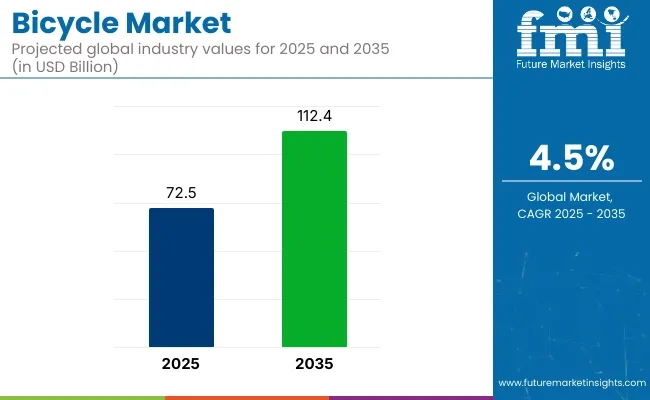

The global bicycle market is projected to grow from USD 72.5 billion in 2025 to USD 112.4 billion by 2035, reflecting a CAGR of 4.5%. Factors driving this growth include increasing demand for eco-friendly transportation, rising health and fitness trends, and technological advancements, particularly in electric bicycles. Additionally, supportive government policies promoting cycling as an alternative transportation mode in urban areas are contributing to the market's expansion.

| Market Attribute | Value |

|---|---|

| Market Size in 2025 | USD 72.5 billion |

| Market Size in 2035 | USD 112.4 billion |

| CAGR (2025 to 2035) | 4.5% |

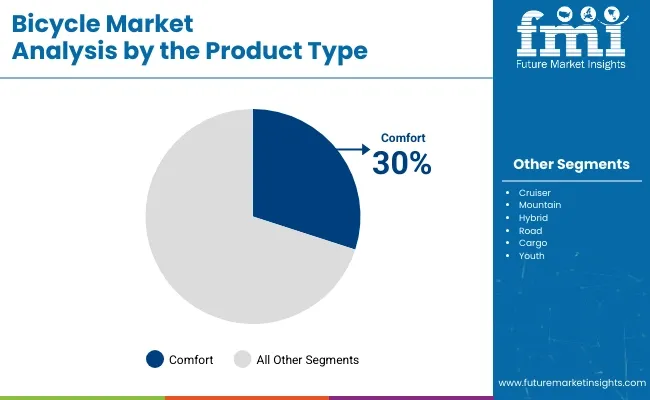

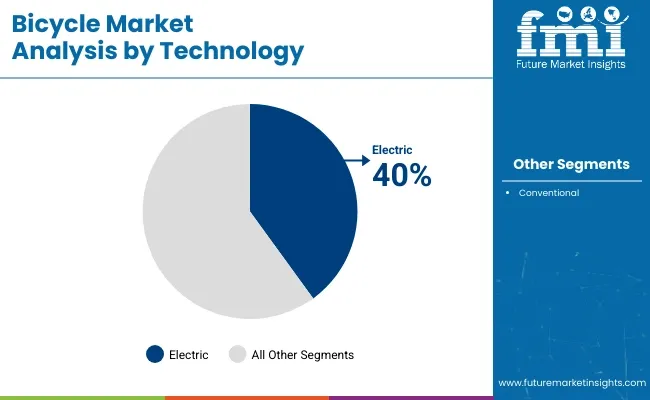

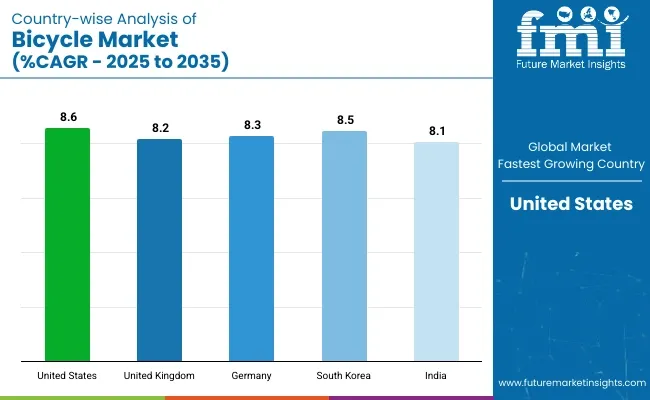

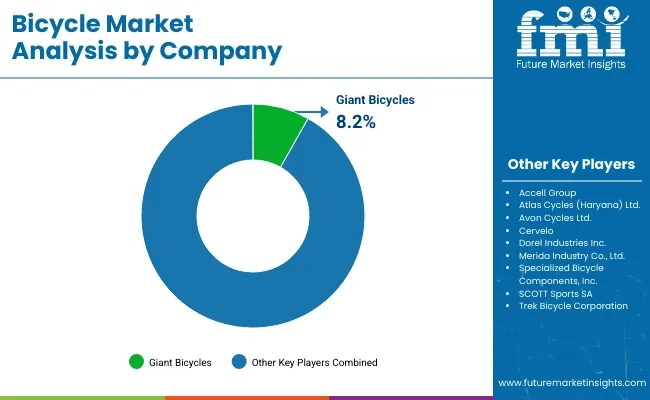

The market sees multiple opportunities across countries and segment. The USA is projected to have the largest market share in the bicycle industry. South Korea is expected to be the fastest-growing market, with an 8.5% CAGR. Comfort bicycles will dominate the product type segment with a 30% market share by 2025. Electric bicycles are expected to lead the technology segment with a 40% share in 2025. Low-range bicycles will lead the price segment with a 35% share. Giant Bicycles is the leading company in the global bicycle market, holding an 8.2% market share.

In 2025, the global bicycle industry is facing significant challenges. Brompton Bicycle reported a drastic 99% drop in profits, largely due to oversupply and aggressive discounting within the market. Additionally, Kent International halted bicycle imports from China because of the unsustainable costs caused by USA tariffs.

Tony Karklins, CEO of Time Bicycles, emphasized the fragmented nature of the industry, stating, "The bike industry is not very close-knit no one's sharing, you know, the pressures that they have." This lack of collaboration and data sharing among industry players is contributing to the current financial difficulties. Despite these setbacks, the industry is slowly showing signs of recovery, with experts predicting a rebound driven by the growing demand for eco-friendly transportation solutions and cycling as a sustainable mode of transport.

Comfort bicycles will lead the product type segment with a 30% share, while electric bicycles will dominate the technology segment with a 40% market share in 2025, driven by demand for eco-friendly transportation solutions.

Comfort bicycles will dominate the product type segment with a 30% share in 2025.

Electric bicycles (e-bikes) are expected to capture 40% of the technology segment by 2025.

The low-range bicycle segment is expected to capture 35% of the market share by 2025. These bicycles are an affordable option for budget-conscious consumers and are typically chosen by first-time buyers or individuals seeking a basic mode of transportation.

Men will dominate the end-user segment of the bicycle market, holding 50% of the market share by 2025.

The global bicycle market is experiencing significant growth, driven by increasing demand for eco-friendly transportation, fitness trends, and advancements in bicycle technology. However, the market also faces challenges such as rising material costs and infrastructure limitations.

Recent Trends in the Bicycle Industry

Challenges in the Bicycle Market

The bicycle market is expanding globally, fueled by rising health awareness, sustainability trends, and technological advancements. Leading countries in manufacturing, distribution, and innovation include the United States, United Kingdom, Germany, South Korea, and India.

The USA bicycle market is expected to expand at a CAGR of 8.6% from 2025 to 2035, supported by a surge in cycling culture and eco-conscious transportation. Companies like Trek, Specialized, and Giant dominate the market, catering to both recreational and e-bike consumers. Technological advancements are a key driver, with a growing shift toward electric bikes.

The UK bicycle market is projected to grow at a CAGR of 8.2% between 2025 and 2035, fueled by the increasing demand for sustainable transportation solutions. Key market players include Brompton Bicycle and Raleigh, which focus on high-quality, eco-friendly bicycles. Government initiatives, such as the Cycling and Walking Investment Strategy, further encourage growth in this sector.

Germany’s bicycle market is forecasted to register an 8.3% CAGR from 2025 to 2035. This growth is primarily driven by sustainable mobility trends and advancements in electric bicycle technology. Prominent players like Cube, Canyon, and Haibike dominate the German market, leading in both traditional and e-bike innovations.

South Korea’s bicycle market is expected to grow at an 8.5% CAGR, driven by urbanization and the rising focus on health and wellness. Key players such as Samchuly and Hyundai have introduced innovative e-bikes to cater to the diverse needs of consumers. Government policies to support cycling infrastructure also play a crucial role in market growth.

India’s bicycle market is projected to grow at an 8.1% CAGR from 2025 to 2035, fueled by health and sustainability trends. Prominent brands like Hero Cycles, TI Cycles, and Avon are leading the market by providing affordable bicycles for diverse demographics. Increased urbanization and government initiatives to improve cycling infrastructure are expected to further drive this growth.

The bicycle market is dominated by tier-one players such as Giant Bicycles, Trek Bicycle Corporation, and Specialized Bicycle Components, Inc., which hold the highest market shares. These companies invest heavily in product innovation, R&D, and marketing strategies.

For example, Giant Bicycles leads the electric bicycle segment, while Trek focuses on high-performance mountain and road bikes. Their strategies often involve continuous product launches and leveraging technological advancements to cater to changing consumer preferences, including the rise of eco-friendly and electric mobility solutions.

On the other hand, tier-two players like Accell Group, SCOTT Sports SA, and Atlas Cycles target niche markets with specialized products, often focusing on performance or affordability. Entry barriers in this market include high R&D and manufacturing costs, along with the need for strong brand recognition. The industry is relatively consolidated, with larger players acquiring smaller brands to expand their portfolios, though niche segments remain fragmented with room for innovation.

Recent Bicycle Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 72.5 billion |

| Projected Market Size (2035) | USD 112.4 billion |

| CAGR (2025 to 2035) | 4.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Product Types Analyzed | Comfort, Cruiser, Mountain, Hybrid, Road, Cargo, Youth |

| Technology Types Analyzed | Electric, Conventional |

| Price Range Segments Analyzed | Low Range, Medium Range, Premium |

| End-Use Segments Analyzed | Kids, Men, Women |

| Regions Covered | North America, Europe, Asia Pacific, The Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players Influencing the Market | Accell Group, Atlas Cycles (Haryana) Ltd., Avon Cycles Ltd., Cervelo, Dorel Industries Inc., Giant Bicycles, Merida Industry Co., Ltd., Specialized Bicycle Components, Inc., SCOTT Sports SA, Trek Bicycle Corporation |

| Additional Attributes | Dollar sales growth by product type, regional demand trends, competitive landscape, consumer preferences by price range, e-bike adoption, technological innovations |

The bicycle market is categorized based on product types such as comfort, cruiser, mountain, hybrid, road, cargo, and youth bicycles.

In terms of technology, the bicycle market is divided into electric and conventional bicycles.

The market is also classified according to price, including low range, medium range, and premium bicycles.

The bicycle market is segmented by end user into three key groups: kids, men, and women.

Geographically, the bicycle market is divided into regions like North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

The bicycle market was valued at USD 72.5 billion in 2025.

It is projected to reach USD 112.4 billion by 2035.

Giant Bicycles is the leading company in the global bicycle market, holding an 8.2% market share.

South Korea is expected to have the fastest growth with a projected CAGR of 8.5%.

Electric bicycles (e-bikes) are expected to command the largest share i.e. 40 %, with mid-range price-band models likely to remain the most popular across all user groups.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA