The Battery Electrolytes industry is anticipated to be valued at USD 4.55 billion in 2025. It is expected to grow at a CAGR of 7.7% during the forecast period and reach a value of USD 9.55 billion in 2035, and also experience more technological advances, with solid-state electrolytes continuing to gain prototypes and commercial momentum. The demand for safer, higher-capacity batteries will accelerate the transition from liquid electrolytes to gel, polymer-based, and solid-state alternatives.

In 2024, the market for battery electrolytes underwent some significant progress, predominantly due to the growth of EV usage, the deployment of battery-grade energy storage systems on the grid, and advancements in electrolyte formulations.

Several players in battery manufacturing were boosting their production capacities to meet the demand, and companies were putting money into the development of solid-state and lithium-sulfur batteries. Governments worldwide made major pushes for policy support for clean energy storage, increasing R&D spending, and regulatory changes that would boost battery innovation.

Lithium-ion battery electrolyte chemistries received stepwise performance improvements, such as high energy density and fast charge. At the same time, supply-side constraints on lithium and other essential raw materials somewhat constrained production growth and stirred up short-term price volatility.

The industry will focus on recycling and circular economy programs as manufacturers seek to reduce reliance on rare raw materials. The sector will benefit from enhanced energy densities, lower costs, and sustainable battery chemistry advances beyond 2035, solidifying its role in the global energy transition.

Industry Forecast Table

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.55 billion |

| Industry Value (2035F) | USD 9.55 billion |

| CAGR (2025 to 2035) | 7.7% |

Explore FMI!

Book a free demo

A new study by Future Market Insights (FMI) surveyed key stakeholders such as battery producers, raw material producers, and final consumers. A notable 78% of respondents pointed out an increasing demand for high-performance electrolytes due to the push for longer battery life and faster charging. Solid-state electrolytes were another area of interest, where 65% of industry specialists indicated commercial scalability in the next five years.

Supply chain constraints remain a significant challenge, with more than 60% of respondents citing raw material price fluctuations and sourcing difficulties. Stakeholders highlighted the importance of increased investment in recycling batteries and alternative electrolyte chemistries to decrease reliance on limited resources such as lithium and cobalt. Further, 50% of respondents stated that regulatory policies will have a defining influence on the industry, with a focus on sustainability mandates and standards for battery safety.

When questioned about the future, almost 70% of industry leaders anticipate a boom in strategic partnerships among battery makers, automakers, and energy storage companies to drive innovation. Industry players also highlighted the increasing importance of localized production to counter geopolitical threats and supply chain disruptions.

| Countries | Regulations & Certifications |

|---|---|

| United States | Local battery manufacturing has been incentivized by the Bipartisan Infrastructure Law and the Inflation Reduction Act (IRA). Battery safety standards such as UL 2580 and SAE J2464 guide industry compliance, while the Department of Energy (DOE) continues to push for supply chain localization. |

| United Kingdom | The UK Battery Strategy promotes local production. Industrial batteries need to conform to the UK Battery Regulations (equivalent in the EU) and BS EN 62619. Legislation for Extended Producer Responsibility (EPR) also plays a role. |

| France | France has now instituted the Battery Regulation Act, which has very strict guidelines around recycling once batteries reach end-of-life. A business is consequently required to meet standards for CE marking and the EU Battery Directive (2013/56/EU) to acquire environmental and security standards. |

| Germany | Tight adherence to the BattG (Battery Act) and the EU Battery Passport under the Green Deal For high-energy battery systems, the VDE-AR-E 2510-50 standard is necessary. The standard necessitates the reporting of battery parts' carbon footprint. |

| Italy | The EU Battery Directive applies, and other local recycling rules do. Each battery must pass CE certification, and ECO-Design standards influence electrolyte content for sustainability. |

| South Korea | The K-Battery Strategy focuses on localized production. Main Battery Safety Regulations Battery Safety The KC Certification (KATS) is mandatory for batteries in South Korea according to the Safety Control Act, which includes testing for the safety and performance of battery functions. The government subsidizes R&D on solid-state batteries. |

| Japan | The METI (Ministry of Economy, Trade and Industry) governs battery manufacturing under the PSE (Product Safety Electrical Appliance & Materials) Act. Lithium-ion batteries are subject to JIS C 8712 compliance for the purpose of safety. |

| China | Note that the GB/T 31467 series establishes national standards for EV batteries. There are mandatory recycling laws, and manufacturers must implement China Compulsory Certification (CCC) standards. The Made in China 2025 initiative undergirds domestic battery supply chains. |

| Australia & New Zealand | Recycling is required under the Australian Battery Stewardship Scheme. Batteries will need to conform with AS/NZS 62133 safety standards. Government policies encourage local processing of lithium under the premise of self-sufficiency. |

| India | Producer responsibility for recycling is mandated under the Battery Waste Management Rules, 2022. Safety standards also include BIS (Bureau of Indian Standards) IS 16046. |

The USA battery electrolytes industry will expand at a CAGR of 8.2% over the 2025 to 2035 period, higher than the global average, largely due to an increase in domestic battery manufacturing in the country and the rising adoption of electric vehicles (EVs).

Increased demand for electrolyte manufacturing in North America is driven through tax credits under the Inflation Reduction Act (IRA) for EV batteries produced in the region. Moreover, the industry is witnessing an increase in investments in solid-state battery technology, with Tesla, Quantum Scape, and Solid Power leading the way.

The country is also imposing stricter recycling demands, with the Department of Energy (DOE) supporting efforts to reduce reliance on China-controlled lithium supply chains. Hence, American battery manufacturers increasingly source lithium, nickel, and cobalt from nearby and allied sources, which will ensure long-term stability in the industry for battery electrolytes.

The period of 2025 to 2035 is forecast to show significant growth with a CAGR of 7.5% in the battery electrolyte industry in the UK, primarily due to the desire of the government for localized battery production along with net-zero goals.

The country has committed £1 billion to plans for driving the industrialization of the battery sector, concentrating on lithium refining and advanced electrolyte research. Important regulations, like the UK Battery Strategy and BS EN 62619 safety standards, are impacting the industry by imposing sustainability requirements. Demand for high-performance electrolytes is growing thanks to the likes of gigafactories such as British volt and Envision AESC.

Also helping is the UK government’s 2035 ban on new petrol and diesel cars driving investment into future-generation battery chemistries such as solid-state and sodium-ion batteries, placing the nation as a forerunner in the European industry.

From 2025 to 2035, the use of battery electrolytes is expected to grow at a 7.6% compound annual growth rate in France, owing to battery production plans supported by the government and strict green policies. Compliance with the French Battery Regulation Act and the EU Battery Directive pushes battery makers to focus on eco-friendly electrolyte compositions.

TotalEnergies' Saft and Verkor are investing heavily in lithium-ion and sodium-ion batteries to align with anticipated advancements in performance and electrolyte chemistry. Moreover, France's quest for energy self-sufficiency will only fuel home-refined lithium facilities, reducing reliance on Asian supply chains.

Tax incentives are also being used to encourage behaviors that support a circular economy, while battery electrolyte producers are also being made to incorporate recycling and material recovery into their production lines.

The battery electrolyte industry in Germany is projected to grow at a CAGR of 7.9% over 2025 to 2035, one of the fastest-growing battery electrolyte industries in Europe. Germany’s strong automobile sector, represented by Volkswagen, BMW, and Mercedes-Benz, is helping support demand for high-performance electrolytes. Germany has passed regulations for the EU Battery Passport, requiring traceability and carbon footprint reporting on battery materials.

The National Battery Innovation Strategy also promotes R&D on solid-state and silicon-based electrolytes; BASF and SGL Carbon have made significant progress. Gigafactories like CATL and Northvolt, along with Tesla's Berlin plant in Germany, are driving the demand for electrolytes. Germany is set to become a European hub for next-generation battery electrolytes, with increasing government incentives driving EV battery production.

From 2025 to 2035, the Italian battery electrolytes industry is forecasted to grow at a CAGR of 7.3%, owing to growing demand for EVs and energy storage systems (ESS). Italy has The EU Battery Directive conforms to strict sustainability regulation of battery constituents. The EU Battery Directive provides incentives and allocates grants for domestic battery production, prompting companies like FAAM Energy to invest in high-performance electrolyte solutions.

And Italy’s growing solar sector is boosting demand for grid-scale energy storage, which further encourages the industry. The country is also focusing on recycling batteries, with legislation setting ambitions to boost the recovery rates of lithium, nickel, and cobalt. Overall, Italy is gradually establishing its unique position within the European battery electrolyte value chain.

It is one of the most lucrative industries in the world, with battery electrolyte industries in South Korea projected to witness a healthy pump of 8.5% CAGR during the forecast period from 2025 to 2035. Major players similar to this in South Korea are LG Energy Solution, Samsung SDI, and SK Innovation, leading the way in both lithium-ion and solid-state battery development.

The K-Battery Strategy focuses on local electrolyte manufacturing, thereby reducing China's reliance on imports. The KC Certification (KATS) ensures battery parts are safe and high performing. The government is also pouring substantial investments into lithium refining technology and electrolyte recycling, which could further bolster South Korea as a world battery powerhouse.

Japan's battery electrolytes industry is to capture 7.8% CAGR between 2025 and 2035, owing to advancements in solid-state battery technology and next-gen lithium-ion chemistry. Japan's Ministry of Economy, Trade and Industry (METI) is funnelling money into next-generation battery R&D as part of its push to support cutting-edge companies, including Panasonic, Toyota, and Mitsubishi Chemical.

Moreover, the country has been pursuing the development of safer, non-combustible electrolyte solutions to further extend battery life and prevent thermal runaway risk. With government-sponsored ventures and partnerships with automakers and energy storage companies, Japan is expected to emerge as a global leader in battery innovation.

From 2025 to 2035, China's battery electrolyte industry is likely to grow at a CAGR (compound annual growth rate) of 9.0%, the highest rate in the world, thanks to favourable government policies, large-scale production capacity, and dominant lithium refining capacity.

The Made in China 2025 initiative promotes the development of battery supply chains within China, while the GB/T 31467 standards govern the properties of electrolytes, including quality, safety, and energy density development. The industry leaders in battery-related electrolyte production are CATL, BYD, and Gotion High-Tech, which are all making significant investments in solid-state and high-energy-density lithium-ion batteries.

China is the world’s largest producer of lithium, cobalt, and nickel, enabling a cost-competitive supply chain with reduced reliance on imports. In addition, China is at the forefront of battery recycling and second-life applications, providing a circular economy. With the rise of EVs and energy storage projects, China’s place as an international battery giant will become even clearer.

In Australia and New Zealand, the region's battery electrolytes industry will grow at a compound annual growth rate (CAGR) of 7.1% during 2025 to 2035, driven by increased lithium mining activity, battery recycling programs, and growing energy storage adoption. With a significant lithium supply, large-scale mining in Western Australia underpins global electrolyte and battery manufacturing.

Battery recycling in Australia is registered under the Battery Stewardship Scheme to promote sustainable recovery and proper disposal of battery materials. The same applies to domestic lithium refineries, which aim to establish domestic supply chains and reduce reliance on Chinese processing plants. If the government strengthens support for clean energy policies and local manufacturing of processing capacity, the battery electrolytes industry in Australia and New Zealand is set for steady growth.

The Indian battery electrolyte industry is also anticipated to grow at a CAGR of 8.4% during 2025 to 2035 on account of favorable government incentives, the exponentially emerging electric vehicle industry, and increasing investments in energy storage.

The introduction of the Production Linked Incentive (PLI) scheme is significantly boosting indigenous battery production, with many of the leading international players setting up bases in India to cater to the local requirement through manufacturing factories. The Battery Waste Management Rules (2022), which include strict recycling measures, should also encourage the development of sustainable electrolytes and promote a circular economy.

The rise in solar and wind power projects in India is driving demand for grid-scale battery storage and high-performance electrolytes. Government initiatives and increasing private investments are positioning India as an emerging global competitor in the battery electrolytes industry.

The segment is the largest and fastest-growing for lithium-ion battery electrolytes and is expected to drive the industry between 2025 and 2035. The need for next-generation lithium-ion battery electrolytes stems from the pursuit of high-performance, lightweight, and energy-dense batteries in electric vehicles (EVs) and consumer electronics.

This segment is driven by technological advancements in solid-state and lithium-sulfur battery technologies. The regulatory compulsions toward sustainability and safety improvements has driven investment in non-flammable and high-voltage-stable electrolyte compositions. The lead-acid battery electrolytes industry serves industrial, backup power, and commercial vehicle applications, but despite its economical and recyclable nature, it holds a low market share.

Other chemistries, such as sodium-ion batteries, could also influence industry trends. The others category, category, including flow batteries, is gaining ground for utility-scale energy storage systems, further expanding opportunities for electrolyte manufacturers.

The automotive sector is the largest segment of the global battery electrolyte industry, driven by rising EV adoption and government incentives worldwide. Targets for net-zero emissions and government controls on CO₂ emissions have compelled original equipment manufacturers to invest in long-range, fast-charging, and safer battery technologies that strongly impact electrolyte formulations.

As manufacturers strive for greater energy densities and enhanced thermal stability, the demand for solid-state and next-generation lithium-ion electrolytes, which possess such properties, is expected to grow. The consumer electronics industry is the fastest-growing segment due to the increasing demand for smartphones, laptops, and wearables. Consumers' desire for lightweight, compact, and durable batteries pressures manufacturers to develop high-energy-density and fast-charging electrolytes.

Advances in gel and polymer electrolytes are improving safety and efficiency in consumer electronics. Investments in renewable energy storage and clean power solutions are driving consistent growth in the other segment (e.g., grid-scale energy storage, industrial use).

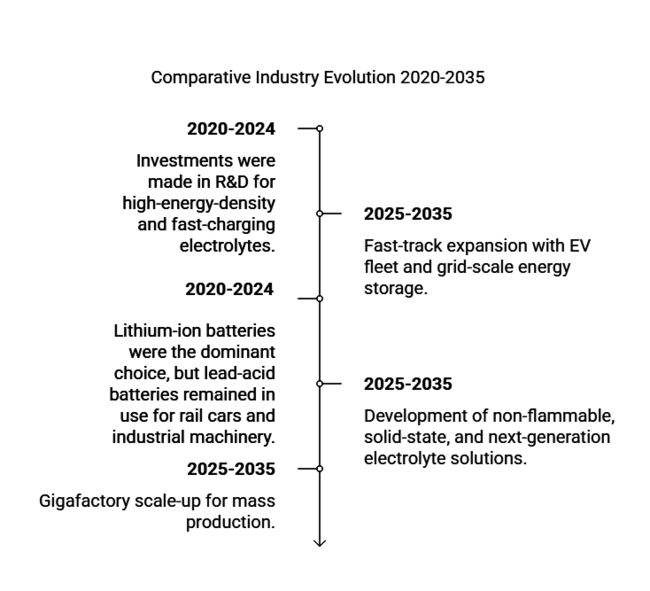

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Between 2020 and 2024, early electric vehicle adoption and energy storage needs drove industry expansion. | The industry is expected to fast-track expansion with an EV fleet and grid-scale energy storage. |

| Lithium-ion batteries were the dominant choice, but lead-acid batteries remained in use for rail cars and industrial machinery. | Lithium-ion batteries have remained dominant, with rapid innovations in solid-state and sodium-ion technologies. |

| They started enacting early regulations and incentive programs regarding battery manufacturing and sustainability. | Regulations became stricter regarding battery safety, recyclability, and local supply chain development. |

| There was heavy dependence on China for battery raw materials and electrolyte production. | By 2025 to 2035, the supply chain is diversifying, with increased production in the United States, Europe, and India. |

| Investments were made in R&D for high-energy-density and fast-charging electrolytes. | Development of non-flammable, solid-state, and next-generation electrolyte solutions. |

| There has been earlier gigafactory activity in key industries. | Gigafactory scale-up across the globe for mass production. |

| Supply chain issues and raw material shortages constrained expansion. | Improved supply chain resilience and focused raw material procurement capabilities. |

Published on Next MTL analytics, the industry for battery electrolytes is part of the advanced materials and energy storage sector, and it has a strong linkage with consumer electronics, renewable energy, and electric vehicle (EV) industries. It functions within the clean energy and sustainable tech sector in a broad sense, which is determined by technology innovation, government regulations, and global supply chain dynamics.

Macroeconomic shifts in industrial policy, energy transformation, and raw material economics are impacting the industry. Increasing trends towards electrification, particularly in power grids and transport, fuel the demand for advanced battery technologies. State subsidies, carbon neutrality targets, and investments in local battery production are shaping industry dynamics, with the EU, the USA, and China leading in developing battery gigafactories.

Price volatility of raw materials, specifically lithium, nickel, and cobalt, significantly affects electrolyte prices and supply. Nations are already diversifying supply chains and exploring alternatives such as sodium-ion batteries to minimize reliance on rare minerals. Inflationary trends and changes in interest rates also impact investment in new battery factories.

But the long term is upbeat, with ongoing innovation in solid-state, high-voltage, and flame-free electrolytes energizing longevity. It is estimated that the battery electrolyte industry will double in size in the coming decade as energy storage becomes a fundamental component of infrastructure.

Key Players in the Battery Electrolytes Industry The battery electrolytes industry is consolidated in nature, wherein a few top players in this industry compete on the basis of pricing, innovation, formation of strategic alliances, and global expansion. Amid growing demand for high-performance electrolytes, companies are focusing on solid-state and high-voltage formulations to gain a technological advantage.

Cost efficiency remains paramount, and companies are optimizing the extraction of raw materials and the localization of production to stay competitive. Mergers, acquisitions and joint ventures with automakers and battery manufacturers build supply chains. Key players are increasingly concentrating on sustainability initiatives, such as recycling and environmentally friendly electrolyte development, to comply with international standards.

BASF SE (Industry Share: ~20-25%)

Having a significant market share in the battery electrolytes industry, BASF is a major global manufacturer in the chemical sector with a strong presence in R&D efforts and strategic partnerships with battery manufacturers.

LG Chem (Industry Share: ~18-22%)

LG Chem, one of the largest players in the battery field, scaled up its electrolyte production in 2024 to meet the growing demand for EV batteries in North America and Asia.

Mitsubishi Chemical Group (Industry Share: ~15-18%)

Mitsubishi (with investments in solid-state electrolytes) and joint ventures with Japan's major automakers helped Mitsubishi Chemical maintain its position in battery electrolytes.

Ube Industries (Industry Share: ~12-15%)

With applications in lithium-ion batteries, Ube Industries is a leading supplier of high-performance electrolytes and will also expand production facilities in 2024.

SoulBrain Co., Ltd. (Industry Share: ~10-12%)

SoulBrain, a South Korean company, specializes in manufacturing electrolyte solutions and has grown in industry share through sound technology and partnerships with EV battery makers.

Guotai Huarong (Industry Share: ~8-10%)

Guotai Huarong, one of China's top electrolyte manufacturers, expanded its domestic and international presence in 2024, driven by rising EV demand and government-backed incentives in China.

Targray (Industry Share: ~5-8%)

Targray, a global battery materials supplier, has prioritized high-purity electrolytes for next-generation batteries, servicing North America and Europe.

The development of advanced battery chemistries like solid-state and sodium-ion batteries has opened up significant opportunities for specialized battery electrolyte chemicals. Increased demand for EV charging infrastructure and grid-level energy storage solutions will fuel these possibilities further.

One is regional supply chain diversification, with governments pushing for onshore battery manufacture to decouple from, or insulate against, China. For instance, a niche in bio-based and fire-resistant recyclable electrolytes is emerging, primarily in Europe and North America. Stricter environmental regulations and circular economy legislation to boost battery recycling also create an industry for making recovered electrolytes.

In conclusion, ongoing efforts by the stakeholders in the research and development of safer, high-energy-density electrolyte solutions would be widely beneficial. Strategic partnerships with material suppliers, energy companies, and automakers will enhance industry competitiveness and ensure supply chain stability.

Companies must secure raw material supply chains through vertical integration or long-term contracts. Expanding into high-growth economies such as India, Southeast Asia, and South America can help offset market saturation risks in mature economies. Lastly, firms should adopt sustainability by implementing recycling-friendly electrolyte formulations to meet the increasing environmental concerns and consumer demand.

Increased EV adoption, energy storage growth, and the development of high-performance batteries are prime drivers.

Companies are creating non-flammable, solid-state, and high-voltage-stable electrolytes to minimize risks and maximize performance.

Automotive, consumer electronics, and renewable energy storage industries dominate use.

Domestic production is supported by regulations, recycling requirements, and research and development grants for next-generation battery chemistries.

Yes, bio-based, water-based, and recyclable electrolyte solutions are on the horizon as environmentally friendly alternatives.

The industry is segmented into lead-acid, lithium-ion and others

It is segmented into automotive, consumer electronics and others

The sector is fragmented among North American, Latin America, Europe, Asia Pacific, Middle East and Africa

Precipitation Hardening Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Polyethylene Terephthalate Glycol (PETG) Market Growth - Innovations, Trends & Forecast 2025 to 2035

Sodium Bicarbonate Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Plywood Market Growth - Innovations, Trends & Forecast 2025 to 2035

Phenylethyl Market Growth - Innovations, Trends & Forecast 2025 to 2035

PP Homopolymer Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.