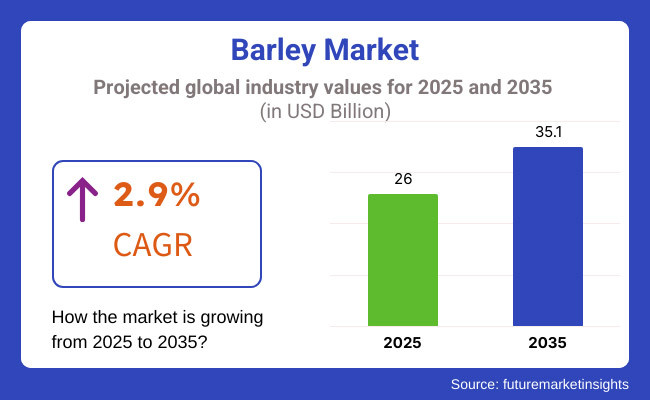

The global barley market is expected to witness USD 26 billion in 2025. The industry is poised to witness 2.9% CAGR from 2025 to 2035, reaching USD 35.1 billion by 2035.

Barley is a staple cereal crop and a key constituent in foods, beverages, and animal feed. It is predominantly grown in temperate regions such as the European Union, Russia, Canada, and Australia. Increasing demand for malted grain from the brewing industry will likely drive market growth and ongoing consumer demand for whole grains and sustainable agriculture.

Within the global brewing industry, the product plays an important role as a key ingredient (in malted form) in the manufacture of beer and whiskey. It is gaining traction in food outside of brewing as it provides nutrition. Due to their high fibre content and gastrointestinal health value, as well as lowered risk of developing a chronic disease, consumers are in higher need of whole grains.

This has led to the product being used in all foodstuffs, from bakers to breakfast cereals. Furthermore, the product is a significant source of animal feed, valued for its nutritional value and digestibility, making it an integral element of feed nutrition, specifically for animal trainees.

Sustainability is increasingly important in the product production, with new agronomic technologies needed as climate change and soil erosion take their toll. Advanced product genetics, which includes drought-tolerant and disease-resistant varieties, enable farmers to produce more by adapting to changing environmental conditions. Together with efforts to improve water use and preserve soils, these technologies drive the trend toward more sustainable farming practices.

The global industry will evolve, and its unique role in brewing, food production, and animal feed will drive long-term consumption. The intersection of tech innovation, sustainable agriculture, and shifting consumer preferences drives a dynamic marketplace where growth and innovation are rippling through multiple sectors.

Explore FMI!

Book a free demo

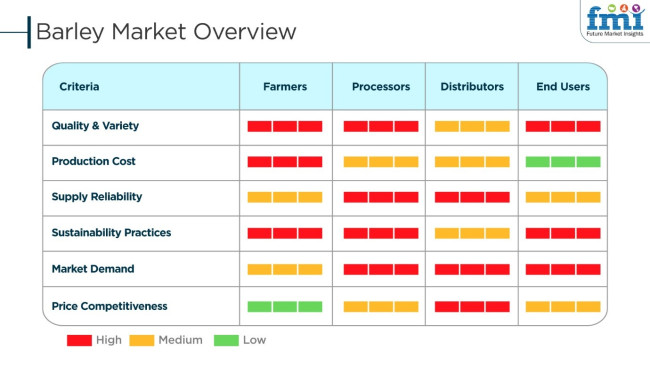

Barley business is driven by growing demand in food, beverage, and animal feed markets and the growing use of functional and plant foods. Growers emphasize high-yielding and disease-resistant product types for reliable supply. Processors highlight efficiency in malting and milling, quality control, and sustainability for brewing and health food. Distributors emphasize pricing management, logistics, and supply chain management to meet growing worldwide demand.

End-users such as breweries, food manufacturers, and animal feed mills place a premium on quality, nutrient content, and traceability. Craft beer, organic product, and proteins trends are driving innovation. Climatic change resistance and sustainability also influence farm and production strategy. As tastes of consumers continue to shift, the industry for gluten-free product, fibre-rich product, and functional ingredients keep on expanding, taking the industry forward toward premium and special product offerings.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) in the global industry. This analysis highlights key shifts in industry performance, providing stakeholders with a clearer view of the growth trajectory. The first half of the year, or H1, spans from January to June, while the second half, H2, includes July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 3.0% (2024 to 2034) |

| H2 2024 | 3.1% (2024 to 2034) |

| H1 2025 | 3.2% (2025 to 2035) |

| H2 2025 | 3.3% (2025 to 2035) |

The above table presents the expected CAGR for the global industry over a semi-annual period spanning from 2024 to 2035. In H1 2024, the business is projected to grow at a CAGR of 3.0%, followed by a slight increase to 3.1% in H2 2024. Moving into 2025, the CAGR is expected to rise to 3.2% in H1 and maintain a steady increase to 3.3% in H2.

In H1 2025, the industry witnessed an increase of 2 BPS, while in H2 2025, the industry observed a rise of 3 BPS, indicating a consistent upward trend. These variations suggest strong industry stability, driven by sustainable product farming initiatives, increasing demand for malted product in brewing and functional food applications, and advancements in climate-resistant product strains ensuring long-term productivity.

Expanding Global Demand for Malted Product in Alcoholic Beverage Production

The alcoholic beverage industry remains the primary driver of product demand, particularly for malted product used in brewing and distilling. With the growing consumption of beer and whiskey worldwide, the demand for high-quality malted product continues to rise.

The craft beer movement, especially in North America and Europe, has further fueled demand for specialty malts that enhance flavor, color, and texture. Additionally, emerging markets in Asia and Latin America are witnessing a surge in beer production, driven by urbanization, evolving consumer preferences, and higher disposable incomes.

AB InBev, Heineken, and Diageo are investing in product supply chain resilience to mitigate risks related to climate change and price volatility. These companies are focusing on contract farming, sustainability programs, and advanced processing technologies to ensure a consistent supply of malted product.

Moreover, non-alcoholic malt beverages are gaining popularity in regions with alcohol restrictions, further boosting demand. As breweries continue to innovate with new beer styles and malt formulations, the global industry will witness sustained long-term growth, reinforcing the strategic importance of product in the beverage industry.

Growing Adoption of Product in Functional and Plant-Based Food Segments

The product is increasingly being incorporated into functional foods, plant-based diets, and health-conscious consumer segments. The rising awareness of product’s nutritional benefits, such as high fiber content, beta-glucans for heart health, and essential micronutrients, has driven its adoption in various food applications. Barley-based products, including flour, flakes, and protein isolates, are being integrated into bakery, cereals, plant-based dairy, and meat alternatives.

Companies such as Nestlé and General Mills are expanding their portfolios to include barley-enriched products that cater to the demand for gut health, weight management, and reduced glycemic index diets.

Additionally, regulatory bodies, such as the European Food Safety Authority (EFSA) and the USA Food and Drug Administration (FDA), have recognized product’s health benefits, leading to increased labeling approvals for cholesterol reduction claims. With the growing adoption of plant-based diets, barley protein is also emerging as an alternative to soy and pea proteins, creating new growth avenues for the global industry.

Rising Use of Barley Extracts in Natural and Organic Skincare Products

These extracts are gaining significant traction in the personal care and cosmetics industry, primarily due to their antioxidant, anti-inflammatory, and skin-rejuvenating properties. As consumers shift toward natural and organic skincare solutions, barley-based ingredients are increasingly being incorporated into moisturizers, serums, and anti-aging formulations. The high concentration of beta-glucans in product helps improve skin hydration and elasticity, making it a valuable component in premium skincare products.

L’Oréal, Estée Lauder, and Shiseido are investing in product-derived bioactives to cater to the growing demand for clean beauty products. These companies are focusing on R&D to enhance the efficacy of extracts in skin barrier repair and UV protection formulations.

Furthermore, the surge in demand for hypoallergenic and sensitive-skin-friendly products has positioned product as a preferred natural ingredient in dermatologically tested cosmetics. With regulatory bodies supporting plant-based and organic certifications, product’s role in the skincare segment is expected to expand, offering lucrative opportunities for ingredient suppliers and personal care brands.

Between 2020 and 2024, the global industry grew steadily, supported by consumption in brewing, animal feed, and functional foods. Large producers such as the EU, Russia, Canada, and Australia experienced climate volatility and trade policy changes, while the COVID-19 pandemic affected supply chains, leading to short-term price fluctuations.

By 2022, though, sales recovered as precision farming, climate-resilient seeds, and sustainability programs stabilized supply. Top agribusinesses and brewers focused on green practices, supporting industry resilience.

Domestic product sales grew with growing craft beer brewing, high-malt premium demand, and greater utilization in plant-based foods and high-fiber applications. The consumption of product containing beta-glucan is more advanced in foods promoting gut health and heart health.

The Russia-Ukraine conflict has benefitted trade, thereby creating supply imbalances and price surges. The livestock industry remained a substantial buyer where product is an inexpensive substitute for corn and wheat. In spite of the challenges, the advances in sustainable agriculture and nutrition will affect long-term growth of the industry.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Strong global demand for product in brewing and animal feed markets | Growing application in plant food ingredients and functional drinks |

| Intermittent product production owing to climate uncertainty | Boosting investment in climate-resistant product and regenerative agriculture |

| Prevalence of traditional product farming practices | Increasing movement toward organic and non-GMO product production |

| North America and Europe as main producers and consumers | Growing demand in Asia-Pacific and Latin America fueled by shifting diets |

| Limited consumer knowledge of the health benefits of product | Expanded marketing efforts highlighting product as a superfood with high fiber and nutrient content |

| Disruptions to supply chains impacting product exports and prices | Enhanced supply networks and diversification of source regions |

| Regulatory emphasis on food safety and product quality standards | Tighter sustainability regulations and incentives for environmentally friendly farming practices |

The industry is at multiple critical risks with the factors such as climate variability to changing consumer demand, supply chain disruptions, price volatility, and regulatory changes.

The impact of climate variability on product yield and quality is major, as droughts, floods, and unexpected weather conditions can both lead to decreased production and higher costs. The production of extreme climate events can have a knock-on effect on the food, feed, and brewing industries, which may be unable to operate optimally due to supply shortages.

Regulatory changes like pesticide use limits, sustainability standards, and trade regulations can influence product planting, storage, and export. Traders and farmers can thus be faced with the risk of non-compliance in case they are unable to adapt to the agricultural policies of regional and international organizations.

An adjustment in food choice by consumers for gluten-free cereals and other ingredients used for brewing is one aspect that may be able to affect the utilization of product for malting and brewing. However, the growth in health foods and animal feed may be able to aid the industry to adjust to the changes.

Globally, the whiskey industry drives product demand as malted product is an essential raw material in whiskey production. Premiumization of spirits, particularly single malts, aged whiskeys and small-batch distillations, have driven greater global demand for higher-grade barley malt. Exports of whiskey, particularly from Scotland and Ireland to North America and Asia Pacific, continue to escalate, strengthening product sourcing strategies among distillers.

Major players such as Diageo, Pernod Ricard, and Beam Suntory prefer long-term sourcing contracts, invest in traceability programs and low-carbon malting technologies to improve their sustainability credentials.

Malted barley is a key ingredient in beer, whiskey, and other fermented drinks. The premium and craft beer industry is growing globally, propelling the demand for high-quality specialty malts. Since consumers are more eager for things like artisanal and unique beer types, breweries are now sourcing and supplying more custom tailored malted product types that better pop flavour, aroma, and beer colour.

However, it is a trend that is particularly prominent in North America and Europe, where the consumption rate of craft beers has continued to increase year on year, whilst the consumption of beer in emerging markets will be driven by increasing urbanization and disposable incomes, thereby expanding the potential target industry for brewers.

Of the many different grades of product, food grade product is used most commonly. This grade is grown and processed specifically for consumption and is therefore the key to producing food and beverage products such as malted product for brewing, barley flour, and breakfast cereals.

Food grade product is selected with utmost care for its quality and purity and is free from contaminants for safety and taste. It's applied in numerous food items due to its nutritional value, such as high fiber, vital vitamins, and minerals.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

| UK | 4.5% |

| Canada | 4.2% |

| India | 5.1% |

| Japan | 3.9% |

The USA is among the globe's largest consumers and producers of product, and brewery investment and sustainable farming characterize the industry. The country hosts leading beer brands and craft breweries that drive malted product demand. Growth in premium and specialty beer drives brewers to purchase high-quality types of product with distinct malting properties. In addition, the expanding industry for non-alcoholic malt beverages is attracting health-oriented consumers seeking functional and low-alcohol drinks.

USA product production is concentrated in North Dakota, Montana, and Idaho, where the climate favors high-yielding cultivation. However, changing weather patterns and water shortages have prompted greater investment in climate-resilient product types and precision agriculture techniques.

Regenerative agricultural practices and carbon sequestration programs improve the health and productivity of the soil in the long term. Such practices ensure a steady supply for both domestic and export markets. FMI believes the USA barley industry will likely grow at a 4.8% CAGR during the forecast period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Rise in Craft and Premium Beer Segment | High-quality malted product demand drives specialty brewing. |

| Growth in Non-Alcoholic Malt Drinks | Health-conscious consumers drink functional, low-alcohol drinks. |

| Climate-Resistant Product Varieties and Regenerative Farming | Climate-resistant product varieties and regenerative farming boost yields. |

| Ideal Growing Conditions | North Dakota, Montana, and Idaho dominate product production. |

Canada's industry relies on increasing demand from the brewing and food industries. The country's craft brewing business is a principal driver of demand for malting barley, and breweries seek to source local high-quality varieties.

In addition, barley functional foods, including plant protein substitutes and high-fiber foods, are expanding the industry. While unexpected climatic trends and soil quality are raising the alarm, Canadian product farming has witnessed the embracement of high-tech agrotech solutions, including artificial intelligence-based crop monitoring and green irrigation.

The schemes offered by the government allow farmers to adopt greenways so that a consistent product output can be maintained. FMI is of the opinion that Canada's industry will achieve 4.2% CAGR growth during the forecast period.

Growth Factors in Canada

| Key Drivers | Details |

|---|---|

| Craft Brewing Growth | Demand for locally sourced malting barley is strong. |

| Functional Food Applications Growth | Protein and fiber products have gained popularity. |

| Agritech Advances | Farm AI monitoring and eco-friendly irrigation optimize yields. |

| Sustainable Farming Government Support | Policies support climate-resilient product cultivation. |

The UK possesses a well-developed industry, serving its distilling and brewing sectors and growing its export industry. The country is a high-quality malting product producer essential for its renowned beer and whiskey industries. Rising demand is spurred by the growing consumption of craft beer and the expansion of whiskey distilleries. British exports of malted product are increasing, particularly in Asian and European markets where tradition and heritage drive premiumization patterns.

Government incentives for carbon-neutral farming allow farmers to maintain yields while reducing emissions. Industry stability is increased through trade diversification in the context of European uncertainty. FMI opines that the UK barley industry will expand at a 4.5% CAGR during the research period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Beer and Whiskey Industries' Demand | Malted product remains an imperative for alcoholic beverages. |

| Craft Brewing Growth | Craving for craft beer raises demand for specialty product. |

| Precision Farming Adoption | Farmers adopt smart irrigation and climate-resilient product varieties. |

| Government Incentives for Carbon-Neutral Farming | The policy promotes product farming with a reduced carbon footprint. |

India's industry is developing rapidly, and traditional and new applications are gaining popularity. The brewing industry, particularly in beer production, remains the biggest user of malting product. The food industry also employs product in health foods like breakfast cereals and vitamins.

Product production in India is localized in regions such as Rajasthan, Uttar Pradesh, and Haryana, where the crop performs well in semi-arid climates. In response to increasing demand, Indian farmers increasingly use hybrid product varieties with enhanced drought tolerance. Government policies favoring contract farming and sustainable agriculture practices further consolidate the supply chain. FMI believes that India's industry is expected to expand at a 5.1% CAGR over the period of study.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Increasing Demand from the Brewing Industry | Beer brewing is a heavy consumer of malting product. |

| Increasing Food Items Based on Product | Product is needed in cereals and supplements by health-conscious consumers. |

| Adoption of Drought-Resistant Product | Farmers take up hybrid strains to increase production. |

| Government Assistance for Sustainable Farming | Policies encourage environmentally sustainable farming practices. |

The industry in Japan is stable, with large markets for brewing, processing food, and animal feed. The beer industry uses high-quality malted product, particularly for premium and craft beer. Barley functional foods such as barley tea and high-fiber foods also constitute domestic demand.

Japan relies on imported product from Australia and Canada to meet industry demand. Local production focuses on niche markets like organic and specialty varieties of product. Technological innovations in food processing and brewing are the key drivers for the utilization of product. FMI estimates that Japan's industry is expected to grow at a 3.9% CAGR during the forecast period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Demand for Premium and Craft Beer | High-quality malted product remains the focus. |

| Expansion in Functional Foods | Tea and snack foods made from product have gained popularity. |

| Reliance on Imports | Australia and Canada supply the majority of Japan's product. |

| Advances in Food Processing Technology | Technology enhances barley-based product applications. |

The global industry has become competitive due to demand coming from breweries, malting, animal feed, and functional food industries. Growth in the industry is due to advancements in precision agriculture; AI is being used to enhance yield, while farms have become more sustainable in their productivity and environmental impact.

The leading companies are focusing on carbon-neutral product sourcing, developing novel malting procedures, and building partnerships with farmers for quality and to ensure supply chain resilience. Specialty product varieties are gaining ground in the craft beer and whiskey markets, influencing maltsters to breed high-quality flavor-enhancing strains aimed at the premium beverage sector.

There are emerging startups and niche players endorsing regenerative agriculture practices and e-agriculture solutions to improve product yield and quality. Sustainability will continue to be crucial, with large agribusinesses prioritizing eco-friendly supply chains, climate-resilient crop breeding, and wise water use.

The climate problems being faced globally, along with shifts in consumer preferences, will define the industry, wherein sustainability combined with supply-chain transparency and innovative practices will provide a competitive edge moving forward.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Cargill Inc. | 15-20% |

| Malteries Soufflet | 10-15% |

| GrainCorp | 8-12% |

| AB InBev | 5-10% |

| Heineken | 5-8% |

| Other Players | 35-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cargill Inc. | Global leader in product sourcing and processing, emphasizing sustainable farming and supply chain optimization. |

| Malteries Soufflet | Major malt supplier specializing in high-quality malt for breweries, distilleries, and food applications. |

| GrainCorp | Key player in grain storage and logistics, investing in digital supply chain solutions and climate-adaptive farming. |

| AB InBev | Implements sustainable product farming programs and partners with farmers for premium brewing ingredients. |

| Heineken | Focuses on carbon-neutral product sourcing and expanding its specialty malt portfolio for diverse beer styles. |

Key Company Insights

Cargill Inc. (15-20%)

This company is at the top of the industry worldwide through its very well-integrated systems, processing features, and chain networks.

Malteries Soufflet (10-15%)

Leading malt producer in Europe with a comprehensive footprint internationally, offering malt to the premium brewing and distilling industries.

GrainCorp (8-12%)

Its main concern is grain storage and logistics activities, ensuring the reliable trading and resilience of the product supply chain.

AB InBev (5-10%)

Investing in climate-resilient product farming while dealing closely with local farmers to ensure constant quality.

Heineken (5-8%)

It continues its journey to broaden its sustainable sourcing initiative by minimizing the environmental impacts in its supply chain.

Other Key Players (30-40% Combined)

The industry is slated to reach USD 26 billion in 2025.

The industry is predicted to reach USD 35.1 billion by 2035.

India, poised to witness 5.1% CAGR from 2025 to 2035, is slated to register fastest growth.

Key companies include Tyson Foods Inc., JBS S.A., WH Group (Smithfield Foods), Cargill Inc., Hormel Foods Corporation, BRF S.A., Pilgrim’s Pride Corporation, Maple Leaf Foods Inc., Nippon Meat Packers Inc., and Danish Crown Group.

Barley malt is being widely used.

By application, the industry is segmented into alcoholic beverages, non-alcoholic beverages, personal care products, animal feed, food, and pharmaceuticals (supplements).

By grade, the industry is segmented into malt grade, standard, food grade, specialty, pharmaceutical grade, cosmetic grade, and feed grade.

By product type, the industry is segmented into barley flour, pearl barley, barley grits, barley malt, barley flakes, and whole grain barley.

By region, the industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Yeast Extract Market Analysis by Type, Grade, Form, and End Use

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.