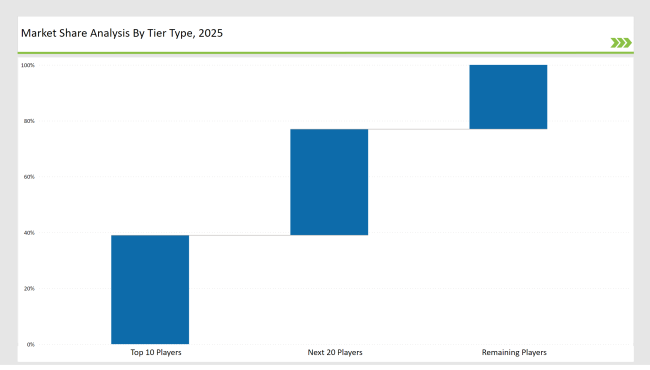

The global beverage can ends market is very competitive and fragmented, with companies classified into Tier 1, Tier 2, and Tier 3 depending on market presence and strategic positioning.

Tier 1 players are Crown Holdings, Ball Corporation, and Ardagh Group, holding 39% of the market. These companies dominate through the use of advanced manufacturing techniques, sustainable aluminum materials, and a strong distribution network to meet the demands of the beverage industry.

Tier 2 players include Canpack, Silgan Holdings, and CPMC Holdings, which account for around 38% of the market. These players focus on cost-effective, customizable can end solutions tailored for regional beverage producers and mid-sized enterprises. These players strengthen their market presence by expanding production capacity and incorporating smart packaging technologies.

Tier 3, which consists of regional manufacturers and niche startups, accounts for 23% market share. Here, the offerings are innovative as well as more environmentally friendly such as lightweight can ends and easy-open designs, and they enjoy flexibility in changing market demands as well as regulation on sustainability.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Crown Holdings, Ball Corporation, Ardagh Group) | 18% |

| Rest of Top 5 (Canpack, Silgan Holdings) | 13% |

| Next 5 of Top 10 (CPMC Holdings, Envases Group, ORG Technology, Baosteel Packaging, Easy Open Lid Group) | 8% |

The beverage can ends market serves industries such as

Vendors offer specialized products to meet evolving industry needs

Manufacturers integrate automation, AI-driven production monitoring, and material optimization to enhance efficiency while sustainability remains a major driver of innovation in the beverage packaging industry.

This section highlights the key players that led innovation and growth in the beverage can ends market in 2025. Companies introduced lightweight aluminum can ends to reduce environmental impact. Manufacturers invested in AI-driven quality control to improve efficiency.

Firms expanded production capacity to meet the increasing demand for premium and eco-friendly can end solutions. Businesses developed smart labeling technologies to enhance traceability and branding.

Year on Year Leaders

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Crown Holdings, Ball Corporation, Ardagh Group |

| Tier 2 | Canpack, Silgan Holdings, CPMC Holdings |

| Tier 3 | Envases Group, ORG Technology, niche startups |

| Manufacturer | Latest Developments |

|---|---|

| Crown Holdings | In January 2024, launched ultra-lightweight aluminum can ends. |

| Ball Corporation | In March 2024, introduced AI-powered quality control for defect detection. |

| Ardagh Group | In June 2024, expanded production capacity for premium beverage can ends. |

| Canpack | In February 2024, deployed advanced embossing and branding customization for beverage cans. |

| Silgan Holdings | In July 2024, developed resealable can ends for on-the-go convenience. |

| CPMC Holdings | In April 2024, focused on biodegradable can end solutions. |

| Envases Group | In August 2024, strengthened production in Latin America to meet increasing demand. |

The industry is transforming with AI-driven production monitoring, sustainable materials, and customized branding solutions. Manufacturers optimize energy-efficient processes to reduce emissions. Companies invest in returnable and lightweight can end systems to support circular economy initiatives.

Engineers develop resealable and easy-open can ends for improved convenience. Firms enhance digital printing for branding and traceability. Emerging innovations will drive further investments in next-generation beverage can end technologies.

Crown Holdings, Ball Corporation, Ardagh Group, Canpack, and Silgan Holdings lead the market.

The tier-1 players collectively hold about 39% of the global market.

AI-based quality control, sustainable materials, and customization drive innovation.

Tier-3 companies, including startups and regional players, contribute 23% by offering localized and specialized solutions.

Explore Packaging Formats Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.