio-material benefits, including improved export compliance and enhanced environmental positioning.

Market dynamics focus on cost-effective bio-material solutions that balance environmental performance with price considerations important to Brazilian manufacturers. Growing consumer goods production creates continued demand for modern packaging systems in new facility infrastructure and manufacturing modernization projects.

Strategic Market Considerations:

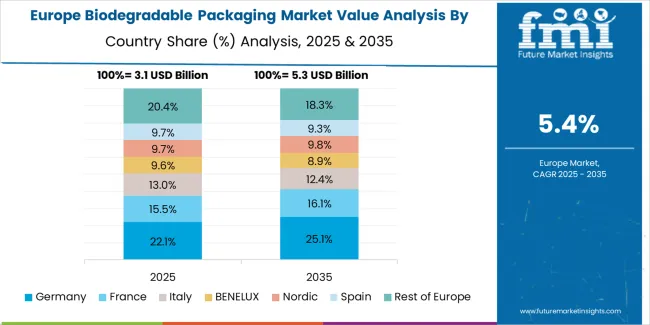

The European biodegradable packaging market is projected to grow from USD 4.2 billion in 2025 to USD 7.1 billion by 2035, registering a CAGR of 5.4% over the forecast period. Germany is expected to maintain its leadership position with a 31.2% market share in 2025, supported by its comprehensive circular economy regulations and advanced waste management infrastructure.

United Kingdom follows with a 23.8% share in 2025, driven by plastic reduction policies and corporate environmental commitments. France holds a 19.6% share through packaging waste legislation and consumer awareness initiatives. Italy commands a 14.7% share, while Spain accounts for 10.7% in 2025. The rest of Europe region is anticipated to gain momentum, expanding its collective share from 5.9% to 6.8% by 2035, attributed to increasing environmental regulation adoption in Nordic countries and emerging bio-material manufacturing facilities implementing advanced packaging programs.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Bio-polymer producers | Raw material supply, polymer chemistry, patent portfolio | Technical innovation; scaling economies; regulatory expertise | Market application knowledge; end-user requirements |

| Packaging converters | Processing technology; customer relationships; application development | Market proximity; customization capability; processing expertise | Raw material costs; supply chain volatility |

| Integrated manufacturers | Full value chain, quality control, market access | Vertical integration; consistent quality; customer control | Innovation speed; market flexibility |

| Specialty formulators | Bio-material modification; performance enhancement; custom solutions | Technical differentiation; niche expertise; high margins | Scale limitations; market penetration |

| Regional processors | Local manufacturing, distribution networks, cost advantage | Market understanding; logistics efficiency; price competitiveness | Technology gaps; certification complexity |

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 12.6 billion |

| Material Type | PLA-Based Packaging, Starch-Based Packaging, PHA-Based Packaging, Cellulose-Based Packaging |

| Application | Food Packaging, Beverage Packaging, Personal Care Packaging, Pharmaceutical Packaging, Industrial Packaging |

| End-Use | Retail & Consumer Goods, Food Service Industry, E-commerce & Logistics, Agriculture, Healthcare |

| Biodegradation Timeline | Home Compostable (90-180 days), Industrial Compostable (60-90 days), Marine Biodegradable (6-24 months) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, China, Germany, India, United Kingdom, Brazil, Canada, Japan, France, Italy, and 30+ additional countries |

| Key Companies Profiled | NatureWorks LLC, BASF SE, Novamont S.p.A., Corbion N.V., Total Corbion PLA, Biome Bioplastics Limited, Danimer Scientific Inc. |

| Additional Attributes | Dollar sales by material type and application categories, regional adoption trends across North America, Western Europe, and East Asia, competitive landscape with bio-polymer producers and packaging converters, consumer preferences for environmental compliance and performance optimization, integration with waste management systems and composting facilities, innovations in barrier technology and processing enhancement, and development of marine-biodegradable solutions with enhanced performance and environmental safety capabilities. |

The global biodegradable packaging market is estimated to be valued at USD 12.6 billion in 2025.

The market size for the biodegradable packaging market is projected to reach USD 22.8 billion by 2035.

The biodegradable packaging market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in biodegradable packaging market are pla-based packaging , starch-based packaging, pha-based packaging and cellulose-based packaging.

In terms of application, food packaging segment to command 40.0% share in the biodegradable packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

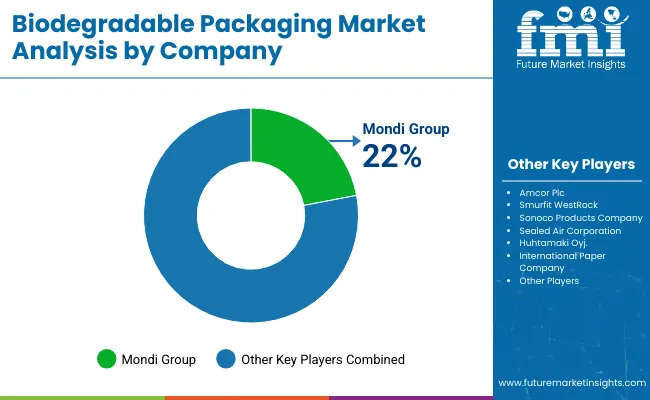

Competitive Landscape of Biodegradable Packaging Providers

Biodegradable Food Packaging Market Size, Share & Forecast 2025 to 2035

Biodegradable Paper & Plastic Packaging Market Forecast 2024-2034

Biodegradable Insulated Panel Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyamide Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Agricultural Films Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biodegradable Glitter for Cosmetics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biodegradable Meal Trays Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Gloves Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Bone Graft Polymers Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Lidding Films Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Stretch Films Market - Analysis Size, Share, and Forecast 2025 to 2035

Biodegradable Polymers Market Growth 2025 to 2035

Biodegradable Baby Diapers Market Analysis – Trends, Growth & Forecast 2025-2035

Biodegradable Microbeads Market Growth – Trends & Forecast 2025 to 2035

Competitive Breakdown of Biodegradable Lidding Films Providers

Biodegradable Lids Market Analysis - Demand, Trends & Outlook 2024 to 2034

Biodegradable Film Market Insights – Growth & Forecast 2024-2034

Biodegradable Disposable Tableware Market Insights – Growth & Forecast 2024-2034

Biodegradable Cutlery Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA