The BTC is fairly concentrated, wherein the top five companies hold about 59.6% of market share. A few of the major players within the market are Incyte, AstraZeneca, Merck & Co., Inc. and. Major reasons for players holding such an important position include excellent pipelines of product, investments within targeted therapies, very wide networks of distribution and strategic partnerships spread across the global platform.

Tier 2 consists of Taiho Pharmaceutical Co., Ltd, Servier Pharmaceuticals LLC, and others that contribute to the remaining share through niche capabilities and regional expertise. This market, which had reached USD 372.5 million in 2025, is expected to register a CAGR of 8.3% by 2035. Motivating all these growth-enabling factors are advances in immunotherapy, incidence of BTCs, a trend of greater use of precision medicine, and easy access to developed treatments across other emerging geographies.

| Attribute | Details |

|---|---|

| Estimated Sales (2025E) | USD 372.5 million |

| Projected Sales (2035F) | USD 824.9 million |

| Value-based CAGR (2025 to 2035) | 8.3% |

The most important contributors in the overall market are the Chinese players. Their cost-effective manufacturing, aggressive pricing, and huge portfolios aligned with regional needs have helped them gain a healthy market share worldwide. Partnerships with international companies, along with improved R&D spending, have further cemented their positions within the market.

Explore FMI!

Book a free demo

| Global Market Share | Industry Share % |

|---|---|

| Top 3 (Incyte, Merck & Co., Inc. and AstraZeneca) | 59.6% |

| Top 5 (Taiho Pharmaceutical Co., Ltd, Servier Pharmaceuticals LLC, Jazz Pharmaceuticals plc, Relay Therapeutics) | 21.0% |

| Chinese Suppliers (Daiichi Sankyo Company, Limited., etc.) | 10.0% |

| Regional & Niche Players | 9.4% |

| Market Concentration | Assessment |

|---|---|

| High (more than 60% by top players) | Medium |

| Medium (40 to 60% by top 10 players) | Medium |

| Low (less than 30% by top players) | Low |

The dominance of the drug class in the biliary tract cancer (BTC) treatment market comes with targeted therapy, as it precisely addresses a specific genetic mutation or molecular pathway associated with the disease.

Actually, the drugs cover FGFR inhibitors, like pemigatinib, and IDH1 inhibitors, such as ivosidenib, whose therapy against BTCs has also been quite beneficial, especially with patients who harbored certain known genetic profiles- FGFR2 fusions in specific settings and IDH1 mutations -and this drugs are targeting diseases at their point at the molecular source, and treatments are being highly effective with more minimal side effects than chemotherapy end.

Institutional sales have dominated the biliary tract cancer (BTC) treatment market due to the central role that hospitals. The main reason institutional sales comprise the bulk of biliary tract cancer (BTC) treatment market share is because of the central role these diagnostic and treatment institutions in hospitals, oncology centers, and cancer treatment institutions play in the diagnosis and treatment of BTCs.

It is only through these advanced diagnostic tools and infrastructure for treatments of these healthcare facilities that BTC patients usually seek medical assistance. Thus, much of the BTC therapy is sold through institutional channels, including hospitals, specialty cancer clinics, etc.

AstraZeneca Plc

AstraZeneca is the global leader in the BTC treatment area with an excellent portfolio of targeted therapies-Imfinzi (durvalumab)-a PD-L1 inhibitor for use in combination with chemotherapy approved. The group has a strong presence in the USA, Europe, and Asia-Pacific and invests heavily in clinical trials, strategic acquisitions, and immuno-oncology research.

AstraZeneca collaborates with all the leading health systems, ranging from the NHS of the UK to EORTC in Europe and Chinese biotech firms. Biomarker-driven therapies, precision medicine, and AI-based diagnostics have made it even stronger in all its key geographies, hence sustaining market growth.

Incyte Corporation

Incyte specializes in targeted BTC therapies, notably pemigatinib (Pemazyre®), which has been approved in the USA, EU, and China for patients with FGFR2 fusion-positive BTC. The company invests significantly in combination therapy trials with immune checkpoint inhibitors to improve treatment effectiveness.

Incyte has strong partnerships with oncology research centers in Japan, Germany, and Brazil that drive innovation in kinase inhibitors. Through expansion of regulatory approvals, conducting real-world evidence studies, and partnering with hospitals across Asia and Latin America, Incyte expands market penetration and maintains steady growth in BTC treatments.

Merck & Co., Inc.

It is the market leader of BTC immunotherapy with anti-PD-1 drug, pembrolizumab known as Keytruda that is the most prescribed MSI-H/dMMR BTC in the USA, Europe and Asia-Pacific. It leads biomarker-driven research in oncology through treatments such as angiogenesis inhibitors in combination with chemotherapy.

It works with China's biotech and Japan's biotech companies for the development of regional treatments. It fortifies Merck's position as a global leader in the development of treatments for BTC with precision medicine programs through government agencies, biomarker research, and training of oncologists within emerging markets.

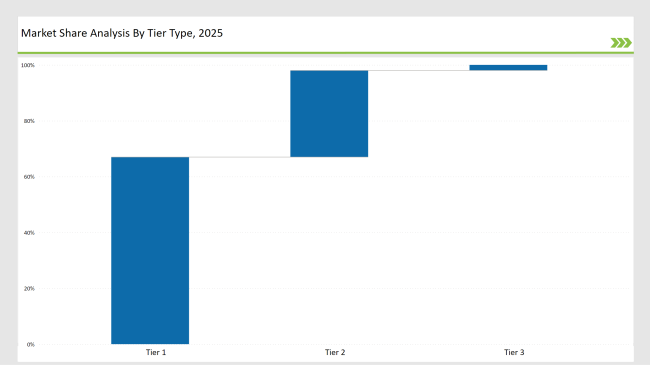

| Tier | Market Share (%) |

|---|---|

| Tier 1 - AstraZeneca Plc, Merck & Co., Inc., Incyte, Roche Holding AG, Bristol-Myers Squibb | 72.4% |

| Tier 2 - Bayer AG, Novartis AG, Eisai Co., Ltd., BeiGene Ltd., Ipsen S.A. | 18.6% |

| Tier 3 - Regional & Emerging Players (Hutchmed, Zymeworks, Innovent Biologics, Ono Pharmaceutical, CStone Pharmaceuticals) | 9.0% |

| Company Name | Unique Initiative |

|---|---|

| Incyte | It emphasizes the areas of precision medicine and combination therapies using targeted inhibitors and immuno-oncology in treating BTC. |

| Merck & Co., Inc. | This combination therapy is increasing patients reached out in Keytruda trials by utilizing its mechanism in innovated targeted treatments in BTC treatments that show an effect over other approaches |

| AstraZeneca | Immunooncology and next-gen-targeted: a front-runner on discovering novel BTC-treating pathways employing AI-powered discovery techniques. |

| Taiho Pharmaceutical Co., Ltd | Oral chemotherapy and targeted therapies for patients with BTC, which are categorized under FGFR inhibitors and smallmolecule drugs. |

| Jazz Pharmaceuticals plc | Precision oncology forwards the company to advance new targeted therapies, new mechanisms for refractory cases of BTC, and creates its portfolio with innovative targeted therapies, research collaborations for developing combination regimens in the treatment of BTC and improves innovation in ADC, antibody drug conjugate, and novel biologic therapies, developing better BTC treatment outcomes. |

| Servier Pharmaceuticals LLC | The company expands its pipeline of immuno-oncology and targeted therapies, favoring access through strategic pricing and regional partnerships. |

| Relay Therapeutics | It advances its kinase inhibitor portfolio to provide precision-targeted therapies tailored for BTC subtypes with high unmet medical needs. |

| BeiGene, Ltd. | It focuses on precision medicine and combination therapies by employing targeted inhibitors and immuno-oncology approaches in BTC treatment. |

| HUTCHMED | It emphasizes the areas of precision medicine and combination therapies using targeted inhibitors and immuno-oncology in treating BTC. |

| Exelixis, Inc. | This combination therapy is increasing patients reached out in Keytruda trials by utilizing its mechanism in innovated targeted treatments in BTC treatments that show an effect over other approaches |

Investment in Precision Medicine and Targeted Therapies

Companies need to develop more tailored treatments. For example, companies need to invest in targeted therapies targeting specific subtypes of BTC. Precision medicine strategies like FGFR inhibitors and IDH1/2 inhibitors allow companies to create a clear difference between firms and help to address the patient population with the highest unmet needs.

Training and Interdisciplinary Collaboration for Clinicians

Pharma and biotech companies need to expend efforts on clinician education and training programs to ensure optimum BTC treatment adoption. It increases confidence in novel treatments among oncologists, gastroenterologists, and hepatologists when multiple hands-on workshops and continuing medical education programs are offered in collaboration with all of these disciplines.

Entry of Biomarker-Driven Treatment Approaches

Industry participants should focus on biomarker-directed treatment approaches by exploiting NGS and companion diagnostics to better target patients. Biomarker- directed therapy plans as indicated in PD-L1 expression for immunotherapy result in better clinical practices and create regulatory spaces for targeted, personalized BTC therapies.

Entry into Emerging Markets and Access Initiatives

Pharmaceutical companies should increase their footprint in emerging markets by launching affordable BTC treatments and patient access programs. Partnering with healthcare providers, government agencies, and non-profit organizations ensures wider availability of innovative BTC therapies in underserved regions, creating a long-term growth avenue.

Expansion into Emerging Markets

BTC treatment companies should focus on expansion into emerging markets through low-cost targeted therapies and immunotherapies. Government health programs and local distributors will be more readily available for the new BTC treatments. Expansion of clinical trials in these markets will also accelerate regulatory approvals and market penetration as there is an increased demand for advanced oncology solutions.

Interoperability in Digital Ecosystems

BTC therapies through digital health ecosystem integration, which may combine AI-driven diagnostic capabilities, patient monitoring on clouds, electronic health record, or EHR-based compatibility, will profoundly enhance the effectiveness of the drugs and outcome of patient treatment. Integration of real-time data between cancer specialists and the researchers would develop personalized treatment regimens and bring about bettering clinical decision.

Sustainability-focused oncology solutions

BTC treatment in the future will revolve around sustainability, covering all aspects of 'green' drug manufacturing, reductions in pharmaceutical waste, and energy-efficient production. Companies embracing such green chemistry and sustainable supply chains will help meet all regulatory requirements and global environmental concerns.

The global BTC treatment market represents sales of USD 372.5 million in 2025.

The global BTC treatment market is expected to reach USD 824.9 million by 2035.

Regional and domestic companies hold nearly 9.4% of the overall market.

Key manufacturers include Merck, Inc., AstraZeneca, TAIHO,, PHARMACEUTICAL CO., LTD, Servier Pharmaceuticals LLC, Jazz Pharmaceuticals plc, Relay Therapeutics, DAIICHI SANKYO COMPANY, LIMITED., BeiGene, Ltd., HUTCHMED and Exelixis, Inc.

Home Respiratory Therapy Market – Growth & Forecast 2025 to 2035

Home Infusion Therapy Devices Market - Growth & Forecast 2025 to 2035

Human Combinatorial Antibody Libraries (HuCAL) Market - Trends & Forecast 2025 to 2035

Home Healthcare Market Growth - Trends, Innovations & Forecast 2025 to 2035

Dental 3D Printing Material Market Trends, Growth & Forecast by Material, Product, and Region through 2035

Catheter Market Insights by Product, Indication, End-user, and Region 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.