The global beveled bottles market is poised for steady growth, driven by rising demand across various industries, including cosmetics, personal care, and premium beverages. Beveled bottles, characterized by their sharp edges and unique angular designs, offer an upscale aesthetic that appeals to brand-conscious consumers and companies looking to differentiate their products. As businesses increasingly focus on distinctive packaging to attract attention on crowded shelves, beveled bottles are gaining traction for their ability to convey quality, luxury, and sophistication.

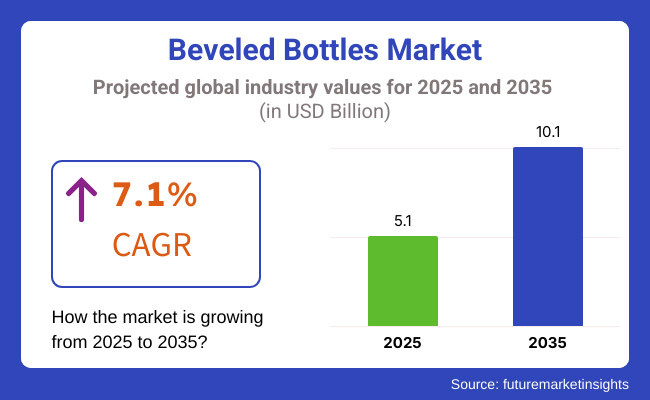

Additionally, these bottles are often made from high-quality materials such as glass and reinforced plastic, which enhance durability while maintaining their elegant appearance. With growing emphasis on sustainability and the use of recyclable materials, the beveled bottles market is set to expand further as manufacturers introduce eco-friendly options that meet evolving consumer expectations. In 2025, the beveled bottles market is estimated to be worth approximately USD 5.1 Billion, driven by increasing use in luxury packaging and enhanced brand presentation.

By 2035, the market is expected to reach around USD 10.1 Billion, reflecting a compound annual growth rate (CAGR) of 7.1%. This steady growth highlights the rising demand for premium packaging solutions and the ongoing innovation in bottle design and manufacturing.

Explore FMI!

Book a free demo

North America is a significant market for beveled bottles, supported by strong consumer demand for luxury personal care products, upscale beverages, and designer fragrances. The United States and Canada lead the region, with companies leveraging beveled bottles to create visually striking and premium-feeling packaging. Additionally, the region’s focus on sustainability has prompted manufacturers to explore recyclable materials and eco-friendly designs, further driving demand for beveled bottles in various segments.

Europe represents another important market for beveled bottles, characterized by a strong tradition of high-end cosmetics and luxury spirits. Countries such as France, Italy, and Germany have long been associated with premium packaging, and beveled bottles are increasingly used to reinforce a product’s premium positioning. The region’s well-established manufacturing infrastructure and emphasis on quality have led to the adoption of advanced production techniques, ensuring that beveled bottles meet both aesthetic and functional requirements.

The Asia-Pacific region is emerging as a rapidly growing market for beveled bottles, driven by rising disposable incomes, increasing urbanization, and the growing popularity of premium personal care and beverage products. China, Japan, and South Korea are key contributors, with a burgeoning middle class seeking more sophisticated packaging options. In addition, local manufacturers are investing in advanced production equipment and innovative designs to meet domestic demand while also catering to international clients. This dynamic growth environment makes Asia-Pacific a critical driver of the global beveled bottles market’s expansion.

Challenges

High Manufacturing Costs, Design Complexity, and Sustainability Concerns

The Beveled Bottles Market faces multiple challenges, primarily due to the high production costs associated with premium materials and intricate designs. Beveled bottles require specialized molding and finishing processes, leading to higher manufacturing expenses compared to standard bottle designs. Additionally, design complexity poses a challenge in mass production scalability and consistency, especially in glass and high-end cosmetic packaging. Sustainability concerns are also a significant hurdle, as consumers and regulatory bodies push for eco-friendly packaging. Recycling beveled glass and plastics can be difficult due to non-standard bottle shapes, leading to higher waste management challenges.

Opportunities

Growth in Luxury Packaging, Sustainable Materials, and Smart Packaging Integration

Despite these challenges, the Beveled Bottles Market presents strong growth opportunities driven by rising demand for premium, high-end packaging in cosmetics, beverages, and luxury goods. The expansion of eco-friendly beveled glass and bio-based plastic alternatives is creating new avenues for sustainable packaging solutions. Additionally, advancements in smart packaging technologies, including RFID tracking, anti-counterfeit labeling, and temperature-sensitive indicators, are expected to boost demand in high-value product categories. Brands that integrate sustainable and smart packaging innovations while maintaining the aesthetic appeal of beveled designs will gain a competitive edge.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with basic packaging safety regulations and labeling requirements. |

| Consumer Trends | Preference for aesthetically appealing, high-end glass and plastic beveled bottles. |

| Industry Adoption | Used predominantly in cosmetics, perfumes, and premium alcoholic beverages. |

| Supply Chain and Sourcing | Reliance on traditional glass and plastic suppliers with limited sustainability initiatives. |

| Market Competition | Dominated by luxury packaging companies and niche premium bottle manufacturers. |

| Market Growth Drivers | Growth fueled by luxury branding, high-end fragrance and beverage packaging demand. |

| Sustainability and Environmental Impact | Moderate adoption of recyclable glass and minimal plastic use. |

| Integration of Smart Technologies | Basic holographic labels and QR code-enabled authentication. |

| Advancements in Manufacturing | Use of traditional molding techniques for glass and PET beveled bottles. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter sustainability mandates, including plastic reduction policies and eco-friendly packaging laws. |

| Consumer Trends | Growth in sustainable beveled bottle designs using bio-based plastics and recycled glass. |

| Industry Adoption | Expansion into luxury personal care, sustainable beverage packaging, and high-end pharmaceutical containers. |

| Supply Chain and Sourcing | Shift toward green materials, carbon-neutral production, and closed-loop recycling systems. |

| Market Competition | Entry of sustainable packaging startups, smart packaging innovators, and 3D-printed bottle manufacturers. |

| Market Growth Drivers | Accelerated by smart packaging integration, anti-counterfeit technologies, and sustainable materials. |

| Sustainability and Environmental Impact | Large-scale adoption of biodegradable plastics, refillable beveled bottles, and circular economy packaging. |

| Integration of Smart Technologies | Expansion into RFID-enabled tracking, temperature-sensitive indicators, and AI-driven supply chain transparency. |

| Advancements in Manufacturing | Shift toward 3D-printed beveled bottles, automated precision molding, and lightweight material innovations. |

The Beveled Bottles market in the USA is experiencing steady growth, driven by increasing demand in the premium beverage, cosmetics, and pharmaceutical industries. Manufacturers are focusing on innovative designs and sustainable materials to attract eco-conscious consumers. The rise of luxury packaging in spirits and skincare products is further fueling market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

In the United Kingdom, the Beveled Bottles market is growing as brands emphasize high-end packaging to enhance product appeal. The demand for unique glass and plastic beveled bottles in the cosmetics, perfume, and specialty food sectors is increasing. Sustainability trends are also driving the adoption of recyclable and biodegradable packaging materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.0% |

Across the European Union, the Beveled Bottles market is expanding due to a strong focus on premiumization in the beverage and beauty industries. The region’s stringent regulations on sustainable packaging are pushing manufacturers to adopt eco-friendly materials while maintaining aesthetic appeal. Growing consumer preference for personalized and custom-designed bottles is also driving market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.1% |

Japan’s Beveled Bottles market is witnessing steady growth, fueled by demand from the cosmetics and premium sake industries. The country’s preference for aesthetically appealing and high-quality packaging is encouraging manufacturers to introduce innovative designs with a blend of tradition and modernity. The increasing trend of luxury product packaging is further supporting market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.0% |

In South Korea, the Beveled Bottles market is growing as brands focus on enhancing product differentiation through stylish and sustainable packaging. The rising demand for high-end skincare, cosmetics, and premium alcoholic beverages is driving the market forward. Technological advancements in glass and plastic molding techniques are also contributing to the production of innovative beveled bottle designs.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.2% |

The Beveled Bottles Market continues to grow as industries such as cosmetics, pharmaceuticals, food & beverages, and personal care prioritize aesthetic appeal, durability, and eco-friendly materials in packaging solutions. Beveled bottles offer a sleek design with refined edges, enhancing brand perception while ensuring product protection. The market is segmented by Shape (Bullet, Cylinder, Oval, Round) and Material (HDPE, PET, LDPE, Glass, MDPE, PP, Plastic, Others).

Round beveled bottles hold the largest market share as they offer versatility, ergonomic handling, and enhanced durability. These bottles are widely used in cosmetic packaging, pharmaceuticals, and beverage industries, where a smooth and symmetrical design is preferred for both brand presentation and storage efficiency.

Manufacturers favor round bottles due to their ease of labeling, reduced material wastage, and ability to maintain structural integrity during transportation. Their application extends to lotions, liquid medicines, essential oils, and premium alcoholic beverages.

Bullet-shaped beveled bottles are increasingly used in hair care, skincare, and personal hygiene products due to their sleek, modern design and premium appearance. These bottles provide excellent grip, controlled dispensing options, and an aesthetic edge for branding.

With growing consumer preference for sophisticated, travel-friendly packaging, bullet-shaped beveled bottles are becoming a preferred choice for luxury cosmetics, shampoos, and high-end liquid formulations.

PET (Polyethylene Terephthalate) beveled bottles are the most widely used in food & beverage, pharmaceutical, and personal care applications due to their lightweight nature, high transparency, and recyclability. PET bottles offer superior resistance to impact, moisture, and external contamination, making them ideal for retail and e-commerce packaging.

As sustainability and circular economy initiatives gain momentum, manufacturers focus on producing recyclable and bio-based PET beveled bottles to align with eco-conscious consumer trends.

Glass beveled bottles continue to see strong demand in perfume, essential oil, and premium liquor packaging, where product purity and aesthetic appeal are key selling factors. Glass provides superior chemical resistance, preserves product freshness, and enhances brand perception in luxury markets.

Despite being heavier and more fragile than plastic alternatives, glass beveled bottles remain a preferred choice in premium cosmetics, pharmaceuticals, and gourmet beverages, where a classic, high-quality look is essential.

The beveled bottles market is expanding due to increasing demand for premium packaging, luxury beverage and cosmetic containers, and sustainable glass alternatives. Companies are focusing on AI-driven design optimization, eco-friendly manufacturing processes, and high-end customization to enhance aesthetic appeal, durability, and brand differentiation. The market includes glass bottle manufacturers, luxury packaging providers, and specialty bottle suppliers, each contributing to technological advancements in beveled glass production, AI-powered quality control, and lightweight bottle innovations.

Market Share Analysis by Key Players & Beveled Bottle Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Owens-Illinois Inc. (O-I Glass) | 18-22% |

| Ardagh Group S.A. | 12-16% |

| Verallia (Saint-Gobain Packaging) | 10-14% |

| Saverglass Group | 8-12% |

| Vitro Packaging | 5-9% |

| Other Specialty Glass Bottle Manufacturers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Owens-Illinois Inc. (O-I Glass) | Develops AI-powered glass molding, premium beveled bottles for spirits and cosmetics, and lightweight sustainable glass solutions. |

| Ardagh Group S.A. | Specializes in luxury beveled bottles for premium alcohol brands, AI-driven design customization, and high-clarity glass. |

| Verallia (Saint-Gobain Packaging) | Provides sustainable glass bottles, AI-assisted quality inspection, and premium packaging solutions. |

| Saverglass Group | Focuses on high-end beveled bottles for wine and spirits, eco-friendly glass, and AI-driven decorative finishes. |

| Vitro Packaging | Offers cosmetic and fragrance beveled bottles, lightweight glass packaging, and AI-integrated product quality assurance. |

Owens-Illinois Inc. (18-22%)

O-I Glass leads the beveled bottles market, offering high-quality, AI-powered glass molding technology, premium packaging solutions, and sustainable bottle production.

Ardagh Group S.A. (12-16%)

Ardagh specializes in luxury beveled bottles, ensuring high-clarity, fully recyclable glass packaging for premium beverage and cosmetic brands.

Verallia (10-14%)

Verallia provides sustainable glass packaging, optimizing AI-assisted material processing and decorative glass customization.

Saverglass Group (8-12%)

Saverglass focuses on high-end beveled glass bottles, integrating premium aesthetics, artistic decoration, and AI-powered finishing techniques.

Vitro Packaging (5-9%)

Vitro develops luxury beveled bottles for fragrance, beauty, and alcohol markets, ensuring AI-integrated quality control and lightweight glass production.

Other Key Players (30-40% Combined)

Several specialty glass manufacturers, boutique packaging firms, and high-end design houses contribute to next-generation beveled bottle innovations, AI-powered quality control, and sustainable packaging solutions. These include:

The overall market size for beveled bottles market was USD 5.1 Billion in 2025.

Beveled bottles market is expected to reach USD 10.1 Billion in 2035.

The demand for Beveled Bottles is expected to rise due to increasing use in premium packaging for cosmetics, perfumes, and alcoholic beverages. Additionally, growing consumer preference for aesthetically appealing and sustainable packaging solutions, along with advancements in glass and plastic molding technologies, are driving market growth.

The top 5 countries which drives the development of beveled bottles market are USA, UK, Europe Union, Japan and South Korea.

Round-Shaped and PET Material Beveled Bottles to command significant share over the assessment period.

Water-soluble Packaging Market Analysis by Design, Raw Material and End Use Through 2035

Strapping Supplies Market Analysis - Demand & Growth Forecast 2025 to 2035

Temperature Loggers Market Growth - Demand & Forecast 2025 to 2035

Child Resistant Locking Pouches Market from 2025 to 2035

Chocolate Wrapping Films Market from 2025 to 2035

Cartoning Machines Market from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.