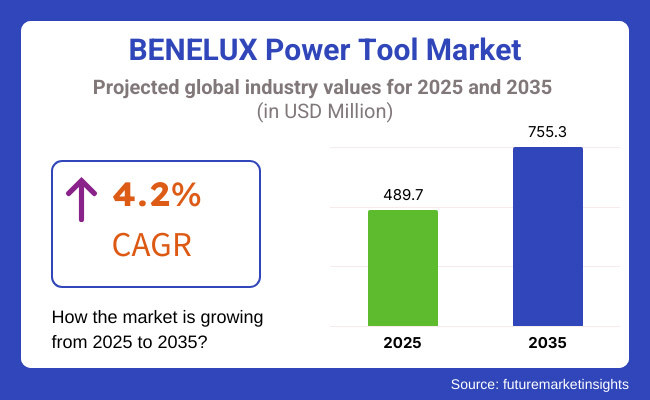

The BENELUX power tool market is projected to witness steady growth over the forecast period, driven by increasing industrialization, rising demand for cordless tools, and advancements in battery technology. With a market size valued at USD 489.7 million in 2025, the industry is expected to expand at a CAGR of 4.2%, reaching USD 755.3 million by 2035. The growth is fuelled by infrastructure development, the expansion of the construction sector, and the increasing adoption of automation in manufacturing. Additionally, the growing preference for ergonomic, high-performance, and energy-efficient tools is shaping market dynamics.

The BENELUX power tool industry is witnessing significant changes as the demand for precision and efficiency increases in different industries. The widespread use of cordless power tools, made possible by technological advancements in lithium-ion batteries, has a strong impact on market trends. The automotive and construction industries continue to be important end-users that utilize power tools to improve productivity and working efficiency. Furthermore, the do-it-yourself (DIY) culture among homeowners is becoming increasingly popular, contributing to higher sales.

Technological improvements, such as brushless motor technology, are increasing the longevity and efficiency of power tools and making them more energy-efficient. Additionally, greater safety standards and ergonomic tool designs are fuelling consumer demand.

Explore FMI!

Book a free demo

Challenges

High Initial Costs and Affordability Constraints

One of the main issues facing the BENELUX power tool sector is the initial expense of high-end power tools, especially cordless versions with lithium-ion batteries and brushless motors. Although these power tools provide better efficiency, robustness, and mobility, their higher prices may be a hindrance to take-up, especially among small enterprises, individual contractors, and do-it-yourself users.

Most users continue to stick with conventional corded or pneumatic tools because of their cost-effectiveness and ease of maintenance. Lastly, battery replacement and charging infrastructure costs add to the overall cost of ownership, making it practically challenging for frugal buyers to switch to new, more efficient technologies. Consequently, price sensitivity remains a limiting factor in market growth.

Regulatory Compliance and Environmental Restrictions

The BENELUX power tool industry is subjected to mounting regulatory pressures with stringent EU environmental and safety regulations. Manufacturers are required to meet strict standards on energy efficiency, noise pollution, and the use of hazardous materials, increasing production costs. Battery-powered tools, especially lithium-ion battery tools, have to comply with regulations on battery disposal, recycling, and sustainability. In addition, labour laws mandate that equipment must be designed with additional safety features, including anti-vibration technology and ergonomic design, raising development expenses.

Adhering to these changing standards tends to delay product release and market introduction for new companies. With governments encouraging cleaner and more environmentally friendly industrial processes, businesses need to spend on R&D to keep up with regulatory requirements, which affects overall profitability.

Opportunities

Technological Advancements Driving Innovation

The BENELUX power tool industry is gaining from speedy technological developments, especially in battery technology, brushless motors, and intelligent tool integration. The creation of lithium-ion batteries with longer lifetimes has greatly enhanced the performance of cordless power tools, and they are more appealing to professionals and DIY users. Brushless motor technology also increases durability, minimizes maintenance, and enhances power output, which makes tools more dependable and economical in the long term.

IoT-connected smart power tools with autonomous features are also on the rise, enabling customers to track performance and optimize tool utilization through digital platforms. Not only do these innovations improve productivity but also unlock new revenue sources for manufacturers supplying high-performance and connected tool customers.

Growing Demand for Sustainable and Eco-Friendly Tools

Increased focus on sustainability and environmental legislation is a big opportunity for BENELUX power tool makers. Businesses and consumers are increasingly demanding low-emission, energy-efficient tools in compliance with EU green policies. Those manufacturers who invest in eco-friendly battery technology, recyclable products, and energy-efficient products are taking the competitive lead. The demand for more energy-efficient cordless tools is also on the rise as companies seek to cut carbon footprints. In addition, sustainability-oriented initiatives like tool rental and refurbishment programs provide new business models that serve environmentally aware consumers. Businesses innovating in low-noise, low-vibration, and ergonomic tool designs can also gain further market share by satisfying both regulatory needs and consumer demand for sustainable solutions.

The BENELUX power tool industry, including Belgium, the Netherlands, and Luxembourg, has seen consistent growth from 2020 to 2024, spurred by growing construction activity, infrastructure upgradation, and rising usage of cordless and battery-operated tools. The surge in popularity of DIY activities, especially during the COVID-19 pandemic, also contributed to higher demand for power tools among end-users. Further, improvements in lithium-ion battery technology and ergonomic tool design have improved user experience and productivity.

Looking forward to 2025 to 2035, the industry will see a huge shift with sustainability laws, digitalization, and automation trends taking center stage. The European Union's strict policies encouraging low carbon emissions will speed up the transition towards green and energy-saving power tools. Additionally, the infusing of IoT and AI-enabled diagnostics into power tools will fuel innovation, improving productivity and safety in industries. With increasing industrial and residential demand, the BENELUX power tool market is on the verge of long-term growth.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Implementation of safety and quality standards for power tools. |

| Technological Advancements | Rise of cordless tools powered by lithium-ion batteries; integration of basic digital features. |

| Industry-Specific Demand | High demand from construction and automotive sectors; growing interest from DIY enthusiasts. |

| Sustainability & Circular Economy | Initial steps towards sustainable practices; limited recycling programs for tools and batteries. |

| Production & Supply Chain | Reliance on global supply chains; challenges with raw material sourcing during global disruptions. |

| Market Growth Drivers | Urbanization leading to construction booms; rise in DIY projects during pandemic lockdowns. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Introduction of stricter environmental regulations promoting eco-friendly and energy-efficient tools. |

| Technological Advancements | Widespread adoption of smart tools with IoT connectivity, AI-driven diagnostics, and enhanced battery technologies. |

| Industry-Specific Demand | Continued growth in construction and automotive, with emerging demand from renewable energy and smart manufacturing sectors. |

| Sustainability & Circular Economy | Emphasis on circular economy models; comprehensive recycling and remanufacturing programs; development of biodegradable tool components. |

| Production & Supply Chain | Shift towards localized manufacturing; adoption of AI-driven supply chain management for resilience and efficiency. |

| Market Growth Drivers | Infrastructure modernization; technological innovations in tool design; increased focus on sustainability and energy efficiency. |

The Belgium power tool industry is growing because of the rise in residential and commercial building projects. Government investments in infrastructure development, as well as the rise in the usage of power tools in manufacturing and automotive industries, are fueling growth. Battery and cordless tools are increasing in popularity, keeping pace with sustainability trends. Moreover, growth in home improvement and DIY culture also fuels market growth. The availability of important world manufacturers and increasing demand for high-efficiency and ergonomic tools are influencing the market environment. With digitalization and automation improving tool capabilities, Belgium's power tool market will grow at a CAGR of 4.0% during 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Belgium | 4.0% |

The Netherlands is witnessing strong growth in the power tool industry, with the country's booming construction, automotive, and renewable energy industries supporting it. Demand for high-performance power tools is increasing as businesses focus on productivity and efficiency. Strong usage of electric and cordless tools, combined with intelligent technology integration, is also driving market dynamics. Growing infrastructure construction projects, along with a properly developed logistics framework, facilitate easy distribution of power tools. Apart from this, sustainability efforts are promoting the development of energy-saving and long-lasting tools. As these factors contribute, the Netherlands power tool market is expected to grow at 4.5% CAGR from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Netherlands | 4.5% |

Luxembourg's power tool market is comparatively smaller but increasingly growing, led by urbanization and construction activity. The growing need for quality, long-lasting tools in business and industrial uses is a key driver of growth. The nation's emphasis on green buildings and intelligent infrastructure is propelling the usage of battery-driven and green power tools. With labor costs escalating, businesses are favoring more investment in automation and power-augmented tools to enhance efficiency. In addition, the availability of sophisticated equipment through online and offline distribution channels is driving market growth. Luxembourg's power tool market will grow at a CAGR of 3.8% during the period 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Luxembourg | 3.8% |

Drilling Tool Leads the Market Due to Versatility and High Demand

Drilling tools lead the BENELUX power tool market because of their extensive use in various industries, such as construction, manufacturing, and home improvement. The tools are necessary for operations like hole-making, fastening, and material removal and, thus, are a must-have for professional and domestic use. Increased infrastructure projects, especially in Belgium and the Netherlands, are driving demand for sophisticated cordless drilling tools with improved battery efficiency. Moreover, manufacturing automation is raising the demand for precision drilling, aiding market growth. Energy-efficient and ergonomic tool standards set by regulations further propel innovations in this category. With increasing investments in intelligent tools with IoT integration, the market for drilling tools is likely to continue steady growth.

Fastening Tool Gains Traction Due to Rising Industrial Applications

Fastening equipment is another market-leading segment within the BENELUX power tools market, highly influenced by its essential use in construction, auto assembly, and metal fabrication. The fasteners provide a tight hold of the components, thereby being indispensable where precision and effectiveness are of priority. Increasing demands for lightweight yet robust fastening techniques in aerospace as well as railroad production are critical drivers. Moreover, the transition towards battery-powered and cordless fastening tools is gaining traction, providing greater mobility and convenience. The use of intelligent fastening tools with torque monitoring systems is also increasing, guaranteeing quality control in manufacturing processes. With the growth of industrial automation in the region, the demand for advanced fastening tools will keep rising.

Manufacturing Sector Dominates Due to Extensive Power Tool Utilization

The manufacturing sector is the dominant sector of the BENELUX power tool industry, fuelled by its multiple applications in metalwork fabrication, automotive, aerospace, and furniture manufacturing. Increased precision and efficiency requirements in industrial activities have spurred power tool adoption in automated production lines. Power tools are significantly used in assembly, welding, and fastening operations by the automotive and aerospace sectors in the Netherlands and Belgium. Also, smart and connected tool advancements increase productivity while decreasing downtime. The demand for sustainability in manufacturing has also brought about the invention of power tools that are energy-efficient. With ongoing industrial investment coupled with a high emphasis on automation, the manufacturing sector is poised for continuous growth.

Construction Sector Sees Strong Demand Due to Urban Development Projects

The building construction segment is another prime driver of the BENELUX power tool market, with growth spurred by urbanization, infrastructure developments, and repair works. Belgium and Luxembourg are experiencing growing investment in commercial and residential buildings, which is boosting the use of power tools for drilling, fastening, cutting, and grinding. The adoption of modular construction and prefabricated buildings has also increasedthe demand for high-performance power tools to improve efficiency. Also, strict safety standards in the workplace are promoting the adoption of ergonomic and low-vibration tools. The trend towards battery-operated and cordless tools is picking up pace, providing for mobility on the site. With ongoing urban infrastructure growth, this segment is likely to grow greatly.

The Benelux Power Tool Market is extremely competitive, with key global brands such as Bosch, Makita, Stanley Black & Decker, Hilti, and Festool dominating the market. The market is experiencing a move towards cordless and intelligent power tools, and there is a growing demand for battery-operated solutions that leverage IoT and automation. Sustainability is also a focus area, and companies are spending on energy-efficient designs and sustainable materials. Increased e-commerce and direct-to-consumer sales have amplified competition, driving firms to step up digital marketing and distribution practices. Market consolidation trends are also being witnessed, with strategic alliances and acquisitions enhancing leading players' positions. The professional construction and industrial segments are still the largest end-users, with the DIY segment growing with increasing home improvement trends. With the progress in technology, the sector is poised for more innovation, especially in lightweight, high-efficiency, and AI-based tools, defining the competitive landscape in the next few years.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Bosch | 18-22% |

| Makita | 15-18% |

| Stanley Black & Decker | 12-16% |

| Hilti | 10-14% |

| Festool | 5-8% |

| Other Companies (combined) | 25-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Bosch | Innovates in smart, battery-powered tools, integrating IoT and automation. Focuses on sustainability, R&D investments, and digital solutions for professionals and DIY users. |

| Makita | Specializes in high-performance cordless tools, enhancing battery efficiency and durability. Strengthens distribution channels with online retail and direct partnerships. |

| Stanley Black & Decker | Expands into sustainable, connected tools, integrating eco-friendly materials and IoT features. Acquires brands to broaden professional tool offerings. |

| Hilti | Targets premium professional tools for construction. Focuses on fleet management solutions, customer service, and rental models to enhance B2B relationships. |

| Festool | A niche player in high-precision woodworking and automotive tools. Competes on craftsmanship, durability, and premium quality, appealing to specialized users. |

Bosch dominates the Benelux power tool market with an emphasis on innovation, sustainability, and smart technology. The company has been building its range of battery and IoT-enabled tools for professional and DIY customers. Bosch spends heavily on R&D and automation to drive power tool performance efficiency. Sustainability continues to be a focus, with new environmentally friendly designs and energy-efficient technologies taking center stage. Its digital integration strategy, which involves smart tracking and connected jobsite solutions, reinforces its competitive advantage. The company also adopts robust distribution networks, using e-commerce and retail partnerships to push market reach. Bosch's focus on technology advancements and customer solutions reinforces its leadership in the changing power tool market.

Makita is known for high-performance cordless power tools, especially in the industrial and construction industries. Makita focuses on battery technology, improving runtime, durability, and charging efficiency to enhance user experience. Makita has a strong presence in the Benelux market with a large distribution network, retail partnerships, and increasing e-commerce sales. With a focus on sustainability, it is investing in environmentally friendly battery technology and energy-efficient power tools. Makita's emphasis on professional-level durability and long-lasting equipment makes it a contractor favorite. The company continually refreshes its product line with light, ergonomic designs for comfort and ease of use. With a delicate balance between affordability, performance, and durability, Makita continues to be one of the leading players in the industry.

Stanley Black & Decker is a giant in the power tool sector, with a wide portfolio of tools for professionals and consumers. It has been increasing its presence in green tool solutions, launching environmentally friendly materials and energy-efficient tools. The company is making significant investments in intelligent tools with IoT connectivity, enabling remote tracking and control of tools. With a robust acquisition plan, Stanley Black & Decker continues to expand its professional tool business, head-to-head competing with high-end brands. Stanley Black & Decker also emphasizes low-cost, high-quality tools, and therefore is a well-liked option in the Benelux market. With the expansion of brands, strategic investments, and innovation aimed at customers, Stanley Black & Decker fortifies its hold in the very competitive market.

Hilti is a high-end power tool brand recognized for its professional-grade, high-end tools for construction and industrial use. The company stands out with superior customer service, rental options, and fleet management solutions. Its tools are engineered for durability and accuracy, meeting high-performance requirements on construction sites. Hilti is also heavily investing in digital jobsite solutions, incorporating smart tracking and automation for enhanced tool efficiency and management. Sustainability is also an emerging emphasis with initiatives to minimize carbon footprints by using energy-efficient equipment and sustainable materials. As a high-cost brand, Hilti is still enjoying high market share because of its higher product quality and long-term value proposition for professionals.

Festool is a high-end, specialized brand with a focus on precision woodworking, automotive, and specialty tools. It differs from mass-market brands in that it targets craftsmen, artisans, and professionals who value quality over price. Festool excels in outstanding durability, ergonomic design, and state-of-the-art dust extraction systems, guaranteeing top performance and user safety. The firm continuously invests in premium solutions for demanding tasks, becoming a brand of choice in cabinet making, furniture design, and precise construction activities. Its dedication to niche sectors, craftsmanship, and longevities ensures the loyalty of customers. By infusing specialized innovation with sustainability strategies, Festool continues to stake out a niche position in the Benelux power tool markets.

The BENELUX Power Tool market is projected to reach USD 489.7 million by the end of 2025.

The market is anticipated to grow at a CAGR of 4.2% over the forecast period.

By 2035, the Power Tool market is expected to reach USD 755.3 million.

The drilling tool segment is expected to dominate the market, due to high demand in construction, woodworking, and DIY projects. Their versatility, precision, and efficiency make them essential for professionals and homeowners alike.

Key players in the Power Tool market include Bosch, Makita, Stanley Black & Decker, Hilti, Festool.

In terms of products, the industry is divided into drilling tool, fastening tool, heat gun, angle grinder, chain saw, orbital sander, jigsaw, impact wrench, and circular saw.

In terms of application, the industry is segregated into manufacturing, MRO services, DIY, and construction.

The report covers key country, including Belgium, Netherlands, Luxembourg

Diaphragm Coupling Market Growth - Trends & Forecast 2025 to 2035

HID Ballast Market Growth - Trends & Forecast 2025 to 2035

Fluid Conveyance Systems Market Growth - Trends & Forecast 2025 to 2035

GCC Magnetic Separator Market Analysis by Over band/Cross Belt Separator and Magnetic Roller Separator through 2035

United Kingdom Magnetic Separator Market Analysis by Over band/Cross Belt Separator and Magnetic Roller Separator through 2035

Glass Door Merchandisers Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.