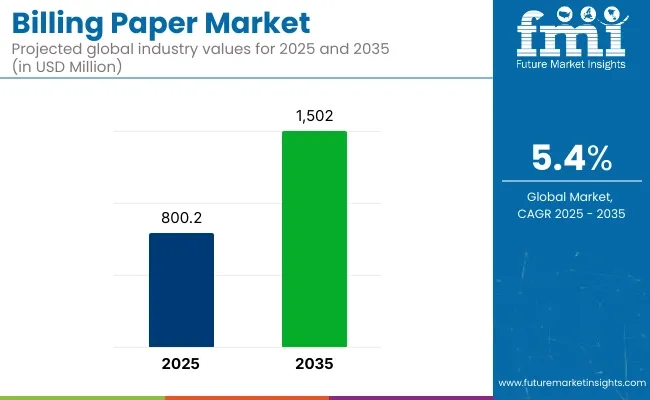

The billing paper market is projected to grow from USD 800.2 million in 2025 to USD 1,502 million by 2035, registering a CAGR of 5.4% during the forecast period. Sales in 2024 clocked USD 700 million, reflecting a steady increase in demand across various industries.

This growth has been attributed to the rising need for reliable and secure documentation solutions in sectors such as retail, banking, and healthcare. Despite the digital transformation, billing paper remains essential for transaction records, invoices, and receipts, especially in regions with limited digital infrastructure. The proliferation of point-of-sale (POS) systems, in emerging economies, further bolsters the need for billing paper.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 800.2 million |

| Projected Value (2035F) | USD 1,502 million |

| Value-based CAGR (2025 to 2035) | 5.4% |

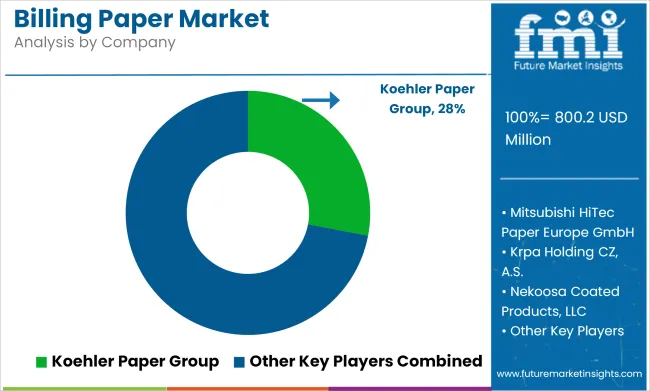

Significant investments have been made by leading companies to expand production capacities and develop innovative billing paper solutions. In a press release dated June 2025, Koehler Group announces their partnership with Brizzi Distribuzione Italia SPA for sales.

"We’re tremendously proud of the fact that we’re now the official sales partner for Koehler Eco® paper products in Italy, with the goal of offering luxury packaging manufacturers, high-end print shops, and paper project developers a wide range of colors and grammages of premium recycled paper," says Brizzi Italia Marketing Manager Wafaa Messouk. Premium Koehler Eco® paper products, made from 100% secondary fiber materials, will open new possibilities for creative designers, print producers, premium print shops, publishers, and processors of luxury packaging in Italy.

The shift towards sustainable and environmentally friendly solutions has significantly influenced the billing paper market. Manufacturers have been focusing on developing papers that are recyclable, lightweight, and made from renewable resources. Innovations include the integration of biodegradable materials, modular designs, and the use of recycled fibers to reduce environmental impact. These advancements align with global sustainability goals and regulatory requirements, making billing paper an attractive option for environmentally conscious industries.

The billing paper market is poised for significant growth, driven by increasing demand in retail, banking, and healthcare industries. Companies investing in sustainable materials, innovative designs, and eco-friendly production processes are expected to gain a competitive edge. As global supply chains expand and environmental regulations become more stringent, the adoption of billing paper is anticipated to rise, offering cost-effective and eco-friendly documentation solutions.

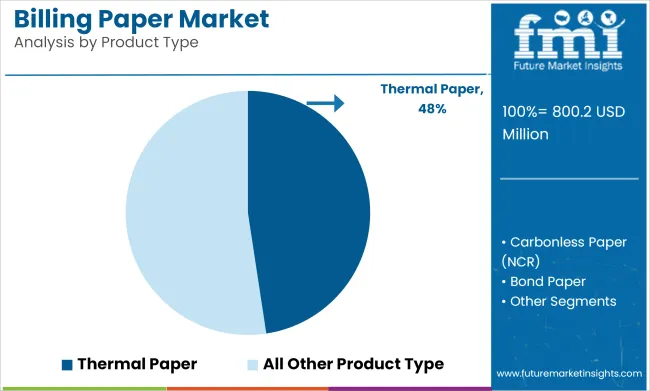

Thermal paper is projected to capture approximately 47.6% of the billing paper market by 2025, as it has been widely utilized for point-of-sale (POS) receipts, billing slips, and transaction records due to its fast-printing capability and clean image output. A heat-sensitive coating has been applied to the paper surface, eliminating the need for ink cartridges or ribbons, thereby reducing operational costs and maintenance.

Usage of thermal paper has been standardized in industries requiring rapid, high-volume receipt printing such as retail, hospitality, and transport. Its compatibility with compact thermal printers has facilitated adoption in mobile billing, kiosk-based printing, and automated checkout systems.

Thermal paper has been manufactured in varying roll sizes, paper weights, and coatings to meet the demands of both small vendors and enterprise-level systems. Enhanced formulations offering BPA-free coatings and fade resistance have also been introduced to align with environmental regulations and consumer safety concerns.

As speed, clarity, and cost-efficiency continue to define billing operations, thermal paper is expected to maintain its leading position across global transaction environments, reinforced by its established supply infrastructure and printer integration advantages.

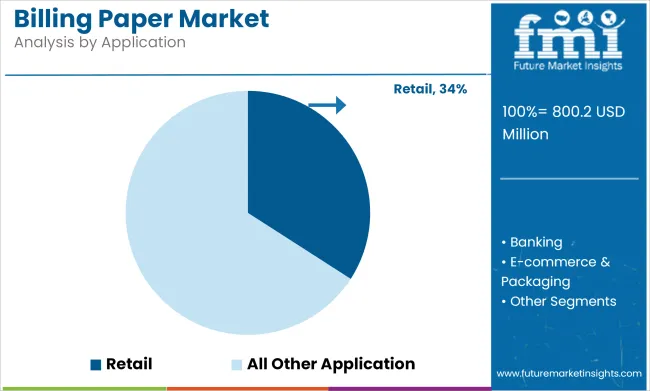

The retail sector is expected to hold the largest share of the billing paper market by 2025, accounting for an estimated 34.1%, as billing and receipt documentation has remained an integral part of retail operations across formats ranging from supermarkets and department stores to convenience shops and e-commerce pickup points. Billing paper has been used to support both physical and digital point-of-sale systems, providing printed documentation for purchases, returns, and inventory tracking.

In-store POS systems have been configured to utilize thermal rolls and carbonless paper formats for fast, legible, and compliant printing, especially where customer interaction and record retention are essential. Promotional coupons, barcoded offers, and VAT summaries have also been printed on billing paper within retail environments, adding functional and marketing value.

Billing documents have been required for customer service processes, audit trails, and financial reconciliations, reinforcing the sector's reliance on paper-based records despite digital advancements. High daily footfall and transactional volume have further fueled the demand for low-maintenance, high-efficiency billing solutions. As Omni channel retailing, in-store automation, and hybrid checkout models expand globally, the use of billing paper in retail is expected to remain prominent supported by demand for physical proof-of-purchase and operational continuity.

Rising Digitalization and Decline in Paper Usage

The Billing Paper Market has been largely affected with the rising trend of digital billing solution, electronic invoices and paperless transactions. Businesses and consumers are showing heightened preference for digital alternatives over eco-unfriendly paper billing. This evolution puts pressure on manufacturers to create new and diverse product lines

Raw Material Costs and Environmental Concerns

Fluctuations of raw material prices, such as pulp and chemical coatings, affect production and profitability. Furthermore, manufacturers are compelled to implement sustainable production practices due to mounting environmental regulations and sustainability fears, which can be costly and need large investments.

Expansion of Sustainable and Recyclable Paper Solutions

Increasingly on sustainability is an opportunity for the Billing Paper Market to produce biodegraded, recycled and FSC certified paper products. Businesses that switch to green alternatives and carbon-neutral ways of production will have an edge over their competitors.

Niche Market Demand for Secure and Specialty Paper

While other sectors have adapted to digitalization, sectors like banking, healthcare, and government still need secure billing paper, requiring anti-counterfeiting features, watermarks, and tamper-resistant coatings. Specialty paper, such as recycled or laminated, is also in demand, which also gives a good turnover segment for the market to grow.

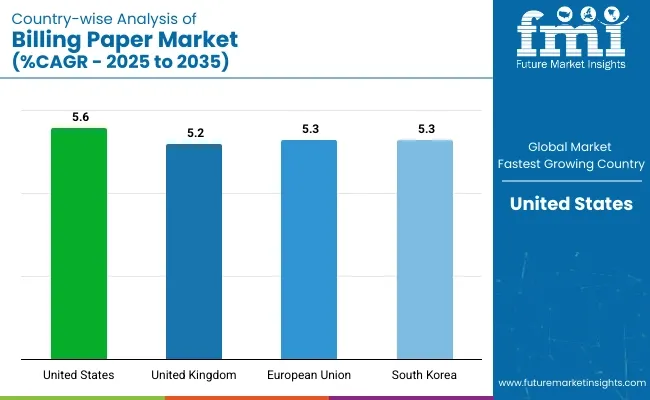

The North America billing paper market is primarily driven by the high demand for receipts, invoices, and other transactional documentation in sectors such as retail, banking, and healthcare, which accounts for a sizable portion of the paper market, despite the ongoing trend towards electronic or digital billing solutions.

| Region | CAGR (2025 to 2035) |

|---|---|

| United States | 5.6% |

In the UK, the demand for printed records for regulatory compliance, along with the ongoing adoption of paper for commercial applications, is driving moderately growing demand.

| Region | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.2% |

Billing paper is experiencing stable demand in the European Union due to its massive consumption in logistics, government documents, and financial operations and an increase in demand for sustainable and FSC-certified paper solutions.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.3% |

In South Korea, the billing paper market is growing, with businesses moving towards standard paper, such as billing paper while introducing security features as watermarks and anti-counterfeit paper printing in financial documents.

| Region | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.5% |

The growth of billing paper market across the globe is steady, backed by a consistent demand across end-use sectors, compliance to regulatory aspects, and the growing application of high quality, eco-friendly paper materials.

The global billing paper market is witnessing steady growth due to the increasing demand for thermal and carbonless paper in retail, banking, logistics, and other commercial applications.

Factors such as advancements in eco-friendly paper technologies, rising adoption of digital transactions, and stringent regulations on paper quality are shaping market trends. While digital receipts are gaining popularity, traditional billing paper remains essential in various industries.

The overall market size for Billing Paper market was USD 800.2 million in 2025.

The Billing Paper market is expected to reach USD 1,502 million in 2035.

The demand for Billing Paper will grow due to increasing use of 2-5 Parts NCR Paper for invoicing and record-keeping. Lightweight papers up to 40 GSM offer cost-effective solutions, while 40-100 GSM ensures versatility, and above 100 GSM provides durability. Institutional, educational, business, and household sectors drive demand as documentation needs expand.

The top 5 countries which drives the development of Billing Paper market are USA, European Union, Japan, South Korea and UK.

Retail and Banking Industries demand supplier to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Billing and Revenue Management Market Size and Share Forecast Outlook 2025 to 2035

Cloud Billing Market Size and Share Forecast Outlook 2025 to 2035

Telecom Billing And Revenue Management Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Growth – Trends & Forecast 2024-2034

Subscription and Billing Management Market Insights – Forecast 2023-2033

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkins Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA