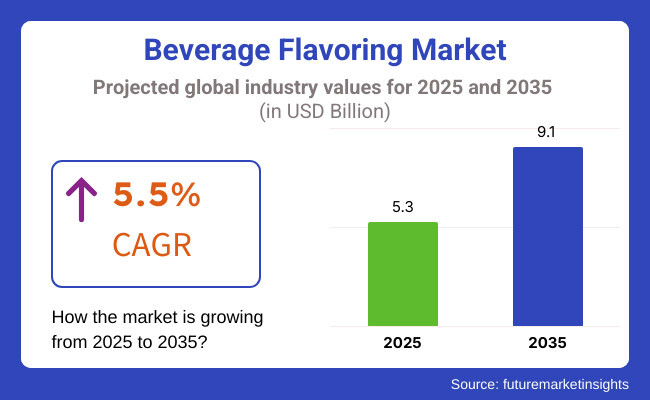

Global beverage flavoring sales reached approximately USD 5.3 billion at the end of 2025. Forecasts suggest the market will achieve a compound annual growth rate (CAGR) of 5.5% and exceed USD 9.1 billion in value by 2035.

The increasing consumer demand for flavorful, functional, and health-conscious beverage products has been viewed as the primary catalyst steering this market’s forward momentum. Across carbonated drinks, sports beverages, and dairy alternatives, the role of innovative flavoring has been increasingly recognized as a critical differentiator not just in taste, but in perceived product quality and brand value.

Beverage formulators are progressively aligning with regulatory and consumer shifts toward natural, organic, and allergen-free labeling-thus propelling the demand for natural flavors to the forefront.

It has been consistently observed that the clean-label movement, particularly in North America and Europe, is fostering innovation in botanical and fruit-based flavoring solutions. The segment comprising natural flavorings has been holding a 43.6% share in 2025-a clear signal of consumer migration away from synthetic additives.

This trend, widely embraced across global beverage companies, is enabling reformulation strategies that appeal to health-aware demographics, especially Millennials and Gen Z, who demand authenticity and transparency.

The market is also being shaped by rapid advancements in flavor encapsulation technologies and extraction methods, allowing better stability, solubility, and shelf life without compromising taste profiles. Leading flavor houses, including Givaudan and Firmenich, are actively expanding their portfolios with plant-based and functional blends designed for novel beverage applications such as adaptogenic drinks, kombucha, and electrolyte-rich waters. Their R&D efforts-supported by robust sensory science and AI-enabled flavor mapping-have lent them a competitive edge in an increasingly innovation-intensive marketplace.

With the beverage sector continuously evolving toward premiumization and personalization, flavor houses and beverage manufacturers alike are expected to prioritize cross-category collaboration, IP development in flavor molecules, and regional taste customization.

As regulatory standards tighten globally, especially around synthetic sweeteners and allergens, stakeholders across the value chain will be compelled to invest more in traceable, sustainable, and multifunctional flavor solutions.

The natural flavoring segment is projected to grow at a CAGR of 6.1% from 2025 to 2035, holding a dominant 43.6% market share in 2025.The dominance of natural flavorings in beverage formulations has been underscored by the clean-label movement, now firmly entrenched across Western markets and gaining ground in Asia-Pacific.

This segment has been strategically prioritized by beverage producers seeking to align with consumer expectations around transparency, wellness, and plant-derived authenticity. The growing aversion to synthetic additives has repositioned natural flavorings from niche to necessity, particularly as consumers demand function alongside flavor-spanning botanical extracts, fruit distillates, and spice infusions.

Natural flavoring growth is being underpinned by investments in ingredient provenance, proprietary extraction methods, and water-soluble delivery systems that preserve aroma and taste under harsh processing conditions. Global leaders such as Givaudan and Symrise are not only scaling operations but also deepening collaborations with functional beverage startups, tapping into demand for immunity, relaxation, and gut-health-related drinks.

Their ability to merge sensory science with health-forward narratives will remain a core strategic advantage. The segment’s outlook remains favorable, driven by regulatory tightening on artificial ingredients and an increasingly segmented beverage landscape that rewards clean innovation.

The functional and hybrid flavoring segment is projected to grow at a CAGR of 7.2% from 2025 to 2035, outpacing the overall beverage flavoring market growth of 5.5%.Flavor innovation is being redefined as a value proposition beyond palatability-serving as a vehicle for wellness, personalization, and premium positioning in beverages.

Functional and hybrid flavoring systems-combining taste modulators, plant extracts, and encapsulated nutraceuticals-are emerging as a decisive growth engine, particularly within RTD teas, energy drinks, and dairy alternatives. These advanced flavoring formats are strategically developed to mask bitterness, enhance mouthfeel, and synergize with bioactives-thus becoming integral to the product’s functional claim architecture.

Advanced R&D, including AI-assisted flavor modeling and microencapsulation, is being employed by leaders such as IFF and Firmenich to address technical challenges in flavor stability and release. These innovations allow flavorings to perform under increasingly complex beverage matrices, where shelf life, pH tolerance, and ingredient interactions must be managed without compromising sensory appeal.

The premiumization trend-coupled with rising consumer curiosity for exotic and regional flavors-is accelerating cross-border flavor innovation. Functional flavoring’s trajectory is therefore not only anchored in health consciousness but also in market diversification strategies that anticipate the evolving taste expectations of global consumers.

Challenges

Regulatory Compliance, Clean-Label Demand, and Supply Chain Volatility

The action and beverage flavoring market has some important restraints, such as strict regulations on artificial and natural flavors, which may be imposed by the FDA (Food and Drug Administration), EFSA (European Food Safety Authority), while FSSAI (Food Safety and Standards Authority of India) repressive strategies being harmful, also creates the barriers to the growth of the market. These regulations include the need for detailed ingredient disclosures, allergen management, and safety evaluations, adding significant compliance costs. Formulation challenges emerge as a result of the demand for clean-label, organic, and plant-based flavoring since many artificial flavors must be substituted by natural extracts, but at the same time, the shelf life must be in demand, keeping the sensory aspect alluring. However, supply chain volatility is another significant challenge - whether raw material availability is effective or whether geopolitical disruption and impacts from climate change on flavor crops (vanilla, citrus, and cocoa) alter production costs and cause market unrest.

Opportunities

Natural Extracts, Functional Flavor Innovation, and AI-Driven Personalization

However, the beverage flavoring market still has substantial growth opportunities, including an increase in functional and plant-based beverages, bioengineered natural flavors, and AI-driven flavors for personalized flavor profiles. As they look for beverages with health-boosting properties, consumers are gravitating toward botanicals and herbal flavors like hibiscus, turmeric, ginger, and adaptogens. Brands have been using AI-assisted flavor mapping and predictive analytics to design custom-made flavors on the basis of regional preferences and individual consumer data. Furthermore, sustainable, lab-produced flavoring compounds are being created that can be produced on a consistent basis without draining natural resources.

Consumer desire for functional and innovative beverages continues to fuel stable growth in the beverage flavoring market in the USA. The growth of natural and organic flavoring agents, as well as the advancement in food science, are further driving the market. Clean-label ingredients and sugar-reduction strategies have been a focal area for beverage manufacturers looking to attract health-conscious consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.6% |

The beverage flavoring market in the UK is growing in the liquids & rejuvenating beverage segment, and the growing attention on lower sugar formulations and botanical extracts is shaping new flavors & natural ingredients segment market trends. For non-food manufacturers, investments are made in advanced flavor extraction machinery that meets their product lines.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.4% |

The beverage flavoring market expands at a constant pace, and demand for natural and functional beverage components emerges as the key driver of growth across the E.U. The region’s stringent regulatory framework about artificial additives is driving manufactures towards clean-label and plant-based flavor solutions. The rising popularity of flavored waters, energy drinks, and organic drinks is also fueling market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.5% |

Japan's beverage flavoring market is characterized by moderate growth, with increasing consumer interest in premium teas, infused fruit-based beverages, and health-focused beverages. The market is largely driven by the appeal of umami-based and fermented flavors, as well as a strong preference for traditional Japanese ingredients.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.4% |

Probiotic drinks, flavored milk, and energy drinks are becoming more popular, which is contributing to the growth of the Beverage Flavoring market in South Korea. The adoption of K-food, which is a trend in food and beverage formulations, will drive the demand for unique and regionally inspired flavors.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.6% |

Givaudan SA (20-25%)

As a beverage flavor leader, we assure you that you get only the highest quality within our AI-powered natural systems, our functional beverage flavors, and our sustainable beverage ingredient solutions.

Firmenich SA (12-16%)

Firmenich has sugar-reduction and plant-based flavors, artificial-intelligence (AI)-driven taste profiling, and clean-label formulation.

International Flavors & Fragrances Inc. (IFF) (10-14%)

Customizes beverage flavors through advanced sensory profiling and AI-based consumer-flavor trends.

Symrise AG (8-12%)

Fruit and botanically derived flavoring solutions, AI-augmented trend analysis, and organic material sourcing

Takasago International Corporation (5-9%)

Takasago has a range of Asian-inspired and exotic beverage flavors with precision formulation and AI-assisted process including sustainable style flavor extraction.

Other Key Players (30-40% Combined)

Several natural flavor houses, ingredient suppliers, and beverage formulation specialists contribute to next-generation flavor innovation, AI-powered consumer insights, and sustainable ingredient solutions. These include:

The overall market size for beverage flavoring market was USD 5.3 Billion in 2025.

Beverage flavoring market is expected to reach USD 9.1 Billion in 2035.

The demand for Beverage Flavoring is expected to rise due to increasing consumer preference for flavored drinks, clean-label trends, and innovations in natural and functional ingredients.

The top 5 countries which drives the development of beverage flavoring market are USA, UK, Europe Union, Japan and South Korea.

Fruits & Nuts and Beverage to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Food Flavours, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Food Flavours, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Origin, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Origin, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Food Flavours, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Food Flavours, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Origin, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Origin, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Food Flavours, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Food Flavours, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Origin, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Origin, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Food Flavours, 2018 to 2033

Table 34: Western Europe Market Volume (MT) Forecast by Food Flavours, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: Western Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 38: Western Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Origin, 2018 to 2033

Table 40: Western Europe Market Volume (MT) Forecast by Origin, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Food Flavours, 2018 to 2033

Table 44: Eastern Europe Market Volume (MT) Forecast by Food Flavours, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: Eastern Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 48: Eastern Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Origin, 2018 to 2033

Table 50: Eastern Europe Market Volume (MT) Forecast by Origin, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Food Flavours, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (MT) Forecast by Food Flavours, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (MT) Forecast by Form, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Origin, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (MT) Forecast by Origin, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Food Flavours, 2018 to 2033

Table 64: East Asia Market Volume (MT) Forecast by Food Flavours, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 66: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 68: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Origin, 2018 to 2033

Table 70: East Asia Market Volume (MT) Forecast by Origin, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Food Flavours, 2018 to 2033

Table 74: Middle East and Africa Market Volume (MT) Forecast by Food Flavours, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 76: Middle East and Africa Market Volume (MT) Forecast by Application, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 78: Middle East and Africa Market Volume (MT) Forecast by Form, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Origin, 2018 to 2033

Table 80: Middle East and Africa Market Volume (MT) Forecast by Origin, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Food Flavours, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Origin, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Food Flavours, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Food Flavours, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Food Flavours, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Food Flavours, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Origin, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Origin, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Origin, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Origin, 2023 to 2033

Figure 26: Global Market Attractiveness by Food Flavours, 2023 to 2033

Figure 27: Global Market Attractiveness by Application, 2023 to 2033

Figure 28: Global Market Attractiveness by Form, 2023 to 2033

Figure 29: Global Market Attractiveness by Origin, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Food Flavours, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Origin, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Food Flavours, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Food Flavours, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Food Flavours, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Food Flavours, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Origin, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Origin, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Origin, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Origin, 2023 to 2033

Figure 56: North America Market Attractiveness by Food Flavours, 2023 to 2033

Figure 57: North America Market Attractiveness by Application, 2023 to 2033

Figure 58: North America Market Attractiveness by Form, 2023 to 2033

Figure 59: North America Market Attractiveness by Origin, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Food Flavours, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Origin, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Food Flavours, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Food Flavours, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Food Flavours, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Food Flavours, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Origin, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Origin, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Origin, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Origin, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Food Flavours, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Origin, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Food Flavours, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Origin, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Food Flavours, 2018 to 2033

Figure 101: Western Europe Market Volume (MT) Analysis by Food Flavours, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Food Flavours, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Food Flavours, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 105: Western Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 109: Western Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Origin, 2018 to 2033

Figure 113: Western Europe Market Volume (MT) Analysis by Origin, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Origin, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Origin, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Food Flavours, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Form, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Origin, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Food Flavours, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Origin, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Food Flavours, 2018 to 2033

Figure 131: Eastern Europe Market Volume (MT) Analysis by Food Flavours, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Food Flavours, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Food Flavours, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 135: Eastern Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 139: Eastern Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Origin, 2018 to 2033

Figure 143: Eastern Europe Market Volume (MT) Analysis by Origin, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Origin, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Origin, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Food Flavours, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Form, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Origin, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Food Flavours, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Origin, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Food Flavours, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (MT) Analysis by Food Flavours, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Food Flavours, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Food Flavours, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Origin, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (MT) Analysis by Origin, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Origin, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Origin, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Food Flavours, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Form, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Origin, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Food Flavours, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Origin, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Food Flavours, 2018 to 2033

Figure 191: East Asia Market Volume (MT) Analysis by Food Flavours, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Food Flavours, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Food Flavours, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 195: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 199: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Origin, 2018 to 2033

Figure 203: East Asia Market Volume (MT) Analysis by Origin, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Origin, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Origin, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Food Flavours, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Origin, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Food Flavours, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Form, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Origin, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Food Flavours, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (MT) Analysis by Food Flavours, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Food Flavours, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Food Flavours, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Origin, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (MT) Analysis by Origin, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Origin, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Origin, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Food Flavours, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Form, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Origin, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cartoners Market Size and Share Forecast Outlook 2025 to 2035

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Beverage Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beverage Clouding Agent Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Beverage Premix Market Size and Share Forecast Outlook 2025 to 2035

Beverage Acidulants Market Size and Share Forecast Outlook 2025 to 2035

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Beverage Tester Market Size and Share Forecast Outlook 2025 to 2035

Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Beverage Container Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Ends Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cups Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Seamers Market Size and Share Forecast Outlook 2025 to 2035

Beverage Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Beverage Stabilizer Market Growth, Trends, Share, 2025 to 2035

Beverage Emulsion Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA