Beverage manufacturers have auspiciously been working on new flavors, useful elements, and attention-grabbing upside-down emulsion impacts, the world drink emulsion market is in some slices. Beverage emulsions are also being used to stabilize (improve the suspension of ingredients) and deliver flavor, color and nutrients, becoming a crucial function in the manufacture of a wide range of drinks, including the obvious choices: carbonated sodas and energy drinks, flavored waters and dairy-based drinks.

Consumer preference for beverages that offer natural ingredients, functional benefits and unique taste and texture experiences has driven the demand for advanced emulsion technologies. New emulsifiers, hydrocolloids and natural stabilizers are allowing producers to make visually appealing, long-life and health-conscious beverages. Used in low-fat, reduced-sugar, plant-based drinks, which require emulsions that can navigate complex ingredient systems while preserving taste and mouthfeel.

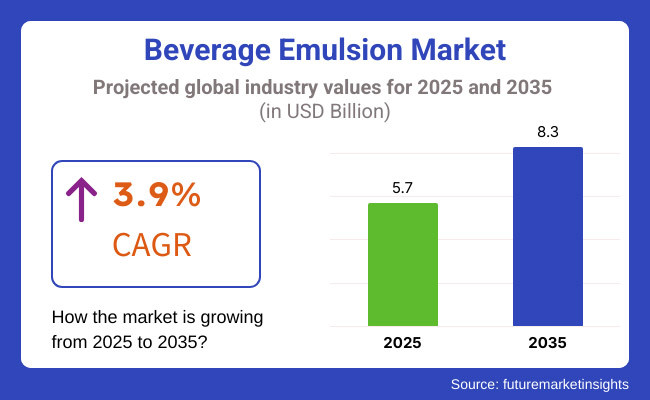

The market is expected to see a consistent expansion from 2023 to 2035 as emulsion technology develops and the variety of beverages is predicted to expand. In 2025, the worldwide beverage emulsion market was worth over USD 5.7 billion. And is expected to expand to around USD 8.3 Billion by 2035, at a CAGR of 3.9%. The demand for healthier and functional beverages, improvements in emulsion technology, and diversification of beverage categories by the beverage industry are fueling this growth.

Explore FMI!

Book a free demo

North America has emerged as a dominant market for beverage emulsions, buoyed by a prevalent beverage industry and a robust consumer preference towards health-conscious and functional beverages. The USA, especially, has experienced an uptick in demand for plant-based drinks, low-sugar products and drinks spiked with vitamins, minerals and probiotics. This change has spurred innovation in emulsion technologies that allow manufacturers to add complex ingredient systems without losing clarity, stability and flavor. The increasing market for natural and organic beverages in Canada also bolsters the region’s lead in the field of beverage emulsions.

Europe is another major market, with strong demand for natural ingredients, clean-label products, and unique flavor profiles. Premium & innovative beverage products require high-performance emulsion systems and countries such as Germany, the United Kingdom, and France are leading in the introduction of such products. Besides, the staunch regulatory framework of region, as well as accent on sustainability, has urged manufacturers to spend into green, and plant based emulsifiers. And the European demand for artisanal and crafts beverages including flavored waters, botanically-infused sodas and functional dairy-based drinks remains the driver of growth in the beverage emulsion market.

The demand for beverage emulsions in the Asia-Pacific region is flourishing faster than anywhere else in the world, driven by rapid urbanization, increasing disposable incomes, and growing tastes for a variety of beverage choices. Nations such as China, India, and Japan are witnessing a spike in consumption of ready-to-drink teas, flavored dairy products, and wellness-centric drinks.” The new middle class of the region is encouraging beverage manufacturers to create unique, high-end products that stand out on cluttered shelves. Additionally, the increasing interest in traditional herbal beverages blended with modern tastes and health advantages opens doors to advanced emulsion technologies. However, Asia-Pacific is leading both beverage consumption and beverage production, and is anticipated to drive a prominent growth for the global beverage emulsion market in the forthcoming future.

Challenges

Stability Issues, Regulatory Compliance, and High Production Costs

Stability criteria can be a challenge to the beverage emulsion market, the key challenges being ingredient separation, oxidation, and shelf life. Maintaining the same uniform appearance and texture as regular beverage emulsions without losing flavor, aroma or the integrity of nutrients requires cutting edge formulation techniques. Moreover, stringent food safety regulations by FDA (Food and Drug Administration), EFSA (European Food Safety Authority), and other international regulatory bodies impose compliance to clean-label standards, natural ingredient sourcing, and allergen-free formulations. Production costs are additionally an issue: Emulsifiers, stabilizers, and various encapsulation technologies tend to be prohibitively expensive and require ongoing innovation to meet consumer demand for natural and organic options.

Opportunities

Natural and Clean-Label Emulsifiers, Functional Beverages, and AI-Driven Formulation

However, there are several challenges faced by the beverage emulsion market such as the need for clean-label emulsifiers and rising popularity of plant-based drinks. Driven by the rising demand for minimally processed foods, consumers are on the lookout for naturally-based emulsifiers from plant sources like acacia gum, pectins and lecithin rather than synthetic stabilizers. The demand for high-performance emulsions is growing with the rise of functional beverages such as those featuring CBD, sports nutrition drinks, and drinks with probiotic properties. AI-based formulation and Nano-emulsion technology to enhance stability, bioavailability, and mouthfeel would also be the future of innovation in the market.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with food safety, allergen labeling, and synthetic additive regulations. |

| Consumer Trends | Demand for natural, organic, and low-calorie emulsions for flavored and functional beverages. |

| Industry Adoption | High adoption in soft drinks, flavored water, and dairy-based beverages. |

| Supply Chain and Sourcing | Dependence on synthetic stabilizers and high-cost natural emulsifiers. |

| Market Competition | Dominated by traditional beverage emulsifier manufacturers and food ingredient suppliers. |

| Market Growth Drivers | Growth fueled by increased beverage diversification, natural ingredient demand, and sports nutrition expansion. |

| Sustainability and Environmental Impact | Moderate adoption of biodegradable packaging and eco-friendly production techniques. |

| Integration of Smart Technologies | Early-stage use of AI in ingredient formulation and digital quality control monitoring. |

| Advancements in Beverage Formulation | Development of low-sugar, high-fiber, and fortified beverage emulsions. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Expansion of organic-certified emulsions, clean-label transparency, and eco-friendly processing mandates. |

| Consumer Trends | Growth in CBD-infused, probiotic, and adaptogen-enriched beverage emulsions. |

| Industry Adoption | Expansion into plant-based dairy alternatives, sustainable protein beverages, and bioactive ingredient emulsions. |

| Supply Chain and Sourcing | Shift toward sustainable sourcing of plant-based emulsifiers and AI-driven supply chain management. |

| Market Competition | Entry of biotech-driven functional ingredient firms and AI-assisted food science companies. |

| Market Growth Drivers | Accelerated by nano-emulsion technology, functional beverages, and AI-powered beverage stability innovations. |

| Sustainability and Environmental Impact | Large-scale adoption of sustainable ingredient sourcing, reduced carbon footprint emulsifiers, and circular economy production models. |

| Integration of Smart Technologies | Expansion into AI-driven predictive analytics for beverage stability, smart emulsifier blending, and blockchain-powered ingredient tracking. |

| Advancements in Beverage Formulation | Evolution toward next-gen encapsulation, bioavailability-enhanced emulsions, and 3D-printed beverage ingredients. |

United States beverage emulsion market is growing at a perfect pace with the consumer preferences towards flavored and functional beverages. The increased use of emulsions in soft drinks, energy drinks, and plant-based beverages is expected to drive market growth. As consumer preferences shift toward more healthy drink formulations, manufacturers are catering to this by formulating toward natural and clean-label ingredients.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.0% |

The beverage emulsion market in the United Kingdom is developing due to the application of beverage manufacturers in devising novel taste, texture, and stability. An increase in demand for emulsions in sports drinks, flavored waters and premium juices. Moreover, governments are pressuring manufacturers to handhold the use of artificial additives, thus driving the demand for natural or organic emulsifiers.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.8% |

The beverage emulsion market in the European Union is growing with the increasing demand for plant-based and functional beverages. Flattery and flavoring improvements captivate the market thanks to continuous advancements (emulsions) in beverage stability. In addition, regulatory action regarding food safety and clean-label ingredients are affecting product formulations throughout the region.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.9% |

this is steady demand with moderate growth for latest generation beverage emulsions in Japan, the steady growing-country market where strong demand for novel beverage formulations such as ready-to-drink teas, functional beverages and flavored dairy products are pivotal. In Japan, the focus on quality and natural ingredients has resulted in increased uptake of advanced emulsion solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.8% |

With consumers becoming increasingly invested in energy drinks, bubble teas, and functional health beverages, the beverage emulsion industry is expanding in South Korea. The country also benefits from a robust food and beverage manufacturing sector, along with advances in beverage stabilization and natural emulsifiers, which are driving market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.0% |

As beverage manufacturers seek improved stability, texture, and shelf life for their drink formulations, the Beverage Emulsion Market is on the rise. In liquid products, emulsions are critical for the distribution of flavors, colors, and functional ingredients. Segment by Source, the Beverages Thickener market is segmented into Xanthane Gum Pectin Carboxymethyl Cellulose Carrageenan Segment by Application Non-Alcoholic Carbonated Beverages

The superior thickening, stabilizer and emulsifying properties of Xanthan gum are ruling the beverage emulsion market. It is very common in juice drinks, dairy-based beverages, sports drinks and milk substitutes to keep ingredients from separating and improve mouth feel.

As hydrocolloids such as xanthan gum are preferable for many beverage manufacturers, on account of rising demand for low-calorie, sugar-free and functional beverages coupled with high compatibility with a wide range of pH levels and temperature fluctuations, resulting in the growth of global xanthan gum market.

Pectin a natural hydrocolloid that is extracted from fruit is finding its way into upscale fruit juice drinks, smoothies, and organic beverages where clean-label and plant-based formulation are key. Its functional properties of viscosity enhancement and natural mouthfeel make it a widely preferred ingredient in the formulations of health-focused beverages.

The occurrence of vegan, organic, and clean label friendly beverages is predicted to propel the demand for pectin-based emulsions in the functional beverages segment.

Demand for healthy, functional, and innovative beverages continues to lead consumers towards non-alcoholic beverages the non-alcoholic beverage category is the most lucrative category within the beverage emulsion market. Emulsions are fundamental to the sensory character and stability of juice-based preparations, dairy and plant-based drinks, energy drinks, and flavored waters.

Natural emulsifiers like xanthan gum and pectin are being increasingly adopted by manufacturers to meet clean-label and organic beverage trends. Meanwhile, innovations using protein and fat-based emulsions to generate plant-based equivalents for energy and other drinks are helping to broaden the functional beverage sector.

Use of emulsions in carbonated beverages include among others, flavor suspension, cloud stability, and sedimentation prevention. The shift towards natural and low-calorie carbonated beverages is increasing the adoption of hydrocolloids including xanthan gum and carrageenan to enhance texture and stability.

On the one hand, consumer interest is mounting when it comes to sparkling functional drinks, probiotic sodas, and flavored carbonated waters, putting pressure on the importance of a beverage emulsion, and what it needs to do when it comes to carbonation retention and ingredient dispersion.

This growing demand for functional beverages, clean label ingredients, and natural or cleaner emulsification are the driving factors for the beverage emulsion market. Shift in focus towards AI-based formulation, plant-based emulsifiers along with advanced microencapsulation techniques to improve stability, flavor dispersion and increase shelf-life. Food ingredient manufacturers, beverage companies, and specialty emulsifier providers are also part of the market, where technological advancements in beverage emulsification, AI-based quality control, and sustainable formulation improvements are made.

Market Share Analysis by Key Players & Beverage Emulsion Suppliers

| Company Name | Estimated Market Share (%) |

|---|---|

| Cargill, Inc. | 18-22% |

| Kerry Group plc | 12-16% |

| ADM (Archer Daniels Midland Company) | 10-14% |

| Ingredion Incorporated | 8-12% |

| Tate & Lyle PLC | 5-9% |

| Other Beverage Emulsion Ingredient Suppliers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cargill, Inc. | Develops AI-driven beverage emulsification solutions, plant-based emulsifiers, and high-performance clouding agents. |

| Kerry Group plc | Specializes in natural emulsifiers, AI-powered beverage formulation analytics, and shelf-stable flavor emulsions. |

| ADM (Archer Daniels Midland Company) | Provides clean-label beverage emulsions, advanced microencapsulation technologies, and AI-assisted ingredient stability testing. |

| Ingredion Incorporated | Focuses on starch-based emulsification solutions, high-efficiency beverage stabilizers, and AI-driven quality control. |

| Tate & Lyle PLC | Offers natural gum emulsifiers, citrus oil-based stabilizers, and AI-powered texture enhancement solutions. |

Cargill, Inc. (18-22%)

As the global leading beverage emulsion supplier powered by superior AIt beverage stability capabilities, together with a unique natural emulsifiers and game changing clouding agents.

Kerry Group plc (12-16%)

Kerry's expertise lies in clean-label emulsifiers that guarantee AI-assisted formulation optimization and provide suspension stability over prolonged time periods.

ADM (10-14%)

ADM offers innovative beverage emulsification solutions that perfect microencapsulation and AI-based quality control while also ensuring sustainable ingredient sources.

Ingredion Incorporated (8-12%)

Ingredion score metalworking beverage cloud emulsifiers from warp starch Primevisc, natural hydrocolloid solutions integrated and AI-assisted viscosity enhancement

Tate & Lyle PLC (5-9%)

Plant-derived emulsification agents developed by Tate & Lyle to ensure high-performance beverage stability and quality analysis of ingredients powered by AI

Other Key Players (30-40% Combined)

Several specialty ingredient manufacturers, beverage formulation companies, and emulsifier technology firms contribute to next-generation beverage emulsion innovations, AI-driven formulation enhancement, and clean-label beverage stabilization solutions. These include:

The overall market size for beverage emulsion market was USD 5.7 Billion in 2025.

Beverage emulsion market is expected to reach USD 8.3 Billion in 2035.

The demand for Beverage Emulsions is expected to rise due to growing consumption of functional drinks, clean-label trends, and advancements in emulsion technologies.

The top 5 countries which drives the development of beverage emulsion market are USA, UK, Europe Union, Japan and South Korea.

Xanthan Gum and Non-Alcoholic Beverages to command significant share over the assessment period.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.