The market for barcode printers and consumables is expected to experience moderate growth between 2025 and 2035 as the use of automated identification and data capture (AIDC) technologies continues to rise across a diverse range of industries such as retail, healthcare, logistics, manufacturing, and e-commerce.

Barcode printers create labels and tags that can be scanned, and their consumables (i.e., labels, ribbons, ink cartridges, and even print heads) as supply chain management systems, warehouse automation and Omni channel retailing continue expanding in deployment, the need for high-quality barcode printing is also growing.

E-commerce & logistics operations, which is one of the primary growth drivers. These demand in fulfillment and distribution centers have made these barcode printers as widely used in printing shipping label, inventory tracking, and warehouse management system.

Furthermore, the strict requirements for product traceability & serialization in industries like pharmaceuticals & food & beverage force the organizations to invest in high resolution barcode printers & long right-lasting consumables.

Other technology trends influencing the market include thermal printing, RFID-integrated labels, and cloud-based barcode printing solutions. This goes for mobile and wireless barcode printers too, and it further leads to increased operational flexibility, especially in retail businesses, medical establishments, and mobile delivery service companies.

Furthermore, the growing use of environmentally friendly and sustainable barcode printing consumables, including biodegradable labels and non-toxic printing inks, is gaining considerable traction, even among business entities opting for processes that prioritise sustainable practices.

The high upfront investment for these systems is a barrier to wider adoption, as is the high cost of maintenance and compatibility issues with legacy systems. But the market will experience growth due to the increasing demand for real-time asset tracking, enhancement in print resolution and durability, and development of cloud & hosted based barcode printing software.

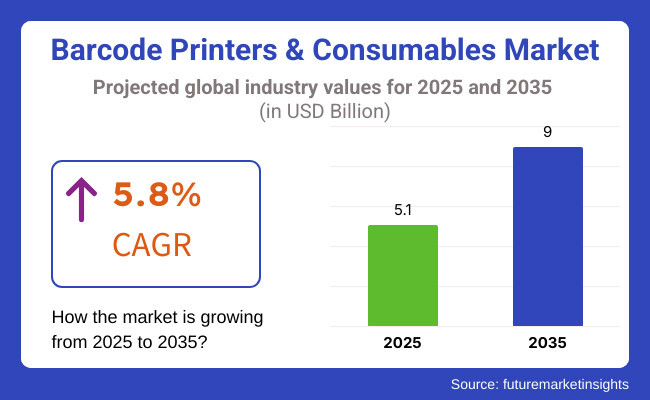

The barcode printers and consumables market accounted for USD 5.1 billion in the year 2025 and is expected to reach USD 9.0 billion by the year 2035, at a CAGR of 5.8% during the forecast period.

Explore FMI!

Book a free demo

In North America, a significant market share is anticipated owing to rapid adoption of AIDC technologies in addition to growth of e-commerce, coupled with regulatory requirements mandating AIDC barcode labelling in healthcare, pharmaceutical, and manufacturing environments.

North America Thermal Barcode Printers RFID enabled Barcode solutions Market is growing demand for thermal barcode printers and RFID-enabled barcode solutions in the USA and Canada.

The demand for barcodes is also high in Europe, especially in Germany, the UK, and France where barcode labelling is extensively used within the retail, logistics, and industrial sectors. There is also growing demand of sustainable barcode printing solutions in the region.

The Asia-Pacific is the fastest growing region in the market owing to the growing e-commerce and digital transformation projects being undertaken by China, India, and Japan among other countries with new manufacturing hubs. Government mandates for traceability across food and pharmaceuticals business sectors to further speed up adoption of barcode printers.

Latin America is experiencing strong growth, as countries such as Brazil and Mexico invest more in supply chain automation, retail digitization, and logistics infrastructure. There is an increasing need for economical barcode printing.

The Middle East & Africa has become a developing market, where growth includes improved logistics networks, retail expansion, and modernized healthcare. The UAE, Saudi Arabia, and South Africa are the industries that underpin the growth of the market for rugged mobile barcode printer and supplies.

Challenges

High Initial Costs and Maintenance

High initial costs of industrial-grade barcode printers are one of the most crucial restraints in the barcode printers and consumables market. It becomes increasingly difficult for businesses, particularly small and medium enterprises (SMEs) to invest in new printing solutions due to the nature of their high roosting, initial investment and continuous maintenance cost.

Moreover, expenses incurred from consumables are also a factor in overall operational costs, including thermal ribbon, labels, and print heads.

Another disadvantage is that regular maintenance is necessary to keep the print quality from degrading and prevent hardware malfunctions. Failure of printers causes downtime that disrupts supply chain operations, logistics, and retail operations.

Opportunities

Growing Demand for Advanced Printing Technologies

The growing need for precise inventory management, supply chain optimization, and product tracking processes drive the requirement for high-speed as well as high-resolution barcode printing solutions. To meets the needs for labelling in various industries such as healthcare, retail logistics, manufacturing, and companies are investing thermotransfer and direct thermal printing technologies.

And the shift to sustainability and eco-friendly consumables comes with new opportunities. As companies embrace greener practices, the recycling of barcode labels, non-BPA thermal paper, and solvent-free inks is also becoming more common. Cloud-based barcode printing and RFID-enabled solutions are also paving the way for innovations in the market.

Between 2020 to 2024, the market was boosted by the increase in e-commerce, retail automation, and warehouse management systems. With businesses more focused on optimizing supply chain operations, the demand for high speed barcode printing increased. But problems with printer idle time, consumable expenses, and regulatory compliance presented obstacles.

The 2025 to 2035 market will also see advancements in wireless and mobile barcode printout technologies for real-time tracking and labelling solutions. AI-powered barcode scanning, cloud-based print management systems, and IoT-enabled barcode printers will take industrial standards to the next level. Environmental impact reduction will also be driven by the use of sustainable barcode printing materials and digital printing solutions.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Printing Technology | Dominance of thermal transfer and direct thermal printers |

| Market Demand | Growth in retail, logistics, and e-commerce-driven demand |

| Sustainability Trends | Initial adoption of eco-friendly consumables |

| Cost and Investment | High investment in industrial-grade barcode printers |

| Integration with Digital Solutions | Limited integration with cloud and IoT |

| Regulatory Compliance | Compliance with industry labelling regulations |

| Printing Technology | Dominance of thermal transfer and direct thermal printers |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Printing Technology | Expansion of RFID-integrated and AI-enhanced barcode printing solutions |

| Market Demand | Increased adoption in healthcare, pharmaceuticals, and automotive industries |

| Sustainability Trends | Large-scale shift toward recyclable, biodegradable labels and solvent-free inks |

| Cost and Investment | Rise of cost-effective mobile and cloud-based barcode printing solutions |

| Integration with Digital Solutions | Widespread adoption of cloud-based printing, AI-driven scanning, and predictive maintenance |

| Regulatory Compliance | Enhanced traceability solutions with blockchain integration and real-time tracking |

| Printing Technology | Expansion of RFID-integrated and AI-enhanced barcode printing solutions |

From printed labels to print heads and ink ribbons, our specialty is in the wide range of barcode printers and consumables market in the United States. Besides, the growth of Omni channel retailing, e-commerce, and warehouse automation is further boosting the demand for high-speed barcode printing solutions to improve inventory tracking and supply chain efficiency.

As IoT and AI-enabled tracking solutions are being rapidly adopted, businesses are connecting smart barcode printing systems with real-time inventory monitoring and cloud-based data management.

In addition, the shift of the retail industry toward the adoption of RFID integrated barcode labels for improved product authentication and anti-counterfeit is creating a positive impact on the demand for higher-level barcode consumables such as synthetic labels, ribbons, and RFID-enabled tags.

Demand growth is also strong in the USA healthcare industry, which has led hospitals and pharmaceutical companies to adopt barcode printing for medication tracking as well as patient identification and regulatory compliance per FDA and GS1 standards.

As the importance of data security and counterfeiting precautions rises, the global demand for durable and tamper-proof barcode labels and high-resolution thermal printers are anticipated to rise.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.1% |

The UK barcode printers and consumables market is witnessing steady growth due to rising logistics operations, booming contactless retail solutions, and increasing number of barcode-based automation solutions in healthcare and manufacturing industry. The rise in online shopping and last-mile delivery services driven businesses to invest in high-speed, industrial barcode printers for real-time tracking and inventory accuracy.

As the UK moves toward digitalisation in supply chain management, RFID and 2D barcode printing solutions are increasingly being used by companies seeking to enhance traceability, combat fraud and improve asset tracking. Moreover, the government regulations regarding food labelling and pharmaceutical packaging drive the growth of high-resolution barcode labels and thermal transfer ribbons, which help to meet safety and traceability standards.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.7% |

The EU barcode printers and consumables market is expanding strongly, aided by strict traceability regulations in food, pharmaceuticals, and logistics, rapid growth of e-commerce, and increasing automation in industrial manufacturing. The emphasis by the EU on product safety, sustainability, and anti-counterfeiting measures is driving businesses towards using RFID barcode solutions and durable labelling material.

As the European Union's Falsified Medicines Directive (FMD) and GS1 compliance standards the pharmaceutical and healthcare industries turn to secure, tamper-proof barcode printing solutions for drug serialization and patient safety. Supply chain transparency and efficiency is being improved with the adoption of barcode-based digital inventory systems across retail and automotive industries as well.

Additionally, the emergence of sustainable barcode printing alternatives, such as linerless labels and recyclable thermal ribbons, is impacting purchase decisions among eco-friendly companies.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 5.8% |

Advancements in precision printing technologies, growing adoption of barcode-based logistics automation, and strong demand from the retail and healthcare industries are driving the growth of Japan’s barcode printers and consumables market. Japan has a highly developed supply chain, and organizations are investing in high-speed, AI-enabled barcode printers that improve inventory management and operational efficiency.

The retail industry in Japan is leading the charge to adopt QR codes and RFID-based barcode solutions, especially using cashless transactions and automated checkout systems. Furthermore, Japan's pharmaceutical and food industries are utilizing high-resolution barcode printing for improving safety, traceability, and adhering to strict government regulations.

To accommodate rising concerns regarding sustainability, manufacturers are diversifying their portfolios to feature biodegradable barcodes labels, solvent-free ribbons as well as ultra-durable synthetic labels to address environmental impact while maintaining maximum print durability.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.9% |

Growing e-commerce facilitated by growing Internet connectivity, increased automation across logistics and warehousing, and growing adoption of RFID barcode labelling across the retail and healthcare industrial sectors are emerging as the key growth drivers for the barcode printers and consumables market in South Korea.

These technologies have caught interest at global companies like Samsung and LG, which are now implementing barcode-based tracking solutions to improve efficiency and trace products.

The women at the head of some of the best companies, with plenty of culturally adapted solutions in the clothing and home goods sector all the way down to digital attire such as translating your orders for a private business of tackling the most diverse keywords based on misspellings in identification numbers.

Moreover, increasing demand for small scale businesses and ecommerce sellers are driving demand for compact, speedy desktop barcode printers under DTC business models.

The growing trend of sustainability and environmental-friendly printing solutions is carousing linerless labels, recyclable barcode tags, and low-emission thermal printing technologies in the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.9% |

Increased Demand for High-Speed Printing and Cost-Effective Solutions: The Barcode Printers and Consumables Market is driven mainly through the Desktop Printer and the Industrial Printer segments since companies are focusing on efficiency and cost-effectiveness in barcode labelling. Across multiple domains, these printers offer seamless inventory management, tracking and product authenticity.

The Desktop Printer segment is increasingly being adopted as they are compact, easy to operate, and affordable. Desktop barcode printers are widely used by small to medium businesses (SMB), retail stores, and healthcare facilities for their daily labelling requirements.

The growing trend towards thermal transfer and direct thermal desktop printers that provide high-resolution printing, fast label output, and low maintenance are some of the factors driving the market adoption for desktop printer devices so that businesses can utilize low-cost yet durable barcode labelling.

Mobile printers include portable printers for on-the-go usage as well as Wi-Fi and Bluetooth-enabled desktop (which in themselves are cloud-enabled) printers whose demand worldwide is witnessing growth due to the obvious need for supply chain integrations with a mobile and thus cloud-oriented inventory.

The increasing adoption of sustainable desktop barcode printers, which include recyclable label materials, low-energy consumption, and ink-free printing technologies, leads to market growth while ensuring sustainable compliance.

On the other hand, desktop barcode printers are economical and simple to use but have volume and durability limitations. Nevertheless, innovations including high-speed printing, longer-lasting print heads, and integrated software solutions are increasing their efficiency, and the market will no doubt continue to grow.

The Industrial Printer segment accounts for a lion’s share, as large-scale industries, warehouses and logistics centers rely on high-quality barcode printers for bulk production of labels. These printers help in the business of supply chain operations and also for real-time inventory tracking.

Demand for rugged industrial barcode printers with heavy-duty metal casings, dustproof enclosures, and high temperature resistance has further driven the market growth as these products offer maximum durability even in harsh work environment.

Growth in demand for high-speed industrial printers with automatic label feeding, precision print mechanisms and minimal downtime was a key aspect sustaining market demand and giving high-productivity advantages for high-volume printing applications.

By eliminating the need for application software to manage RFID and providing built-in encoding capabilities, the growth of RFID-enabled industrial printers has supported the market adoption by allowing for smooth integration with smart tracking and warehouse management platforms.

The expanding incidence of automated industrial barcode printing solutions with advanced function capabilities like real-time label inspection, machine learning-enabled print optimization, and predictive maintenance features are fueling market growth, enabling error-proof labelling processes.

While industrial barcode printers are best in terms of efficiency and durability, they are not cheap, which can prove a hurdle for small businesses. But, modular and cloud-connected industrial printers are what taking it to the next level - and making them available for the masses, ensuring the steady growth of its market penetration.

Having the largest data base, the Industrial/Manufacturing segment dominates the market due to the use of barcode printers for product labelling, batch tracking, and quality control automation processes.

It streamlines production processes, minimizes human error, and maintains compliance. Demand for on-demand industrial barcode printing, high-speed output, and automated label application and further to market growth, providing seamless integration with manufacturing lines.

The increasing demand for customizable barcode printing solutions, such as multi-language printing, variable data printing, and real-time serialization, has bolstered the adoption of market players, enabling compatibility among distinct manufacturing types.

Industry 4.0 which includes AI-based predictive analytics, IoT connectivity, and cloud-based tracking, has enlarged the scope of smart barcode printers, which has further consolidated the market demand for barcode printing due to optimum automation of workflow.

This is expected to contribute to market expansion, particularly with the increased adoption of high-durability labels for industrial applications, with many featuring water-resistant, heat-resistant and chemical-proof coatings for maintaining barcode readability in extreme environments.

The barcode printer and consumables market is growing at a rapid pace as automatic tracking, inventory management, and product labelling solutions are increasingly used in retail, logistics, healthcare, and manufacturing sectors.

E-business, digitalization, and IOT-based barcode printing solutions have also contributed to the market growth. Furthermore, various breakthroughs, such as in thermal printing technology, RFID integration, and eco-friendly consumables, are also propelling innovation in this domain.

Market Share Analysis by Key Players & Barcode Printing Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Zebra Technologies | 24-28% |

| Honeywell International Inc. | 15-19% |

| SATO Holdings Corporation | 10-14% |

| TSC Auto ID Technology Co., Ltd. | 8-12% |

| Brother Industries, Ltd. | 6-10% |

| Others | 22-30% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Zebra Technologies | Specializes in thermal barcode printers, mobile printing solutions, and RFID-integrated printing systems. |

| Honeywell International Inc. | Develops industrial-grade barcode printers with smart connectivity and high-speed printing. |

| SATO Holdings Corporation | Offers label printers with precision tracking, cloud-based printing, and durable barcode consumables. |

| TSC Auto ID Technology Co., Ltd. | Focuses on cost-effective, high-performance barcode label printers with robust connectivity. |

| Brother Industries, Ltd. | Provides compact, portable barcode printers for retail and small business applications. |

Key Market Insights

Zebra Technologies (24-28%)

As the market leader, Zebra Technologies dominates with thermal printing, RFID-enabled barcode printers, and cloud-based printing solutions for industries including logistics, retail, and healthcare.

Honeywell International Inc. (15-19%)

Honeywell’s high-performance industrial barcode printers cater to warehousing, transportation, and manufacturing sectors, offering fast printing speeds, Wi-Fi connectivity, and rugged designs.

SATO Holdings Corporation (10-14%)

SATO specializes in on-demand label printing solutions, integrating cloud technology and precision thermal printing to serve pharmaceutical, food, and logistics industries.

TSC Auto ID Technology Co., Ltd. (8-12%)

TSC is known for affordable yet high-quality barcode printers, with a strong presence in emerging markets and small-to-medium businesses looking for durable and cost-efficient printing solutions.

Brother Industries, Ltd. (6-10%)

Brother excels in portable and compact barcode printing for point-of-sale (POS), retail stores, and small-scale logistics, offering wireless connectivity and mobile printing options.

The overall market size for barcode printers and consumables market was USD 5.1 billion in 2025.

The barcode printers and consumables market is expected to reach USD 9.0 billion in 2035.

The growth of the barcode printers and consumables market will be driven by increasing adoption of automated labelling solutions across retail, healthcare, and logistics sectors.

The top 5 countries which drives the development of Barcode printers and consumables market are USA, European Union, Japan, South Korea and UK

Industrial Printers to command significant share over the assessment period.

High Voltage Glass Insulator Market Growth - Trends & Forecast 2025 to 2035

Heavy Duty Heat Pump Market Growth - Trends & Forecast 2025 to 2035

Hedge Trimmers Market Growth - Trends & Forecast 2025 to 2035

High Speed Steel (HSS) Tools Market Growth - Trends & Forecast 2025 to 2035

Heat Shrink Tubing and Sleeves Market Growth - Trends & Forecast 2025 to 2035

Diaphragm Coupling Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.