Banquet carts is an important equipment in hotels, banquet halls, convention centers, restaurants, and cruise ships to ensure smooth foodservice, transportation, and storage. With the increased luxury event catering, large-scale food services, and high-end banqueting facilities, the demand for durable, efficient, and technologically advanced banquet carts is growing.

The booming event and catering industry is one of the key factors propelling market growth. The growing market for corporate events, destination weddings, and high-visibility social functions spurred demand for specialized banquet carts that can optionally maintain temperature and adhere to food safety regulations during the transfer.

Innovations including heated and refrigerated compartments, modular designs, and smart storage solutions are becoming more popular with hotels, catering companies and event organizers, according to the International Association of Conference Centers.

In addition, the hospitality and cruise ship industry is significantly driving the demand for multipurpose banquet carts due to long-standing and emerging buffet trend coupled with live food stations. Stainless steel, lightweight and corrosion-resistant coating technology pave the way for popularizing rust-proof carts that are extremely durable, ideal for heavy, high frequency usage in wildly diverse conditions.

Moreover, the advent of technology such as IoT-enabled tracking, smart temperature regulation, and ergonomic designs are all making modern banquet carts more efficient and functional.

The banquet cart manufacturers are being created due to the growth of the hospitality industry in developing economies, especially in APAC, the Middle East, and Latin America. In nations such as China, India, Brazil and the UAE, considerable investment is made in luxury hotels, places for events, and catering, and the demand for premium banquet service equipment is therefore on the increase.

Manufacturers are also looking ahead to new continents, and at the moment, the North American continent and Europe are focusing more and more on sustainable and eco-friendly catering solutions, such as these recyclable materials, energy-efficient insulation, and hybrid-powered banquet trolleys

But market growth may be hampered by high initial costs, space limitations, and maintenance difficulties. However, the growing consumer demand, growing automation of catering service and continuous product innovations are key factors anticipated to add in the overall market adoption for banquet cart in diverse hospitality settings.

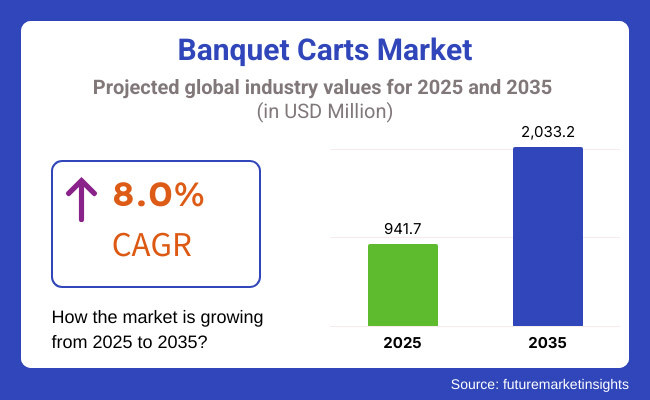

The banquet carts market accounted for USD 941.7 million in the year 2025 and is expected to reach USD 2033.2 million by the year 2035, at a CAGR of 8.0% during the forecast period.

Explore FMI!

Book a free demo

North America dominates the market because of high demand from premium hotels, corporate catering services, and luxury event venues. The USA and Canada are increasingly focused on custom-made, lightweight, temperature-controlled banquet service carts that maximize service efficiency.

The demand for such materials in the production of smart banquet carts is in high demand in Europe, as they use eco-friendly materials. Germany, France, and UK are among the nations investing on high-end catering solution for corporate and social events.

The market in Asia-Pacific is expected to grow at the fastest pace due to factors such as rapid urbanization, rising disposable incomes, and, strong wedding and hospitality industry. Major contributors include countries such as India, China, and Japan, and luxury hotels and resorts have been upgrading their banquet service equipment.

Latin America, however, is stagnant, particularly in Brazil and Mexico, where the hospitality and event planning industries are developing. As more hotels and event halls upgrade their catering and food service, there is an increasing demand for durable banquet carts that are less expensive but still of high quality.

The Middle East is a strong emerging market with UAE, Saudi Arabia, and Qatar investing heavily in luxury hotels, grand venues, and high-volume catering services. In particular, such as for 5-star hotels and high-end venues, the need for premium and heavy-duty banquet carts is increasing.

Challenges

Durability and Cost Constraints

One of the major challenges in the banquet carts market is providing the balance between durability and affordability. Professional level products in hotels, event facilities, and catering services require high quality banquet carts, and such as, heavy duty materials such as aluminum and stainless steel are used.

The downside to these materials is the cost to purchase and maintain them, which can be prohibitive for smaller businesses and tight budgets.

Moreover, manoeuvrability and space efficiency are still considered challenges in high-traffic banquet environments.

Opportunities

Rising Demand for Ergonomic and Smart Banquet Carts

It is this growing hospitality industry and demand for effective food and beverage service which opens the doors for banquet carts market. Such advances have led to an increasing demand for lightweight, modular and easy to manoeuvre banquet carts that improve the operational efficiency of catering and events.

Technological innovations, including induction-heated or temperature-controlled banquet carts, smart storage compartments, and foldable designs, offer fresh growth avenues. Sustainable materials and energy-efficient carts also create opportunities for manufacturers introducing alternative design.

The market has registered a shift toward high-capacity and durable banquet carts between 2020 and 2024, particularly with the resurgence of large-scale events, conferences, and weddings from the pandemic in ways that see the return of in-person functions.

Hygiene-minded designs like easy-to-sterilize surfaces and contact-free food transport became top priorities. As commercial kitchens and event venues needed better space management, the demand for stackable and space-efficient banquet carts also increased.

Between 2025 to 2035, the market will be flooded with demand that records IoT-enabled tracking, automated food temperature regulation, and light-weight, foldable smart banquet carts in the catering and hospitality business. “Sustainability focus will lead to increased utilization of banquet carts built with recyclable and eco-friendly materials.” In the banquet carts market, customization, modularity, and automation will lead the way for innovation.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Material Innovations | Stainless steel and aluminum banquet carts |

| Smart Functionality | Limited integration of technology |

| Market Demand | Recovery-driven demand for durable, high-capacity carts |

| Cost and Investment | High cost of durable materials limiting adoption |

| Customization Trends | Standardized cart designs with fixed compartments |

| Energy Efficiency and Sustainability | Early adoption of eco-friendly coatings and easy-to-clean surfaces |

| Material Innovations | Stainless steel and aluminum banquet carts |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Material Innovations | Expansion of lightweight, eco-friendly, and antimicrobial-coated materials |

| Smart Functionality | Widespread adoption of IoT-enabled tracking, automated temperature control, and RFID-based inventory management |

| Market Demand | Growth in demand for smart, ergonomic, and energy-efficient banquet carts |

| Cost and Investment | Increased use of cost-effective, modular, and foldable cart designs |

| Customization Trends | Expansion into customizable, multi-functional, and stackable banquet carts |

| Energy Efficiency and Sustainability | Large-scale implementation of carbon-neutral, recyclable, and energy-efficient banquet carts |

| Material Innovations | Expansion of lightweight, eco-friendly, and antimicrobial-coated materials |

The United States banquet carts market is segmented into material, end user and region. Weddings, corporate events, and large-scale banquets are constantly becoming more elaborate, and therefore there is an increasing need for durable, temperature-controlled banquet carts that ensure seamless service and preservation of food and beverages.

With the hotel and tourism industry bouncing back from a pandemic, catering services have also gone through modernization, top-end hotels and event holding places have replaced their conventional banquet carts with smart designs, with three features IoT-enabled temperature monitoring, ergonomic design and high-mobility.

Moreover, sustainability is a significant trend forcing manufacturers to offer energy efficient banquet carts made of recyclable materials with optimized insulation to reduce energy consumption.

Sales of portable and lightweight banquet carts that can be effortlessly transported in large quantities for outdoor parties and events are also driving demand, owing to the burgeoning of off-site catering and mobile food service enterprises. As luxury and destination weddings have gained popularity, so to have the demand for customizable high-end banquet carts, with expected growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.3% |

The United Kingdom banquet carts market is gaining traction, primarily due to increasing demand from hotels, fine dining restaurants, and event management companies. The market for high-quality banquet carts with superior insulation and mobility features is in high demand as the number of high-profile weddings, business conferences, and social events rises.

The UK hospitality sector's drive for efficiency via the introduction of precision temperature controlled, lightweight stainless steel smart banquet carts and compact storage architecture is also reflected in similar orders through the USA. The rise of pop-up dining and gourmet catering (London, Manchester and Edinburgh) is also fuelling demand for multifunctional banquet carts, which are suited to the use and display of both hot and cold food.

Additionally, stringent food safety regulations issued by the UK Food Standards Agency (FSA) is catalyzing the adoption of hygienic, easy-to-clean banquet carts that ensure food quality while complying with the industry standards.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.1% |

Some of the major factors driving the growth of the European Union (EU) banquet carts market include expansion of the luxury hospitality industry, growing need for energy-efficient catering solutions, and a focus on food safety compliance.

Nations like France, Germany, and Italy are at the vanguard of high-end activity catering and five-star hospitality departments, strengthening the requirement for top-of-the-range banquet carts with excellent insulation and temperature management.

Sustainability EU regulations are prompting manufacturers to design eco-friendly banquet carts manufactured with recyclable materials and low energy consumption heating and cooling systems. Moreover, the development of automated catering equipment has led to the introduction of IoT-enabled banquet carts with remote monitoring, smart sensors, and improved manoeuvrability.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 8.0% |

Demand from high-end catering and luxury hotels as well as business events continue to drive steady growth within Japan’s banquet carts market. To address the demands for high-end catering operations in Japan, banquet carts are indeed being manufactured with features such as microprocessor precision temperature control, a compact airflow storage design, and extrinsic decoration for delicate aesthetics.

Alongside this explosion in international tourism, business conferences, and traditional Japanese kaiseki wedding receptions has created demand for custom designer banquet carts that maintain the freshness and temperature stability of the food offered.

Japan has also led the trend of automation and smart kitchen equipment, affecting the development of AI-powered banquet carts equipped with temperature-freezing and IoT-based two-way remote monitoring.

As a consequence, the move to energy-efficient catering equipment is driving manufacturers to create low-energy, highly insulating banquet carts that cost-effective to keep powered whilst maintaining food safety benchmarks.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.2% |

The South Korean market for high-end banquet carts has seen rapid growth, driven by a rising number of five-star hotels and luxury event spaces and catering services. And as cities such as Seoul and Busan attract more premium hospitality infrastructure, demand is surging for temperature-controlled banquet carts that can preserve the quality of food for events on a large scale.

The Korean government’s efforts to promote smart commercial kitchen equipment is also responsible for the creation of IoT-enabled banquet carts that include smart sensors, and provide real-time temperature tracking.

Moreover, the evolving trends of fine dining along with growth of high end catering services in the market are pushing up the demand for strategically designed trays and display banquet carts for luxury dining experience.

Moreover, increasing global food tourism in South Korea as a catering business adds to the growth of demand for modular and portable banquet carts for serving authentic Korean cuisine at international events and exhibitions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.1% |

The banquet carts market can be segmented into two categories: Heated Banquet Carts and Non-Heated banquet carts segments that are crucial for commercial kitchen, hotel and large-scale food service providers to ease the challenges associated with food transportation and storage.

These carts optimize meal service operations, providing efficient temperature preservation for food, and enhancing orderliness as well as mobility.

The heated banquet carts segment is not only in demand but will also grow to be an increasingly competitive market among food service providers, as maintaining temperature and food quality as things are delivered becomes necessary. These built-in heating elements maintain the temperature of a meal for optimal serving conditions for catered events, banquet halls, and institutional dining services.

Market growth has been further propelled by the rising integration of thermostat-controlled heated banquet carts that have digital displays, humidity control and dual-temperature areas with multi-compartment heating.

With the spread of energy-efficient heating system with insulating inner up fitting, rapid heating technology, and other program heating modes, the market demand is creating a balance at reduced energy consumption and operational cost.

This has further supported the adoption of mobile heated banquet carts in the market with heavy-duty casters, ergonomic handles and impact-resistant designs providing better manoeuvrability in high-traffic catering environments.

Their durability, easy-to-clean surfaces, and corrosion resistance have contributed to the increasing adoption of stainless steel heated banquet carts, driving market growth by ensuring product longevity and compliance with food safety standards.

Heated banquet carts may help keep food warm and facilitate timely service, but they are sometimes more expensive up front than conventional carts and rely on electrical power.

In contrast, the introduction of multiuse products in the market and battery-operated heating systems as well as solar-assisted banquet carts are supplying solutions to these above-mentioned concerns, thereby maintaining demand across the globe market.

The market for Non-Heated Banquet Carts is anticipated to sustain its stronghold owing to the nature of applications where food is not heated during transportation. These rolling carts use premium-insulating and enclosed segments to keep the heat in and your food safe from any contaminants in the environment.

The increasing adoption of lightweight and portable banquet carts, which are characterized by their compact design, stackable configuration, and sturdy handles, facilitates easy movement and flexible storage, propelling the market growth.

Growing preference for versatile non-heated banquet carts with adjustable shelving, removable tray racks and multi-tier design has been driving the market, providing improved storage capacity and service efficiency.

Increasing high-durability offerings like aluminum and polymer construction, shock-absorbing wheels, reinforced door seals etc. has helped further grow demand for such products in fast moving catering and storage environments.

The increasing adoption of modular and multi-functional banquet carts with integrated compartments designed for holding beverages, cutlery, and meal trays empowering the market growth over next few years with fully equipped food service solutions.

Non-heated banquet carts can provide cost savings, durability and low maintenance needs, but these are not ideal for transporting food over long distances when heat retention is a factor.

The application of banquet carts includes hotels and restaurants segments, which are the most prominent ones, as this application is focusing on the large cake or banquet catering solution, buffet catering solution, and room service, where we grab foods or beverages from one place to another in a proper manner.

Luxury hotels, resorts, and business hotels depend substantially on banquet carts to streamline food service operations, thus contributing immensely to the market share of the hotels segment. Providing rapid delivery of meals, organized catering, and flawless room service execution, these carts are a must-have.

Significant market adoption is driven by growing utilization of high-capacity banquet carts, containing several storage sections, hot and cold compartments, and user-friendly access doors, ensuring improved service efficiency for large events.

The demand within the food cart market is further driven by the proliferation of premium banquet carts in five-star hotels equipped with silent-rolling wheels, aesthetic finishes, and high-end material construction, contributing to an upscale dining experience.

The upsurge in demand for automated banquet carts characterized by smart tracking systems, RFID-based inventory management, and digital temperature controls has further bolstered market expansion, leading to real-time monitoring and operational efficiency.

The market growth rate has been increased by the increasing use of designs for multi-functional banquet carts in hotel chains for serving beverage dispensers, plate warmers, and compartments for storage which expands their market reach providing all-in-one service solutions.

The global banquet carts market is projected to grow substantially through 2030, driven by the rising demand for effective food transport, serving and storage solutions across the hospitality and event management industries.

Food service efficiency and food quality are among the top priorities for hotels, convention centers and catering services, as many are turning to insulated, heated and mobile banquet carts to support better food service. In addition, the adoption of IoT-enabled temperature control, lightweight materials, and ergonomic designs is supporting market growth.

Market Share Analysis by Key Players & Banquet Cart Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Carter-Hoffmann | 18-22% |

| Cres Cor | 14-18% |

| Alto-Shaam, Inc. | 12-16% |

| FWE (Food Warming Equipment Company, Inc.) | 9-13% |

| Metro (InterMetro Industries Corporation) | 6-10% |

| Others | 26-36% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Carter-Hoffmann | Manufactures durable and insulated banquet carts with efficient heat retention for large-scale events. |

| Cres Cor | Specializes in mobile banquet carts with humidity control and heavy-duty stainless steel construction. |

| Alto-Shaam, Inc. | Focuses on Halo Heat® banquet carts designed for precise temperature management and energy efficiency. |

| FWE (Food Warming Equipment Company, Inc.) | Provides customizable banquet transport carts with touchscreen control panels and easy maneuverability. |

| Metro (InterMetro Industries Corporation) | Develops smart banquet carts featuring IoT-enabled temperature monitoring and modular shelving options. |

Key Market Insights

Carter-Hoffmann (18-22%)

A dominant player in the banquet cart industry, Carter-Hoffmann offers high-capacity, insulated transport solutions with advanced airflow technology for even heat distribution.

Cres Cor (14-18%)

Known for heavy-duty, impact-resistant banquet carts, Cres Cor integrates humidity-controlled systems to preserve food texture and taste during transport.

Alto-Shaam, Inc. (12-16%)

Alto-Shaam leverages its Halo Heat® technology, providing consistent, low-energy heat retention, making its carts a preferred choice for luxury hotel and fine dining catering services.

FWE (Food Warming Equipment Company, Inc.) (9-13%)

FWE focuses on lightweight and manoeuvrable banquet carts with touchscreen controls, customizable compartments, and advanced insulation technology.

Metro (InterMetro Industries Corporation) (6-10%)

Metro leads in smart banquet cart innovations, integrating IoT-based remote monitoring, digital displays, and modular storage solutions.

The overall market size for banquet carts market was USD 941.7 million in 2025.

The banquet carts market is expected to reach USD 2033.2 million in 2035.

The expansion of the banquet carts market will be fueled by the growing need for efficient food transportation and serving solutions in hotels, catering services, and event venues, supported by innovations in lightweight and durable materials.

The top 5 countries which drives the development of banquet carts market are USA, European Union, Japan, South Korea and UK

Hotels and restaurants to command significant share over the assessment period.

Coffee Roaster Machine Market Analysis by Product Type, Capacity, Control, Heat Source and Application Through 2035

Indoor Smokehouses & Pig Roasters Market – Smoked Meat Processing 2025 to 2035

Vegetable Sorting Machine Market Analysis by Processing Capacity, Technology, Operation Type, Vegetable Type, and Region Through 2035

Automated Brewing System Market Analysis & Forecast by Product Type, Capacity, Mechanism, and Region through 2035

Brewing Boiler Market Analysis by Material Type, Application, Automation, and Region 2025 to 2035

Bakery Processing Equipment Market Analysis by Product Type, End User, Application & Region: A Forecast for 2025 and 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.