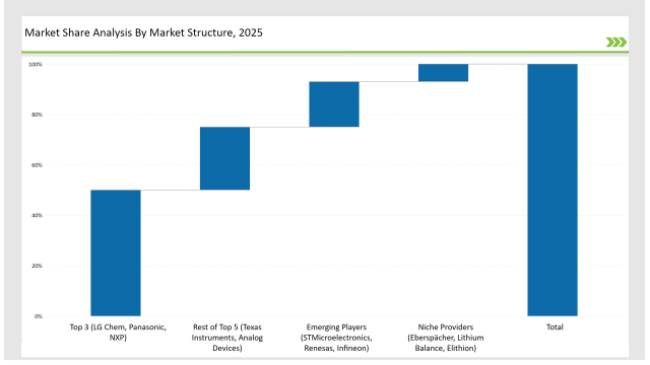

As the need for effective energy storage solutions grows in various sectors, especially in electric vehicles (EVs), consumer electronics, renewable energy storage, and industrial applications, the Battery Management System (BMS) industry is witnessing significant growth. AI-powered battery diagnostics, predictive analytics, and enhanced safety features from leading BMS vendors are facilitating innovation to enhance battery performance and longevity. The top three vendors Texas Instruments, NXP Semiconductors, and Analog Devices hold 50% of the market, focusing on automotive-grade BMS and AI-powered battery monitoring solutions. The rest of the top five Infineon Technologies and Renesas Electronics control 20% of the market, emphasizing modular and scalable BMS solutions for industrial and energy storage applications. Emerging players such as Lithium Balance, Navitas Systems, and Eberspaecher account for 20% of the market, offering specialized BMS solutions tailored for renewable energy, military, and grid-scale energy storage systems. Niche providers, including Midtronics, Elithion, and Nuvation Energy, capture 10%, catering to customized BMS solutions, battery diagnostics, and aftermarket battery management solutions.

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 (LG Chem, Panasonic, NXP) | 50% |

| Rest of Top 5 (Texas Instruments, Analog Devices) | 25% |

| Emerging Players (STMicroelectronics, Renesas, Infineon) | 18% |

| Niche Providers (Eberspächer, Lithium Balance, Elithion) | 7% |

The Battery Management System Market is moderately concentrated, with leading firms controlling between 50-65% of the market. Industry pioneers LG Chem, Panasonic, and NXP set performance and efficiency benchmarks, while high R&D costs and stringent regulatory requirements create barriers to entry.

The BMS market is segmented into Lithium-ion BMS, Lead-acid BMS, Nickel-Cadmium BMS, Nickel-Metal Hydride BMS, and Others.

The market is divided into Centralized, Modular, and Distributed BMS.

With the increasing stringency of energy efficiency requirements, organizations are now incorporating AI-enabled BMS solutions to further streamline operations and reduce energy consumption. AI-driven BMS predictive maintenance allows data analysis in real-time to identify possible failures of equipment before such failure actually happens and reduces operating downtime and costs. Moreover, AI amplifies anomaly detection, thus providing insights into irregularities in energy consumption and operation patterns. Adaptive energy management is another immediate benefit of AI-powered BMS, leveraging from history and real-time conditions continuously to keep energy distribution optimized. As AI-driven BMS solutions do their part in addressing sustainability concerns of industries by maximally optimizing energy consumption, thus reducing overall carbon footprints.

Cloud computing is transforming capabilities related to BMS by way of remote monitoring, higher levels of predictive analytics, and real-time data access. Cloud-connected BMS solutions let facility managers monitor energy usage, equipment performance, and environmental conditions remotely, increasing their capacity for better decision-making and flexibility of operations. Such cloud integration is specially helpful in smart grids, in which energy distribution and load balancing need round-the-clock monitoring and adjustment. The same has recently started being employed in the case of EV fleets to monitor the performance of their batteries, enable efficient charging scheduling, and generally develop better types of vehicles. With increasing cloud adoption, BMS solutions are becoming more scalable and data-driven, providing insights that improve operational efficiencies in a wide range of applications.

High-performance computing and edge computing are becoming an integral part of BMS as industries look toward faster data processing and real-time decision-making capabilities. The BMS has to analyze a great load of sensor information in real-time to manage batteries' performance in autonomous cars for energy efficiency, safety, or other purposes. Similarly, within industrial automation contexts, edge-enabled BMS forms the core method of monitoring energy usage across entire manufacturing facilities. In this scenario, processing of data at the edge allows effective running of these BMS applications in an ecosystem where real time responsiveness is inevitable. With the rise of automation and intelligent energy management systems, further integration of HPC and edge computing into BMS will form the bedrock of smarter and more efficient energy solutions.

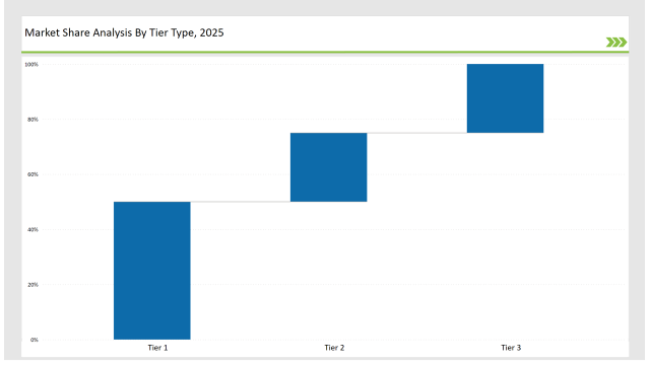

Tier-Wise Company Classification (2025)

| Tier | Tier 1 |

|---|---|

| Vendors | LG Chem, Panasonic, NXP |

| Consolidated Market Share (%) | 50% |

| Tier | Tier 2 |

|---|---|

| Vendors | Texas Instruments, Analog Devices |

| Consolidated Market Share (%) | 25% |

| Tier | Tier 3 |

|---|---|

| Vendors | STMicroelectronics, Renesas, Infineon, Eberspächer |

| Consolidated Market Share (%) | 25% |

Key Company Initiatives

| Vendor | Key Focus |

|---|---|

| LG Chem | Expanding solid-state battery BMS solutions |

| Panasonic | Strengthening EV battery management systems |

| Tesla | Advancing wireless BMS technology |

| Texas Instruments | AI-driven predictive maintenance for BMS |

| Renesas | Developing scalable modular BMS for industrial use |

The Battery Management System market is poised for a significant transformation over the next decade, driven by innovations in AI-powered analytics, blockchain authentication, and enhanced cybersecurity. Vendors will need to invest in smart BMS that leverage machine learning algorithms for real-time data analysis, predicting battery failures and optimizing energy storage performance.

LG Chem, Panasonic, and NXP dominate with a 50% share.

The rise of EVs, renewable energy, and AI-based predictive maintenance.

Automotive, energy storage, and telecom lead BMS adoption.

By ensuring optimal charge/discharge cycles and preventing thermal issues.

AI-driven predictive analytics, wireless BMS adoption, and cybersecurity enhancements

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.