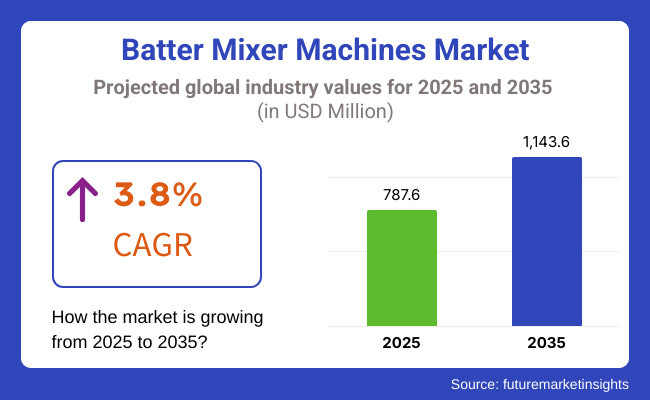

The global batter mixer machines market is expected to grow consistently at a CAGR of 3.8%. The global bakery processing equipment market size is expected to reach USD 787.6 Million by 2025. Aspects such as Automation, energy efficiency, and IoT-enabled smart mixers are they shaping the advancements in the industry. In the coming years, The size of the industry is estimated to reach USD 1,143.6 million by 2035, driven by urbanization, increased disposable income, and the growth of foodservice establishments.

To cater to evolving consumer demands, manufacturers are emphasizing cost-effective, high-performance solutions, ensuring continued expansion of the sector in the years ahead. In 2024, the batter mixer machines industry continued to see consistent expansion due to growing levels of demand from the commercial food service sector, especially bakeries, quick-service restaurants, and confectionary businesses.

Large players have introduced intelligent and automated mixing solutions in recent years, as producers have started embracing IoT-supported monitoring systems to improve efficiency. In addition, local sector trends varied with North America and Europe focusing on high-capacity, premium models, while the Asia-Pacific saw a surge in demand for cost-efficient, space-saving mixer solutions targeted at small companies and domestic households.

As demand for precision and consistency in food production increases, the adoption of AI-driven mixing solutions will continue to gain momentum. Furthermore, growing urbanization, changing nutrition patterns and rising disposable income in emerging economies will continue to enhance sales as innovation and cost-effectiveness will be integral differentiators between competitors.

Explore FMI!

Book a free demo

A comprehensive survey carried out in the batter mixer machines landscape by Future Market Insights (FMI), took feedbacks from some of the key players and stakeholders, like manufacturers, suppliers, food industry expert and retailers.

Key findings from the survey revealed that automation and energy efficiency are top of mind for manufacturers as over 65% of surveyed participants reported pivoting to IoT-enabled smart mixers to improve their overall operational efficiency. Quality of consistent batter, while lower mix time and reduced maintenance cost are the prominent factors on stakeholders mind while deciding to purchase.

Sustainability issues have also raised demand for mixers with better power efficiency and recyclable parts. More than half of manufacturers surveyed said they also had trouble buying high-grade stainless steel and durable food-safe plastics, adding to production costs.

In response, firms are pursuing local sourcing strategies and alternative material innovations - either to preserve profit margins. In addition, regional consumer preferences seen in previous years impacted demand patterns, with North American and European sectors favoring premium, high-capacity machines and Asia Pacific industry showing higher purchase incidence of affordable, compact models ideal for small business and household use.

In 2025 and beyond, stakeholders expect robust growth in the demand for energy-efficient batter mixers as governments encourage the adoption of energy-efficient solutions in industrial food processing equipment. More than 70% of surveyed industry respondents expect AI-led batter mixers, equipped with adaptive speed controls, to open up the segment for high production rates in large-scale food production. In addition, growing health-conscious consumer trends have driven manufacturers to provide precision-controlled mixers that offer uniform texture in gluten-free and organic batters.

| Countries/Region | Regulations Impacting the Industry |

|---|---|

| United States | FDA Food Equipment Standards require food-grade materials and hygiene compliance. The Energy Star Program promotes energy-efficient machinery. |

| European Union | Ecodesign Directive (2009/125/EC) mandates lower energy consumption in food processing equipment. CE certification is required for safety compliance. |

| China | GB Standards for Food Machinery regulate manufacturing safety, while the Made in China 2025 initiative promotes domestic innovation. |

| India | Bureau of Indian Standards (BIS) mandates quality control in industrial food processing equipment. The FSSAI Act ensures hygiene standards. |

| Japan | JIS (Japanese Industrial Standards) set performance and safety benchmarks for industrial food equipment. Energy-saving policies drive efficiency improvements. |

| 2020 to 2024 (Past Trends & Segment Conditions) | 2025 to 2035 (Future Outlook & Projections) |

|---|---|

| Moderate growth with a CAGR of 3.5% - 3.8%, driven by rising demand in food service sectors. | Continued 3.8% CAGR, reaching USD 1,143.6 million by 2035, driven by industrial demand and automation. |

| Early adoption of automated and semi-automated mixers; limited IoT integration. | Widespread use of AI-driven mixers, IoT connectivity, and smart automation for better efficiency. |

| Growth in foodservice sector, increased home baking due to COVID-19, and demand for convenience foods. | Expansion of industrial food processing, sustainability focus, and rising urbanization fueling demand. |

| High demand for compact, affordable mixers for small businesses and households. | Consumers prefer high-efficiency, durable, and multi-functional mixers with smart features. |

| Supply chain disruptions led to fluctuations in stainless steel and food-grade plastic prices. | Improved local sourcing strategies and alternative materials expected to stabilize production costs. |

| North America & Europe focused on premium mixers; Asia-Pacific saw demand for cost-effective models. | India, China, Southeast Asia expected to drive major growth; USA and EU shift toward sustainable solutions. |

| Compliance with basic food safety and hygiene standards; early energy efficiency rules. | Stricter efficiency laws, sustainability mandates, and government incentives for low-power equipment. |

| Dominated by established global brands, with regional manufacturers slowly gaining traction. | Increased competition from new entrants, regional manufacturers, and smart technology-driven innovations. |

Each segmentation have a better insight into the different sector factors influencing the demand for batter mixer machines. In terms of capacity, 20 kg mixers are gaining popularity, especially in medium-sized bakeries and restaurants, due to their compact size, efficient performance, and affordable pricing.

They are in demand in requests for medium-sized bakeries, restaurants, and catering, where maximum output with zero wastage of space is preferable. Conversely, 30 kg mixers cater to large-scale and industrial food processing needs while facilitating effective bulk production.

Commercial bakeries, large confectionery manufacturers, and mass food producers favor these machines. On the other hand, 10 kg mixers are mainly suitable for small bakeries, home-based businesses, and niche confectioners that are looking for smaller and economical solutions. Other capacities, such as 40 kg, 50 kg, and larger models, are available for specialized industrial applications, but these account for a smaller portion of the overall industry.

The bakery segment is expected to dominate in 2025, as a result of the rising demand for cakes, pastries, and other specialty baked products. Additionally, rising consumer demand for artisan, organic, and gluten-free bakery products is helping to drive innovation and the adoption of state-of-the-art mixer technologies.

The restaurant industry is another fast-growing segment since QSRs, cloud kitchens, and fine-dining sectors are looking for utensils that can prepare batter, which can reduce their operation time and food quality. Steady growth in the confectionery segment is also observed on the back of the rising trend of premium chocolates, desserts, and handmade sweets requiring a precise mixing solution.

Other uses include hotels, catering establishments, and institutional kitchens, which need high-performance mixers since they mix food in large quantities. The future of the bakery and foodservice sectors will be shaped by the increasing use of automated, intelligent, and energy-efficient batter mixers. These advancements will help companies improve sustainability, enhance operational efficiency, and ensure consistent quality in food preparation.

The strong food processing industry in the United States drives demand for batter mixer machines. The USA batter mixer machines is currently valued at around USD 89.75 million and it accounts for 38% share of the North American batter mixer machines sectors. The nation’s sprawling network of bakeries, restaurants and cake shops creates a hunger for mixing solutions.

Recently, we are witnessing a trend towards automation and smart kitchen tools, as manufacturers are implementing IoT-enabled mixers in order to increase efficiency and ensure product consistency in the industry. Subjecting to the Environmental regulations and the consumer preferences for sustainable practices, the USA sector also accentuates energy-efficient appliances.

Key players across the United States are concentrating efforts towards research and development toward offering advancement features including programmability to settings along with convenient mechanisms & safety to cater to commercial and upper-class residential application.

The batter mixer machines landscape in the UK is primarily attributed to the country's thriving foodservice sector armed with armed with a tradition of baking culture. Holding around 32% share of the Europe sector, the United Kingdom batter mixer machines industry is expected to is projected to reach a valuation of USD 80.70 million by 2025 and further expand at a steady pace during the next ten years.

A demand that is often overlooked is for mixers that offer precision and versatility, driven by the UK's emphasis on artisan bakeries and specialty confectioneries. An emerging trend, particularly in regions like Europe and North America, is the demand for compact, multifunctional mixers.

These mixers cater to smaller establishments, such as artisanal bakeries and small restaurants, that need space-saving solutions without sacrificing performance. Similarly, the UK businesses are also demanding mixers with lower energy consumption and sustainable designs because of its sustainability commitment. Since the users vary from professional chefs to amateur bakers, manufacturers find it necessary to design ergonomics and a user-friendly interface.

The France boasts a well-defined culinary heritage along with the pastries and baked goods, the batter mixer machines industry is expected to flourish owing to this factor. France’s many pâtisseries and boulangeries rely on mixers capable of producing the delicate textures needed for French pastries. Bakers seem to prefer mixers with10 speed settings and high precision controls, letting them go back down when a recipe calls for it.

The French industry has a lifestyle aspect, looking for aesthetic, beautiful equipment that matches the ambience of French traditional bakeries. And with an expanding interest in organic, healthy line of products, the demand of mixers, that can work with alternative flour and ingredients while preserving consistent quality in specialty products is growing too.

The batter mixer machines market in Germany emphasizes on engineering sophistication and build quality. German bakers and food processing units give preference to tech equipment that have superior performance and durability. Due to its higher safety regulations and efficiency-driven approach, there is a higher demand for mixers with enhanced safety features and automation capabilities.

Drawing on a consistent experience to industrial scale production, Germany is in the lead thus to high-capacity mixers for larger batches. However, the increasing importance of digital controls and connectivity features is also facilitating integration into the smart factory.

Specialized batter mixer machines are in high demand in Italy, considering the country's culinary culture, especially baking and confectionery. Italian bakers and pastry shops also often need machines that can mix all types of doughs and batters, from light cake mixes to denser bread dough.

Many users have a preference for mixers which are versatile and adaptive, with the likes of removable attachments and variable speed settings. Equipment must combine function with an eye for Italian design, a nation that takes pride in style. Moreover, as the industry pivots towards artisanal and organic products, there is an emerging demand for mixers that can maximize the efficacy of natural and unrefined ingredients.

The batter mixer machines sector in South Korea is driven by its dynamic food industry and technological advancements. Cafés and bakeries in the country leaning toward innovative and trendy require mixers that can support new recipes and unique textures. Urban premises with limited capacity are in need of compact and energy-efficient mixers.

Smart technologies are another key trend, with mixers that offer touchscreen controls, operate on precise programmable settings, and have connectivity features to enhance operation. Moreover, since South Korean consumers focus on exterior beauty, they prefer the mixer to have a slim and modern design in different colors which complements their interior décor.

The batter mixer machines segment in Japan is influenced by its culinary precision and technological advancement. Japanese bakeries and bakeries focus on mixers that provide precise control over mixing parameters to ensure consistency in delicate recipes such as mochi and castella.

Mixers with compact designs are in high demand as most modular kitchen spaces in metropolitan cities are small. Brewing in Japan emphasizes quiet operation to minimize machine noise, which is why manufacturers have focused on creating quiet-run mixers.

Besides, the combination of automation features and user-friendly interface suits Japanese technology hysteria, which enables not only specialists, but home mixers to work on this appliance candy without additional complexity or lack of accuracy.

The market for batter mixer machines is being propelled by China's growing food sector, which is witnessing an increasing number bakeries, restaurants and food processing units that all need effective mixing processes. China's batter mixer machines segment is currently valued at over USD 57.86 million and it holds approximately 35% of the Asia Pacific batter mixer machines industry.

A significant move towards mixers on an industrial scale, catering to mass production to serve the needs of a large population. However, Chinese manufacturers are still focusing on producing a variety of affordable mixers, ensuring quality while incorporating advanced mixing technology, which they initially offered only to a select few.

The segment dynamics of automation are also inducing a trend as mixers are equipped with programmable settings and integrations with IoT and sensors to facilitate operations. Moreover, the increasing popularity of e-commerce platforms in China has enabled the distribution and availability of various models of mixers designed for both commercial and household users.

The market can also be attributed to a thriving café culture and increasing affinity towards home baking in Australia and New Zealand. There is a need for mixers that are durable and versatile, appropriate for a commercial environment but also in the hands of a passionate home baker.

Most stand mixers come with multiple attachments and variable speed controls, so users can try out all kinds of recipes, which the segment has responded to. There’s also a growing focus on sustainability, causing consumers to look in mixers for energy.

In 2024, the batter mixer machines market witnessed substantial developments, with prominent companies employing strategic initiatives to solidify their positions. Among all, Jas Enterprises stood out with a diverse portfolio of batter mixer machines for different capacities and applications.

Their diverse product range caters to small to large-scale food preparation units, including models with capacities from 5 kg to 25 kg. Another major player, Maxel, also embraced innovation by offering commercial batter mixers aimed at maximizing efficiency and counter-workspace ease in high-volume food production environments. Their products offer fast blending, consistency, and durability, which are the requirements of commercial kitchen and high volume food processing facilities.

Tactically, Jas Enterprises launched new models with advanced specifications to reel in a wider customer demographic, the report added. Maxel's mixers were designed using cutting-edge technology and advanced research and development.

When looking at product offerings, Jas Enterprises shows versatility with numerous capacities and applications of mixers that can take on all types of batters for khaman, dalwada, idli, dosa, medu vada, pakora, and besan dough. Maxel, in contrast, seems to specialize in high-capacity, commercial-grade mixers with features such as high-speed motors, uniform mixing, and durable construction most appropriate for a commercial kitchen that requires large batches of batter.

| Company | Industry Share / Details |

|---|---|

| JAS Enterprises | Specific industry share; a key player in Asia-Pacific for batter mixers, likely holding 5-10% of the regional food processing equipment due to its focus on bakery machinery. |

| Trident Engineers | Specific data unavailable; strong in India and Southeast Asia, estimated at 5-8% of the regional sectors for small to medium-scale batter mixers. |

| Sri Lakshmi Food Machines | Estimated 25-30% of the South Asian sector for bakery and snack equipment, dominant in India based on regional prominence. |

| Sri Vinayaga Industries | Specific data unavailable; likely 3-5% of the Indian and Southeast Asian sector, focusing on budget-friendly batter mixers for small-scale producers. |

| DIOSNA Dierks & Söhne GmbH | Specific data unavailable; a leader in Europe and North America, estimated at 10-15% of the high-end batter mixing equipment due to automation focus. |

| Hamburg Dresdner Maschinenfabriken | Specific data unavailable; likely 5-10% of the European sector for large-scale food processing equipment, known for innovative solutions. |

| Cargill Incorporated | One of the largest privately held companies, estimated at 12-15% of the global food ingredients sector, with USD 160 billion revenue in FY 2024, per company reports. |

The sector for Batter Mixer Machines is a part of the larger food processing equipment industry, which includes various machinery for bakery and confectionery purposes. For commercial food manufacturing, mixing batter ensures consistency, efficiency, and product quality when making cakes, pancakes, waffles, and other baked goods, are the machines found in these establishments.

Growth of food processing industry across the globe, increasing need for automation, and rising demand for ready-to-eat and convenience foods are some of the factors expected to drive the growth of batter mixer machines sector. The rising demand for high-efficiency mixing equipment will primarily be driven by the growing bakery and confectionery sector, particularly in developing countries.

The anticipated recovery of the post-pandemic economy for hospitality and foodservice sectors has also positively influenced the industry’s growth as bakeries, restaurants, and large-scale food manufacturers are increasingly investing in automated solutions to improve productivity while maintaining quality standards.

The upscale segments of the population, who can afford premium products, also encourage the usage of large-scale mixers with enhanced features to uphold credibility in the food sector, pushing the economy toward the adoption of trendsetters such as IoT-enabled mixers and strict food safety regulations in most developed regions, which is one of the major restraints affecting the global large-scale mixers sectors and leading to the growth of the Industry technologies.

North America and Europe lead in food processing equipment distribution due to their advanced infrastructure, while the Asia-Pacific region is experiencing the highest growth rate, driven by urbanization and rising disposable income. Supply chain flaws and raw material cost fluctuations can restrain the growth, but innovations in sustainable and energy-efficient solutions are expected to drive the future segment boom.

The market for batter mixer machines is expected to experience considerable growth owing to advancements in automation, growth of the emerging economies and changing consumer preferences.

Advancements in Industry solutions, including IoT-enabled mixers and AI-driven quality control, are transforming the food processing industry by improving efficiency, minimizing reliance on human labor, and ensuring consistency in products.

Also, the increase of urbanization and the growth of disposable incomes in the Asia-Pacific nations such as India, China, and Southeast Asia; will contribute as a driving factor for the demand of commercial food processing equipment, providing great opportunities for the manufacturers. Therefore, Companies need a strategy that is focused on the right partnerships, local production, and low-cost innovations in regional demand to boost their growth.

In addition, growing demand for gluten-free and better-for-you products available in clean-label style products has led batter mixers consumer to develop specialized mixers to cater to specific needs. Sustainability is also fueling demand as laws compel manufacturers to spend on energy-efficient and integrated equipment, so it is one of the best means of attaining customers' and brand reputation based on their sustainability objectives.

The most important strategies for manufacturers to remain competitive are concentrating on R&D for intelligent and sustainable mixers, increasing footprint in developing but high-volume industry, and improving after sales support to ensure customer retention. By adhering to these trends, investing in innovation, and being ahead of the curve, firms can facilitate long-term growth within the batter mixer machines industry.

The increasing automation of food production, consumers' growing demand for convenience foods, and ongoing developments in smart technology are the main factors that are expected to drive the growth of batter mixer machines. And trends around sustainability and energy-efficient innovations are influencing what gets purchased.

Batter mixer machines find application for bakers, confectionery factories, foodservice chain, and industrial food processing units. They are the basis of a wide variety of consistent batters for things like cakes, pancakes, waffles, tempura coatings, or other food products.

From IoT connectivity and AI-powered automation to intelligent sensors, batter mixing is now becoming more efficient and uniform. However, new machines also feature energy-efficient motors, auto-cleaning mechanisms, and personalized mixing programs for productive applications.

Asia-Pacific growth is happening very fast, led by China, India, and Southeast Asia, due to urbanization, increased disposable income, and bakery & food processing. North America and Europe are the leaders in most of the advanced adoption of automation.

Busineses should consider batch size, level of automation, energy conservation, cleaning needs, and compliance with food safety regulation. When it comes to long-term efficiency, installing a machine in accordance to the volume of production and experience of the product is essential.

Coffee Roaster Machine Market Analysis by Product Type, Capacity, Control, Heat Source and Application Through 2035

Indoor Smokehouses & Pig Roasters Market – Smoked Meat Processing 2025 to 2035

Brewing Boiler Market Analysis by Material Type, Application, Automation, and Region 2025 to 2035

Flake Ice Machines Market - Industry Growth & Market Demand 2025 to 2035

Exhaust Hood Filters & Cleaning Kits Market – Market Innovations & Industry Growth 2025 to 2035

Catering Food Warmers Market Analysis by Product Type, End Use, Sales Channel, and Region Forecast Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.