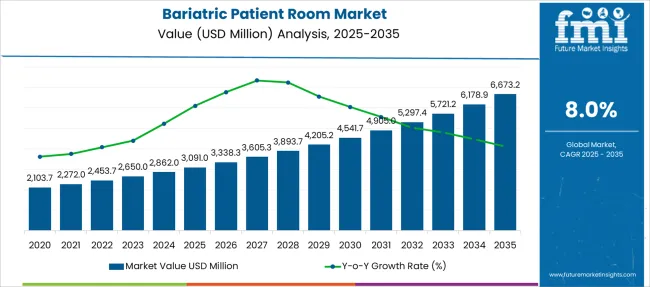

The Bariatric Patient Room Market is estimated to be valued at USD 3091.0 million in 2025 and is projected to reach USD 6673.2 million by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

| Metric | Value |

|---|---|

| Bariatric Patient Room Market Estimated Value in (2025 E) | USD 3091.0 million |

| Bariatric Patient Room Market Forecast Value in (2035 F) | USD 6673.2 million |

| Forecast CAGR (2025 to 2035) | 8.0% |

The bariatric patient room market is experiencing steady growth driven by the global rise in obesity prevalence and the increasing demand for specialized care infrastructure. Healthcare facilities are prioritizing investments in bariatric-specific equipment and room configurations to ensure safety, comfort, and mobility for patients with obesity.

Innovations in load-bearing furniture, reinforced flooring systems, and expanded doorways are supporting this transition. Additionally, the focus on minimizing caregiver injuries and improving patient dignity has encouraged widespread adoption of ergonomic and assistive technologies.

Regulatory guidelines around accessibility and patient safety have further reinforced the need for tailored patient care environments. The market outlook remains strong as hospitals and specialty clinics continue to reconfigure rooms and adopt purpose-built equipment to align with evolving patient demographics and clinical best practices.

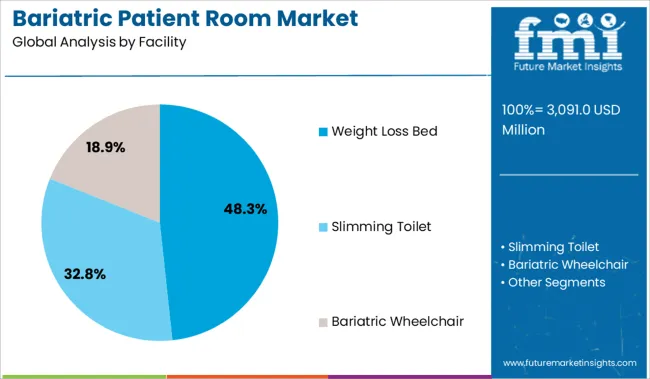

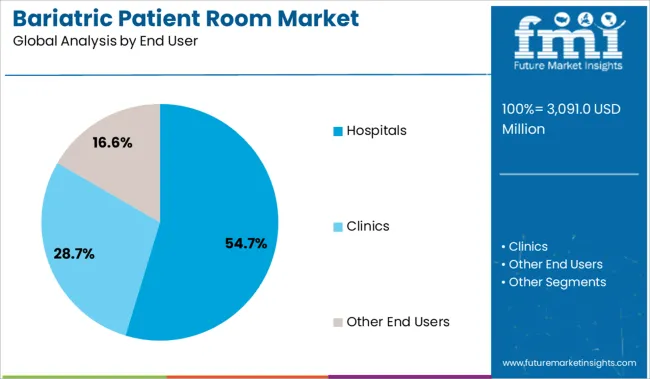

The market is segmented by Facility and End User and region. By Facility, the market is divided into Weight Loss Bed, Slimming Toilet, and Bariatric Wheelchair. In terms of End User, the market is classified into Hospitals, Clinics, and Other End Users. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The weight loss bed segment is projected to represent 48.30% of total revenue by 2025 within the facility category, positioning it as the leading segment. This dominance is attributed to the critical role of bariatric beds in patient management, providing both structural support and enhanced mobility functions.

These beds are designed to accommodate higher weight capacities while maintaining patient comfort and enabling caregiver efficiency. Features such as integrated lift systems, adjustable height, and reinforced frames contribute to safer transfers and repositioning, which are essential in reducing complications and hospital stay durations.

Their inclusion as a central fixture in bariatric care spaces reflects their indispensability, making them the most widely adopted facility component in bariatric patient room setups.

Hospitals are expected to account for 54.70% of total market revenue by 2025 under the end user category, making them the most dominant setting for bariatric patient room installations. This growth is driven by the need to cater to a broader patient base requiring obesity-related treatment and post-operative recovery.

Hospitals are proactively upgrading infrastructure to comply with safety standards and to improve care quality for bariatric populations. The centralized nature of acute care services and higher procedural volumes further support this dominance.

Investments in bariatric-specific patient rooms have been prioritized to mitigate injury risk, reduce readmission rates, and enhance patient satisfaction, securing hospitals’ position as the primary end user in this market.

The demand for bariatric patient rooms in hospitals and clinics is projected to rise due to the availability of several service alternatives, gadgets, and connections with healthcare organizations to improve healthcare goods and services. The older population is growing, and there is more assistance and infrastructure for their care.

The market share is also anticipated to be driven by rising demand for hemorrhoid treatment equipment at outpatient surgical clinics in medical situations.

In 2025, minimally invasive surgical instruments are expected to hold a share of more than 90% of the bariatric patient room industry. To accelerate the sector's growth, less invasive surgical techniques are increasingly being used instead of more traditional surgical techniques.

The market for bariatric patient rooms is undoubtedly growing due to sophisticated technologies. The projected revenue for gastric sleeve surgery is likely to be USD 3091 Million by 2025. Some of the major factors driving industry growth are the launch of technologically sophisticated devices by manufacturers and the growing acceptability of gastric sleeve surgery by doctors and patients.

The players investing in the bariatric patient room industry are anticipated to face challenges due to a shortage of qualified medical personnel with the necessary expertise. It is intended to cause significant difficulties since it makes it tough to treat a patient.

The primary concerns discouraging individuals from opting for weight control surgery and affecting the industry growth include side effects such as blood clots, infections, bleeding, constipation, and gallstones. Additionally, the adoption rate is anticipated to decline as patients frequently have postoperative concerns such as heartburn, protein or calorie deficiencies, gallstones, constipation, and gastrointestinal blockage.

According to research, the risk for mental health is increasing at a rapid pace. As per estimates, more than 20% of patients who are considering weight reduction surgery have mental health issues, particularly melancholy, anxiety, and hyperphagia. These problems are expected to impede the expansion of the bariatric patient room industry, and businesses may suffer as a result.

Hospitals all across the United States are struggling to serve an increasing number of obese patients, and are adopting new design guidelines to accommodate such kind of patients. This has led to a sharp focus on bariatric patient room market that is poised to show a robust growth. In addition, going through a bariatric surgery has become relatively necessary for people who are obese and overweight.

Due to the increasing prevalence of obesity in developed western countries, the awareness about bariatric surgery has increased. This has generated a need for conducive environment for bariatric patients in the healthcare facilities where there every need is met easily and they are comfortable during their surgery and recovery phase.

In order to treat bariatric patients, healthcare providers must invest in equipment, furniture and renovation that support heavier patients. The median estimated cost of obesity related renovations is USD 100,000. However, such costs are being recovered by the hospitals through the increase in popularity of bariatric surgeries, and Medicare reimbursements. Also, equipment inventory cost is recovered within 6 months. All this contributes to the growing bariatric patient room market.

While most healthcare facilities recognize the need to modify existing spaces and create better spaces to support an increasing bariatric patient population, there is no specific minimum weight requirement or code to follow. What complicates the matter further is the fact that there is a complete lack of a standard for what defines a bariatric patient. In addition, rates of obesity vary from region to region, making it difficult to cater to requirements that would be applicable universally.

Apart from this, it should be noted that caring for obese and overweight patients cost an average of 37% more than treatment of non-obese patients.

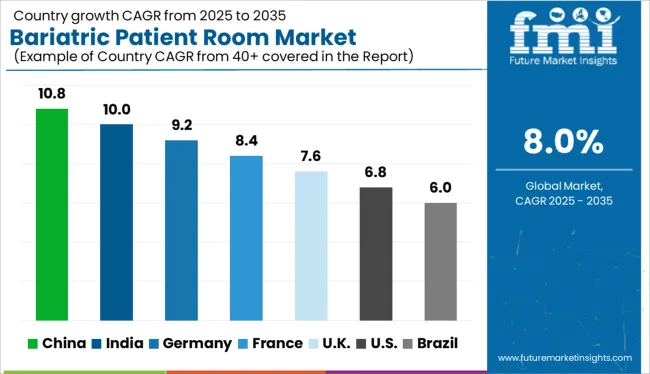

As per the available data, the North America bariatric surgery market was the largest in 2014, with increasing amount of investment by both the government and the industry to counter the ill effects caused by obesity. Also, the initiatives by the United States government in the healthcare sector makes the North American bariatric patient room market lucrative.

Obesity is also increasing at an alarming rate in Europe, making it a growing market for bariatric patient rooms. Asia Pacific is the fastest growing market for bariatric surgery and hence the market for bariatric patient rooms is also gaining huge traction.

By Facility:

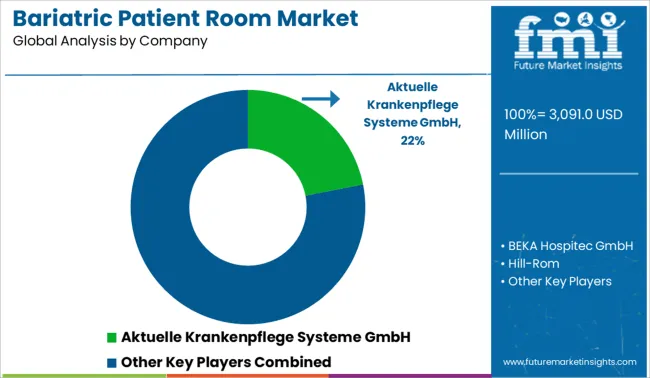

By Facility:The bariatric patient room market is growing fast, however it is not dominated by one key player in particular. Some of the important companies in the field of bariatric market in the United States are Hill-Rom, Nemschoff, Brayton, NewCare, Stryker Medical, Softcare and a few others.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, types and applications.

The global bariatric patient room market is estimated to be valued at USD 3,091.0 million in 2025.

The market size for the bariatric patient room market is projected to reach USD 6,673.2 million by 2035.

The bariatric patient room market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in bariatric patient room market are weight loss bed, slimming toilet and bariatric wheelchair.

In terms of end user, hospitals segment to command 54.7% share in the bariatric patient room market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bariatric Surgery Device Market Forecast and Outlook 2025 to 2035

Bariatric Walking Aids Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Walkers Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Rollator Walkers Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Lifts Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Transport Wheelchairs Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Beds Market Analysis and Forecast for 2025 to 2035

Patient-Controlled Analgesia Pumps Market Size and Share Forecast Outlook 2025 to 2035

Patient Transportation Market Size and Share Forecast Outlook 2025 to 2035

Patient Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Patient Positioning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring Accessories Market Size and Share Forecast Outlook 2025 to 2035

Patient Self-Service Kiosks Market Size and Share Forecast Outlook 2025 to 2035

Patient Recliners Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Patient Transport Services Market Size and Share Forecast Outlook 2025 to 2035

Patient Engagement Platforms Market Size and Share Forecast Outlook 2025 to 2035

Patient Registry Software Market Size and Share Forecast Outlook 2025 to 2035

Patient Positioning System Analysis by Product Type and by End User through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA