The expanding worldwide market for wellness supporting snacks mirrors developing shopper interest for more beneficial choices. Items like crisp baked potato chips, protein bars, normal popcorn and nut-based nibbles are advanced as more advantageous options in contrast to customary tidbits, regularly highlighting bring down sugar substance, diminished sodium, more extensive utilization of whole grains and useful fixings.

Developing recognition of common brands, basic fixings and plant-based decisions is driving deals, while makers adjust their contributions to oblige an assortment of dietary propensities including gluten-free, keto and veggie lover ways of life.

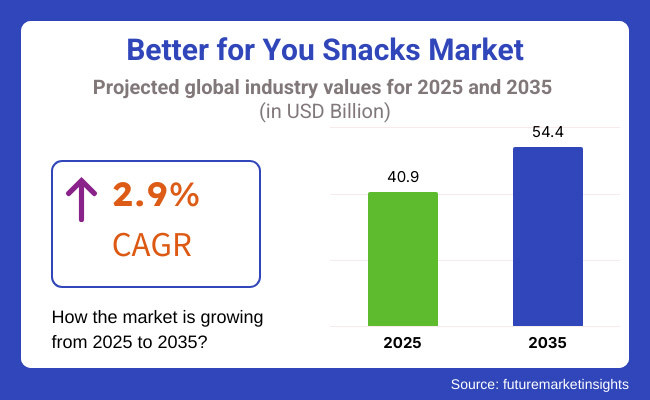

As wellness cognizant practices turn out to be progressively standard, the market for more advantageous snacks is relied upon to encounter consistent development until 2035. In 2025, the worldwide market was assessed to achieve around USD 40.9 billion.

By 2035, investigations anticipate it will arrive at somewhere in the range of USD 54.4 billion, demonstrating a normal yearly development rate (CAGR) of roughly 2.9%. This steady development direction demonstrates the developing interest for snacks that coordinate with wellbeing cognizant buyer inclinations and ongoing advancements being made to item contributions by producers.

Explore FMI!

Book a free demo

The fast-paced United States and Canada have witnessed surging demand for snacks providing more protein and fewer empty calories. Busy lifestyles, low-carb and high-protein diet fads, and focus on natural and non-GMO labels have spurred healthier innovation, ensuring the market's continuing expansion. Key players skillfully craft snacks balancing taste with wellness, from filling fiber-rich bars to hearty veggie chips, opportunely meeting the demands of health-minded buyers and fueling still more growth.

Across regions like the conscientious UK, diligent Germany and gastronomic France, consumers increasingly opt for tasty but wholesome options. Government pushes for prevention, stringent nutritional disclosures, and a rising preference for plant and gluten freedom have impacted choices. Attention to environmental sustainability and neighborhood origins also influence spending, making transparently sourced better snacks very appealing. As brands creatively diversify product lines with novel flavors and added Wellness benefits, Europe maintains significance for BFY products.

The rapidly developing Asia-Pacific arena is emerging as the quickest growing sector for better snacks. Growing pay, speedier urbanization and heightened awareness of fitness and well-being drive change. Nations including progressive China, industrious India and disciplined Japan witness a shift toward reduced-fat, sugar-sparing snacks with extra nutritional value. Easier access to international and indigenous brands combined with diverse culinary heritage stimulates new formulations. As Pacific populations become increasingly health-focused and desire convenient but more nutritious options, the future appears bright over the next decade.

Challenges

High Production Costs, Regulatory Compliance, and Consumer Perception

The makers of wholesome treats confront diverse hurdles, specifically the immoderate costs related to premium fixings, normal preservatives, and natural bundle. Customers requesting natural, non-GMO, and gluten-free choices oblige organizations to assign assets to costly sourcing arrangements and imaginative formulas to support flavor and surface while satisfying wellbeing situated cases. Additionally, exacting naming and nourishment wellbeing principles actualized by offices, for example, the FDA, EFSA, and USDA necessitate painstaking obedience, swelling working costs. Another obstruction is public notion, as numerous wellness cognizant purchasers associate "more beneficial for-you" bites with bland tastes or elevated costs, building wide acknowledgment troublesome in specific locales. Regularly, the merchants of more beneficial alternatives experience the ill effects of the expenses related with ensuring wellbeing claims and obliging client interests for natural choices and regular fixings, making benefit exceptionally testing to acquire without expanding costs to buyers. While guidelines ensure wellbeing and straightforwardness, they likewise present challenges to little makers wanting to convey tasty and gainful items to the market.

Opportunities

Functional Ingredients, Personalized Nutrition, and Sustainable Packaging

In spite of these hurdles, the BFY Snacks Market presents sizeable possibilities, propelled by increasing demands for functional snacks, plant-based replacements, and personalized nourishment. Customers are searching for snacks fortified with protein, fiber, probiotics, and super foods that attend to explicit dietary demands like keto, paleo, and gluten-free diets. Advances in AI-powered personalized nutrition platforms are letting brands offer tailored snack remedies depending on person health targets. Moreover, eco-friendly and sustainable packaging remedies are turning into a major selling point, as environmentally mindful customers favor biodegradable, recyclable, and plastic-free wrapping.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with clean-label, non-GMO, organic certification, and food safety regulations. |

| Consumer Trends | Rising demand for low-sugar, high-protein, and allergen-free snacks. |

| Industry Adoption | Growth in plant-based snacks, alternative sweeteners, and gluten-free formulations. |

| Supply Chain and Sourcing | Dependence on organic and non-GMO-certified ingredient suppliers. |

| Market Competition | Dominated by major health food brands, emerging startups, and private-label retailers. |

| Market Growth Drivers | Growth fueled by rising health awareness, clean-label demand, and increased plant-based consumption. |

| Sustainability and Environmental Impact | Early efforts in biodegradable packaging and sustainable ingredient sourcing. |

| Integration of Smart Technologies | Basic e-commerce-driven snack customization and subscription box models. |

| Advancements in Snack Formulation | Development of low-calorie, high-fiber, and protein-rich snack alternatives. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter nutritional transparency requirements and sustainability-focused food policies. |

| Consumer Trends | Expansion of functional snacks with gut health benefits, adaptogens, and brain-boosting ingredients. |

| Industry Adoption | Widespread adoption of AI-driven snack customization and hyper-personalized nutrition. |

| Supply Chain and Sourcing | Shift toward regenerative agriculture, sustainable sourcing, and vertical farming for ingredient production. |

| Market Competition | Entry of tech-driven food companies offering AI-optimized, subscription-based snack solutions. |

| Market Growth Drivers | Accelerated by functional food innovations, nutraceutical-infused snacks, and precision nutrition. |

| Sustainability and Environmental Impact | Large-scale adoption of fully compostable packaging, zero-waste snack production, and carbon-neutral operations. |

| Integration of Smart Technologies | Expansion into block chain-powered food traceability, AI-driven taste profiling, and smart vending machines. |

| Advancements in Snack Formulation | Shift toward bioengineered functional snacks, cultured protein-based crisps, and 3D-printed personalized snacks. |

The better-for-you snacks market in the USA continues advancing at a steady clip as customers place ever more importance on maintaining healthy eating habits. Increasing demands for organic, non-GMO, and protein-rich snacks are powering invention in the industry. Producers are concentrating on plant-based, low-sugar, and purposeful component-founded items to satisfy health-conscious clients. The growth of e-commerce and direct-to-consumer sales channels is additionally supporting market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.0% |

In the United Kingdom, the better-for-you snacks sector broadens as purchasers adopt clean labels and nutritious alternatives to typical snacks. The rising availability of gluten-free, low-calorie and fortified selections boosts requirement. Guidelines promoting reduced sugar and salt intake in packaged foods also inspire innovative answers.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.8% |

Across the European Union, the Better-for-You Snacks market is growing steadily as consumers adopt healthier lifestyles and demand more functional foods. The presence of strong regulatory policies on food labeling and nutritional transparency is encouraging manufacturers to focus on clean ingredients and sustainable sourcing. The increasing penetration of online grocery platforms is further enhancing product accessibility.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 2.9% |

Japan’s better-for-you snacks market sees slow but steady growth as citizens prioritize portion-controlled and nutrient-dense snacking options. The rising popularity of protein-rich, probiotic and fiber-enriched snacks shapes trends. With an aging society, demand increases for functional snacks supporting gut health, immunity and general well-being.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.8% |

In South Korea, evolving cognizance of nutritive benefits and developing impacts of well-being patterns drive demand within the Better-for-You Snacks exchange. The call for nutritious snacking alternatives, such as vegetable-founded, sugar-free, and antioxidant-prosperous products, is acquiring grip. The speedy growth of health-oriented retail stores and electronic trade platforms additionally propels marketplace infiltration. Concurrently, custom tailoring of offerings and rising utilization of digital media strengthen shopper appreciation.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.0% |

The dynamic better-for-you snacks sector continues to grow mightily as shoppers prioritize wholesome nibbling selections that furnish helpful gains, transparent fixings, and diminished sugar, fat, and fake added substances. Industry players zero in on cutting-edge item plans, plant-based options, and clear naming to address developing shopper inclinations. The market is isolated by Type (Bakery Snacks, Candy, Sweet Treats, Natural products Snacks, Savory Snacks), Deals Channel (Offline and Online), and District.

Savory snacks hold the most significant piece of the pie in the better-for-you snacks market as buyers move toward protein-rich, fiber-loaded, and minimally prepared nibbling choices. Well known classes incorporate nut-based snacks, entire grain chips, air-popped popcorn, organic product crisps, and baked snacks, which give fulfillment and adjusted supplements without trading off flavor.

With expanding interest for low-carbohydrate, high-protein, and keto-accommodating nibbling choices, makers are joining practical fixings, for example, quinoa, chickpeas, lentils, and ocean weed to make supplement-dense options in contrast to conventional salty snacks.

Natural products snacks are rapidly developing in the better-for-you snacks market, as they address shoppers looking for normal sweet taste, fiber, and vitamin-rich snacking decisions. Items, for example, dried organic product chips, natural product bars, and freeze-dried natural product snacks offer advantageous options instead of conventional sugary delights.

Brands are advancing with super fruit fixings, for example, acai, goji berries, and dragon natural product, highlighting natural and non-GMO certifications to draw in wellbeing cognizant buyers. The fragment is additionally seeing development in fortified natural product snacks that incorporate added probiotics, cell reinforcements, and plant-based protein.

The online deals channel is arising as the quickest developing portion in the better-for-you snacks market, energized by web based business development, direct-to-customer (DTC) image procedures, and computerized helpfulness.

Customers progressively turn to organization sites and e-business stages, for example, Amazon, Walmart, and specialty wellbeing sustenance retailers to investigate specialty snacks with clear mark fixings. The capacity to get to membership-based nibbling administrations, customized supplements choices, and web-unique brands additionally drives interest in this portion.

Supermarkets and hypermarkets proceed with holding a huge offer in the better-for-you snacks market, as they offer wide item perceivability, focused evaluating, and helpfulness. Sellers are extending their wellbeing cognizant item pathways, exclusive mark better-for-you nibbling contributions, and natural ensured nibbling classifications to address standard customers.

With the ascent of wellbeing centered market chains, for example, Whole Foods, Trader Joe’s, and Sprouts Farmers Market, the disconnected portion stays a key dissemination channel for better-for-you snacks.

The better-for-you snacks arena continues to cultivate owing to consumers seeking more nutritious noshing choices, functional ingredients lists, and transparent production pathways. Companies focus on AI-guided merchandise evolution, plant-based and protein-dense formulations, and sustainable packaging to boost nourishment, relish, and convenience. Spanning health-centric snack makers, food manufacturers, and all-natural substance providers, each party contributes to progress in useful munching, personalized diet recommendations aided by machine learning, and functionality on-the-go.

Market Share Analysis by Key Players & BFY Snack Brands

| Company Name | Estimated Market Share (%) |

|---|---|

| PepsiCo (Frito-Lay, Quaker, Bare Snacks, Off The Eaten Path) | 20-25% |

| General Mills (Nature Valley, Lärabar, EPIC Provisions) | 12-16% |

| Nestlé (Garden of Life, Sweet Earth, Vital Proteins) | 10-14% |

| Kellogg’s (RXBAR, Kashi, Bear Naked) | 8-12% |

| Mondelez International (Enjoy Life, Perfect Snacks, Hu) | 5-9% |

| Other BFY Snack Brands & Natural Food Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| PepsiCo (Frito-Lay, Quaker, Bare Snacks, Off The Eaten Path) | Develops plant-based, protein-rich, and fiber-enhanced snacks with AI-driven consumer insights for healthier product development. |

| General Mills (Nature Valley, Lärabar, EPIC Provisions) | Specializes in whole grain, minimally processed, and organic snacks with AI-assisted ingredient sourcing for clean-label production. |

| Nestlé (Garden of Life, Sweet Earth, Vital Proteins) | Provides functional snacks with probiotics, collagen-based products, and AI-powered personalized nutrition recommendations. |

| Kellogg’s (RXBAR, Kashi, Bear Naked) | Focuses on protein-packed bars, whole grain cereals, and AI-driven clean-label ingredient transparency. |

| Mondelez International (Enjoy Life, Perfect Snacks, Hu) | Offers gluten-free, allergen-free, and low-sugar snacks with AI-powered taste and texture optimization. |

PepsiCo (20-25%)

PepsiCo leads the better-for-you snacks field, offering AI-powered product evolution, plant-based ingredients, and sustainable snacking solutions.

General Mills (12-16%)

General Mills specializes in organic and minimally handled snacks, ensuring functional components, whole grain content, and AI-driven taste progression.

Nestlé (10-14%)

Nestlé provides practical health snacks, optimizing AI-aided nutrient profiling, gut-health innovations, and collagen-infused snack products.

Kellogg’s (8-12%)

Kellogg’s focuses on protein-rich and clear-label snacks, merging sustainable ingredient sourcing and AI-driven consumer preference examination.

Mondelez International (5-9%)

Mondelez develops allergen-free and sugar-aware snacks, ensuring AI-assisted product evolution and market trend adaptation.

Other Key Players (30-40% Combined)

Several natural food brands, startup snack companies, and organic ingredient suppliers contribute to next-generation better-for-you snack innovations, AI-driven flavor optimization, and sustainable snacking solutions. These include:

The overall market size for better for you snack market was USD 40.9 Billion in 2025.

Better for you snack market is expected to reach USD 54.4 Billion in 2035.

The demand for Better-for-You Snacks is expected to rise due to increasing health-conscious consumer preferences, growing demand for clean-label and functional ingredients, and rising awareness of nutritional benefits. Additionally, innovations in plant-based, protein-rich, and low-calorie snack options are driving market growth.

The top 5 countries which drives the development of better for you snack market are USA, UK, Europe Union, Japan and South Korea.

Savory Snacks and Online Sales to command significant share over the assessment period.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.