The global beef flavors market primarily and aggressively grows between 2025 and 2035 as it constructs the landing of tasting ingredients into several street borne snacks, and fast, and harmony, cuisine and flavors taste as food ingredients in several ready-to-eat meals, street vending products, and fruits taste in cooking.

Beef flavors are used broadly in seasonings, soups, sauces, snacks and frozen meals to increase flavor and aroma. Market growth is favored by the increasing consumer demand for meat-based flavors as well as developments in the formulation and extraction technologies for the flavor. Additionally, the variety of plant-based and clean-label beef flavor alternatives is driving further innovation in the industry.

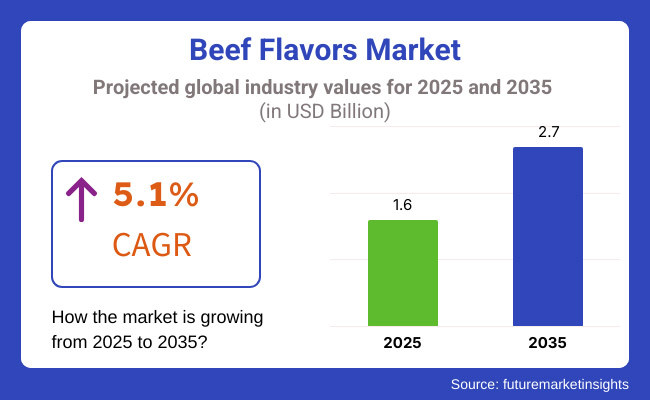

The Beef flavors market was valued at USD 1.6 Billion in 2025. It is expected to be USD 2.7 Billion by 2035, at a compound annual growth rate (CAGR) of 5.1%. Market drivers for this market include: ongoing research for natural flavor enhancers, augmented demand of protein based diets, increasing investments for food innovation and reinvestments.

Additionally, the adoption of novel processing techniques, sustainable sourcing of ingredients, and increased consumer awareness are also aiding market growth. Besides that, the development of non-GMO, allergen-free and organic beef flavors is a major factor enhancing market penetration on consumer acceptance.

It very much is the case that North America is a leading market for beef flavors, buoyed by a robust food processing sector, strong consumer interest in savory, umami taste experiences and high levels of investment in flavor development. Next generation solutions for the beef flavoring industry (including plant based products) are being innovated in treatment of beef in the USA and Canada.

The market growth is attributed to the rising use of natural and clean-label flavors coupled with regulatory initiatives promoting food safety and transparency. The high demand for convenience foods and restaurant-style meal replacements is also pushing the development and uptake of products.

By expanding the European market, these trends come together to create an environment in which an offering like a natural flavors molecule can thrive; with the demand for authentic, premium-quality beef tastes growing, regulations encouraging government pressured clean-labeling to ride on the tails of the next culinary innovation.

Germany, France and the UK are working on sustainable, non-GMO and allergen-free beef flavor for different food applications. Key trends supporting market adoption include the increasing focus on regulatory compliance, ethical sourcing, and transparency within food production.

The expanding applications in gourmet food, plant-based meat enhancers, and hybrid protein products are also creating opportunities for the manufacturers.

Beef flavors are particularly thriving in the Asia-Pacific region, outpacing growth in other regions of the world due to increased urbanization, growing disposable income, and consumers looking to experience bigger and bolder flavors in their food. China, India, and Japan are making significant investments in the research and development of cost-effective and high-impact flavoring solutions.

The rise of quick-service restaurants, packaged foods, changing culinary tastes, and government programs promoting food innovation are all contributing to regional market growth.

Additionally, rising application of beef flavors in convenient foods, snacks seasonings, and instant meal solutions is propelling market penetration. The domestic flavor creating sectors and collaboration with international food brands provide cues for market growth.

Increasing awareness of the benefits associated with premium flavoring solutions, the high demand for processed meat products, and growing investments in the foodservice sector will result in steady growth in this market in Latin America. Brazil and Mexico are significant suppliers, aimed at increasing the availability of beef flavor notes of high quality to traditional and modern cuisines.

The application of local taste preferences, economical production techniques, and promotional events for flavor-enhanced foods are also propelling market growth. The rapid emergence of food manufacturing hubs in all corners of the world, as well as greater investment in agricultural research and development, are also making products more accessible throughout the region.

Beef flavors market in the Middle East & Africa has been gradually growing with significant investments in food processing, flavor development, and culinary tourism. This sector is being led by the UAE and South Africa, both of who are driving increased product availability and technological advances.

Market in the forecasted period is also bolstered by the demand for Halal-certified ingredients, the growth of meat-based flavoring solutions, and collaboration between international and local manufacturers.

Moreover, government policies supporting clean-label food ingredients and advances in alternative protein flavoring technologies are likely to sustain long-term industry growth. Beef flavor enhancers are also benefitting from the rising popularity of Western cuisine and fast-food chains in the region.

The utilization of our developments in flavor extraction technologies, sourcing of sustainable ingredients and innovative culinary uses will lead to a growing Beef flavors market via a steady annual increase for the next ten years. Aimed at providing better market application and long usability, companies are emphasizing innovation in taste enhancement, natural ingredients development and strategic collaborations.

The future of the industry is also being shaped by growing consumer interest in gourmet and convenience foods, digital integration in flavor production, and changing dietary preferences. This is further boosting the production efficiency and quality standards in the taste manufacturing with the infusion of AI-based formulation processes, and precise fermentation solutions.

Challenge

Rising Costs of Raw Materials and Production

The retail level price in the Beef flavors market is affected as well because of the rising cost of raw materials including beef extracts, natural flavoring agents, and different processing ingredients. In addition, fluctuating meat prices, disruptions in the supply chain, and stringent quality standards contribute to the production costs.

The sustainable debate around raising beef makes for allocating more resources than necessary for the operation, thus investing in other alternative protein sources. Surging costs of transport and energy compound the blow to profitability.

Facing these challenges, companies need to look at low-cost sourcing strategies, alternative plant-based flavoring solutions, sustainable meat processing, and the operational efficiencies offered by automation, waste reduction technologies, and AI-based supply chain optimization.

Regulatory Compliance and Clean Label Demand

However, stringent food safety regulations and increasing consumer demand for clean label products present challenges to the Beef flavors market. Since many consumers are looking for food that contains no artificial additives, preservatives, and genetically modified ingredients, this requires manufacturers to develop new flavoring solutions.

It makes product development much more complex when global food safety compliance, like FDA, EU food laws and organic certification requirements are required. Transparency regarding ingredient sourcing and ethical treatment of animals is becoming a hot-button issue.

In order to solve this societal problem, organizations or companies will have to focus on R & D for natural, organic, allergen-free beef flavor alternatives, and tracking of the source, establishment of AI-based tracking of the suppliers for quality control, in order to meet the expectations of the regulatory authorities and consumers.

Opportunity

Growth in Plant-Based and Alternative Protein Markets

Increase in demand for plant-based meat is anticipated to offer lucrative opportunities for the growth of beef flavors market. With an increasing number of consumers following vegetarian, vegan and flexitarian diets, there is growing demand for true-to-beef flavor profiles from heightened protein alternatives.

As hybrid meat becomes more the default and planet-based foods become more popular, they drive demand for new flavor solutions. This growing market segment will benefit companies that develop fermentation-, yeast extract- and natural umami enhancer-derived plant-based beef flavoring solutions.

The services will also be able to cater for product applications in alternative protein companies, biotech companies and food scientists, expanding product applications in meat substitutes, snacks, ready-to-eat meals and functional food formulations.

Expansion into Emerging Markets and Foodservice Industry

Emerging regions are motivated by the global proliferation of QSRs, processed food industries, and convenience foods, all of which stimulate for beef flavors. Higher countries of processed meat products, instant soups, sauces, seasonings, and frozen meals have now come in to Asia, Latin America, and Africa.

Furthermore, the increasing focus of the foodservice industry on improving taste profiles coupled with premium product offerings and convenience-driven formulations offers new revenue prospects.

These high-growth regions will benefit from companies investing in localized flavor profiles, culturally adapted formulation and halal or kosher-certified flavors, as well as developing mutually beneficial agreements between food manufacturers and restaurant chains.

Beef flavors Market Trends 2020 to 2024 and Forecast 2025 to 2035 The growing demand for processed and convenience foods, the rise of plant-based meat alternatives and the progress in food technology over the period of 2020 to 2024 will drive the beef flavors market.

Nonetheless, several factors, including volatile meat prices, clean label preferences, regulatory hurdles, and changing consumer preferences affected market conditions. In response, brands launched clean-label beef varieties, expanded their plant-based lines, invested in sustainable processes and AI-powered food science innovations to meet changing consumer requirements and industry shifts.

From 2025 to 2035, none of the competing products in terms of meat will strictly rely on meat sourcing, increasing the degree of acceptance of flavor production driven by AI, fermentation beyond A1-based technologies. Environmental issues will help push the movement towards carbon neutral production processes, eco-conscience sourcing, and ethically grown components.

The combination of personalized nutrition, AI, to the flavorings and digital consumers is bringing food manufacturers closer to new standards of beef taste by addressing specific dietary requirements and preferences of people, introducing a new era of tailored food experiences on the shelves and in the restaurants.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with clean-label trends and food safety regulations |

| Technological Advancements | Growth in plant-based flavoring and fermentation techniques |

| Industry Adoption | Increased use in processed foods and plant-based meats |

| Supply Chain and Sourcing | Dependence on traditional beef extracts and synthetic flavors |

| Market Competition | Dominance of traditional meat-based flavor manufacturers |

| Market Growth Drivers | Rising demand for processed and convenience foods |

| Sustainability and Energy Efficiency | Initial adoption of plant-based and clean-label formulations |

| Integration of Smart Monitoring | Limited use of AI in flavor formulation |

| Advancements in Flavor Innovation | Development of natural umami-rich alternatives |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter sustainability mandates, carbon-neutral flavor production, AI-driven ingredient compliance, and ethical sourcing regulations |

| Technological Advancements | AI-optimized flavor profiling, precision fermentation, cultured meat flavoring, and lab-grown beef flavor compounds for plant-based applications |

| Industry Adoption | Expansion into nutraceuticals, functional foods, protein-enriched products, hybrid meats, and smart food applications |

| Supply Chain and Sourcing | Shift toward alternative protein sources, sustainable umami enhancers, circular economy production, and zero-waste supply chain models |

| Market Competition | Rise of biotech firms, AI-driven food tech startups, fermentation-based flavor innovators, and sustainable ingredient-focused companies |

| Market Growth Drivers | Personalization of flavors, demand for hybrid meat products, functional ingredients, and sustainable ingredient sourcing |

| Sustainability and Energy Efficiency | Widespread use of circular economy principles, carbon reduction strategies, energy-efficient flavor extraction, and regenerative agriculture methods |

| Integration of Smart Monitoring | Full-scale deployment of AI-powered taste prediction, blockchain-based ingredient tracking, digital consumer feedback loops, and machine learning R&D |

| Advancements in Flavor Innovation | Introduction of bioengineered flavors, precision-fermented beef essence, AI-personalized taste customization, and data-driven ingredient development |

The United States holds the highest share for the Beef flavors market, owing to the robust food processing sector of the country, increasing consumer preference for meat-based seasonings, and the growing need for savories in packaged foods. A surge in number of significant food industries and the increased technological proficiency in terms of food flavor augment the market growth.

Increasing demand for both natural and artificial beef flavor, enhanced production methods, and exploration of plant-based substitutes are additional factors driving market growth. Furthermore, AI-powered food formulation and new flavor and seasoning blends are diversifying food and beverage products in food service and retail spaces.

Catering to Format Fracturing: 27% of Consumers Of the consumers who identify as 'committers' in newer things, companies are also focusing on clean-label and organic beef flavors to adapt derivatives to changing consumer preferences.

In addition, the rise of ready-to-eat meals and other convenience foods is also driving the growth of beef flavor profiles in the USA market. In addition, the growing prevalence of protein-rich diets and keto-friendly products is creating demand for high-quality beef flavoring solutions, especially in snack foods and meal replacements.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.4% |

Beef flavors in the UK - a growing market based on gourmet food demand, the growth of fast food and ethnic cuisine popularity Demand is further driven by the rising popularity of meat substitutes featuring authentic flavor profiles.

Rising government regulations in favor of clean-label ingredients and an inherent need for sustainable flavoring solutions are key factors driving market growth. Additionally, technology related to fermentation-based flavor production and umami-rich formulations are on the rise.

Companies also are focusing on culinary-inspired beef flavors designed for premium and restaurant-quality packaged foods. The UK demand for innovative beef flavoring solutions is primarily attributed to growing consumer awareness of high protein-rich diets and meal enhancements.

In addition, the trends of expanding online grocery shopping and home meal kits are also supporting the increasing demand for premium, durable beef flavor solutions across multiple processed food categories.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.9% |

European Beef flavors market is dominated by Germany, France and Italy, owing to its natural cuisine, high demand for processed meat and well organized food manufacturing market.

He adds, “The EU’s push for sustainable food production, along with investments in plant-based & hybrid meat flavors, are driving fast market growth. Moreover, advanced extraction techniques, yeast-based flavor enhancers, and clean-label ingredients support product innovation.

The increasing prevalence of high-protein meal replacements, snack foods and seasoning applications are also contributing to demand for versatile beef flavors.

The growth of international cuisine66 and gourmet food trends also adds to the diversification of the tasting offerings for beef on the EU market. Additionally, plant-based meat producers are adding beef tastes to give their foods a more authentic flavor and increase the chances that they will be appealing to eat.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.0% |

The growth of Beef flavors market in Japan is driven by the strong culinary traditions in the country, the demand for umami-rich seasonings, and food processing technology innovations. The growth is driven by the increasing demand for quality beef flavors in ramen, sauces and snacks.

With optimization of flavors through fermentation-based flavor production and the influence of AI on food analysis, this joint emphasis on technological advancement in the country is creating new levels of innovation. In addition, robust government regulations regarding food safety and an increase in premium product offerings have compelled companies to manufacture high-quality, authentic beef flavors.

Market growth in Japan’s food market is being further propelled by increasing demand for convenience foods, instant ramen noodles, and seasoning mixes. Moreover, the growing usage of beef flavors in alternative protein solutions to create familiar meat taste underlines its current-trend.

AI-based sensory analysis tools are even being implemented, enabling companies to better fine-tune beef flavor profiles to shift future consumer tastes within Japan's food industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

With a dynamic food industry, rising demand for barbecue seasonings and the growing portfolio of processed foods South Korea is fast becoming an important market for beef flavors.

Robust government regulations in favor of food innovation and the increasing adoption of premium flavoring solutions by emerging economies can spur the market expansion. Further, the nation’s drive to boost food texture and palatability by introducing umami-based seasonings and enzyme hydrolyzed beef flavors is boosting competitiveness.

Market adoption is also spurred by demand for beef-flavored instant meals, snacks, and fusion cuisine. To meet changing consumer tastes, some companies are pouring resources into developing flavors with AI and fermentation-derived flavor enhancers.

In South Korea, demand for innovative beef flavor solutions is also further driven up by the booming food delivery services and delivery of gourmet home-cooked meals. In addition, consumers are demanding high-end, restaurant-type flavors within packaged foods, creating a global pressure on companies to produce more complex beef flavor profiles that differ per region according to local taste palettes.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.3% |

Natural beef flavors hold the key as consumers seek clean-label ingredients that deliver true flavor and nutrition. These flavors are created from true beef extracts and natural sources, adjusting protein and amino acid ratios to create the most effective taste profiles for processed foods, soups, sauces and ready-to-eat meals.

The increasing consumer awareness towards natural food ingredients and increasing health-conscious consumer preferences are creating a demand for natural beef flavors in household as well as commercial food production. Emerging natural flavor extraction methods have also improved the long-term stability of these products in addition to their shelf life, further increasing their implementation.

Synthetic beef flavors still account for a large portion of the market territory on account of their affordability and steady flavor profiles. These flavors are commonly found in products of mass food production, such as snacks, frozen meals, and products made by fast food chains.

In the food manufacturing world, USD 5/kg there is still a lot of demand for artificial beef flavors as manufacturers search for cheap substitutes for meat based ingredients; Additionally, flavor science progress such as synthesized beef flavors with enhanced sensory characteristics, which are very similar to regular beef taste, attractive to base consumers and producers.

Beef flavors with bag and bottle packaging solutions have gained significant traction in the market, as they provide the convenience of high shelf life and are suitable for bulk or retail distribution. Bags will be economical storage and transport solutions for powdered and granular beef flavors, which are popular for food manufacturers, commercial buyers, etc.

Using bottles, however, provides superior, long-lasting preservation of liquid beef flavor concentrates, promoting seamless use in a wide variety of foodservice applications and further in mom's kitchen.

The box and jar packaging formats appeal to the premium and specialty product segments, providing advantages such as improved branding and consumer-friendly storage.

(Some pastes are in jars, which make for easy dipping-jars also help keep seasoning blends fresh, allowing for scooping and resealing.) Cans also provide better protection from moisture and contaminants, preserving product integrity longer. Increasing demand for sustainable and eco-friendly packaging solutions has also pushed manufacturers to explore recyclable and biodegradable packaging materials, enabling them to align with changing consumer expectations.

The B2B (Direct Sales) segment continues to be a robust distribution channel, wherein food manufacturers, restaurants, and industrial end users purchase beef flavors in bulk for massive food production.

This approach enables manufacturers to create lasting relationships with food processing businesses, providing a steady supply of their products while offering customized flavor solutions. The increasing growth of the foodservice industry and growing needs for customized seasoning blends have bolstered B2B distribution in the market.

Rising demand for packaged beef flavor products from the consumers is anticipated to drive B2C (Indirect Sales) segment growth in store-based as well as online retailing.

Consumers can choose from numerous beef flavor choices from supermarkets, hypermarkets, and specialty stores for cooking and culinary exploration at home. As integral retail touch points for beef flavor, convenience stores and groceries deliver accessible and affordable solutions for consumers to use in their most common meals.

Moreover, online retailing has also gained traction, offering consumers the convenience of doorstep delivery and a wider assortment of beef flavor products, thus boosting the market growth.

Beef flavors are gaining traction as a vital component in the flavoring of processed food, snacks, and culinary applications due to developing interest for appetizing and umami-rich fixings.

To keep up with changing consumer demands, companies are homing in on natural and artificial flavor innovations, clean-label solutions, and plant-based options. Market Trends: Sustainable sourcing, Non-GMO beef extracts, Technology in encapsulated flavor delivery system.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Givaudan | 18-22% |

| Kerry Group | 14-18% |

| Symrise AG | 11-15% |

| Firmenich | 8-12% |

| International Flavors & Fragrances (IFF) | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Givaudan | Leading provider of beef flavors with expertise in natural extracts and clean-label formulations. |

| Kerry Group | Specializes in authentic, umami-rich beef flavor systems for processed foods and ready-to-eat meals. |

| Symrise AG | Develops innovative flavor solutions, including plant-based beef alternatives and sustainable meat flavor profiles. |

| Firmenich | Focuses on sensory-driven beef flavors, enhancing taste and mouthfeel in various food applications. |

| International Flavors & Fragrances (IFF) | Innovates in encapsulated beef flavors for extended shelf life and improved stability. |

Key Company Insights

Givaudan (18-22%)

Givaudan is a leading player in the Beef flavors market as it invests in extracting techniques, sustainable sourcing, offering a broad portfolio of natural and artificial flavors.

Kerry Group (14-18%)

Kerry Group - Umami-driven beef flavors with a focus on clean-label solutions and innovations in plant-based meat flavors.

Symrise AG (11-15%)

Symrise focuses on sustainable beef flavor production, incorporating alternative protein sources and environmentally friendly processing methods.

Firmenich (8-12%)

Utilizing the latest cutting-edge research in the fields of sensory science and functional flavor compounds, Firmenich elevates beef flavor profiles and drives business success.

International Flavors & Fragrances (IFF) (6-10%)

Out of all these 30 companies selected, IFF is working on encapsulation technology which can help resist moisture and oxygen, making the beef flavor more stable with longer shelf life than before in processed food products.

Innovation has also come from global and regional companies concerned with sustainability, meeting regulatory requirements, and improving sensory experience for beef flavour. Key players include:

The overall market size for Beef flavors market was USD 1.6 Billion in 2025.

The Beef flavors market expected to reach USD 2.7 Billion in 2035.

These macro as well as micro factors contributing to the increasing demand for savory and umami fortified food products, demand for plant-based meat alternatives with real beef taste, growth of processed food industry, and improving technology for flavor enhancement will drive demand for beef flavors market.

The top 5 countries which drives the development of Beef flavors market are USA, UK, Europe Union, Japan and South Korea.

Natural and artificial beef flavors growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beef Fat Market Size and Share Forecast Outlook 2025 to 2035

Beef Concentrate Market Size, Growth, and Forecast for 2025 to 2035

Beef Bouillon Market

Wagyu Beef Market Analysis by Type, End-use, Region and Others Through 2035

Global Organic Beef Meat Market Size, Growth, and Forecast for 2025 to 2035

Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

Grass Fed Beef Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Breakdown of Processed Beef Market Share

Plant-Based Beef Market Size and Share Forecast Outlook 2025 to 2035

UK Processed Beef Market Analysis

Analysis of the USA Processed Beef Market by Product Type, Processing Method, Distribution Channel, Packaging Type and Region through 2035

Analysis of the Europe Processed Beef Market by Product Type, Processing Method, Distribution Channel, Packaging Type and Region through 2035

Asia Pacific Processed Beef Market Outlook - Size, Share & Industry Trends 2025 to 2035

Flavors for Pharmaceutical & Healthcare Applications Market Size and Share Forecast Outlook 2025 to 2035

Flavors and Fragrances Market Analysis by Type, Nature, Application, and Region through 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Food Flavors Market Insights – Taste Innovation & Industry Expansion 2025 to 2035

Pork Flavors Market Analysis by Form, Packaging and Distribution Channel Through 2035

Bacon Flavors Market Size, Growth, and Forecast for 2025 to 2035

Dairy Flavors Market Trends - Growth & Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA