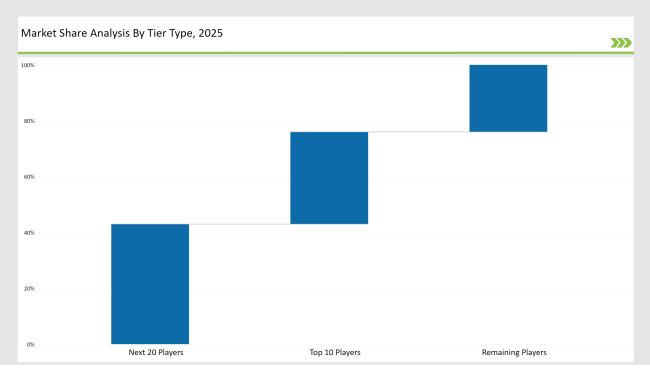

The global beer bottles market is very competitive and fragmented, with companies classified into Tier 1, Tier 2, and Tier 3, based on the market presence and strategic positioning.

Tier 1 players include Owens-Illinois, Ardagh Group, and Verallia, which collectively hold a market share of 33%. They maintain leadership by using sustainable packaging, advanced glass production technologies, and strong distribution networks. Their focus on light bottles, high recycling ratios, and premiumization strategies position them to best serve the world's beer manufacturers.

Tier 2 players make up about 43% of the market-players like Vidrala, BA Glass, and Orora Packaging. Here, the producers focus on region-specific markets with customized beer bottle designs that also cater to microbreweries or large-scale brewery manufacturers. It is a way of staying at par with competitive energy-efficient production processes and improved labeling techniques for these companies.

Tier 3 players consist of regional manufacturers and niche startups, accounting for 24% of the market. They focus on customized, sustainable, and small-batch beer bottle production. Agility enables them to respond to industry-specific needs while competing through innovative design and eco-friendly solutions.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Owens-Illinois, Ardagh Group, Verallia) | 15% |

| Rest of Top 5 (Vidrala, BA Glass) | 10% |

| Next 5 of Top 10 (Orora Packaging, Consol Glass, Heineken Glass, Piramal Glass, Vetropack) | 8% |

The beer bottles market serves industries such as:

Vendors offer specialized products to meet evolving industry needs:

Manufacturers integrate automation and AI-driven quality control to improve efficiency, while sustainability remains a key driver for innovation in the beer packaging industry.

This section discusses the innovators that spearheaded growth in the beer bottles market during 2025. Companies unveiled lightweight glass designs with a more environmental-friendly footprint. Manufacturers began investing in AI-driven quality control to increase the efficiency of their production.

Companies increased their capacity for production as demand for green packaging solutions was on the rise. Businesses introduced smart labeling technologies to improve traceability and branding.

Year on Year Leaders:

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Owens-Illinois, Ardagh Group, Verallia |

| Tier 2 | Vidrala, BA Glass, Orora Packaging |

| Tier 3 | Consol Glass, Piramal Glass, niche startups |

| Manufacturer | Latest Developments |

|---|---|

| Owens-Illinois | In January 2024, launched AI-powered quality control in beer bottle production. |

| Ardagh Group | In March 2024, introduced ultra-lightweight glass beer bottles. |

| Verallia | In June 2024, expanded its returnable glass bottle portfolio. |

| Vidrala | In February 2024, deployed digital printing for custom branding on beer bottles. |

| BA Glass | In July 2024, developed refillable and returnable beer bottle solutions. |

| Orora Packaging | In April 2024, introduced premium embossed beer bottles for craft breweries. |

| Consol Glass | In August 2024, scaled up production to cater to growing beer markets in Africa and Asia. |

The industry is evolving with AI-driven production monitoring, sustainable materials, and customized branding solutions. Manufacturers optimize energy-efficient processes that decrease emissions. Companies invest in returnable bottle systems to support circular economy practices.

Engineers are designing lightweight yet very durable beer bottles to make them more sustainable. Firms improve digital printing to increase the brand's visibility. Emerging innovations will drive further investments in next-generation beer bottle technologies.

Owens-Illinois, Ardagh Group, Verallia, Vidrala, and BA Glass lead the market.

The top 10 players collectively hold about 33% of the global market.

AI-based quality control, digital printing, and returnable bottle solutions drive innovation.

Smart packaging enhances traceability, improves freshness indicators, and allows for interactive consumer engagement.

Sustainability drives the development of lightweight bottles, increased use of recycled glass, and investments in returnable packaging solutions.

Explore Packaging Formats Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.