The bio-wax market is experiencing strong expansion due to increasing demand for sustainable and biodegradable alternatives to synthetic waxes. Market growth is being supported by rising consumer preference for eco-friendly and natural ingredients across personal care, food, and industrial applications. Regulatory encouragement toward renewable materials and reduced carbon emissions is also driving adoption.

Manufacturers are focusing on optimizing extraction processes and improving the performance characteristics of bio-based waxes to match conventional options. Market competitiveness is being enhanced through technological advancements and collaborative product innovation between bio-refineries and end-user industries. The future outlook indicates continued growth driven by expanding applications in cosmetics, pharmaceuticals, and packaging, supported by global sustainability mandates.

The growth rationale rests on the ability of bio-wax producers to deliver cost-effective, high-performance, and environmentally compliant solutions This is expected to ensure long-term market stability and progressive penetration across multiple downstream industries.

| Metric | Value |

|---|---|

| Bio-wax Market Estimated Value in (2025 E) | USD 2.7 billion |

| Bio-wax Market Forecast Value in (2035 F) | USD 4.0 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

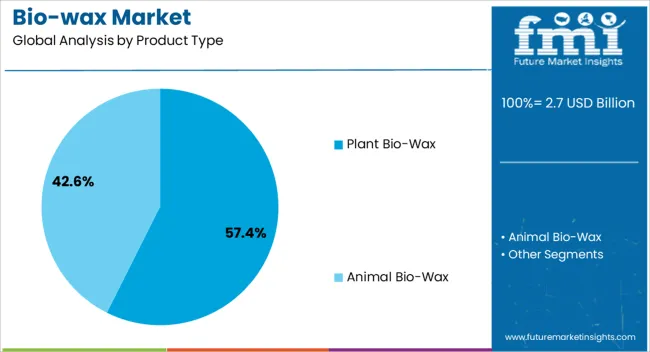

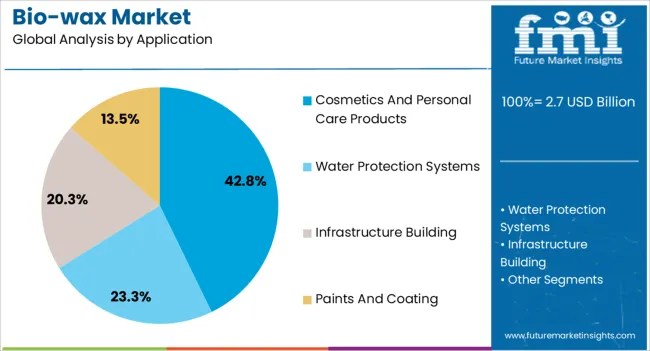

The market is segmented by Product Type and Application and region. By Product Type, the market is divided into Plant Bio-Wax and Animal Bio-Wax. In terms of Application, the market is classified into Cosmetics And Personal Care Products, Water Protection Systems, Infrastructure Building, and Paints and Coating. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plant bio-wax segment, accounting for 57.4% of the product type category, has emerged as the dominant segment due to its renewable origin and versatility in formulation. Demand has been supported by consumer preference for plant-derived ingredients and the growing transition away from petroleum-based raw materials.

The segment’s performance is being reinforced by advancements in extraction technologies and improved processing efficiency, which have enhanced purity and consistency. Manufacturers are leveraging agricultural byproducts and sustainable feedstocks to reduce production costs and environmental impact.

Product differentiation strategies are focused on developing specialty grades tailored for cosmetics, food coatings, and pharmaceutical uses Continued regulatory support for bio-based alternatives and expanding industrial applications are expected to sustain the segment’s share and strengthen its leadership position in the bio-wax market.

The cosmetics and personal care products segment, representing 42.8% of the application category, has been leading the market due to the rising incorporation of bio-waxes in skincare, haircare, and color cosmetic formulations. The segment’s growth is being driven by increasing consumer awareness regarding natural and sustainable ingredients and the regulatory shift toward banning synthetic and non-biodegradable substances.

Bio-waxes are being valued for their emollient properties, texture enhancement, and stability benefits in formulations. Leading cosmetic manufacturers are integrating bio-waxes into premium product lines to meet clean-label and ethical sourcing demands.

The ongoing expansion of organic and vegan cosmetic categories is further accelerating adoption Continued investments in formulation innovation and sustainable sourcing are expected to support long-term growth and maintain the segment’s prominent market position globally.

Global bio wax sales increased at a CAGR of 3.3% between 2020 to 2025. Total industry size at the end of 2025 reached USD 2476.8 million. This high growth was fueled by rising awareness regarding the harmful effects of synthetic waxes and the shift towards eco-friendly alternatives.

Climate change LED to the adoption of sustainable processes that lowered the environmental footprint of companies, thereby catering to environmental conscious consumers. Bio-based wax allowed producers to formulate products with a sustainable profile, thereby driving growth.

There was also a growing demand for natural and organic cosmetics and bio waxes offered the desired functionalities while aligning with the clean beauty movement. Advances in research for bio-based wax production further opened the door for more sustainable and potentially cost-competitive wax options during the historical period.

The global sector is witnessing robust growth and the trend is likely to persist through 2035. With a projected CAGR of 4%, the industry is estimated to reach USD 4 million by 2035. A leading factor behind the growth of the sector is rapid expansion of feedstock options.

The sector is moving beyond traditional sources and exploring alternative options like algae oil or insect fats to enhance sustainability. These are potentially reduce the reliance on agricultural land for bio wax production.

Technological advancements are being made to further create progress in the sector. Integration of biotechnology through fermentation processes and enzyme technology can streamline bio-based wax, potentially improving efficiency and reducing costs.

The sector is expected to progressively find new applications in various sectors that hold promise for future growth, thereby providing opportunities for bio-wax producers in emerging markets. Regulations related to bio-based products and sustainability are expected to continue evolving. Companies that can adapt production processes and demonstrate the environmental benefits of bio waxes will be well positioned in the sector.

The section below depicts the bio wax market share and size across various countries. The section evaluates the latest trends of the industry in leading countries. India and China have emerged as the prominent countries in the sector and are estimated to experience considerable CAGRs of 6% and 4.5%, respectively, through 2035.

The regional analysis of the sector is also presented for companies to determine the key locations for investment. The full report contains detailed information on the current trends, growth drives, and challenges in the industry.

The sector is experiencing robust growth in various countries. This growth is attributed to factors including rising environmental concerns resulting in a shift towards sustainable and renewable products. High versatility, government initiatives, and continuous research and development efforts by leading players in the industry also play a significant role in the expansion of the market.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 2.2% |

| Germany | 1.9% |

| China | 4.5% |

| Japan | 1.7% |

| India | 6% |

India is emerging as the dominant sector with an estimated CAGR of 6% during the forecast period from 2025 to 2035. This is attributed to changing bio wax market trends and the vast production of oilseed crops such as castor, rapeseed, and mustard in the country. These crops are considered the potential feedstock for bio-based wax production.

Demand for cosmetics and personal care products is rapidly increasing in the country, leading to a significant expansion of the sector. Bio-based waxes have emerged as a popular choice in the cosmetics sector owing to natural and sustainable properties, which is contributing to growth.

Another key factor for the advancement of the sector in India is the availability of low-cost labor. The country has a large workforce that can potentially contribute to cost-competitive production of bio-based waxes compared to other developed countries. Abundant availability of natural resources coupled with the availability of workforce and government norms facilitates growth of the sector.

China’s bio wax sector is projected to grow at a CAGR of 4.5% through the forecast period from 2025 to 2035. The country has a well-established chemical industry and with a strong infrastructure for large-scale production that can be adopted for the manufacturing of wax products.

The country also has a huge workforce, mainly in the chemical and manufacturing sectors that can be efficiently trained and employed in bio-based wax production facilities. China is heavily investing in research and development of bio-based products.

The country has launched initiatives to promote the development of a bio-based economy, thereby encouraging the production and utilization of bio-based products. Owing to these initiatives, China-based companies have easier access to capital for investing in wax production facilities and technology compared to other nations.

There is also a rise in disposable income due to the growing middle-class population demanding high-quality consumer goods. These goods include cosmetics and personal care products. Expansion of sectors of products that utilizes bio-based wax, such as food packaging, coatings, candles, and other industrial products, is set to result in the progressive growth of China.

Canada has a strong potential for future growth in the bio-wax industry. The country is expected to grow at a CAGR of 2.4% between the assessment period of 2025 to 2035. Canada has a vast agricultural land, which is boasting a strong agricultural sector that translates into a readily available supply of potential feedstock for wax production.

The country’s government prioritizes environmental sustainability and aims to reduce reliance on fossil fuels. Being a renewable and eco-friendly alternative, bio-based wax aligns with these goals. Government support through funding for research and development, policies, and incentives for bio-based product manufacturers can greatly benefit the industry.

The section provides information regarding the leading segments in the bio-wax industry. The sectipon has details regarding the anticipated growth rates that will help companies identify the dominating sectors and invest accordingly.

Based on product type, the plant segment is leading with a market share of 62.8% in 2025. By application, the cosmetics and personal care products segment is dominating the industry with a value share of 38.5% in 2025.

| Segment | Plant Bio-wax (Product Type) |

|---|---|

| Value Share (2025) | 62.8% |

The plant segment accounted for a value share of 62.8% in 2025, owing to sustainable profile amid rising environmental concerns. Being derived from readily available and renewable resources like vegetable oils, the product aligns with the surging demand for sustainable and eco-friendly products.

Plant-based waxes can be easily formulated based on requirements, thereby achieving functionality for various uses. These can even be tailored to have different hardness levels, viscosities, and melting points.

High compatibility with other natural ingredients and certain synthetic components allows for easy blending and customization to achieve the desired functionalities in the final product. Manufacturers prefer plant-based products as these have cost-effective production methods due to the established technologies and processes for extracting and refining waxes from vegetable oils.

Government regulations in favor of the use of bio-based products are further improving popularity and production. These regulations include subsidies for companies using plant-based waxes or tax breaks.

| Segment | Cosmetics and Personal Care Products (Application) |

|---|---|

| Value Share (2025) | 38.5% |

Based on application, the cosmetics and personal care products segment is witnessing significant growth, with a value share of 38.5% in 2025. This dominance is attributed to several functional benefits, which include emollient properties and film-forming ability.

Bio waxes offer a wide range of textures and consistencies, allowing manufacturers to create a variety of cosmetic products. A few types of waxes help soften and moisturize the skin, adding to the sensory experience. These often act as thickening agents in products and provide structure to lipsticks and balms, enhancing the spreadability of ointments.

A key driver of the industry is non-toxic and hypoallergenic nature, which makes the wax suitable for sensitive skin types. Bio-based waxes are biodegradable, perfectly aligning with the increasing focus on sustainability and the clean beauty movement worldwide. These also have a lower environmental footprint compared to petroleum-based waxes.

Bio-based waxes are versatile and compatible, thereby offering a luxurious feel and natural sheen to cosmetic products. These are anticipated to further enhance visual appeal, raising demand.

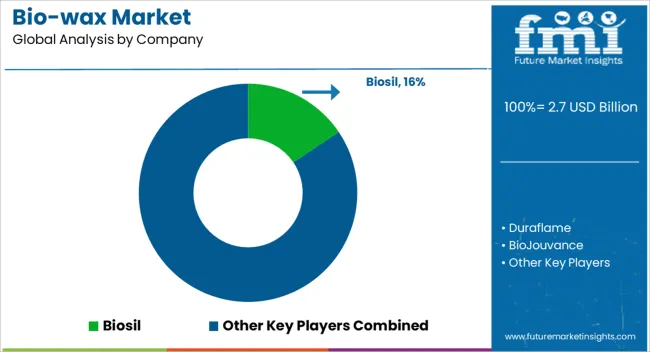

The bio-based wax market is expected to experience steady growth throughout the forecast period. Key players are investing in research and development to create new waxes that have wide applications and functionalities.

While the market is dominated by established brands, many new entrants are progressively strengthening positions, especially those from emerging economies with abundant renewable resources. The competitive landscape of the bio wax market is challenging and will evolve according to industry trends.

A key challenge for bio-wax manufacturers is achieving cost parity with traditional waxes. Brands that can succeed in optimizing production processes along with lowering prices of products will have a competitive edge in the market.

Increasing awareness of sustainability is a key trend with a potential to drive growth in the market. Both consumers and businesses are progressively seeking eco-friendly alternatives for petroleum-based waxes. As a result, companies capable of providing sustainable solutions such as bio-based waxes from renewable resources like vegetable oil are poised to experience growth.

Technological advancements are driving the market. These include tailoring the molecular structure of bio waxes to achieve specific functionalities. This can lead to improved hardness, melting points, and high compatibility with other ingredients.

Industry Updates

The bio-wax industry is segmented into animal and plant bio-wax based on product type.

Based on application, the industry is distributed in bio wax for cosmetics and personal care products, water protection systems, infrastructure building, and paints and coating.

Details of key countries across North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and the Middle East and Africa is given.

The global bio-wax market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the bio-wax market is projected to reach USD 4.0 billion by 2035.

The bio-wax market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in bio-wax market are plant bio-wax and animal bio-wax.

In terms of application, cosmetics and personal care products segment to command 46.7% share in the bio-wax market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA