Benzyl trimethyl ammonium chloride has seen growing use across sectors, influenced by its diverse industrial and consumer roles. As a surfactant, catalyst, and disinfectant, BTMAC has proven to be a stalwart ingredient in water treatment, manufacturing, and personal care goods. Its proven ability to safely emulsify, transfer phases, and remove harmful microbes underpins demands within chemical synthesis, conditioners, and broader solutions.

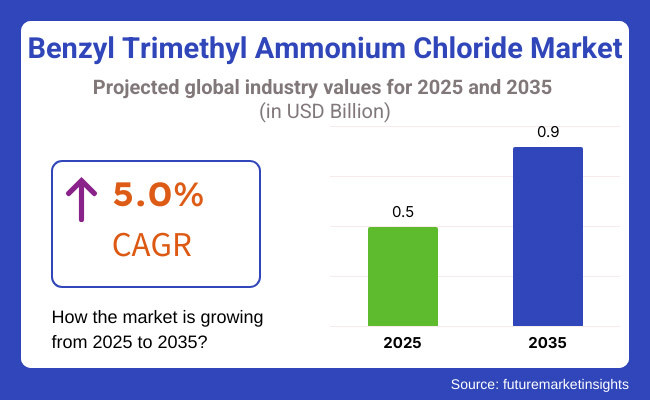

Global forecasts indicate the BTMAC market will experience consistent gains, arriving at approximately USD 0.9 billion by 2035 on steady 5% annual growth. Its market value in 2025 is estimated at USD 0.5 billion. Supporting factors include rising needs for effective surfactants within an array of end uses, swelling use in water remediation efforts, and expanding presence in cosmetics and synthetic processes.

Explore FMI!

Book a free demo

North America comprises a core portion of overall sales, driven by heavy investment in industry, waterworks, and personal products. The USA and Canada especially contribute through strong manufacturing bases and strict water quality mandates. A focus on eco-friendly techniques has further spurred BTMAC integration across various applications.

Europe also anchors the market, supported by rigorous environmental laws, well-established chemical centers, and burgeoning water treatment priorities. Nations like Germany, the UK, and France are at the forefront of advanced solutions for industrial and consumer sectors. Thriving personal and textiles industries additionally fuel demand as a surfactant and antistatic solution.

The Asia-Pacific region has emerged as the fastest developing market for benzyl trimethyl ammonium chloride, propelled by swift industrialization, swelling consumer demand for personal care items, and growing financial commitment in water treatment infrastructure. China, India, and Southeast Asian nations are guiding the charge, making use of cost-effective manufacturing capabilities and broadening manufacturing capacities. As urbanization and commercial activities increase across the region, the necessity for high-performance surfactants, coagulants, and disinfectants continues to rise.

Challenges

Regulatory Constraints, Raw Material Price Volatility, and Limited Awareness in Emerging Applications

Regulatory limitations, fluctuating feedstock rates, and restricted knowledge in arising markets pose difficulties for the benzyl trimethyl ammonium chloride industry. Stringent norms from bodies like the EPA and REACH administer exacting principles involving protected handling, environmental effect, and allowable focus levels, specifically in water treatment and disinfecting uses. Furthermore, unstable pricing for essential substances such as benzyl chloride and trimethylamine impact creation expenses. An extra principal test is restricted learning and endorsement in budding applications, as enterprises still depend on conventional surfactants and sterilizers, restricting BTMAC's business development. New companies search for methods to expand understanding and fulfill progressively stringent administrative prerequisites, battling inconsistent substance evaluation and seeking new opportunities to expand the chemical's relevance.

Opportunities

Growth in Disinfectants, Water Treatment Chemicals, and Industrial Surfactants

Despite numerous difficulties, opportunities for significant growth exist within the BTMAC market, propelled by the escalating need for industrial disinfectants, antimicrobial surface treatments, and water remediation solutions. As worldwide standards of cleanliness and sanitation climb, BTMAC's function in disinfectants and biocides is anticipated to expand. The proliferating adoption of QACs in industrial surfactants, textile softeners, and phase transfer catalysts additionally offers novel profit avenues. Moreover, sustainability-inspired innovations, such as eco-friendly QAC formulations and green synthetic methods, are positioned to impel market expansion in the ensuing years. The applications of BTMAC continue to diversify alongside technological progress and the evolution of industry demands. While regulatory obstacles require ongoing considerations, the multifaceted benefits of BTMAC for public health protection and environmental remediation point toward an assuring future.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Strict EPA, REACH, and FDA regulations on QAC-based disinfectants and industrial chemicals. |

| Application Trends | High demand for BTMAC in disinfectants, phase transfer catalysts, and fabric softeners. |

| Industry Adoption | Used in biocides, oilfield chemicals, and wastewater treatment. |

| Supply Chain and Sourcing | Dependence on petrochemical-based raw materials, with moderate price fluctuations. |

| Market Competition | Dominated by established chemical manufacturers and specialty chemical suppliers. |

| Market Growth Drivers | Growth was driven by rising sanitation awareness, expansion of industrial cleaning solutions, and water treatment demand. |

| Sustainability and Environmental Impact | Growing concerns about toxicity, bioaccumulation, and chemical runoff from QACs. |

| Integration of Smart Technologies | Limited automation in BTMAC production and quality control. |

| Advancements in Chemical Engineering | Use of conventional synthesis processes with limited focus on green chemistry. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | More stringent eco-friendly guidelines promoting biodegradable and low-toxicity BTMAC formulations. |

| Application Trends | Expansion into biodegradable surfactants, high-performance coatings, and next-gen industrial cleaners. |

| Industry Adoption | Widespread adoption in green chemistry solutions, pharmaceutical intermediates, and specialty surfactants. |

| Supply Chain and Sourcing | Shift toward bio-based chemical synthesis and sustainable raw material alternatives. |

| Market Competition | Entry of biotech firms and green chemistry startups focusing on low-environmental-impact formulations. |

| Market Growth Drivers | Accelerated by biodegradable QAC innovations, eco-friendly industrial applications, and increased regulatory support for sustainable chemicals. |

| Sustainability and Environmental Impact | Development of low-toxicity, biodegradable, and environmentally safe BTMAC alternatives. |

| Integration of Smart Technologies | Expansion into AI-driven chemical process optimization and smart formulation monitoring. |

| Advancements in Chemical Engineering | Shift toward sustainable catalysts, low-energy synthesis methods, and carbon-neutral production processes. |

The benzyl trimethyl ammonium chloride market in the USA is thriving as demand diversifies across industries. Its use in water purification, personal items, and commercial cleaning solutions fuels steady progression. Environmental friendliness and productivity encourage broader acceptance

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.1% |

The benzyl trimethyl ammonium chloride industry expands little by little, upheld by more employment of quaternary ammonium blends in industrial and family unit cleansers. Rising interest for top-notch surfactants in individual consideration and agrarian formulas additionally energizes statistical development.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.9% |

The European Union, the benzyl trimethyl ammonium chloride industry broadens because of its wide utilize in water treatment synthetic concoctions, material conditioners, and against contamination operators. Strict directions on synthetic wellbeing and supportability drive makers to zero in on high-purity and degradable structures, underpinning long-haul statistical development.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.0% |

Japan’s benzyl trimethyl ammonium chloride industry is experiencing consistent development, empowered by its application in the process of cleaning operators, pharmaceutical structures, and mechanical water treatment. The country’s accentuation on premium synthetic creation and advancements in surfactant innovations add to the statistical extension.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.9% |

In South Korea, the benzyl trimethyl ammonium chloride market sees moderate development, upheld by the extending individual consideration and family unit ventures. The expanding utilization of specialty synthetic concoctions in material conditioners, antimicrobial nanocoatings, and mechanical sanitization forms drives interest further.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

The expanding benzyl trimethyl ammonium chloride industry continues accommodating various applications from water treatment and pharmaceuticals to personal care due to its multifaceted quaternary ammonium structure. As an effective surfactant, disinfectant, and transfer catalyst, it permeates market segments by physical state and concentration. The market distinguishes itself by Form (Liquid or Powder) and Concentration (100% Benzyl Trimethyl Ammonium Chloride or diluted variations).

The liquid formulation of Benzyl Trimethyl Ammonium Chloride currently holds sway over other physical states owing to its solubility, manageability, and swift reactivity especially in aqueous applications. It sees widespread use in water solutions, textile processing, and medication mixtures where even dispersion and blending are paramount.

As an antimicrobial and surfactant agent, liquid Benzyl Trimethyl Ammonium Chloride proves particularly valuable in cleansers, disinfectants, and personal maintenance, sustaining robust demand from industry and customers alike with its proficiency in fluid preparations.

Meanwhile, the dehydrated variant gains traction in concentrated settings, catalyzed syntheses, and crystallized industrial processes, leveraging attributes like longevity, constancy, and controlled solubility optimal for high-purity uses.

Customized formulations and fine-tuned syntheses increasingly turn to powdered quaternary salts in specialized manufacturing as the segment carves a niche.

The powerful 100% concentration of benzyl trimethyl ammonium chloride continues to lead demand in crucial industries that necessitate maximum activity and purity. This potent mixture is heavily relied upon in oilfield goods, biocides, pharmaceutical synthesis, and polymer processing, where top functionality and cleanliness are compulsory.

Those sectors dependent on transfer facilitators, static deterrents, and emulsifiers opt for the 100% focus as it confirms ideal output without the inefficiencies related to weakening. Seeing that requests for exceptionally clean synthetic intermediates rise, this section carries on to see sturdy marketplace infiltration.

The 60% attention is widely embraced in cost-conscious applications where watered-down formulas are essential. This concentration is utilized in individual care merchandise, disinfectants, cloth softeners, and commercial water remedies, where it offers a balance between usefulness and affordability.

As administrative structures advocate for the risk-free management of focused chemicals, the 60% fragment persists in an increase in consumer-aimed and commercial cleaning programs.

The benzyl trimethyl ammonium chloride (BTMAC) market is expanding because of the increasing requirements for transfer facilitators, intermediaries, and antimicrobial brokers in industries like pharmaceuticals, water treatment methods, personal care, and chemical synthesis. Companies center on AI-driven chemical formulation, extremely pure synthesis, and sustainable production techniques to boost efficiency, regulatory conformity, and merchandise quality. The market includes specialty chemical manufacturers, pharmaceutical ingredient providers, and commercial chemical distributors, each contributing to technological developments in BTMAC production, AI-powered quality control, and environmentally friendly manufacturing.

Market Share Analysis by Key Players & Specialty Chemical Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Merck KGaA | 18-22% |

| SACHEM Inc. | 12-16% |

| Tatva Chintan Pharma Chem Ltd. | 10-14% |

| Novo Nordisk Pharmatech A/S | 8-12% |

| Stepan Company | 5-9% |

| Other Specialty Chemical Suppliers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Merck KGaA | Produces high-purity BTMAC for pharmaceutical applications, AI-driven chemical analysis, and sustainable production solutions. |

| SACHEM Inc. | Specializes in phase transfer catalysts, quaternary ammonium compounds, and AI-assisted reaction optimization. |

| Tatva Chintan Pharma Chem Ltd. | Provides BTMAC for specialty chemical applications, green synthesis technology, and AI-driven purity control. |

| Novo Nordisk Pharmatech A/S | Focuses on pharmaceutical-grade BTMAC, AI-powered quality testing, and precision chemical manufacturing. |

| Stepan Company | Offers BTMAC for water treatment, surfactant synthesis, and antimicrobial applications, with AI-assisted regulatory compliance tracking. |

Merck KGaA (18-22%)

Synthesis expertise and AI monitoring tools lead the burgeoning BTMAC sector. Offering the highest purity levels through computer-guided organic reactions and pharmaceutical-grade quaternary ammonium compounds, Merck set the industry standard.

SACHEM Inc. (12-16%)

Distinguishes itself through advanced phase transfer catalysis, leveraging artificial intelligence to optimize efficiency and sustainability across diverse processes. Cutting-edge synthesis technologies powered by machine learning ensure reaction success.

Tatva Chintan Pharma Chem Ltd. (10-14%)

Applies expertise in BTMAC to industrial and pharmaceutical applications alike, maximizing green techniques through computational supervision of complex manufacturing procedures. Precision control steered by artificial neural networks drives compliance.

Novo Nordisk Pharmatech A/S (8-12%)

It focuses singularly on producing pharma-grade BTMAC and integrating artificial intelligence at all levels to guarantee quality beyond expectation. Automated assurance and flexible scale-up bolster precision production. Stepan Company (5-9%)

Develops versatile BTMAC solutions, empowering water treatment and industrial needs through regulatory technology that safeguards ecosystems during computer-guided production scaled for communities worldwide.

Other Key Players (30-40% Combined)

Several specialty chemical firms, pharmaceutical ingredient suppliers, and surfactant manufacturers contribute to next-generation BTMAC innovations, AI-powered purity verification, and sustainable chemical synthesis. These include:

The overall market size for benzyl trimethyl ammonium chloride market was USD 0.5 Billion in 2025.

Benzyl trimethyl ammonium chloride market is expected to reach USD 0.9 Billion in 2035.

The demand for Benzyl Trimethyl Ammonium Chloride is expected to rise due to its growing use in chemical synthesis, water treatment, and disinfectants. Additionally, increasing applications in pharmaceuticals, agrochemicals, and personal care products are driving market growth.

The top 5 countries which drives the development of benzyl trimethyl ammonium chloride market are USA, UK, Europe Union, Japan and South Korea.

Liquid Form and 100% Concentration to command significant share over the assessment period.

The global diverse market of Benzyl Trimethyl Ammonium Chloride can be segmented on the basis of form, concentration and end use applications

Magnesium Metal Market Report - Demand, Growth & Industry Outlook 2025 to 2035

LATAM Road Marking Paint & Coating Market Analysis by Material Type, Marking Type, Sales Channel, and Region Forecast Through 2035

Refinery and Petrochemical Filtration Market Analysis by Filter Type, Application, End-User and Region 2025 to 2035

Plastic Market Growth Analysis by Product, Application, End Use, and Region 2025 to 2035

Industrial Oxygen Market Report - Growth, Demand & Forecast 2025 to 2035

Medical Grade Coatings Market Trends – Demand, Innovations & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.