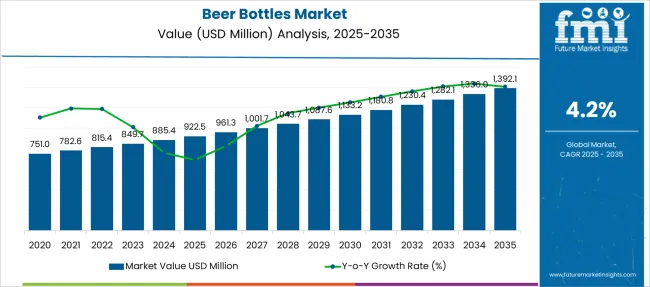

The Beer Bottles Market is estimated to be valued at USD 922.5 million in 2025 and is projected to reach USD 1392.1 million by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

| Metric | Value |

|---|---|

| Beer Bottles Market Estimated Value in (2025 E) | USD 922.5 million |

| Beer Bottles Market Forecast Value in (2035 F) | USD 1392.1 million |

| Forecast CAGR (2025 to 2035) | 4.2% |

The beer bottles market is expanding steadily, influenced by growing craft beer consumption, brand differentiation strategies, and sustainability commitments across the alcoholic beverage sector. Increasing preference for premium and artisanal beers has reinforced demand for durable, aesthetically pleasing packaging formats such as glass bottles.

Regulatory support for reusable packaging, especially in Europe and parts of Asia, is reshaping material choices and encouraging returnable systems. At the same time, breweries are focusing on size standardization and distribution efficiency, which is influencing capacity preferences among consumers and retailers.

Rising consumer awareness around packaging waste and carbon footprints is also driving investments in recyclable materials and lightweight bottle engineering. Looking ahead, digital printing, smart labeling, and automated bottle return technologies are expected to create new value propositions in both traditional and emerging beer markets.

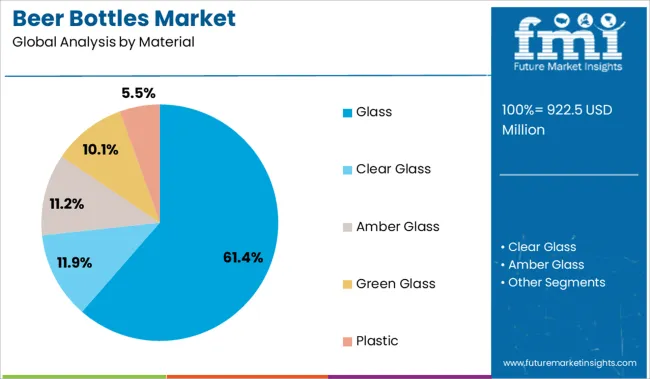

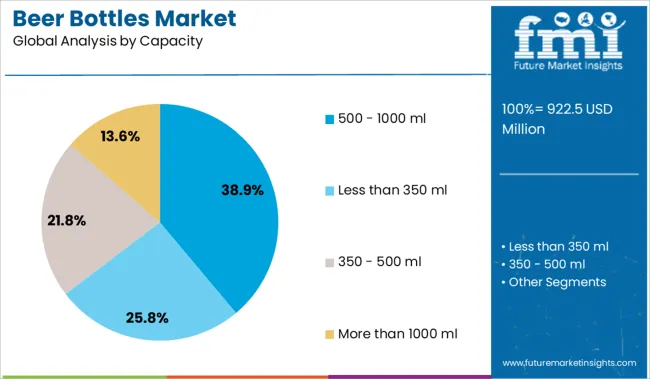

The market is segmented by Material and Capacity and region. By Material, the market is divided into Glass, Clear Glass, Amber Glass, Green Glass, and Plastic. In terms of Capacity, the market is classified into 500 - 1000 ml, Less than 350 ml, 350 - 500 ml, and More than 1000 ml. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Glass is projected to account for 61.4% of the total revenue in the beer bottles market by 2025, making it the dominant material choice. This leadership is being driven by the material’s inert chemical properties, which preserve beer quality by preventing oxidation and flavor contamination.

Glass also supports premium branding through transparency, embossing, and reusable design aesthetics, which resonate with both craft brewers and mainstream producers. Its high recyclability and compatibility with circular economy models have aligned with rising environmental mandates and zero-waste packaging goals.

Moreover, strong infrastructure for glass collection and sterilization in key markets has reduced operational friction, making it a viable solution for refillable bottle programs. As global breweries shift toward sustainable packaging portfolios without compromising product integrity, glass is expected to maintain its leadership.

The 500-1000 ml range is expected to hold 38.9% of the beer bottles market share in 2025, establishing it as the leading capacity segment. This size range strikes a balance between portion control and consumption value, catering to both individual and shared drinking occasions.

Preferred by craft breweries and regional producers, this capacity is often used for limited editions and seasonal batches, aligning with consumer interest in variety and experimentation. Its compatibility with existing filling and capping lines makes it a cost-effective choice for mid-size operations.

Additionally, retail shelf optimization and consumer portability have supported wider adoption of this format. As both on-trade and off-trade channels look to simplify inventory and enhance logistics, the 500-1000 ml range remains a strategic volume segment for brewers seeking differentiation and efficiency.

Beer is the oldest and most widely consumed alcoholic beverage in the world. However, in order to preserve the quality of the beer, an effective packaging solution is needed. The beer bottle has gained vital importance for the packaging of various types of beer.

Beer bottle made from raw material such as glass and plastic which are effective to reduce spoilage from light especially ultraviolet and other external contaminants. Availability of beer bottle in different size and shape have proven to increase retail sales of a beer bottle.

Beer bottle made from glass are the most predominant for beer packaging as they are chemically inert, highly recyclable, durable, hygienic, and offer high security against external contaminations. However, beer bottle made of plastic (Polyethylene Terephthalate) are gaining significant importance for beer packaging due to their light-weight, sturdy, and recyclable nature.

Also, the increasing trend of printing and lamination on beer bottle offers numerous opportunity for manufacturers and brand owner to bolster their brand in the marketplace. Overall, the global outlook for beer bottle market is expected to remain progressive during the forecast period.

Numerous market trends influencing the beer bottle market for packaging applications, but consumer preference for hygienic, sustainable, and premium products remain at the top. Although plastic has made significant headway into some of the glass’s traditional market, glass container acceptance is still rising in alcoholic beverage packaging industry.

As per the Glass Packaging Institute (GPI), over 95% of beer and wine consumer across Europe and USA are preferred to consume their drink packed in a glass bottle. As consumer believed that glass provides a truer taste by preserving the quality of the beverage. It appears as vital factors for the growth of global beer bottle market during the forecast period.

Growing number of individuals are consuming beer across the globe, owing to the perception that it relaxes state of mind. Changing lifestyles, the influence of social media and Internet, and increasing social parties are also expected to increase the sales of beer bottle across the globe.

Also, a growing urban population coupled with factors such as rising disposable income, modernization, and a growing preference for beer is expected to fuel the growth of the global beer bottle market during the forecast period.

The increasing popularity of beer around the world and rapid expansion of bars clubs, and lounges have started in the recent past especially in developing nations are foreseen to drive the growth of global beer bottle market throughout the forecast period. However, the increasing usage of metal cans over beer bottle is expected to hamper the growth of beer bottle market during the forecast period.

However, in order to spark the consumer interest, many beer bottle manufacturers are focusing towards the high-quality bottle manufacturing. Which is expected to create an optimistic outlook for the growth of global beer bottle market during the forecast period.

The Asia Pacific excluding Japan (APEJ) is expected to dominate the global beer bottle market accounting largest market share. Large urban population, modernization, and growing disposable incomes led to the consumption of beer in this region which in turn expected to fuel the growth of beer bottle market during the forecast period.

China remains dominant in terms of market share of beer bottle market, while India is expected to be highly attractive in terms of growth rate during the forecast period. Western Europe is expected to follow the APEJ region in terms of beer bottle market size during the forecast period.

Beer is the most consumed alcoholic beverage in this region is likely to create significant demand for beer bottle market during the forecast period. The beer consumption per capita in countries such as the Czech Republic, Austria, Germany, and Poland are very high which expected to create a substantial growth opportunity for beer bottle market during the forecast period.

The beer is the most popular alcoholic beverage in North America which accounts for nearly 80%. High consumption of beer in North America region is likely to fuel the growth of beer bottle during the forecast period. The United States will remain the largest market for a beer bottle, while Canada is expected to register a notable growth rate of beer bottle during the forecast period.

Examples of some of the key players operating in the global beer bottles market are:

Some of the key trends are observed among the beer bottle manufacturers are listed below:

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides an in-depth analysis of parent market trends, macroeconomic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global beer bottles market is estimated to be valued at USD 922.5 million in 2025.

The market size for the beer bottles market is projected to reach USD 1,392.1 million by 2035.

The beer bottles market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in beer bottles market are glass, clear glass, amber glass, green glass and plastic.

In terms of capacity, 500 - 1000 ml segment to command 38.9% share in the beer bottles market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights for Beer Bottles Providers

Beer Fermenter Market Size and Share Forecast Outlook 2025 to 2035

Beer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Beer Dispensers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beer Pasteurization Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beer Glass Chillers Market Size and Share Forecast Outlook 2025 to 2035

Beer Packaging Market Size, Share & Forecast 2025 to 2035

Beer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beer Keg System Market Forecast & Outlook for 2025 to 2035

Beer Dispensing Machine Market Trends - Growth, Demand & Analysis 2025 to 2035

Beer Bottling Kit Market Insights by Equipment, Application, Mode of Operation, Distribution Channel, and Region 2025 to 2035

Beer Line Cooling System Market Trend Analysis Based on System, Application, and End-Use, and Region 2025 to 2035

Beer Filter System Market insights by Equipment Type, Type, Filtration Process, Application, and Region 2025 to 2035

Beer Line Cleaning Kit Market Trend Analysis Based on Product, End-User, Type, and Region 2025 to 2035

Assessing Beer Canning Machines Market Share & Industry Trends

Competitive Overview of Beer Glassware Market Share

Beer Brewing Machine Market

Beer Cans Market

PVPP Beer Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Root Beer Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA