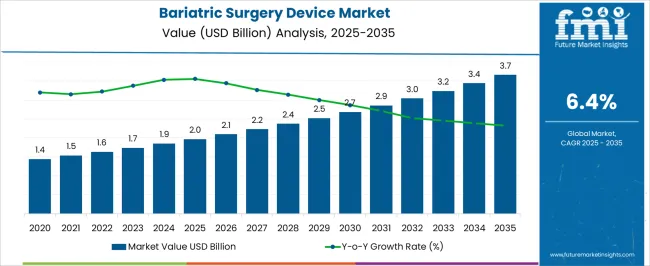

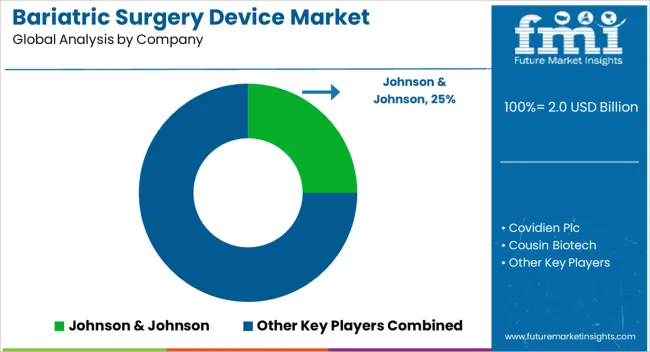

The Bariatric Surgery Device Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 3.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

The Bariatric Surgery Device market is witnessing significant growth driven by the rising prevalence of obesity and related metabolic disorders globally. Increasing awareness about health risks associated with obesity and the growing adoption of surgical interventions as effective long-term solutions are contributing to market expansion. The market outlook is further shaped by advancements in minimally invasive surgical technologies, which improve patient outcomes and reduce recovery time.

Rising healthcare expenditure, coupled with the expansion of hospital infrastructure and availability of trained surgical professionals, is facilitating broader access to bariatric procedures. The focus on improving post-surgical quality of life and managing comorbidities such as diabetes, hypertension, and cardiovascular disorders is driving the demand for innovative surgical devices.

Additionally, favorable reimbursement policies in key regions and increasing acceptance of bariatric surgery among patients are supporting the adoption of advanced devices As patient preference shifts towards safer and more efficient procedures, the market is expected to sustain growth with continuous technological advancements and increasing procedural volumes.

| Metric | Value |

|---|---|

| Bariatric Surgery Device Market Estimated Value in (2025 E) | USD 2.0 billion |

| Bariatric Surgery Device Market Forecast Value in (2035 F) | USD 3.7 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

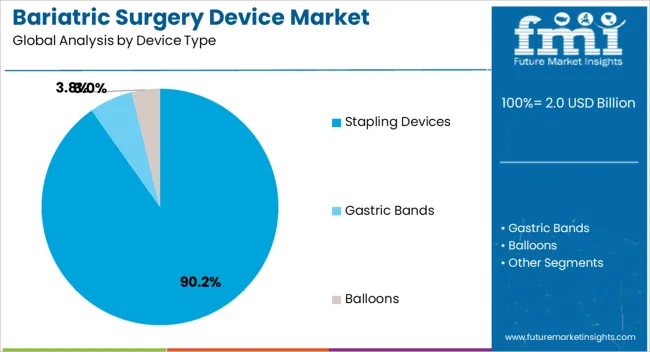

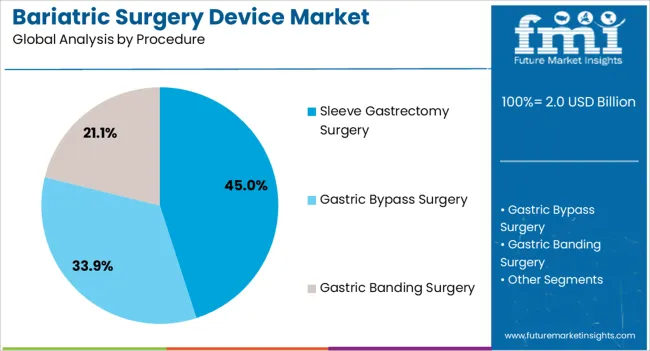

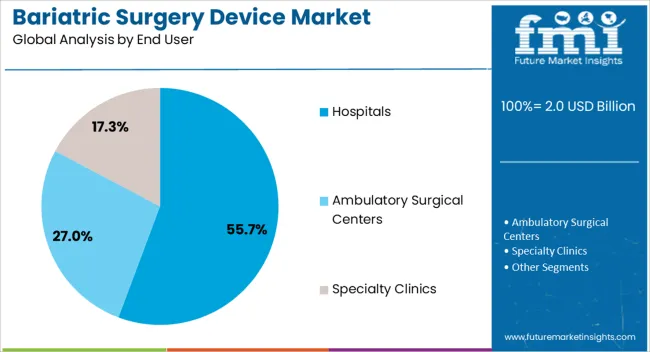

The market is segmented by Device Type, Procedure, and End User and region. By Device Type, the market is divided into Stapling Devices, Gastric Bands, and Balloons. In terms of Procedure, the market is classified into Sleeve Gastrectomy Surgery, Gastric Bypass Surgery, and Gastric Banding Surgery. Based on End User, the market is segmented into Hospitals, Ambulatory Surgical Centers, and Specialty Clinics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The stapling devices segment is projected to hold 90.20% of the Bariatric Surgery Device market revenue share in 2025, establishing it as the leading device type. This dominance is attributed to the critical role of stapling devices in ensuring precision, safety, and efficiency during bariatric procedures.

Technological advancements have enhanced device reliability, ease of use, and consistency of outcomes, making stapling devices the preferred choice among surgeons. The increasing demand for minimally invasive techniques and laparoscopic procedures has further reinforced the adoption of stapling devices, as they facilitate reduced operative time and faster recovery.

Additionally, the growing procedural volumes of bariatric surgeries globally have created a sustained need for high-quality stapling devices Hospitals and surgical centers prioritize these devices for their durability, compatibility with various surgical procedures, and ability to minimize post-operative complications, driving continued growth of the segment.

The sleeve gastrectomy surgery segment is expected to account for 45.00% of the Bariatric Surgery Device market revenue share in 2025, making it the leading procedure type. The segment’s growth is driven by the procedure’s effectiveness in significant weight loss and improvement of obesity-related comorbidities.

Minimally invasive techniques associated with sleeve gastrectomy offer reduced hospital stays, lower risk of complications, and faster recovery compared to traditional bariatric surgeries, boosting patient preference. Advances in surgical devices, including staplers and energy-based tools, have enhanced procedural efficiency and safety.

The increasing prevalence of obesity and rising awareness about the long-term health benefits of surgical interventions are reinforcing adoption Additionally, hospitals are investing in specialized bariatric surgery programs, which further propels the use of sleeve gastrectomy procedures as a preferred treatment option, contributing to the segment’s leading revenue share.

The hospitals end-use segment is anticipated to account for 55.70% of the Bariatric Surgery Device market revenue in 2025, positioning it as the leading end-use industry. This growth is fueled by the concentration of advanced surgical facilities, specialized bariatric programs, and trained surgical professionals within hospital settings.

Hospitals provide comprehensive perioperative care, post-operative monitoring, and access to advanced surgical technologies, which support the adoption of bariatric surgery devices. The demand for high-quality, safe, and efficient surgical solutions in hospitals is further reinforced by increasing patient inflow and rising obesity rates.

Additionally, hospitals benefit from favorable reimbursement policies and insurance coverage for bariatric procedures, enhancing the accessibility and affordability of surgeries The integration of modern surgical infrastructure and continuous adoption of innovative devices ensures hospitals remain the primary driver for market growth in this sector, sustaining their dominant revenue share.

Minimally Invasive Procedures to Augment Industry Growth

The past few years have seen tremendous development in the global healthcare and medicare sector, especially when it comes to surgeries. This has led to the development of modern and more advanced devices and equipment to carry out complex surgeries such as bariatric procedures.

Patients are also increasingly preferring minimally invasive bariatric procedures for reduced postoperative pain and quicker recovery times. This trend has further increased the requirement for bariatric surgery devices in hospitals.

Industry to Benefit from Increasing Adoption of Endoscopic Procedures

There is also an ongoing trend of endoscopic procedures for bariatric surgery. These surgeries, like maximum bariatric procedures, are also a minimally invasive procedure that reduces the size of the stomach using an endoscopic suturing device.

Medical professionals all over the world are actively recommending these operations due to their effectiveness and safety. This, in turn, is amplifying the adoption of bariatric surgery devices in the medical world.

High Cost of Surgeries and Poor Healthcare Services Slows Down the Industry Growth

Bariatric surgeries are generally very expensive. This has kept an enormous number of potential consumers away from the market, especially those living in the rural parts of underdeveloped and developing countries.

Poor healthcare facilities and the unavailability of healthcare infrastructure to support bariatric surgeries also act as significant restraints in these regions. These factors are considerably slowing down the bariatric surgery device market growth.

The bariatric surgery device market heavily relies on the region’s prevalence of obesity and related health conditions. The industry is also influenced by the availability of healthcare infrastructure and reimbursement policies for bariatric surgery procedures. Technological advancements also play an important role in the adoption of bariatric surgery devices. The sector, in the last few years, has seen a series of ups and downs.

During the pandemic, as the world faced sudden shutdowns, the priority of almost all medical facilities shifted toward mitigating the transmission of the virus. This led to a decline in the number of bariatric surgeries performed in hospitals, ambulatory surgical centers, clinics, etc. The reduced bariatric procedures also meant a plunge in the demand for bariatric surgery devices such as laparoscopic instruments, staplers, sutures, and intragastric balloons.

The industry during the period from 2020 to 2025 exhibited a CAGR of 5%. As the world became accustomed to the new norm, elective surgical procedures, including bariatric surgeries, gradually resumed. The pandemic also heightened the focus on minimally invasive surgical techniques which eventually drove the market growth for bariatric surgery devices.

The pandemic also instilled a sense of health consciousness among the masses, which has increased the clamor for bariatric surgeries and, hence, the devices in the medical landscape.

The section discusses the category-wise segmentation of the bariatric surgery device market in brief. The industry is categorized on the basis of end user, product, procedure, and type. The top two categories of end user and product are mentioned below.

Bariatric surgery devices are used in various healthcare facilities such as hospitals, ambulatory surgical centers, clinics, etc. Among these, the hospitals segment holds the maximum share of 55.7% as of 2025.

| Segment | Hospitals (End User) |

|---|---|

| Value Share (2025) | 55.7% |

Bariatric surgery devices are increasingly being used in hospitals. This is because hospitals are equipped to handle medical emergencies and complications that may arise during or after bariatric surgery. Besides this, hospitals are also generating huge demand for these equipment. They are equipped with the necessary bariatric surgeons, anesthesiologists, nurses, dietitians, and psychologists to provide comprehensive care to bariatric surgery patients.

Various devices and products are used during bariatric procedures and treatments, such as stapling devices, gastric bands, gastric balloons, etc. As of 2025, the stapling device segment holds an industry share of 90.2%.

| Segment | Stapling Device (Product) |

|---|---|

| Value Share (2025) | 90.2% |

The clamor for stapling devices has skyrocketed in the past few years as they offer precise and efficient tissue closure during bariatric surgeries. This reduces the risk of leaks and complications during and after surgery. Apart from this, these devices are also designed to minimize tissue trauma.

They aim to reduce the risk of postoperative complications such as bleeding, infection, and anastomotic leaks. These features have increased their adoption in the recent past.

The section discusses the region-wise analysis of the bariatric surgery device market. According to this analysis, it can be inferred that Asian countries such as India, China, and Japan are performing very well in the industry. This is primarily due to government initiatives, large populations, and increased healthcare investments, especially post-pandemic. Western countries like the United States and the United Kingdom are also not far behind in terms of industry growth.

| Countries | CAGR 2025 to 2035 |

|---|---|

| China | 9.9% |

| India | 9.7% |

| Japan | 8.6% |

| United States | 7.9% |

| United Kingdom | 7.7% |

China is one of the highly lucrative countries in the bariatric surgery device market. From 2025 to 2035, the industry is slated to showcase a 9.9% CAGR.

The government has been investing billions of dollars to modernize China’s healthcare infrastructure. This has made the adoption of these bariatric surgery devices very feasible in the country. This hefty investment has also led to the establishment of specialized bariatric surgery centers as well as the adoption of advanced bariatric surgery devices and techniques in China. Besides this, the government's efforts to reduce obesity have also positively contributed to industry growth.

The United States is also a promising country in this industry. Over the next ten years, demand for bariatric surgery devices in the United States is projected to rise at a 7.9% CAGR.

The United States is home to one of the leading populations dealing with obesity and weight-related issues in the world. According to a survey, more than forty percent of adult residents in the United States are classified as obese. These numbers are significant proof that the country generates a huge demand for bariatric surgery devices. Besides this, the availability of insurance coverage and reimbursement for bariatric surgery has led to an increase in the number of procedures being performed and an increased demand for bariatric surgery devices.

The United Kingdom is also one of the most highly profitable countries in the global bariatric surgery device market. The country is anticipated to exhibit a CAGR of 7.7% through 2035.

The National Health Service in the United Kingdom has been actively providing financial assistance and bariatric surgery services to potential patients. This increasing support from the government has led to a growing number of procedures being performed. Besides this, the United Kingdom is currently facing the problem of the obesity epidemic, with increasing rates of obesity-related health conditions such as type 2 diabetes. This scenario has also contributed to the increased sales of bariatric surgery devices in the United Kingdom.

The bariatric surgery device market is highly competitive, and companies are increasingly focusing on developing new and advanced devices to stay ahead. These companies are also collaborating and merging with each other to take advantage of each other’s expertise. Besides this, players are investing in training and education programs for healthcare professionals to enhance their skills and expertise in bariatric surgery procedures.

Industry Updates

In February 2025, BariaTek Medical successfully conducted the first implantation of its BariTon device, aiming to mimic the results of sleeve gastrectomy and bypass surgery. The reversible implant, consisting of gastric and intestinal parts, reduces food intake and calorie absorption.

On the basis of procedure, the sector is segmented into gastric bypass surgery, sleeve gastrectomy surgery, and gastric banding surgery.

The industry is divided into stapling devices, gastric bands, and balloons based on the device type.

Bariatric surgery devices are categorized by end user: hospitals, ambulatory surgical centers, specialty clinics, etc.

As per region, the industry is divided into North America, Latin America, Europe, Asia-Pacific, and the Middle East and Africa

The global bariatric surgery device market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the bariatric surgery device market is projected to reach USD 3.7 billion by 2035.

The bariatric surgery device market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in bariatric surgery device market are stapling devices, gastric bands and balloons.

In terms of procedure, sleeve gastrectomy surgery segment to command 45.0% share in the bariatric surgery device market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bariatric Walking Aids Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Walkers Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Rollator Walkers Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Lifts Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Transport Wheelchairs Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Patient Room Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Beds Market Analysis and Forecast for 2025 to 2035

Biosurgery Equipment Market Size and Share Forecast Outlook 2025 to 2035

Post-Surgery Skin Repair Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Neurosurgery Surgical Power Tools Market Analysis – Growth & Forecast 2022-2032

Electrosurgery Accessories Market Size and Share Forecast Outlook 2025 to 2035

Guided Surgery Kits Market Size, Growth, and Forecast for 2025 to 2035

Electrosurgery Generators Market Analysis - Size, Share, and Forecast 2025 to 2035

Electrosurgery Devices Market Overview - Trends & Growth Forecast 2025 to 2035

General Surgery Devices Market Insights – Demand and Growth Forecast 2025 to 2035

Cardiac Surgery Devices Market Analysis – Trends & Forecast 2024-2034

Cosmetic Surgery Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cataract Surgery Device Market Analysis – Growth & Forecast 2024-2034

5G Remote Surgery System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Refractive Surgery Device Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA