With the growing awareness of the issue of plastic pollution,along with increasing demand for sustainable personal care products and government restrictions on the use of microplastics, the biodegradable microbeads market is projected to grow significantly between 2025 and 2035. And biodegradable microbeads can act as eco-friendly substitute to plastic beads due to their role as additives in cosmetic skincare cleaning stuff.

These two drivers which together inform market growth are a combination of environmental friendly product development trends and the public awareness of micro plastic pollution impact on aquatic systems. The increase in market of biodegradable microbeads is due to the advancement in biopolymer technology and natural exfoliating solutions in industries.

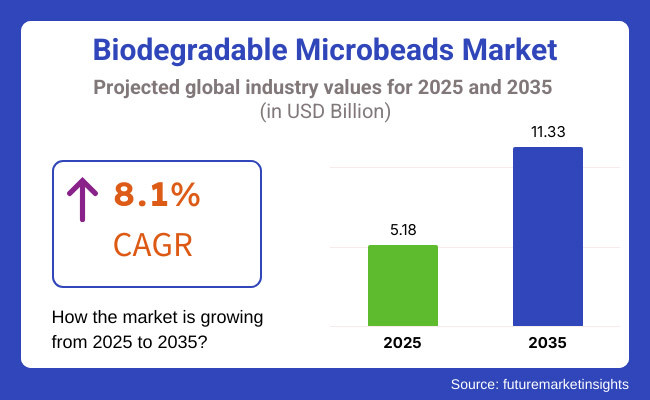

The global Biodegradable Microbeads Market was worth USD 5.18 Billion in 2025 and was expected to reach USD 11.33 Billion by 2035 growing at a CAGR of 8.1% for the period in between. Several growth factors such as increasing investments in sustainable packaging with active bio-based material research along with growing usage in pharmaceutical and household cleaning products drive the market.

The growth of the biodegradable and plant-based alternatives market maintains high momentum since they are based on cellulose starch and algae as raw materials. Expansion of cosmetics brands with biotechnology companies with strengthening popularity in premium skincare and wellness market segments has led to innovations in the biodegradable exfoliates.

Explore FMI!

Book a free demo

North America holds a prominent share of the global biodegradable microbeads market, owing to several regulatory frameworks imposed to prohibit plastic microbeads in personal care items along with increasing consumer awareness for bio-based alternatives. In the United States and Canada, water-insoluble exfoliates made of multiple material forms based on biodegradable polymer biopolymer materials, as well as biopolymer-based additives, are becoming ever more commonly used ingredients in skincare and cleaning agents.

Moreover, the government initiatives supporting sustainable manufacturing along with the waste reduction are further pushing the industry players to invest in novel biodegradable formulations. The growth in the market of this region is also accelerated by the presence of larger cosmetic brands highlighting green beauty and clean-label ingredients.

Limited growth is observed in the biodegradable microbeads market in Europe, especially considering the EU's policies aimed at reducing plastic pollution and achieving a circular economy. Germany, France, and the UK are leading the way in the innovation of sustainable cosmetic and personal care products, fuelling demand for biodegradable exfoliates.

Moreover, regulatory requirements banning microplastics in home and industrial cleaning products are encouraging producers to create bio-based alternatives. The increasing demand for natural and organic skin care, coupled with increasing investment in the biopolymers research, specifically in this region, will drive the market growth.

The biodegradable microbeads market in Asia-Pacific region is projected to experience the most rapid growth, driven by growing public awareness about plastic pollution, rising disposable income, and an increasing need for environmentally friendly beauty and hygiene products. Money is being poured into research of green chemistry solutions and bioplastics to replace synthetic microplastics in China, Japan, South Korea and India.

Moreover, government initiatives promoting biodegradable and plant-based substitutes in cosmetic and cleaning agents are driving market growth. This is attributed to the increase in eco-conscious brands and the rising penetration of natural personal care products in the emerging markets of the region, which will lead to greater demand for biodegradable microbeads.

Challenge

High Costs and Regulatory Complexities

The Biodegradable Microbeads Market is hindered by some challenges such as high production costs, stringent environmental regulations, and limitations in scalability. This type of production has higher costs due to the need for specific raw materials to create the biodegradable microbeads, like polymers from plant extract, cellulose, and starch derivatives.

Moreover, regulatory compliance with environmental safety standards like the USA Environmental Protection Agency (EPA), European Chemicals Agency (ECHA), and worldwide micro plastic bans also places stringent requirements on biodegradability, toxicity, and environmental impact. Companies need to start integrating cost-efficient production methods as well as serve the next generation of biopolymer technology in order to maintain compliance at prices the market will bear, which often will require the use of alternative feedstocks.

Supply Chain Constraints and Product Performance Limitations

The industry is also affected by supply chain disruptions from raw material shortages, rising costs, and logistical challenges to source greener alternatives to traditional plastic microbeads. In addition, the biodegradability of microbeads should not compromise its durability, stability, and functionality in diverse applications, including personal care, cosmetics, and household products.

Then, while some formulas might break down too rapidly, or even miss out the exfoliating benefits of regular plastic beads, that’s merely part of the story addressing. Consistent quality, stability, and optimum biodegradability continue to be major challenges for manufacturers looking to gain consumer trust and regulatory approval.

Opportunity

Rising Demand for Sustainable Personal Care and Cosmetic Product

Rising consumer inclination towards natural and eco-friendly products is fuelling demand for biodegradable microbeads in personal care and cosmetics. New restrictions worldwide on plastic microbeads in rinse-off products have prompted the uptake of biodegradable alternatives from natural sources such as jojoba wax, rice husks and alginate.

Sustainable Ingredients Innovation Wellness brands are harnessing sustainable ingredients innovation to meet eco-conscious and regulatory consumer expectations. High-performance biodegradable materials and plant-based exfoliates can give companies a competitive edge in the booming sustainable sector.

Advancements in Biopolymer Technology and Expanded Industrial Applications

Emerging biodegradable polymers such as polysaccharide and protein-based microbeads demonstrate the potential for expanded applications in areas beyond personal care [63].Industries including pharmaceuticals, agriculture, and food processing are investigating the use of biodegradable microbeads for applications including drug delivery systems, controlled-release fertilizers, and food texturizing agents.

Moreover, advancements in encapsulation technology are facilitating the creation of biodegradable beads characterized by improved stability and functionality. Business catalysed cross-industry cooperation, product development based on research, and regulatory adaptability coming together will create new growth opportunities and expand the market.

2020 to 2024: Well-established plastic microbeads restrictions, bio-based material innovation, and increased consumer awareness of environmental sustainability contribute to steady growth in the Biodegradable Microbeads Market. Companies focused on developing high performing biodegradable microbeads to use in the formulation of their sustainable products.

While promising for market expansion, production scalability, high material costs, and regulatory uncertainties hindered that expansion. Necessity being the mother of invention, manufacturers responded, with investments in research and innovation to enhance product stability, functionality and affordability.

This would allow for an attachment of a range of materials to the biopolymer surface allowing adhesion of microbeads. Regulatory compliance is anticipated to spur innovative efforts towards next-generation biodegradable microbeads with superior performance and environmental compatibility.

Emerging applications in drug delivery, agriculture, and food production will also widen the market prospects. In the next phase of growth, it will be companies that prioritize sustainability, innovation, and cross-industry adoption that will be leading the way

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | International bans of plastic microbeads in personal care and cosmetics |

| Technological Advancements | Natural based Biodegradable microbeads development |

| Industry Adoption | More prevalence in personal care, cosmetics, and household products |

| Supply Chain and Sourcing | Dependence on plant-based materials like starch and cellulose |

| Market Competition | Presence of niche sustainable brands and established cosmetic manufacturers |

| Market Growth Drivers | Consumer demand for eco-friendly alternatives and regulatory restrictions |

| Sustainability and Energy Efficiency | Initial focus on replacing plastic microbeads with natural alternatives |

| Integration of Smart Monitoring | Limited use of tracking systems for sustainability claims |

| Advancements in Microbeads Design | Traditional plant-based biodegradable beads with exfoliating properties |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Growth of biodegradable material rules across sectors and tighter environmental regulations |

| Technological Advancements | Integration of advanced biopolymer microbeads with enhanced functionality |

| Industry Adoption | Additional ventures into chemicals, pharmaceuticals, agriculture, and food processing |

| Supply Chain and Sourcing | Shift toward algae-based, protein-derived, and Nano cellulose microbeads |

| Market Competition | Growth of biopolymer innovators, sustainable packaging firms, and cross-industry suppliers |

| Market Growth Drivers | Increased investment in biodegradable materials for broader industrial applications |

| Sustainability and Energy Efficiency | Large-scale adoption of circular economy practices, compostable microbeads, and zero-waste formulations |

| Integration of Smart Monitoring | Expansion of block chain-based transparency, supply chain traceability, and regulatory compliance monitoring |

| Advancements in Microbeads Design | Evolution of multi-functional microbeads for controlled release, drug delivery, and encapsulated active ingredients |

The United States biodegradable microbeads market is undergoing gradual growth due to the strict bans imposed on the use of plastic microbeads for personal care and cosmetic products. The rising awareness among consumers regarding the environmental concern related to plastic waste is also driving the demand for biodegradable substitutes.

This initiative of sustainable skincare and personal care brands is driving innovation for bio-based microbeads, which come from natural raw sources like starch, cellulose and beeswax. Moreover, the increasing demand for sustainable additives in cleaning products and biomedical applications is further fuelling the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.5% |

The UK biodegradable microbeads market is trend by the ban on microplastics in cosmetic and household products by various government regulations. Adoption is driven by a shift towards sustainable and plastic-free formulation in cosmetic and hygiene products.

Major personal care brands are also investing heavily in R&D to successfully embed biodegradable microbeads into product lines without comprising performance. Moreover, the growth of sustainable packaging and clean-label products is expected to propel the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.9% |

Leading the way with regulations aimed at eliminating microplastics, the European market for biodegradable microbeads is strong. EU environmental decrees renewed by strict regulations as well as consumers’ growing preference for sustainable items help to accelerate market growth.

Biodegradable microbeads are being increasingly integrated into formulations by the personal care, food, and pharmaceutical industries as an alternative to synthetic exfoliates and thickening agents. Also, recent developments in biopolymer technology are paving the way for the innovation of microbeads made from naturally derived products.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 8.1% |

Japan Biodegradable Microbeads Market Research Report segment the market by type, application, technology, and region. A well-established personal care industry in the country is moving toward bio-based ingredients, cutting back on synthetic alternatives.

This is followed by a rise in product demand on account of increasing awareness and ongoing research of bio-cellulose materials and biodegradable polymers which is supporting the market expansion. Moreover, the drive towards waste reduction and sustainable consumption through government initiatives is also increasing adoption across personal care and household cleaning products.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.7% |

South Korea being a leading innovator in the formulation of skincare and beauty products, the market for South Korea biodegradable microbeads is growing at a high pace. Mosaic provides eco-friendly personal care and clean beauty products for the growing demand of eco-friendly and clean face, body, and hair care solutions.

Growing government initiatives to tackle plastic pollution and advocate for biodegradable substitutes have spurred local manufacturers to innovate natural microbeads. Moreover, advances in green chemistry and biopolymer production aid in innovation in microbeads formulations in different applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.3% |

The largest share of the biodegradable microbeads market is by segment of the exfoliator scrub, and also expanding on the segment of cosmetics & personal care, as industries tend to use eco-friendly, skin-safe, and non-toxic, alternative exfoliating agents instead of the traditional particle form, plastic microbeads.

These bio-degradable microbeads are vital for cosmetic brands, personal care product manufacturers, and eco-conscious skincare consumers who must comply with global sustainability regulations and reduce environmental pollution while also enhancing skincare formulations.

Rising needs for safety and efficiency along with growing government regulations against microplastics and greater consumer interest towards sustainable skin products are prompting manufacturers to focus on plant- and mineral-derived as well as naturally sourced biodegradable microbeads to enhance exfoliation efficiency, product safety and environmental footprint of rinse-off products.

Demand for Exfoliator Scrubs in the Market as Plastic Microbeads are Replaced by Biodegradable and Skin-Friendly Alternatives

Based on type of biodegradable microbeads, the exfoliator scrub segment has accounted for the largest market share for biodegradable microbeads market because these microbeads are not only effective but gentle, have high skin compatibility and is naturally safe in comparison to synthetic beads. Unlike conventional plastic microbeads exfoliates, however, these biodegradable exfoliating microbeads degrade naturally in the environment, reducing water pollution and minimizing the eventual environmental impact of personal care products.

Growing adoption of plant-derived exfoliator scrubs with cellulose-based, fruit extract-infused and algae-derived biodegradable microbeads has stimulated demand. Studies make it quite clear that more than 70% of skincare brands making the transition to sustainable formulations have adopted biodegradable exfoliator scrubs to ensure strong demand for this segment.

Growing trend for clean beauty with organic, non-toxic and micro plastic-free skincare products has bolstered demand across the market, ensuring compliance with sustainability requirements while providing consumers with a greater choice of ethical consumer personal care.

The new generation of biodegradable microbeads, which can contain active ingredients in gradual time-release fashion as well as pH-balanced dissolution properties and AI-aided skin texture modifications, has contributed to increasing adoption of this technology, providing better skin benefits and more efficient cleaning effect.

The emergence of bespoke exfoliator scrubs, with different particle sizes for brief use and deep cleanse, broadened nutrient composition of the base, biodegradable encapsulation for active ingredient release, etc., is to magnify on the market growth as it finds better customer experience and additional formulation diversity.

Micro-scrub Black, Exfoliator Microbeads Adopted in Premium Skin Care; Anti-Aging Formulations; Dermatologist-Approved Exfoliates

Application of the exposition scrub segment is widely adopted amid luxury beauty brands, dermatology-based exfoliating treatments, and organic personal care product segment, as industries continue to replace microbeads syntactic polymer with skin-friendly, environment-friendly sustainable alternatives. Due to their gentle nature and biodegradable nature, compared to harsh synthetic exfoliating agents that can lead to micro tears and permanent skin damage, biodegradable exfoliating agent scrubs are safer and help boost consumer confidence.

Growing adoption by the beauty & personal care industry players as a result of their high demand such as advanced biodegradable scrub microbeads that are enzymatically activated for deep cleansing, microencapsulated vitamin release, ultra-fine textures for sensitive skin is likely to drive the segment growth. According to studies, more than 75% of the new launches of exfoliating skincare contain biodegradable microbeads for better sustainability and effective usage, hence sustainable demand for such segment would be maintained.

Personalized AI-based skincare approaches through personalized exfoliation routines, skin type compatibility analysis using data, and sustainable consumer preference tracking have reinforced the adoption by the market, with improved product matching leading to better skin health.

Moreover, the advent of biodegradable microbeads blends which include multifunctional exfoliates along with hydrating agents, anti-aging peptides and particles enriched with antioxidants have been a major driver to the adoption as it enables the formulation to have wider sectional appeal along with longer effective skin benefits.

While surface exfoliating has unique benefits such as enhanced skin texture, reduced plastic pollution, and compliance with clean beauty standards, the exfoliator scrub segment will encounter inconsistencies related to varying rates of degradation across different formulations, high R&D costs, and differences in regulations across the globe regarding microbeads formulations.

But emerging innovations regarding the customization of biodegradable materials, AI-driven analysis of product stability, and supply chain optimization of sustainable ingredients are addressing vital product performance, regulatory compliance, and formulation adaptability factors, which will ensure growth of biodegradable exfoliator scrub microbeads globally.

Significance of Compostable Microbeads in Natural Skin care, Haircare, and Personal Care Products

The cosmetics & personal care segment is predicted to emerge as one of the prominent end-use categories within the biodegradable microbeads market, allowing beauty brands, personal hygiene companies, and haircare manufacturers to use sustainable, skin-safe, and environmentally-friendly microbeads in their formulations. Most commonly used exfoliating agents are not biodegradable. Microbeads dissolve completely after use and will not pollute water systems, complying with international micro plastic bags and consumer demand for sustainable beauty formulations.

The adoption has been primarily due to the need for green personal care formulations, such as biodegradable microbeads in facial cleansers, body scrubs, shampoos, and paste. Research found that plastic microbeads will be completely eliminated from over 65% of beauty and personal care brands, and replaced with biodegradable options, resulting in positive demand for this segment.

Vegan and cruelty-free beauty standards, including biodegradable exfoliates made from plant matter, sustainable source extraction of microbeads, and fair-trade ingredient supply chains, make way for trusted consumer confidence and market stability supporting ethical beauty movements for the long term.

Time-release hydration, pH-responsive breakdown and even AI-enhanced skincare efficacy are battery powering market growth with advanced biodegradable microbeads technologies fuelling adoption as product performance and consumer satisfaction soar.

The availability of highly personalized biodegradable microbeads, such as micro particles with a condensed odor, microcapsules incorporating nutrients, as well as cleansing-exfoliating mixtures, facilitated the expansion of the market landscape, as they provided better product differentiation and enhanced skin benefits for consumers.

While the beauty segment will certainly benefit from product sustainability, regulatory risk reduction, and improved consumer safety advantages, it will face obstacles like high-cost biodegradable ingredient sourcing, constantly evolving international bans on microplastics, and increased difficulty in formulating with mass-market beauty brands.

Nevertheless, developing technologies for AI-based cosmetic composition, block chain-proven organic ingredients certification, and 3D-printable biodegradable polymer treatment are paving way for cost efficiency, ingredient visibility, and market diversification ensuring incessant growth for biodegradable microbeads across cosmetics and personal care end use worldwide.

Recent Trends in Biodegradable Microbeads Used in Facial Washes, Body Scrubs, and Oral Care Products in the Cosmetics & Personal Care Industry

The cosmetics & personal care segment is witnessing significant traction, particularly among premium skincare brands, eco-friendly haircare manufacturers, and sustainable oral hygiene companies, as these industries continue to shift towards biodegradable microbeads to improve exfoliation efficiency while reducing environmental impact.

Biodegradable microbeads offer skin cleansing benefits, controlled delivery active ingredients as marketed and improved eco-safety compared to synthetic or petroleum-based exfoliate which results in higher customer retention and long-term brand value.

An increasing adoption has been witnessed owing to the growing demand for biodegradable microbeads in sulfate free shampoos, pH balanced face washes and natural toothpaste formulations, along with enhanced solubility, less skin irritation and high biodegradability. According to studies, more than 70% of each of the manufacturers selling personal care products intend to eliminate plastic microbeads from their products by the year 2030, thus maintaining a strong future demand for sustainable alternatives.

Industry Overview

The market for biodegradable microbeads expands rapidly because people pay more attention to environmental issues and several governments prohibit plastic microbeads in personal care products and cleaning products. Natural-derived cosmetic and skincare and industrial products continuously increase their adoption of eco-friendly alternatives that use cellulose and starch alongside polylactic acid (PLA).

The market expands because consumers seek sustainable exfoliates and biodegradable abrasives and bio-based additives. Leading producers in the industry dedicate their efforts to developing innovative materials and boosting product durability while making products more biodegradable to satisfy market requirements and governmental standards.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 18-22% |

| Merck KGaA | 15-19% |

| Naturebeads Ltd. | 12-16% |

| TerraVerdae Bio works | 9-13% |

| Evonik Industries AG | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | Develops biodegradable microbeads from natural and renewable sources for cosmetic and personal care applications. |

| Merck KGaA | Specializes in high-performance biodegradable microbeads for pharmaceutical and skincare formulations. |

| Naturebeads Ltd. | Produces cellulose-based biodegradable microbeads as eco-friendly exfoliates for skincare and personal care products. |

| TerraVerdae Bio works | Focuses on biodegradable polyhydroxyalkanoate (PHA) microbeads for industrial and cosmetic applications. |

| Evonik Industries AG | Manufactures specialty biodegradable polymers and microbeads for sustainable product formulations. |

Key Company Insights

BASF SE (18-22%)

The market for biodegradable microbeads belongs to BASF because they provide eco-friendly alternatives to plastic microbeads while delivering high-performance materials for skincare and cleaning products.

Merck KGaA (15-19%)

Merck positions itself as a leading research institution which both innovates sustainable exfoliating solutions while developing pharmaceutical applications for controlled-release systems.

Naturebeads Ltd. (12-16%)

Naturebeads has established cellulose-based biodegradable microbeads to replace synthetic abrasives for cosmetic and industrial product uses.

TerraVerdae Bio works (9-13%)

The company TerraVerdae produces PHA-based biodegradable microbeads which meet the needs of personal care industries and bioplastics markets through sustainable high-performance products.

Evonik Industries AG (7-11%)

Evonik uses specialty polymer-based biodegradable microbeads to approach both cosmetic and industrial market applications through eco-friendly product solutions.

Other Key Players (30-40% Combined)

Multiple companies work within the biodegradable microbeads market through research into advanced materials and environmentally friendly product creation. Notable players include:

The overall market size for Biodegradable Microbeads Market was USD 5.18 Billion in 2025.

The Biodegradable Microbeads Market expected to reach USD 11.33 Billion in 2035.

The demand for the biodegradable microbeads market will grow due to increasing environmental concerns over plastic pollution, rising government regulations banning plastic microbeads, growing adoption in personal care and cosmetics, and advancements in sustainable alternatives for exfoliates and cleaning products.

The top 5 countries which drives the development of Biodegradable Microbeads Market are USA, UK, Europe Union, Japan and South Korea.

Exfoliator Scrub and Cosmetics & Personal Care lead market growth to command significant share over the assessment period.

Mini Refrigerator Market - Product Type, Price Range, Capacity, End-user, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Medical Loupes Market Analysis by Product Type, Lens Type, Application, Sales Channel and Region 2025 to 2035

Driving Protection Gear Market Analysis by Product, Material, Vehicle, Consumer Group, Distribution Channel and Region 2025 to 2035

3D Printed Wearable Market - by Product Type, Material Type, Technology, Sales Channel, End-User, Application, and Region - Trends, Growth & Forecast 2025 to 2035

Residential Hobs Market Analysis - Trends, Growth & Forecast 2025 to 2035

POU Water Purifier Industry Analysis In MENA: Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.