The bariatric beds market is valued at USD 329.41 million in 2025. As per FMI's analysis, the market will grow at a CAGR of 5.3% and reach USD 552.1 million by 2035.

FMI analysis found that the global bariatric bed market expanded steadily in 2024, driven by rising obesity rates and the growing demand for specialized medical equipment. Especially developed countries witnessed hospitals and healthcare institutions boost investments in new and state-of-the-art equipment for the treatment of obese individuals. Efforts also improved patient mobility and care in public as well as private healthcare.

Equipment design and technological advancements saw ongoing modifications with better weight capacity and greater automation for patient comfort. Supply chain interruptions, along with escalating raw material costs, have negatively affected manufacturers' pricing strategies. During the times of these obstructions, there was an even flow of demand from healthcare units across the globe, which has thereby aided sustained growth in this sector.

The FMI opines that in 2025 and after, the industry would continue to grow as investment in healthcare becomes greater and the legislative framework facilitates enhancements to patient care infrastructure. Emerging industries will see increased adoption of specialized equipment as governments enhance healthcare access. The prevalence of obesity-related diseases, including cardiovascular conditions as well as diabetes, will continue to accelerate demand, thereby strengthening growth.

Key Metrics

| Metric | Value |

|---|---|

| Estimated Global Size in 2025 | USD 329.41 Million |

| Projected Global Size in 2035 | USD 552.1 Million |

| CAGR (2025 to 2035) | 5.3% |

| Countries/Region | Regulatory Policies & Mandatory Certifications |

|---|---|

| United States | The Medicare and Medicaid Reimbursement Policy significantly impacts bariatric bed adoption in long-term care facilities. The FDA (Food and Drug Administration) classifies hospital beds as Class I or Class II medical devices, requiring 510(k) clearance for new models. OSHA (Occupational Safety and Health Administration) mandates ergonomic compliance for caregiver safety. |

| Western Europe | The EU Medical Device Regulation (MDR 2017/745) enforces strict compliance for medical beds, requiring manufacturers to meet CE certification and conduct clinical evaluations. EcoDesign Directive 2009/125/EC influences material choices, pushing for sustainable production. Individual countries, like Germany and France, impose additional safety and ergonomic guidelines for hospital beds. |

| China | The National Medical Products Administration (NMPA) regulates hospital beds under Class II medical devices , requiring clinical trials before approval. The Made in China 2025 Initiative promotes domestic production, affecting import-dependent foreign manufacturers. Hospitals must comply with GB/T 18029.3-2008 (national standard for assistive devices, including beds). |

| Japan | The Pharmaceuticals and Medical Devices Act (PMDA) oversees hospital bed certification. Medical beds must meet JIS T9254:2014 (Japan Industrial Standard for medical beds). Government-backed aging population policies encourage the adoption of assistive technologies but with cost constraints limiting premium smart beds. |

| Australia-New Zealand | The Therapeutic Goods Administration (TGA) in Australia requires medical beds to be registered in the ARTG (Australian Register of Therapeutic Goods). New Zealand follows MedSafe regulations, ensuring compliance with AS/NZS 3200.2.38:2007 (standards for medical electrical beds). Government subsidies for aged care facilities support industry growth. |

The industry is set for sustained growth, driven by rising global obesity rates and increasing investments in specialized healthcare infrastructure. Hospitals and long-term care facilities will benefit from advanced bariatric bed designs, while manufacturers must navigate supply chain challenges and pricing pressures. Emerging industries present significant expansion opportunities as governments prioritize improved patient care accessibility.

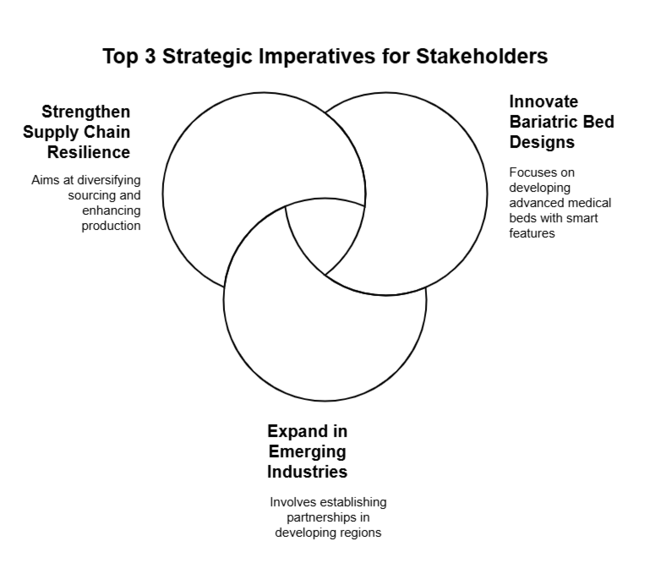

Innovate Bariatric Bed Designs

Executives should invest in R&D to develop advanced medical beds with higher weight capacity, smart monitoring systems, and enhanced mobility features. Prioritizing automation and patient comfort will drive competitive differentiation and increase adoption in hospitals and long-term care facilities.

Expand in Emerging Industries

Aligning with rising healthcare investments in developing regions, companies should establish local partnerships and distribution networks to penetrate high-growth industries. Tailoring pricing and product offerings to regional needs will ensure sustained demand and long-term industry presence.

Strengthen Supply Chain Resilience

To mitigate raw material cost fluctuations and supply chain disruptions, manufacturers must diversify sourcing strategies and enhance production capabilities. Strategic supplier partnerships and localized manufacturing can improve cost efficiency and ensure steady product availability.

| Risk | Probability & Impact |

|---|---|

| Supply Chain Disruptions - The industry's reliance on raw materials and global logistics exposes it to shortages, transportation bottlenecks, and geopolitical tensions. Delays in production and rising costs could impact profitability, requiring firms to diversify suppliers and invest in localized manufacturing. | High Probability, Severe Impact |

| Regulatory Challenges - Changing healthcare regulations, evolving safety standards, and varying compliance requirements across regions could delay product approvals and restrict industry access. Companies must proactively engage with policymakers and develop flexible strategies to navigate regulatory uncertainty. | Moderate Probability, Significant Impact |

| Pricing Pressures - Increasing competition and cost-sensitive healthcare budgets could compress profit margins. Hospitals may favor lower-cost alternatives, making it essential for manufacturers to differentiate through innovation, cost efficiency, and value-added services. | Moderate Probability, High Impact |

| Priority | Immediate Action |

|---|---|

| Supply Chain Resilience | Evaluate alternative raw material suppliers and establish contingency plans to mitigate disruptions. Expand localized manufacturing to reduce dependency on global logistics. |

| Regulatory Compliance | Conduct a comprehensive review of evolving healthcare regulations and engage with policymakers to anticipate potential policy shifts. Implement a compliance monitoring framework to ensure product approvals remain on track. |

| Competitive Differentiation | Launch R&D initiatives focused on smart monitoring systems and enhanced mobility features to improve bariatric bed offerings. Strengthen partnerships with healthcare providers to align product development with patient care needs. |

To stay ahead, companies must prioritize supply chain resilience as a priority by having diversified raw material sources and localized production investments against possible disruptions. Active regulatory participation with policy makers and proactive compliance anticipation in product development reduce expensive delay.

The intelligence gathered from these smart systems for monitoring and feedback will accordingly facilitate differentiation in competitive terms and promote patient comfort, which allows for long-term success. Intelligence demands a strategic redirection towards innovation-led growth, operational flexibility, and deep-market penetration for sustainable profits and leadership within the industry.

The 500 to 700 lbs segment is projected to grow at a CAGR of 5.6% from 2025 to 2035, leading due to its comfort, safety, and high adoption in hospitals and long-term care. Rising rates of obesity coupled with the need for specialized medical equipment to cater to bariatric surgeries are propelling the demand for medical beds for obese patients in a sizable manner, especially in hospitals. Its advanced features like customizable positioning, effective side rails, etc. along with ergonomic design promote patient safety and mobility.

Therefore, government interventions in providing healthcare and technology like automated adjustments or pressure redistribution systems can enhance the demand in this segment. Long-term demand should be sustained by a growing preference for multi-purpose use of beds, in health facilities, rehabilitation centers, and home care.

The hospital segment is expected to grow at a CAGR of 5.5% from 2025 to 2035, remaining dominant due to rising bariatric surgeries and growing obesity rates. Hospitals invest in advanced medical beds to improve patient care, reduce complications, and enhance mobility during recovery. Government initiatives and insurance coverage for obesity-related treatments further drive adoption.

Smart beds with automated adjustments, real-time patient monitoring, and pressure-relief systems minimize caregiver strain and improve patient independence. Increasing focus on infection control and durable, easy-to-clean materials enhances product demand. Expanding healthcare infrastructure and rising admissions for bariatric care ensure continued segment growth in hospitals and specialized treatment centers.

The USA is projected to expand at a CAGR of 5.8% from 2025 to 2035, driven by a rising obesity rate and increasing demand for specialized healthcare equipment. Hospitals and long-term care facilities are prioritizing advanced solutions to accommodate obese patients, ensuring comfort and safety.

FMI analysis found that government-backed programs such as Medicare and Medicaid are driving hospital purchases and infrastructure upgrades by incentivizing reimbursement policies for specialized healthcare equipment. Advanced features like fall prevention mechanisms and smart monitoring systems are gaining traction, improving patient care standards and operational efficiency in healthcare settings.

Manufacturers must comply with FDA 510(k) clearance requirements for medical devices and ensure adherence to OSHA caregiver safety regulations for broader industry acceptance. While healthcare investments are rising, supply chain disruptions and material cost fluctuations pose challenges. Localized manufacturing and strategic supplier partnerships will be key to sustaining long-term growth.

The UK is expected to grow at a CAGR of 5.1% from 2025 to 2035, supported by National Health Service (NHS) investments in obesity care and specialized patient handling solutions. Rising hospital admissions linked to obesity-related conditions are driving higher demand across public and private healthcare facilities.

FMI opines that sustainability regulations and infection control measures are influencing product design, with antimicrobial coatings and recyclable materials becoming essential features. Automation in patient handling is also gaining importance, improving caregiver efficiency and reducing musculoskeletal injuries among healthcare workers.

Manufacturers must adhere to UKCA medical device certification and NHS procurement guidelines for successful industry entry. Public sector contracts present lucrative opportunities, but stringent approval processes and cost-control policies require suppliers to demonstrate value-based pricing and long-term durability.

France is projected to register a CAGR of 5.0% from 2025 to 2035, driven by government-backed obesity management programs and a growing elderly population. Increasing hospitalizations related to chronic conditions such as diabetes and cardiovascular diseases are pushing healthcare providers to invest in advanced patient care solutions.

FMI analysis found that French healthcare institutions emphasize ergonomic designs and automation to enhance patient mobility. Electric adjustment features and pressure-relief technologies are becoming standard, improving patient outcomes and reducing the risk of complications associated with prolonged immobility.

Compliance with EU MDR (Medical Device Regulation) and HAS (Haute Autorité de Santé) guidelines is essential for manufacturers. Strict hospital budget constraints require cost-effective solutions, pushing companies to develop innovative financing models such as leasing options and long-term service contracts to improve industry penetration.

Germany is forecasted to grow at a CAGR of 5.2% from 2025 to 2035, supported by rising obesity rates and a strong healthcare infrastructure. Hospitals and rehabilitation centers are expanding their capacity, with a focus on advanced mobility solutions to improve patient safety and caregiver convenience.

FMI opines that digital integration is playing a crucial role, with IoT-enabled monitoring systems gaining traction in acute care settings. Smart weight distribution and automated repositioning technologies are improving patient comfort, reducing pressure ulcers, and enhancing long-term treatment outcomes.

Manufacturers must comply with German DIN standards for hospital equipment and EU MDR regulations to ensure product approval. Public healthcare funding and insurance reimbursements provide strong industry support, but increasing cost pressures require suppliers to optimize production efficiency and offer scalable pricing models.

Italy is set to expand at a CAGR of 4.9% from 2025 to 2035, fueled by a growing geriatric population and rising obesity-related hospitalizations. Public and private healthcare providers are upgrading their infrastructure, focusing on patient comfort and the efficiency of long-term care delivery systems.

FMI analysis found that Italian hospitals prioritize cost-effective, ergonomic solutions that enhance caregiver productivity. Features such as motorized height adjustments and lateral patient transfer mechanisms are becoming standard, helping reduce strain on healthcare workers and improving patient handling.

Regulatory approvals require compliance with EU MDR and CE marking standards for medical devices. Budget constraints in public hospitals limit purchasing power, pushing manufacturers to explore flexible financing options and partnerships with private clinics to sustain long-term demand.

South Korea is expected to register a CAGR of 5.0% from 2025 to 2035, driven by an aging population and increasing demand for specialized medical solutions. Government healthcare initiatives are promoting advanced patient management systems and improving accessibility in both urban and rural hospitals.

FMI opines that automation and digital integration are key differentiators, with smart monitoring features and AI-assisted mobility aids gaining traction. Private hospitals are leading investments in high-end solutions, while public hospitals focus on cost-efficient alternatives with essential safety features.

Manufacturers must comply with MFDS (Ministry of Food and Drug Safety) regulations and Korean Good Manufacturing Practices (KGMP) for approval. Competitive pricing and technological innovation will be crucial for companies aiming to establish a strong foothold in both premium and budget segments.

Japan is projected to grow at a CAGR of 4.7% from 2025 to 2035, supported by a rapidly aging population and government-driven healthcare reforms. Increased focus on elderly care facilities is driving demand for specialized patient mobility solutions in hospitals and nursing homes.

FMI analysis found that Japanese hospitals emphasize space-saving designs due to limited hospital room sizes. Compact and foldable solutions with automated repositioning functions are gaining popularity, optimizing space utilization while ensuring patient safety and comfort.

Manufacturers must comply with PMDA (Pharmaceuticals and Medical Devices Agency) approvals and JIS (Japanese Industrial Standards) certifications for regulatory clearance. Rising import costs present challenges, pushing domestic firms to invest in local production and supply chain efficiencies to remain competitive.

China is forecasted to expand at a CAGR of 6.0% from 2025 to 2035, driven by rapid urbanization, increasing healthcare investments, and a rising obesity rate. Government-backed infrastructure projects are modernizing hospitals, fueling demand for advanced patient care solutions.

FMI opines that local manufacturers are rapidly scaling up production to meet growing demand. Smart mobility systems and AI-driven patient monitoring technologies are gaining traction, particularly in major metropolitan hospitals, where automation is streamlining patient care workflows.

Regulatory approvals require compliance with NMPA (National Medical Products Administration) guidelines and GB standards for medical equipment. Government price controls and domestic competition are key challenges, requiring international firms to adopt localized manufacturing and strategic partnerships for sustainable growth.

Hill-Rom (Baxter International Inc.): 22-28%

Hill-Rom strengthens its leadership with AI-integrated medical beds featuring real-time pressure ulcer prevention analytics. In 2025, expanded FDA clearances for IoT-enabled weight redistribution systems will solidify its dominance in acute care. Partnerships with telehealth platforms will enhance post-discharge monitoring, improving outcomes for high-BMI patients.

Stryker Corporation: 18-24%

tryker retains its share through SmartBed 2.0, launching in Q1 2025, which features voice-activated adjustments and predictive fall-risk detection systems for enhanced patient care. Focus on military and long-term care contracts drives growth. Additionally, robotic-assisted repositioning technology reduces caregiver injuries, enhancing patient independence and supporting continued adoption in healthcare facilities.

ArjoHuntleigh (Getinge AB): 15-20%

Arjo expanded into homecare sectors in 2025, offering lightweight, foldable medical beds that provide flexibility and ease of storage for home healthcare settings. New CE-certified models integrate with EHRs for seamless data sharing, particularly in European regions. Focus on rental programs boosts accessibility, especially in cost-sensitive areas, making advanced care more affordable and available to a broader consumer base.

Invacare Corporation: 12-17%

Invacare recovers following its bankruptcy, launching low-cost, modular medical beds for emerging regions in 2025. These FDA-cleared beds target home-use niches, providing flexibility and affordability. Advancements in Medicare reimbursement policies further support adoption, enabling Invacare to establish a strong presence in underserved areas and cater to a growing demand.

Drive DeVilbiss Healthcare: 10-15%

Drive DeVilbiss strengthens its position with hybrid rehabilitation beds approved in 2025. These beds, combining mobility and weight capacity, cater to both acute and rehab settings. Partnerships with ASC networks enhance adoption, while AI-driven sleep analytics improve patient comfort, increasing demand across healthcare facilities.

Medline Industries: 9-14%

Medline’s 2025 eco-friendly medical bed line, crafted from recyclable materials, addresses the growing sustainability trends and demand for greener solutions in healthcare. The line is gaining traction, especially in hospitals focused on reducing their ecological footprint. Bulk purchasing agreements with VA and prison systems further reinforce Medline's position, expanding its share in diverse sectors.

Joerns Healthcare: 8-12%

Joerns introduces telehealth-integrated medical beds with vitals monitoring capabilities in 2025, enabling remote patient tracking and enhanced care management. Expansion into pediatric bariatrics, with beds supporting 500+ lb capacities, targets a niche demographic. This move allows Joerns to address a growing demand for specialized care across various patient groups, enhancing the company’s role in the sector.

Benmor Medical: 5-10%

Benmor Medical will focus on customizable medical beds for specialty surgery centers in 2025. New antimicrobial fabric technology helps reduce hospital-acquired infections (HAIs), enhancing patient safety. Supported by clinical trials, this innovation improves the value proposition of Benmor’s beds, positioning the company as a key player in the high-end segment.

Savaria Corporation: 5-9%

Savaria will expand in 2025 by acquiring home medical equipment distributors. Launching wall-to-wall medical bed systems for homecare settings in Europe and Canada, Savaria targets the growing demand for specialized homecare solutions. This strategic move ensures the company can penetrate underserved regions, particularly where homecare is essential for patients’ well-being.

GF Health Products: 4-8%

GF Health focuses on cost-effective medical beds in 2025, targeting the long-term care segment. IoT-enabled maintenance alerts reduce downtime, making the beds ideal for budget-conscious facilities. These beds’ functionality and affordability align with the needs of long-term care providers, ensuring ongoing demand in this expanding segment.

By weight capacity, the industry is segmented into 500 to 700 lbs, 700 to 1000 lbs, and >1000 lbs.

In terms of end-use, the industry is segmented into hospitals and nursing homes.

The industry is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

The rising obesity rates, technological advancements, government initiatives, and increased healthcare investments in specialized equipment drive the growth.

Technological advancements enhance patient comfort, mobility, and safety while reducing caregiver strain through features like automated adjustments and health-monitoring sensors.

Hospital beds are equipped with advanced features for complex care, while home healthcare beds prioritize comfort, ease of use, and compact design.

The increasing obesity rate raises the demand for bariatric care equipment due to more patients needing specialized support for obesity management and surgeries.

Manufacturers face challenges like high material costs, design complexity, and the need to meet regulatory standards while ensuring durability and functionality.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Weight Capacity, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Weight Capacity, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Weight Capacity, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (US$ Million) Forecast by Weight Capacity, 2018 to 2033

Table 12: Europe Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 13: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: South Asia Market Value (US$ Million) Forecast by Weight Capacity, 2018 to 2033

Table 15: South Asia Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 16: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: East Asia Market Value (US$ Million) Forecast by Weight Capacity, 2018 to 2033

Table 18: East Asia Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 19: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Oceania Market Value (US$ Million) Forecast by Weight Capacity, 2018 to 2033

Table 21: Oceania Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 22: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: MEA Market Value (US$ Million) Forecast by Weight Capacity, 2018 to 2033

Table 24: MEA Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Weight Capacity, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Weight Capacity, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Weight Capacity, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Weight Capacity, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 13: Global Market Attractiveness by Weight Capacity, 2023 to 2033

Figure 14: Global Market Attractiveness by End-use, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Weight Capacity, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by End-use, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Weight Capacity, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Weight Capacity, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Weight Capacity, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 28: North America Market Attractiveness by Weight Capacity, 2023 to 2033

Figure 29: North America Market Attractiveness by End-use, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Weight Capacity, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by End-use, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Weight Capacity, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Weight Capacity, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Weight Capacity, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Weight Capacity, 2023 to 2033

Figure 44: Latin America Market Attractiveness by End-use, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ Million) by Weight Capacity, 2023 to 2033

Figure 47: Europe Market Value (US$ Million) by End-use, 2023 to 2033

Figure 48: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ Million) Analysis by Weight Capacity, 2018 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Weight Capacity, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Weight Capacity, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 58: Europe Market Attractiveness by Weight Capacity, 2023 to 2033

Figure 59: Europe Market Attractiveness by End-use, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia Market Value (US$ Million) by Weight Capacity, 2023 to 2033

Figure 62: South Asia Market Value (US$ Million) by End-use, 2023 to 2033

Figure 63: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia Market Value (US$ Million) Analysis by Weight Capacity, 2018 to 2033

Figure 68: South Asia Market Value Share (%) and BPS Analysis by Weight Capacity, 2023 to 2033

Figure 69: South Asia Market Y-o-Y Growth (%) Projections by Weight Capacity, 2023 to 2033

Figure 70: South Asia Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 71: South Asia Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 72: South Asia Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 73: South Asia Market Attractiveness by Weight Capacity, 2023 to 2033

Figure 74: South Asia Market Attractiveness by End-use, 2023 to 2033

Figure 75: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) by Weight Capacity, 2023 to 2033

Figure 77: East Asia Market Value (US$ Million) by End-use, 2023 to 2033

Figure 78: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: East Asia Market Value (US$ Million) Analysis by Weight Capacity, 2018 to 2033

Figure 83: East Asia Market Value Share (%) and BPS Analysis by Weight Capacity, 2023 to 2033

Figure 84: East Asia Market Y-o-Y Growth (%) Projections by Weight Capacity, 2023 to 2033

Figure 85: East Asia Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Weight Capacity, 2023 to 2033

Figure 89: East Asia Market Attractiveness by End-use, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: Oceania Market Value (US$ Million) by Weight Capacity, 2023 to 2033

Figure 92: Oceania Market Value (US$ Million) by End-use, 2023 to 2033

Figure 93: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: Oceania Market Value (US$ Million) Analysis by Weight Capacity, 2018 to 2033

Figure 98: Oceania Market Value Share (%) and BPS Analysis by Weight Capacity, 2023 to 2033

Figure 99: Oceania Market Y-o-Y Growth (%) Projections by Weight Capacity, 2023 to 2033

Figure 100: Oceania Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 101: Oceania Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 102: Oceania Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 103: Oceania Market Attractiveness by Weight Capacity, 2023 to 2033

Figure 104: Oceania Market Attractiveness by End-use, 2023 to 2033

Figure 105: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 106: MEA Market Value (US$ Million) by Weight Capacity, 2023 to 2033

Figure 107: MEA Market Value (US$ Million) by End-use, 2023 to 2033

Figure 108: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: MEA Market Value (US$ Million) Analysis by Weight Capacity, 2018 to 2033

Figure 113: MEA Market Value Share (%) and BPS Analysis by Weight Capacity, 2023 to 2033

Figure 114: MEA Market Y-o-Y Growth (%) Projections by Weight Capacity, 2023 to 2033

Figure 115: MEA Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 116: MEA Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 117: MEA Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 118: MEA Market Attractiveness by Weight Capacity, 2023 to 2033

Figure 119: MEA Market Attractiveness by End-use, 2023 to 2033

Figure 120: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bariatric Walking Aids Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Walkers Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Rollator Walkers Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Lifts Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Transport Wheelchairs Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Patient Room Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Surgery Device Market Insights – Growth & Forecast 2024-2034

Pet Beds Market Analysis - Trends, Growth & Forecast 2025 to 2035

Canopy Beds Market

Hospital Bedsheet & Pillow Cover Market Analysis - Size, Trends & Forecast 2024 to 2034

Air Fluidized Therapy Beds Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA