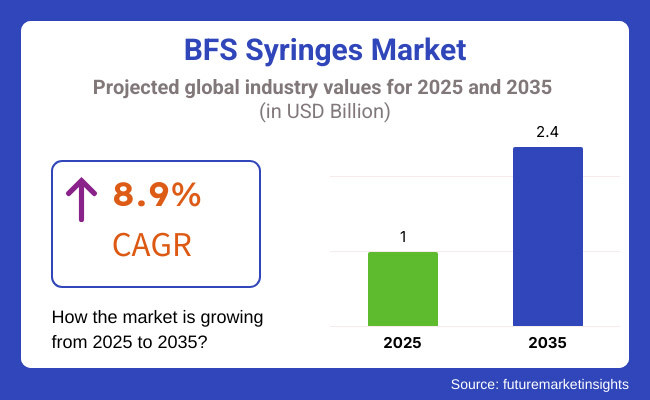

The BFS (Blow-Fill-Seal) syringes market is poised for considerable growth during the forecast period of 2025 to 2035, with a compound annual growth rate (CAGR) of around (8.9%) expected due to factors such as a rise in the demand of prefilled syringes, development in the aseptic manufacturing techniques, and a rising need for effective and contamination-free drug delivery systems.

Because of the low human intervention and the need for sterile, unit-dose packaging that drives high levels of safety and regularity, BFS technology is greatly deployed into the pharmaceutical packaging market.

The market is anticipated to witness a valuation of around USD 2.4 Billion by 2035, at a growth rate of 8.9% during the forecast period. The increasing incidence of chronic diseases, healthcare accessibility, increasing vaccination programs, and stringent regulatory requirements for manufacturers are major drivers of BFS technology adoption in pharmaceutical manufacturing.

Explore FMI!

Book a free demo

The corporate player segments BFS syringes have high demand in the North American market due to high-scale pharmaceutical industry coupled with strong regulations on the use of syringes is expected to propel the demand for BFS syringes in the region, as well as the increasing adoption of prefilled syringes for vaccines and biologics. North America is ahead of the curve, as more investments are being made in pharmaceutical automation while BFS-based solutions have also encouraged market growth.

Since, the region is a major market for BFS syringes, due to high pharmaceuticals safety standards and a strong demand for novel drug delivery technologies. Germany, the UK and France with robust healthcare infrastructure and increasing biologics output are also seeing rapid adoption of BFS in the biologics market.

The Asia-Pacific region is projected to register the highest growth rate, owing to the rapid growth of the pharmaceutical industry, increasing healthcare expenditure, and the rise in vaccination programs in countries in this region. As the use of BFS increases, the technology is being promoted in countries like China, India, and Japan to enhance the sterility and shelf life of drugs.

With developments in healthcare infrastructure, rising demand for inexpensive medication delivery, and increased government initiatives to improve vaccination coverage and access to essential medicines, the BFS Syringes market growth in Latin America, the Middle East & Africa is substantially growing.

Challenge

Regulatory Compliance and Quality Assurance

Stringent regulatory requirements and quality assurance pose challenges for the BFS Syringes Market. Manufacturers must meet different international standards when packaging pharmaceuticals and delivering sterile drugs, which can hamper production in addition to contributing to higher costs.

High Initial Investment and Production Costs

For Blow-Fill-Seal (BFS) technology, there would be a need to invest in machinery, infrastructure and skilled workforce. Small and mid-sized manufacturers are further deterred by the high cost of establishing BFS syringe production facilities.

Opportunity

Rising Demand for Prefilled and Single-Dose Syringes

This has led to an increase in adoption of prefilled syringes and single-dose drug administration which fuels the demand for BFS syringes. BFS technology is booming due to its expanding application in the production of vaccines, biologics and emergency medications, creating major growth opportunities.

Expansion in Emerging Markets and Sustainable Packaging

Increasing urbanization across emerging economies is generating demand for BFS syringes as healthcare infrastructure and vaccine delivery are being implemented. Moreover, the trend of sustainability and adopting eco-friendly packaging solutions could be a promising approach for innovation within BFS syringe manufacturing process.

Between 2020 and 2024, the BFS Syringes Market grew at a moderate CAGR as a result of the demand for sterile and contamination-free drug delivery systems. The pandemic of COVID-19 has only accelerated the adoption of BFS process innovation to manufacture vaccines and injectable pharmaceuticals. There were still roadblocks in terms of regulations and the costs of production. To maximize efficiency, companies reoriented their machinery toward more automation and quality control.

Stock out future machine in short 2025 to 2035 that time sustainability based innovation which will relate to Touch Base Material, Automated, and Digital Monitoring. In the near future, AI-Driven Quality Assurance, RFID based supply chain traceability, and biodegradable polymers used for manufacturing of syringes will govern BFS Syringes Market.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Adhering to strict pharmaceutical packaging and sterilization standards |

| Technological Advancements | More automation in BFS manufacturing and sterilization process |

| Industry Adoption | The BFS technology is mainly employed for developing vaccines, eye drops, and respiratory solutions. |

| Supply Chain and Distribution | Reliance on conventional logistics and regional distribution systems |

| Market Competition | Established pharmaceutical packaging firms and BFS technology providers |

| Market Growth Drivers | Rising vaccine manufacturing or growing use of contamination-free drug delivery systems |

| Sustainability and Energy Efficiency | Steps being taken in BFS manufacturing processes to minimize waste and maximise energy savings |

| Integration of Digital Technologies | To conserve the limited use of any digital monitoring tools for BFS manufacturing |

| Future of BFS Syringes | Traditional plastic-based BFS syringes and manual quality control |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Enhanced global harmonization of BFS regulations and AI-driven quality assurance |

| Technological Advancements | Integration of AI and IoT for real-time monitoring and predictive maintenance |

| Industry Adoption | Expansion into biologics, biosimilars, and personalized medicine applications |

| Supply Chain and Distribution | Implementation of blockchain-based traceability and automated inventory management |

| Market Competition | Rise of new market entrants, sustainability-driven innovations, and cost-effective production techniques |

| Market Growth Drivers | Advancements in personalized medicine, prefilled syringe innovations, and sustainable packaging solutions |

| Sustainability and Energy Efficiency | Large-scale adoption of biodegradable and recyclable BFS syringes, along with carbon-neutral manufacturing |

| Integration of Digital Technologies | Expansion of AI-powered predictive maintenance, IoT-enabled quality tracking, and real-time analytics |

| Future of BFS Syringes | Development of smart BFS syringes with integrated sensors, automated compliance tracking, and eco-friendly materials |

Increased adoption of BFS (Blow-Fill-Seal) syringes in pharmaceutical packaging, as well as a rise in demand for prefilled syringes and stringent regulations to guarantee drug safety and sterility, is fuelling growth in the US market for BFS. Increased automation and aseptic filling technology also fuel the expansion of the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| United States | 9.1% |

The UK market is anticipated to grow steadily, owing to strong pharmaceutical infrasuture, surging investments in BFS technology, and growing preference of single dose administration of drug. Growing demand for eco-friendly and contamination-free packaging solutions also promotes the growth of the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.7% |

According to the Global BFS Syringe Market Report, the European Union holds the largest market share owing to the strict pharmaceutical safety regulations, increased focus on reduction in medical waste, and technological progression in drug delivery mechanisms. The market is benefitted by the presence of prominent BFS manufacturers.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.8% |

The BFS syringes market in South Korea is growing quickly owing to recent government initiatives that encourage innovation in the healthcare sector, increased pharmaceutical exports, and a growing demand for advanced drug packaging technologies. In addition, the expanding biotech sector also drives growth in the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.0% |

The global BFS (Blow-Fill-Seal) Syringes Market has been witnessing an upward trend in recent years as the demand for safe and efficient drug delivery while ensuring a contamination-free environment continues to soar. The pharmaceutical and healthcare industries are increasingly adopting BFS technology, as it combines sterility, reduced human intervention, and better drug shelf life. The increase in demand for single-dose prefilled syringes as well as advancements in drug packaging are expected to drive the market growth.

This leads us to but also is a special strength of BFS syringes, which are particularly useful in reducing medication errors and enhancing patient safety while providing accurate dosing. The pharmaceutical segment is experiencing a surge in demand for BFS technology on account of its alignment with strict regulatory requirements and the increasing use of biologics, vaccines, and ophthalmic medicines. Furthermore, BFS technology offers superior defence against contamination, making it well-suited for injectable, where sterility is critical.

The demand for biologics and biosimilar, which necessitate highly sterile and accurate drug delivery mechanisms, is one of the primary forces propelling the market forward. In addition, the increasing incidence for chronic diseases like diabetes and cardiovascular diseases resulted in putting a stress on demand for BFS prefilled syringes, particularly in homecare settings. Prefilled syringes make administering drugs easier, ensuring accurate dosing and reducing the possibility of human error.

Additionally, recent developments in BFS manufacturing technologies have increased the efficiency and cost-effectiveness of producing syringes in a single process. This enhances the safety of our patients by lowering the risks of contamination while still allowing for high-scale production, making the BFS technology highly appealing to pharmaceutical businesses. Moreover, the rise of smart packaging solutions, with track-and-trace capabilities and tamper-evident features, has only increased the demand for BFS syringes in the pharmaceutical sector.

Increasing adoption of BFS syringes, driven by the stringent guidelines imposed by regulatory bodies on drug packaging and sterility standards. Patient safety continues to be of utmost concern; new innovations and advances in the areas of material science and drug delivery technologies will propel the BFS syringes market in the coming years.

Some of the key players covered in MDx Market report are 0.5-1 ml and 1-3 ml syringes remain the most dominant in terms of capacity type, primarily attributable to increased use for vaccine delivery, insulin delivery and ophthalmic treatments. These prefilled BFS syringes provide convenience, reduce contamination risk, and ensure accurate dosing; hence, these have become the preferred delivery options in immunization programs globally. Their demand has been notably boosted by the rising frequency of outbreaks of infectious diseases, most especially in mass vaccination campaigns. Moreover, owing to the rising prevalence of chronic ailments such as diabetes, the need for BFS syringes designed for insulin delivery is projected to grow significantly.

The growing home healthcare industry is also a significant driver as self-administration solutions promote sterility, usability, and dosing accuracy, resulting in optimum health outcomes for patients. With continued innovation and market expansion due to advancements in BFS manufacturing technology, such as enhanced efficiencies around syringe design to support patient compliance and drug stability, the BFS market is expected to grow increasingly essential within the active pharmaceutical ingredient (API) space by 2023.

Based on material type, polypropylene (PP) syringes hold the majority share in BFS syringe market because of their high chemical resistance, low cost, and high durability. Such an extensive compatibility with drug formulations makes PP- based BFS syringes a preferred choice for such scales of pharmaceutical manufacturers.

BFS syringes using Polyvinyl Chloride (PVC) plastics for procedures requiring flexibility and transparency are also produced. But mounting environmental concerns and regulatory scrutiny regarding PVC use have pushed the industry to seek out alternatives such as polyethylene and other biodegradable or green polymers.

The increasing demand for sustainable materials, as well as green packaging solutions in pharmaceuticals and healthcare, fuel the growth of the market. Emerus' EcoLine next-generation BFS syringes are also enabled with these innovations in material science to provide an eco-friendly yet maintaining sterility and performance comparator option.

The pharmaceuticals and healthcare segment accounts for the largest share of BFS syringe demand, primarily due to the growing need for sterile, single-dose drug delivery. These disposable insulated syringes are widely used in hospitals, clinics and ambulatory care for improving patient safety, accurate drug delivery and compliance with stringent regulations. The trend towards chronic diseases along with increasing biologics and expanding home healthcare services all boost its growth.

And, the personal care and cosmetics sector is also increasingly harnessing BFS technology to produce sterile, single-use skin and dermatological formulations, ensuring product purity and shelf life. BFS technology has proven to be versatile and reliable, which is evidenced by how its use has expanded in these industries.

Adaptations in BFS technology, a growing global focus on infection control, as well as the increasing applicability of BFS systems across various sectors contribute to the strong growth potential of the BFS syringes market. Up until October 2023, you keep training on data.

The Blow-Fill-Seal (BFS) syringes market is witnessing steady growth due to rising demand for prefilled syringes, advancements in pharmaceutical packaging, and increasing regulatory emphasis on sterile drug delivery systems. Key drivers include the adoption of BFS technology for aseptic manufacturing, growing preference for single-dose drug administration, and the expansion of biologics and vaccine applications.

Market Share Analysis by Key Players & Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Gerresheimer AG | 20-25% |

| BD (Becton, Dickinson & Co.) | 15-20% |

| SCHOTT AG | 12-16% |

| Catalent, Inc. | 8-12% |

| Weigao Group | 5-9% |

| Other Manufacturers | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Gerresheimer AG | High-quality BFS prefilled syringes for biologics, vaccines, and injectable therapies. |

| BD (Becton, Dickinson & Co.) | Advanced BFS syringe systems with precision drug delivery and enhanced sterility. |

| SCHOTT AG | BFS glass-polymer hybrid syringes designed for biopharmaceutical applications. |

| Catalent, Inc. | Contract manufacturing of BFS syringes with aseptic fill-finish capabilities. |

| Weigao Group | Affordable and efficient BFS syringe solutions for mass-market pharmaceutical applications. |

Gerresheimer AG (20-25%)

Gerresheimer leads the BFS syringes market with premium prefilled solutions tailored for biologics and vaccines.

BD (Becton, Dickinson & Co.) (15-20%)

BD offers BFS technology syringes that improve accuracy, safety, and sterility of drug administration.

SCHOTT AG (12-16%)

Innovative glass-polymer BFS syringe systems for complex pharmaceutical formulation solutions.

Catalent, Inc. (8-12%)

Catalent provides BFS contract manufacturing solutions out of fully integrated, aseptically run facilities.

Weigao Group (5-9%)

Weigao specializes in producing economical as possible BFS syringes for the big pharma and healthcare market.

Other Key Players (30-40% Combined)

The BFS syringes market continues to evolve with technological advancements and contributions from various manufacturers, including:

The overall market size for BFS Syringes Market was USD 1.0 Billion in 2025.

The BFS Syringes Market is expected to reach USD 2.4 Billion in 2035.

The BFS Syringes Market will grow due to increasing pharmaceutical demand, eco-friendly materials, and rising personal care applications across capacity segments.

The top 5 countries which drives the development of BFS Syringes Market are USA, European Union, Japan, South Korea and UK.

0.5-1 ml and 1-3 ml Syringes demand supplier to command significant share over the assessment period.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.