Beer is an alcoholic drink prepared by fermenting cereal grains, mainly barley, hops, yeast, and corn, and accounts for a large portion of the global alcoholic beverage market. Beer market, this part can be powerful to understand how the global Beer market will develop during the period between 2025 and 2035.

It remains one of the most drunken alcohols on Earth, and as tastes shift, brewers are pushing the envelope to keep up. The global market is dominated due to the rising demand for low alcohol and non-alcoholic beers and also due to innovation in the brewing technology.

Consumer preferences are also being transformed by the proliferation of direct-to-consumer sales channels, from e-commerce applications to home-delivery platforms, to even subscription services.

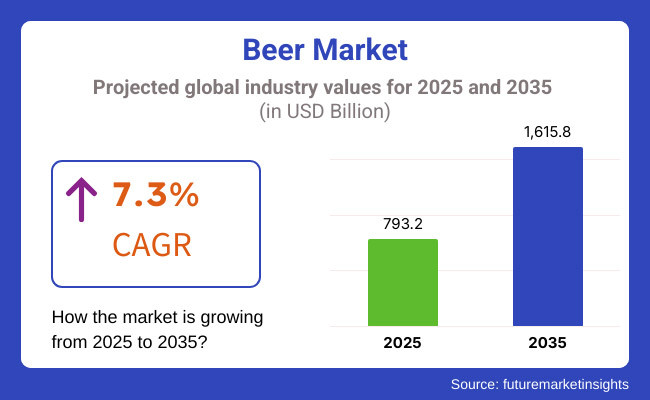

In 2025, the Beer market was valued at around USD 793.2 Billion. And USD 1,615.8 Billion by 2035, expanding at a CAGR of 7.3% during the 2025 to 2035 period. Market Dynamics Key Drivers and Challenges in the Craft Beer Market the key drivers for the market are the growing prevalence of craft and specialty beers, increase in global beer consumption, and escalating investments in sustainable brewing process.

Coalescing with the aforementioned developments, increases in AI-powered production efficiencies, sustainable packaging characteristics, and deepened consumer engagement practices all contribute to the growing expansion of the market as a whole. In addition, the introduction of numerous alternative beer products such as organic and gluten-free beer, is greatly influencing market penetration and adoption among consumers.

Explore FMI!

Book a free demo

Among several other factors that highlight North America as a leading beer market, craft beer culture is one of the most influential retrospectives, aided by high consumer spending on alcoholic beverages and major investments in brewing technology innovation.

The USA and Canada are at the forefront of developing and commercializing these next-generation beer products, such as ultra-low calorie and plant-based beers. The rising adoption of sustainable brewing practices and an increase in government initiatives promoting responsible alcohol consumption are driving market growth.

In addition, demand for new styles of beer, such as hazy IPAs and barrel-aged versions is propelling product development and the adoption of barrel technology.

Demand for traditional and premium beer varieties is driving Europe’s market along with government regulations promoting sustainability in brewing and advancements in alcohol-free beer production. Germany, Belgium, and the UK are - developing the high-quality, craft, and specialty beers.

The increasing focus on reducing carbon emissions in brewing operations, enhancing brewing efficiency and expanding microbrewery operations is also fueling market adoption. Furthermore, the growing functions of e-commerce and digital marketing in the selling of beer are opening up further opportunities for both breweries and retailers.

Beer consumption has also been on the rise with the Asia-Pacific region emerging as the fastest-growing beer market, fueled by rising disposable incomes, increasing social acceptance of alcohol consumption, and growing investment in the hospitality industry. To address the changing consumer trends in the region, China, India and Japan are investing significantly in the R&D of new beer products.

Increasing number of craft beer breweries along with urbanization and elevation of government support for beverage industry are driving regional market expansion.

Moreover, the rising beer consumption at bars and restaurants, along with social events, is further propelling the demand for beer in the market. Additionally, the presence of local brewing giants and the collaboration with international beer brands are also driving the overall market growth.

The market in Latin America is expanding with steady growth thanks to a growing demand for premium and craft beers, increasing beer tourism, and increasing investments in the foodservice sector. This is especially the case in Brazil and Mexico, who have been leading much of the way in working to increase access to premium beer styles in both commercial and residential settings.

Growth in the market is also supported by the incorporation of local brewing practices, inexpensive production processes, and promotional efforts for beer-related events. Besides, the emergence of regional microbreweries, beer festivals, and growing consumer inclination for specialty beer flavors are enhancing product availability throughout the region.

The Middle East & Africa region is getting to have its own share of the Beer market, and is witnessing increasing investments in premium beer distribution, tourism, and hospitality lines. These efforts, spearheaded by the UAE and South Africa, focus on increasing product accessibility and technological advancement in this segment.

Emerging places where non alcoholic and halal certified beers are available, increasing consumer demand for premium beer experiences, and collaborations between domestic and international beer producers are other factors that will further promote the growth of beer market.

Long-term growth of the industry is also aided by government policies pushed by nations across the world towards sustainable brewing, technological advancements in alcohol-free beer manufacturing, and changing consumer attitudes of social drinking culture. The growing presence of luxury hotels and international beer brands is also driving beer consumption in the region.

In general, the Beer industry is expected to achieve moderate growth in the next 10 years as breweries continue to innovate with brewing methods, move toward sustainable sourcing of ingredients, and digital marketing.

To gain functionality for mix and match convenience, as well as longer-term success, businesses are focusing on innovation in beer style, eco-friendly production processes and personal marketing strategies. In addition to this, the shift in penetration and consumer preference for craft and specialty beers, digitalization of alcohol retailing as well as changing consumption trends are changing the future of this industry.

Brewing automation powered by AI, coupled with supply chain monitoring powered by blockchain, means production processes are continuously optimized, and good beer reaches thirsty people all over the world.

Challenge

Stringent Regulations and Taxation Policies

Beer software market is constrained by various government regulations by issuing excise duties and age restriction policies on consumption of this product that stabilizes now and then for every region. Taxation policies on alcoholic beverages are one of the major aspects, having an impact on pricing, it plays an important role in how manufacturers and consumers are affected, thus facing constantly fluctuating profit margins.

Additionally, compliance with advertising restrictions, labeling requirements, sustainability mandates, and health warning policies is also intricately complex, as breweries must accordingly modify their packaging and promotional initiatives.

The response to these challenges requires breweries to develop their knowledge of compliance; adjust marketing strategies to fit with the changing landscape; pursue advertising via digital channels; and offer low- and alcohol-free beers that suit the new consumer health landscape.

Rising Raw Material Costs and Supply Chain Disruptions

The Beer market is significantly hampered by fluctuating costs of raw materials such as barley, hops, yeast, and water. Climate change and geopolitical factors create unstable supply chains that affect ingredient availability and quality. Added transportation, packaging and energy costs increase operating costs, forcing brewers to seek cost-effective solutions.

The strain on supply is exacerbated by the rising demand for organic and sustainably sourced ingredients. Breweries can combat cyclical fluctuations in hops and grain prices by sourcing locally, investing in alternative brews, optimizing its supply chain through artificial intelligence and forming strategic partnerships with regenerative agriculture initiatives to fortify itself against future harvest cycles, ensuring resilient, yet sustainable and cost-effective, production processes.

Opportunity

Growth in Craft Beer and Premiumization Trend

Soaring demand for craft beer, boutique brews, and novel flavor profiles hold promise in the Beer market. As consumers demand unique taste experiences, such as artisanal, local and specialty beers, demand for inventive styles will climb. Changing dynamics from microbreweries, brewpubs, and direct-to-consumer sales channels create new signation of business models.

Breweries continuing to innovate, produce limited-edition releases and barrel-aged brews, as well as brews of a variety of styles (sour, smoked, organic) will gain market share, build brand loyalty, and solidify footprints in local and international markets.

Expansion of Low-Alcohol and Alcohol-Free Beer Segment

Demand for low-alcohol and alcohol-free beers is being fueled by health-conscious consumers and a changing regulatory landscape. But advances in brewing technology have improved the way they taste or are made and made them less stereotypical. And the fitness, wellness and sober-curious movements are broadening the potential market for these products.

With a growing number of breweries investing in alcohol-free innovation, opportunities lie in beneficial ingredient advancements, modified brewing for enhanced mouthfeel and partnerships with wellness brands.

As such, marketing campaigns focused on moderation, lifestyle balance, and social inclusivity will increasingly drive growth in this category for our industry by attracting both traditional and non-traditional beer drinkers.

Changes in the Beer market (2020 to 2024) and Future Direction (2025 to 2035) Market Consumption between 2020 and 2024 between 2020 and 2024, the demand for craft and premium beers in the Beer market. Challenges such as inflation, a shift in consumer preferences, health trends, and challenges in the global supply chain impacted overall market growth.

To counteract the effects of the pandemic breweries diversified their products, focused on ingredient procurement, expanded e-commerce reach, and used digital marketing to increase direct sales, consumer engagement, and brand exposure to overseas markets.

Over the next 5-15 years from 2025 to 2035, we can expect to see further brewing technology innovations, AI-powered customization of flavor profiles, and blockchain systems verifying the transparency of ingredient sourcing and distribution plans.

Sustainability will be central to this vision, with breweries ensuring carbon-neutral production, conserving water, creating biodegradable packaging and cutting their own emissions. The emergence of smart beverage dispensers, personalized beer experiences, and hybrid beer styles blending traditional brewing with modern innovations will reshape the market.

Innovations like automated brewing systems, AI-assisted fermentation monitoring, and regenerative agricultural practices will lead to higher efficiency, lowered environmental impact, and increased sustainability of the beer industry in the long-term.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter taxation and advertising regulations |

| Technological Advancements | Growth in automation and quality control systems |

| Industry Adoption | Increased demand for craft and premium beers |

| Supply Chain and Sourcing | Dependence on traditional hop and barley suppliers |

| Market Competition | Dominance of legacy brewers and craft beer expansion |

| Market Growth Drivers | Popularity of unique flavors, premiumization, and social drinking culture |

| Sustainability and Energy Efficiency | Initial steps toward eco-friendly brewing processes |

| Integration of Smart Monitoring | Limited use of AI in brewery operations |

| Advancements in Beer Innovation | Experimentation with barrel aging, fruit infusions, and unique hops |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-driven compliance monitoring, standardized global regulations, and incentives for sustainable brewing |

| Technological Advancements | AI-driven brewing, personalized flavor engineering, and blockchain-enabled ingredient traceability |

| Industry Adoption | Widespread adoption of alcohol-free, hybrid, and functional beers |

| Supply Chain and Sourcing | Expansion into sustainable and alternative ingredients, regenerative farming, and climate-resilient crops |

| Market Competition | Rise of direct-to-consumer breweries, smart brewing startups, and beverage-tech collaborations |

| Market Growth Drivers | Sustainability-driven production, consumer-driven innovation, and AI-enhanced brewing efficiency |

| Sustainability and Energy Efficiency | Full-scale adoption of carbon-neutral brewing, water recycling, and biodegradable packaging |

| Integration of Smart Monitoring | Real-time fermentation monitoring, predictive quality analytics, and AI-based inventory optimization |

| Advancements in Beer Innovation | Expansion into bioengineered yeast, hybrid fermentation methods, and AI-designed flavor profiles |

The Beer market in the USA is the largest of its kind, thanks to a vibrant craft beer scene, strong demand for premium and flavored beers, along with a rising preference for low-alcohol and non-alcoholic beer options. The presence of large breweries and small craft beer producers are still propelling the market growth.

Continued consumer preference for locally brewed beers, new brewing techniques, sustainable production methods are some of the other factors driving the market growth. Moreover, the adoption of advanced brewing analytics driven by artificial intelligence, digital marketing solutions, and direct to consumer (DTC) sales of beer is improving product access and customer engagement.

People are demanding better, and companies are catering with organic, gluten-free, and health conscious beer alternatives. Continued growth in the USA market is also being driven by the growing popularity of seasonal and limited-edition craft beers, beer tourism and brewery experiences. Additionally, the rise of brewery collaborations and experimental brewing methods are producing unique flavor profiles that are attracting a diverse consumer audience.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

With its well-established pub culture, growing popularity of craft and premium beers, and the introduction of alcohol-free beers, the United Kingdom is an important market for beer. The emergence of new microbreweries and creative brewing styles is leading to increased demand, too.

Market growth is aided by supporting government regulations on responsible alcohol consumption, as well as growing interest in sustainable brewing practices. In addition, newer beer flavor profiles such as fruit-padded and botanical drinks are becoming highly popular due to the fermentation methods.

Companies are also spending money on recyclable packaging and carbon-neutral brewing processes to help meet sustainability goals.

This is further supported by the growing consumer trend of purchasing canned craft beer, services delivering home beer, and consumer interaction with breweries through digital channels, leading to increased market growth in the United Kingdom. Beer subscription services and direct-to-consumer marketing are changing how consumers find and enjoy craft and specialty beers.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.1% |

In the European Beer market, Germany, France, and Italy dominate, having derived benefits from an established brewing tradition with high per capita beer consumption and a growing demand for craft and specialty beers.

It owes to the European Union’s concentration on producing premium beer along with the great investments in organic and localized elements alongside fast-paced growth within the market. Moreover, adopting AI-powered brewing automation, sustainable packaging solutions, and low-alcohol beer alternatives are enhancing product diversity.

Demand for innovative beer offerings is being driven by the increasing popularity of homebrewing trends, and the existence of beer festivals, and direct-to-consumer online beer sales.

The expanded range of hybrid beer styles, fusing both traditional and modern brewing techniques, also plays a role in driving higher consumer engagement throughout the EU market. Plus, the move towards sustainability has translated to more solar powered breweries and water efficient brewing processes.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.2% |

Japan Beer Market is forecast to grow at a compound annual growth rate of 1.61% during the forecast period. Market growth is also being driven by the rising demand in restaurants and retail outlets of craft and specialty beers.

With its emphasis on technological development and the application of AI brewing methods and precision fermentation, the country is an innovation hotbed. In addition, stringent government laws surrounding alcohol production and distribution are motivating manufacturers to produce quality locally brewed beer options.

The demand for such health-oriented beverages is a driving force for further growth in Japan’s beverage market, with functional beers infused with drinks containing health-benefiting ingredients like probiotics and collagen becoming increasingly popular.

Beer pairing experiences and artisanal brewing collaborations are also reflecting changes in the overall market landscape. Moreover, the introduction of sake into beer and fusion brewing methods are drawing in a generation of adventurous beer drinkers.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.4% |

With an ever-changing drinking culture, growing interest for premium and imported beers, and the increasing popularity of craft breweries in South Korea, the country is set to become a critical market for beer.

The market growth is due to robust government regulations, which encourage responsible alcohol consumption and increasing acceptance of Artificial Intelligence-powered brewing systems. What’s more, the country’s investment in improving the quality of beer with small-batch brewing methods, unique flavor profiles and nitrogen-infused beers is raising competitiveness.

Market adoption is further supported by the growing popularity of beer delivery solutions, home consumption trends, and beer-based social experiences. Such beer alternatives are also booming as health conscious consumers enjoy the results.

Korean craft beer is expanding into international markets, and K-culture is going global, affecting beer branding.” In addition, domestic breweries working in tandem with international beer brands are innovating beer flavors and packaging designs that appear more tailored to the international market, bringing South Korean beer into the reach of international consumers as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.6% |

The Beer market is classified into product type, with ale, lager and stouts being the prominent segments. Ale is characterized by its fuller flavors and warmer fermentation temperatures, which has positioned it as the darling of craft beer drinkers and microbrewers alike. The growing popularity of specialty and seasonal ales is expected to drive market growth, particularly in North America and Europe.

With its clean and refreshing profile, Lager continues to be the most popular beer type globally. Big breweries are also launching low-calorie and light lager, targeting health-minded consumers. Stouts have long been known for their dark, rich flavor and creamy mouthfeel-now they're gaining ground with customers hunting for craft and specialty beers. And its allure is further boosted with the rise of nitro-infused stouts and barrel-aged varieties.

Beer is sold in a variety of packaging formats: cans, bottles and large, glass containers, among others, each appealing to different customer sets. Canned beer has become more popular because of its lightweight, longer shelf life, and recyclability. Craft breweries are jumping on the canning bandwagon because they are convenient and preserve flavor better than bottling.

Glass bottles are a traditional packaging option that continues to be very significant in market especially for premium and imported brands of beer. Rising demand for returnable and sustainable glass bottles is also contributing to market growth.

The commercial brewery industry is focusing on growlers and refillable reusable beer containers for selling their products in glass packaging to attract consumers who are seeking environmentally sustainable products as well as fresh draft beer experience at home. Resealable and nitrogen infused containers; the market is currently influenced by consumer interest for advanced packaging solutions.

Beer is produced in macrobreweries, microbreweries, and craft breweries, each of which supports different consumer demands. Macrobreweries account for most beer sold around the world, so they use mass production and widespread distribution to provide a stable and cheap product. Many breweries are looking to grow in the low-alcohol and flavored beer space as consumer tastes change.

Microbreweries, with their specialty small-batch beer production and local appeal, are feeding increasing demand for varieties of beer that are unique to that region. The rise in microbreweries globally speaks to consumer demand for locally brewed and experimental beer flavors.

Small brewers have followed suit, challenging the market with a focus on artisanal processes, all-natural ingredients, and experimental brewing techniques. Due to the rising consumer preference for craft beer and its premium placement, craft brewers have been inclined to distribute widely outside of their niche markets.

There are two distribution channels through which beer reaches consumers indirect and direct beer distribution channels, both are essential for growing the beer market. Brewery-owned retail outlets, such as taprooms and brewpubs, enable brewers to foster direct engagement with their consumers, which helps build brand loyalty and enables offering different beer variants exclusive to brewery sale.

Direct-to-consumer is an exciting development that is taking off with subscriptions and brewery memberships. Beer is sold through indirect sales channels, including hypermarkets, supermarkets, convenience stores, specialty stores (i.e., liquor stores), independent retailers (i.e., mom-and-pop stores), and online retailers, that has large shares.

Hypermarkets & Supermarkets: Hypermarkets and supermarkets offer various beer brands to customers with promotional discounts and budget offers. Convenience stores service impulse buyers, and their beer displays are often all grab-and-go for immediate enjoyment.

Specialty Stores that are focused on a variety of premium, imported, and craft varieties attract connoisseurs and niche consumers. Online has become a key channel, providing convenience, variety, and delivery capabilities. Retail continues to be digitalized, and e-commerce beer sales are more popular than ever, leading to ongoing innovation in this sector.

The Brewery market is funded by rising consumer interest in craft, premium, and non-alcoholic beer beverages. Breweries spend on more eco-friendly production while experimenting with taste profiles, in response to evolving preferences. The three buzzwords were low-calorie beers; nonalcoholic alternatives; and eco-friendly packaging solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Anheuser-Busch InBev | 25-29% |

| Heineken N.V. | 17-21% |

| China Resources Beer | 10-14% |

| Carlsberg Group | 8-12% |

| Molson Coors Beverage Company | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Anheuser-Busch InBev | Leading global brewer offering a diverse portfolio of premium, craft, and non-alcoholic beers. |

| Heineken N.V. | Specializes in premium and alcohol-free beers with strong international market penetration. |

| China Resources Beer | Dominates the Chinese Beer market with a wide range of domestic and premium beer brands. |

| Carlsberg Group | Focuses on craft beer innovation, sustainability initiatives, and expansion into emerging markets. |

| Molson Coors Beverage Company | Develops a strong portfolio of traditional and innovative beer brands catering to global consumers. |

Key Company Insights

Anheuser-Busch InBev (25-29%)

Anheuser-Busch InBev tops the Beer market, with an extensive global portfolio, network of distributors, and investments in sustainable brewing technology.

Heineken N.V. (17-21%)

To stand out, heineken gently focuses on premium, alcohol-free beers and innovative marketing strategies.

China Resources Beer (10-14%)

Through domestic brand strength, as well as strategic partnerships, China Resources Beer has a monopoly in the Chinese space, while bolstering its ranks in the international space.

Carlsberg Group (8-12%)

He added that Carlsberg was working towards sustainability by "investing in renewable energy and developing new brewing methods to produce one of the most sustainable beers."

Molson Coors Beverage Company (6-10%)

Molson Coors has diversified its beer portfolio and continues to add craft, flavored, and non alcoholic beers to meet a variety of consumer tastes.

Global and regional brewers with an emphasis on craft beer, specialty flavors, and sustainable production also support growth. Key players include:

The overall market size for Beer market was USD 793.2 Billion in 2025.

The Beer market expected to reach USD 1,615.8 Billion in 2035.

Demand for the beer market will be augmented by increasing consumer adoption of craft and premium beers, increasing trends of social and recreational drinking, rising disposable incomes, increasing brewery innovations and the rising impact of social media and marketing on alcoholic beverage consumption.

The top 5 countries which drives the development of Beer market are USA, UK, Europe Union, Japan and South Korea.

Ale, Lager, and Stouts growth to command significant share over the assessment period.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.