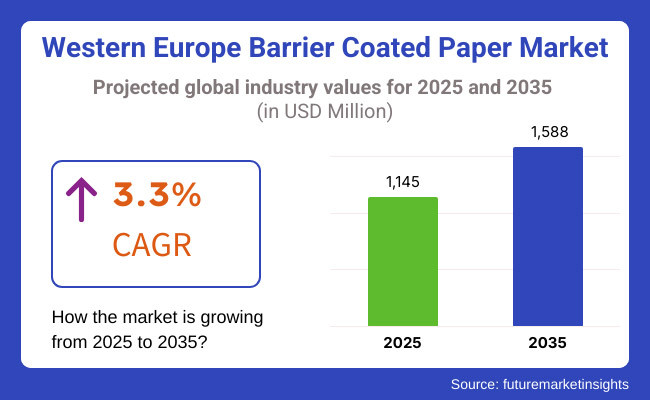

The Western European barrier-coated paper industry is expected to be worth USD 1,145 million in 2025, expanding at a CAGR of 3.3%. In the year 2035, it is projected to be worth USD 1,588 million. Food & beverage manufacturers’ increasing demand for sustainable packaging is expected to drive growth as meeting regulatory criteria becomes more important than ever.

Over the past decade, the general public has become more aware of environmental issues and the need for sustainable packaging. Barrier-coated paper has become more popular as a result of the increased focus on minimizing plastic waste, especially in the consumer goods, food packaging, and pharmaceutical sectors.

Manufacturers are working on many solutions, including innovative coatings that achieve moisture, grease, and oxygen protection but are still biodegradable and recyclable. Stringent government regulations, increasing focus on sustainable development, and consumer awareness of sustainability are other factors that are driving the growth of the market.

Modern coating techniques like bio-based and water-based coatings are increasing the performance of barrier-coated paper as a substitute for traditional plastic-based packaging.

The growing penetration of e-commerce and the increasing need for premium packaging solutions are further accelerating the market growth. Although production costs are often higher and recyclability remains a challenge, the Western European market is expected to experience long-term growth.

Explore FMI!

Book a free demo

The Western European barrier-coated paper industry has seen a significant shift toward sustainable packaging solutions between 2020 and 2024. In this scenario, the demand for eco-friendly materials increased significantly due to rising environmental awareness and strict government mandates to minimize plastic consumption.

The food and beverage sector, in particular, demonstrated this conversion by adopting barrier-coated papers that offer protection and are recyclable. These years have seen a focus on developing bio-based and water-based coatings to enhance the performance and functionality of barrier-coated paper.

Looking ahead from 2025 to 2035, the industry is expected to continue evolving, with health and sustainability emerging as key trends. Developments in biodegradable coatings and smart packaging technologies, such as embedded freshness indicators and improved traceability features, will play a crucial role in enhancing product functionality.

The industry will witness growing funding injections in research and development to enhance barrier characteristics and diversify applications beyond traditional sectors. Leading manufacturers are expected to continue working alongside regulators to promote the adoption of new-generation barrier-coated paper solutions in the industry while ensuring adherence to regulations.

| Key Drivers | Key Restraints |

|---|---|

| Rising demand for sustainable and biodegradable packaging | High production costs of barrier-coated paper |

| Stringent regulations promoting eco-friendly materials | Limited recycling infrastructure for coated paper |

| Growth in the food & beverage industry | Competition from alternative sustainable packaging solutions |

| Increasing consumer awareness about plastic waste | Performance limitations compared to plastic coatings |

| Advancements in coating technologies | Fluctuating raw material prices |

Impact of Key Drivers

| Key Drivers | Impact Level |

|---|---|

| Increased need for sustainable and biodegradable packaging | High |

| Tightening regulations to encourage materials that are environmentally friendly | High |

| Industry Facts: Annual Growth Trends in the Food & Beverage Sector | High |

| Temperature-sensitive nanocapsules enhance barrier-coated paper by improving food safety | Medium |

| Rising consumer awareness on plastic waste | Medium |

| Key Restraints | Impact Level |

|---|---|

| The unsustainable nature of barrier-coated paper | High |

| Production costs | High |

| Poor recycling infrastructure for coated paper | Medium |

| Competitive threat from alternate sustainable packaging options | Medium |

| Not as good performance vs. plastic coatings | Medium |

Kraft paper is expected to gain a significant market share due to its widespread use in robust and durable paper packaging, which can be easily coated with various materials. Folding boxboards will continue to grow steadily, driven primarily by premium packaging segments. Improved water barrier properties of the film will allow for the acceptance of recycled paper.

The specialty papers will find their place in the segments that demand higher performance and durability with advanced resistance to moisture, grease, and oxygen.

Bio-based coatings will quickly follow and provide excellent performance barriers from renewable feedstocks. However, ecological issues and historical regulatory constraints will make solvent-based coatings less popular. We will develop new hybrid coatings that integrate multiple technologies to provide optimum protection while maintaining sustainability.

Bio-based coatings will quickly follow and provide excellent performance barriers from renewable feedstocks. Due to growing environmental concerns and stricter regulations, the demand for sustainable packaging solutions is increasing. These new hybrid coatings will combine several technologies to achieve optimal protection without sacrificing sustainability.

Flexible packaging dominates applications as industries demand low-weight, durability, and green alternatives to traditional plastics in packaging. Packaging of cups and containers will witness giant growth but is especially important in the quick-service restaurant space, where sustainable food packaging is a concern.

As brands continue to enhance the aesthetics of their packaging, they will embrace labels and wraps, keeping recyclability in mind. Demand for barrier-coated paper will grow alongside industrial expansion, driven by corporate and large enterprises' commitment to sustainable packaging solutions.

The food and beverage sector will still account for the largest share of barrier-coated paper consumption as brands look to swap out plastic packaging for paper options. The pharmaceutical industry will adopt these at higher volumes, thus demanding coatings that protect products while complying with stringent safety regulations.

The aesthetics and personal hygiene industry is expected to follow suit with sustainable packaging as consumers increasingly seek environmentally friendly options. Coated paper is positioned as an enabler for online retailers to offer safe and environmentally responsible shipping, driving growth in e-commerce.

The country will dominate the Western European barrier-coated paper industry as they have stringent environmental policies and a commitment towards sustainable development with a CAGR of 3.0%. A well-developed recycling infrastructure in the country will facilitate the switch from plastics to paper in packaging, especially in food and beverages.

Germany will focus on producing advanced coatings that facilitate recyclability while maintaining barrier properties. Moreover, growing demand for sustainable packaging from retail and e-commerce sector will drive industry growth. Government regulations and consumer education will encourage manufacturers to use bio-based and waterborne coatings.

The German focus on circular economy principles will lead to opportunities in innovation and investment in sustainable packaging solutions.

Italy's barrier-coated paper industry is expected to grow significantly as brands and customers move towards sustainable options, with a CAGR of 2.5%. In particular, the nation’s food and beverage industry will pivot toward paper-based alternatives, especially in packaging dry and fresh food items. Domestic packaging manufacturers would invest in advanced coatings that fulfill European Union sustainability aspirations.

With improvements in government waste management systems and better delivery standards, the demand for recyclable and compostable coated paper is expected to increase despite the recycling infrastructure still being in its early stages of development.

The increasing export of sustainable packaging solutions will generate new business and economic opportunities, positioning Italy as a leader in Europe’s eco-friendly packaging industry.

In France, strong industry growth is supported by government policies to promote sustainable packaging and reduce waste. The nation’s food and beverage sector would quickly switch to barrier-coated paper, in line with national bans on plastic packaging here. Eco-friendly paper printing services are adopting high-quality coated paper for cosmetics and personal care products.

Investments in R&D will improve the performance of biodegradable coatings, allowing them to be used for applications beyond traditional packaging. France will play a significant role in the expansion of this industry as consumer preference for environmentally friendly products grows, prompting businesses to adopt innovative solutions.

In the UK, growing consumer awareness and corporate sustainability initiatives will boost demand for barrier-coated paper, which is projected to grow at a CAGR of 3.2%. Tighter regulations on single-use plastic push businesses toward recyclable and compostable coatings. The e-commerce sector in the country will drive industry growth as retailers look for sustainable shipping materials.

New coating technologies will also provide moisture and grease resistance, meaning paper may be an alternative to plastic packaging. Scalable waste management infrastructure will enhance recyclability rates and support the next phase of industry growth, laying the groundwork for a fully circular recycling system despite potential challenges.

As sustainability becomes a priority across industries, the barrier-coated paper industry in Spain is expected to grow at a slower pace. Adoption will be led by the challenges facing the food and beverage sector as restaurants and retailers search for sustainable alternatives to plastic packaging. Government initiatives stimulate sustainable materials, which are expected to drive investment in recyclable coatings.

Although the country’s recycling infrastructure still trails behind some leading European industries, current developments will enable the transition of paper-based solutions. European standards for sustainability will also push local manufacturers to seek innovative coating technologies. Exporting more eco-friendly packaging materials will further boost Spain’s share of the regional barrier-coated paper market.

Tier 1 players dominate nearly 90% of the Western European barrier-coated paper industry. Industry trends, capabilities, technologies, and market dynamics, as well as service providers' hiring and staffing in packaging companies.

These leading players focus on sustainable innovations as stringent European norms encourage them to invest in bio-based and recyclable coating technologies, pushing them out of their comfort zone. The high cost of production and the technical knowledge necessary to create high-performance coating further prevent smaller regional manufacturers from scaling operations.

Tier 2 and Tier 3 players find it difficult to compete against the larger players in the industry; however, there are niche options available in the form of specialized coatings and custom packaging solutions.

In 2024, major players in the Western European coated paper industry began merging to boost their market share and strengthen their competitive edge. A significant transaction took place in October 2024 when Mondi Group, a company from the UK, decided to purchase certain packaging operations from Schumacher Packaging.

These operations are located in Germany, Benelux, and the UK. Mondi Group agreed to pay USD 634 million in cash for this acquisition, aiming to expand its presence and influence in the regional market. They view this acquisition as a strategic move to expand their corrugated converting capacity and strengthen their presence in Western Europe, aligning with their broader strategy to gain market share in sustainable packaging solutions.

The growth of the biodegradable lacquer industry is also attributed to the demand for eco-friendly packaging and regulations related to sustainability, alongside the advancement of biodegradable lacquer technology.

Manufacturers in this space must overcome hurdles like high production costs, strict environmental regulations, and a need for high-end coating technologies.

Leading companies are enhancing the sustainability of coated paper by adopting lower-impact technologies, such as recyclable and bio-based coatings, as well as implementing closed-loop recycling systems.

Sustainable and durable packaging requirements from food packaging, pharmaceuticals, cosmetics, and e-commerce sectors are major end users of this market.

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.