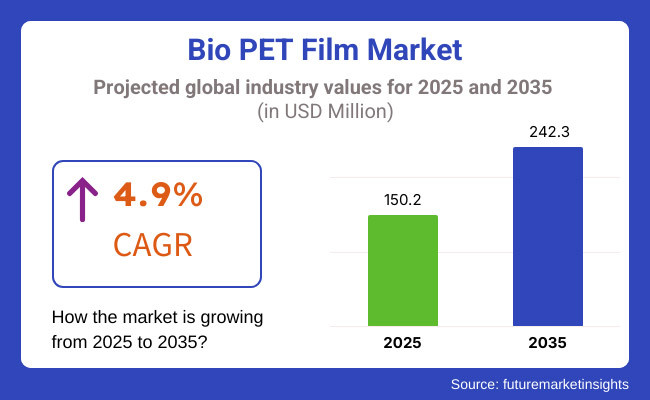

The Bio PET Film industry is expected to witness strong growth during the period from 2025 to 2035. The Bio PET film market is projected to generate USD 150.2 million in revenue in 2025 and is expected to reach USD 242.3 million by 2035. A CAGR of 4.9% is expected for the bio PET film sector during the forecast period. This growth is being driven significantly by the increasing penetration of bio-based materials and the sustainable packaging industry, in particular.

Rising environmental concerns, strict legislation on plastic waste, and the development of bio-based polymer technology drive this growth. Most bio PET films have lower performance than their petroleum-based equivalents.

Gradually, companies are investing in R&D to enhance bioPET film performance and reduce costs, making them a viable substitute for traditional PET, propelling bio PET segment growth.

Significant demand is expected from the Asia-Pacific region, led by rapid industrialization and government initiatives encouraging the use of biodegradable materials. In conclusion, the bio-PET film industry shows a promising outlook, driven by increasing sustainability initiatives and technological advancements.

Explore FMI!

Book a free demo

The Bio PET Film sector report is based on a thorough analysis of the overall industry, which provides the proper and accurate prediction of the industry for the given period of time. The industry, on its own, was still rather new in 2024 with low awareness, high production costs, and low adoption.

However, when governments around the world implemented strict regulations on single-use plastics and promoted bio-based alternatives, the industry started to gain momentum. Production technology advanced between 2020 and 2024, leading to efficiency improvements; however, high production costs remained a challenge despite increased investment in research.

Bio PET films were also increasingly applied in the food and beverage, pharmaceuticals, and consumer goods industries as they sought to comply with their sustainability goal, and the market's value in 2024 reached USD 143.2 million. One of the major drivers of industry growth was rapid industrialization and supportive government policies in the Asia-Pacific region.

The bio-PET film industry has been growing in the period from 2025 to 2035 owing to the growing environmental concerns and global move towards sustainable packages. The poly-based materials experienced further research and development investments in developing their manufacturing processes and applications beyond packaging to textiles, the automotive and electronics industries, and more.

These improvements enhanced the functionality and performance of bio-PET films, making them more attractive to eco-conscious consumers and companies. In terms of future growth, the bio-PET film industry will witness growth from 2025 to 2035 on the back of new technological innovations.

Bio-PET films will be increasingly used across industries. The development of monomaterial packaging will become more systematic, with greater focus on improving recycling processes. These actions have more sweeping environmental goals, as companies and consumers alike hope to cut plastic waste and emissions.

| Key Drivers | Key Restraints |

|---|---|

| Rising Consumer Demand for Sustainable Packaging | High Production Costs of Bio PET Films |

| Advancements in Bio-based Material Technology | Limited Availability of Raw Materials |

| Government Regulations Promoting Sustainability | Slow Adoption in Certain Industries |

| Increasing Investment in Recycling Technologies | Challenges in Bio PET Film Recycling |

| Growing Preference for Bio plastics Across Industries | Complexity in Bio plastic Manufacturing |

Impact Assessment of Key Drivers

| Key Drivers | Imapct Level |

|---|---|

| Rising Consumer Demand for Eco-friendly Packaging | High |

| Advancements in Manufacturing Technologies | Medium |

| Government Regulations Promoting Sustainability | High |

| Growing Preference for Bio plastics Across Industries | Medium |

| Increase in Recycling Technologies | High |

| Key Restraints | Impact Level |

|---|---|

| High Production Costs of Bio PET Films | High |

| Limited Availability of Raw Materials | Medium |

| Slow Adoption in Industries | Medium |

| Challenges in Recycling Bio PET Films | Low |

| Complexity in Bio plastic Manufacturing | Medium |

Bio PET films are expected to gain maximum share in the coming years as industries are increasingly leaning toward sustainable solutions. If you can also increase the mechanical properties of these films through various innovations in film productions, they can be even more effectively used in all industrial sectors.

The global movement towards reducing single-use plastics and the carbon footprint of packaging materials is anticipated to boost the industry growth of biodegradable films during the forecast period. In this segment, the trend towards advanced bio-based materials that can replace petrochemical-based materials is projected to boost the demand for bio PET films.

The application of bio PET films will expand further, with packaging remaining the dominant sector. But sectors such as textiles, electronics and automotive will increasingly adopt bio PET films because of their durability and sustainability. The segment share of packaging is expected to acquire a 46.7% market share in 2025.

Bio PET films will be used in various packaging formats, including food and beverage, medical, and personal care packaging, as demand for eco-friendly solutions grows. As brands strive for sustainability and recyclability, monomaterial packaging solutions will push growth in this segment.

Based on end-use, the food and beverage industry is projected to remain a key consumer of bio PET films, owing to increasing consumer awareness across regions with regards to sustainability. The food and beverage sector is expected to account for 35.6% of the market by 2025.

Major industries like personal care, pharmaceuticals, and consumer goods will increasingly adopt bio PET films in their packaging solutions as part of their environmental responsibility. These industries shall play an important role in driving the industry of bio PET films, especially, the demand of packaging solution with improved barrier properties and biodegradability.

Moreover, the growing demand for green packaging in e-commerce and retail would remain a key factor driving this segment's growth. With technological innovation, regulatory pressure, and a global move toward greater sustainability in industry, each of these segments will add to the overall growth of the bio PET film industry.

The overall revenues in the bio PET film industry in the USA is expected to grow at a rate of 3.4% per year until 2025. This is because more people want eco-friendly packaging options. With regulations on plastic waste becoming stricter and consumers becoming increasingly aware, industries ranging from food, beverages, and pharmaceuticals are switching to bio-based alternatives.

Such investments by the country for enhanced bio PET production and functionality for research and development will drive the growth of the industry further. The USA will maintain its dominance in the production capacity and consumption of bio PET films as companies take action toward their eco-friendly objectives.

In 2025 Canada is anticipated to witness a steady growth for the bio PET film industry, driven by growing consumer demand for sustainable packaging products. Growing environmental awareness and the Canadian government's regulations to address plastic waste will drive the industry's growth.

We expect the food and beverage packaging, cosmetics, and personal care products industries to create demand for bio PET films. Canada’s industry will continue to grow steadily due to the robust government support for biodegradable materials and the growing adoption of bio-based alternatives that cater to eco-conscious consumers and industries aimed at achieving long-term carbon reduction.

The UK bio PET film industry is estimated to come to a 4.5% annual growth rate until 2025 due to mounting regulatory pressure to cut down plastic waste. With going green at the forefront of industrial transformation, all the industries, most importantly, food and beverages, are rushing to shift towards eco-friendly packaging materials.

Increased technological innovations in bio PET production are also creating films with better performance for various applications. The UK will also remain an important player in Europe’s transition toward more sustainable packaging solutions.

Bio PET film industry in France, as sales and production activities were significantly affected due to pandemic-related restrictions in place during the forecast period. France has a strong commitment to reducing plastic waste and proactive policies to ensure environmental sustainability, which is expected to fuel the adoption of bio-PET films.

With growing consumer awareness about eco-friendly products, brands are becoming more interested in packaging solutions that minimize environmental footprint. The country is investing in advancements in bio PET production technology and is focused on meeting regulatory guidelines, which will continue to drive the industry in the country.

By 2025, we expect the German bio PET film industry to grow at a rate of 2.8% in terms of revenue and volume. Germany's strict policies regarding sustainability and recycling support the trend toward higher adoption of bio-PET films across food, beverages, and pharmaceuticals. Consumer preferences for biodegradable and recyclable materials will fuel demand for eco-friendly packaging.

Moreover, government support for decreasing plastic waste and encouraging sustainable packaging will drive firms to invest in bio-PET film production. Germany shall continue to lead the industry of bioplastics as a pioneer in eco-innovation.

The bio PET film industry in South Korea is expected to grow steadily through 2025, driven by increasing environmental concerns among consumers and industries. The South Korean industry is rapidly expanding, adding numerous processes to reduce plastic waste, which significantly contributes to the growth of the bio PET films industry.

The food and beverage industry will play a key role since it is transitioning toward sustainable packaging options. Government policies supporting biodegradable materials and the drive towards greener manufacturing technologies will boost the adoption of bio PET films and make South Korea a leading bio PET film sector in the Asia-Pacific region.

The Japanese bio PET film industry is estimated to reach a CAGR of 3.7% until 2025. The bio PET film market in Japan is driven by increasing efforts toward environmental sustainability and consumer demand for bio-based packaging solutions.

The growing scope of bio PET films, with companies integrating sustainable packaging materials in their manufacturing processes in industries such as food and beverages, construction, and cosmetics, will cause the demand for bio PET films to grow rapidly.

Established manufacturing capabilities and technological proficiency in bio PET production are likely to boost the industry in Japan. The regulatory support from the government and consumer preference will contribute to the industry's growth in biodegradable materials in the country.

It is anticipated that China, as a fast-growing market, is expected to reach a bio PET film industry valuation of approximately USD 4.94 billion by 2025, with a growth rate of 6.1%. The stringency of environmental regulations in China is increasing as people pay more attention to environmental issues, and the impact of sustainability is driving the adoption of bio-based materials.

Bio PET films are widely used in end-user industries comprising food & beverage packaging, pharmaceuticals, and personal care products. Government regulations promoting the use of biodegradable and partially recyclable materials will support the growing demand for bio PET films.

China already has a lot of production capacity, and the current push for sustainable alternatives will help cement its role as a big player in the global bio PET industry.

The bio PET film industry in India is anticipated to grow rapidly through 2025 owing to rising environmental awareness and government initiatives for the reduction of plastic waste. In India, the industry for bio PET films is anticipated to grow strongly, especially due to the higher demand from areas like food and beverages, pharmaceuticals, and personal care.

As consumer demand for sustainable packaging increases, Indian manufacturers are gradually transitioning to bio-based alternatives. Government incentives and the adoption of more sustainable production methods will further drive the industry growth. With the Indian industry rapidly moving toward eco-consciousness, the bio PET film sector is set to thrive.

The industry's highly consolidated nature means that the top few companies account for approximately 90% of the bio-PET film industry. The industry plays a central role because they can scale production, invest heavily in research and development, and implement cutting-edge technology.

However, with a focus on sustainable, eco-friendly solutions, they will continue to be at the forefront of meeting the growing demand for bio-PET films across various sectors.

Covering a smaller section of the industry, small players and regional manufacturers cater to niche regional applications. But they struggle to compete against larger companies because they cannot afford to fund production capacity.

Such funding remains crucial for commercializing innovations, particularly those such as biodegradable films and custom applications. The growing demand for greener solutions should allow new entrants to carve out stakes despite the industry's concentration.

The trends may not be as pronounced in small and regional manufacturers, who continue to make up a smaller segment of the landscape, but they still hold an outsized share of the industry's trends. A major step forward was Terphane's announcement that it would be working with Origin Materials. Its objective is to design and commercialize high-performance bio-polymer films, cementing the industry's commitment to sustainable technology.

In 2024, Hyundai has introduced the all-electric IONIQ 6, featuring an interior made with sustainable materials, highlighting the automotive industry's growing interest in bio-PET films.

However, monitoring of bio-PET usage has so far only focused on packaged goods, meaning that other applications that also use the material will be observed too, which will speak of a positive outlook for various kinds of sustainable materials.

Geography divides the Global Bio PET Film Industry into five districts: North America, Europe, Asia Pacific, Middle East and Africa, and South America. The bio PET film industry, unlike some of the more consolidated segments, has a myriad of companies involved in bio PET film, from the more traditional plastic manufacturers to innovative new entrants concentrating on sustainable alternatives.

Some players dominate the industry, but there are also smaller companies and newer entrants, which help keep it fragmented.

Several factors contribute to the fragmentation. While the cost of entry is substantial, it is lower than in more technology- or capital-intensive sectors. This has opened up opportunities for smaller companies and start-ups to enter the industry, particularly with the increasing trend toward sustainable and eco-friendly packaging solutions.

The relatively low barrier for producing bio-based PET films from natural resources also makes it easy for smaller players to enter and focus on niche segments.

But with the need for technology and expertise, consolidation is inevitable, just happening slowly. Developing high-quality bio-PET films requires substantial R&D investment, bioplastics expertise, and manufacturing capabilities.

In the coming years and scale production will be well-positioned in this industry for the next years to come. More consolidation may happen because bigger companies are better able to deal with regulations and get the money they need to grow. This is because regulations are pushing for more sustainable solutions and eco-friendly packaging is becoming more and more important.

This steady growth is driven by increasing adoption in sustainable packaging, regulatory support, and technological advancements in bio-based materials. Industries such as food packaging, pharmaceuticals, and consumer goods are expected to contribute significantly to the rising demand for bio PET films in 2025.

Bio PET films are a sustainable alternative made from renewable resources and help reduce plastic waste and carbon footprints.

Bio PET films are used in packaging, textiles, automotive, consumer goods, and electronics for their versatility and environmental benefits.

The demand for sustainable packaging solutions and stricter regulations on plastic waste are key growth drivers for bio PET films.

Korea Tape Dispenser Market Analysis by Material, Product Type, Technology, End Use, and Region through 2025 to 2035

Medical Transport Box Market Trend Analysis Based on Material, Capacity, End-User and Regions 2025 to 2035

Japan Heavy-duty Corrugated Packaging Market Analysis based on Product Type, Board type, Capacity, End use and City through 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thermochromic Labels Market Insights - Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.