Banquet cabinets market will be growing steadily from 2025 to 2035 as expansion of hospitality industry push demand for event management solutions and investment in premium banquet furniture grow.

Banquet cabinets are ubiquitous storage and serving solutions found in hotels, banquet halls, convention centers and event venues. Dining room attendants help do just that, making them essential to the infrastructure of hospitality, aiding in efficient organization, food service, and overall flow of the event.

A flourishing event and wedding industry is one of the major growth factors of the market. With an increased number of people choosing opulent weddings, corporate functions and social gatherings, the demand for quality banquet storage solutions is on the rise.

To improve service efficiency and uphold superior guest experiences, hotel and event venue owners/investors are increasingly installing custom-made, high durability and elegance-focused designs of banquet cabinets.

Additionally, the growing trend of catering services and buffet dining across restaurants, cruise ships, and large events are further fueling the demand for multipurpose banquet cabinets.

Temperature control, portability and innovative storage designs are other attributes that are quickly gaining momentum, and brands are launching intelligent banquet cabinets featuring digital tracking systems and energy-efficient cooling technologies.

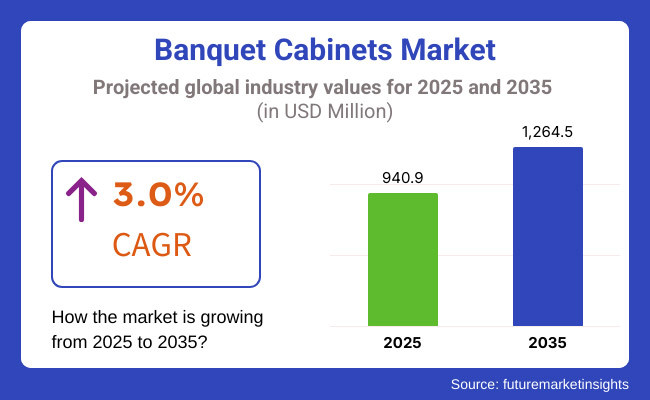

The banquet cabinets market accounted for USD 940.9 million in the year 2025 and is expected to reach USD 1264.5 million by the year 2035, at a CAGR of 3.0% during the forecast period.

North America also stands as a key marketplace, with a high demand for premium banquet facilities in various establishments, such as hotels and resorts and event venues. Frequent corporate events, weddings, and hospitality industry expansions make the USA the country with the largest market share. There’s also a move to custom-designed, modular banquet cabinets that maximize space in the region.

The market in Europe has been driven by the growth of luxury hospitality chains, cultural happenings and large scale events. In Germany, France, and UK the national offers invest heavily in high quality banquet storage systems, mainly focusing on sustainability and energy savings.

Asia-Pacific is expected to witness the highest growth, driven by rapid urbanization, the growth of disposable incomes, and escalating demand for luxury banquet services.

Market Growth and the Role of Banquet Storage Technologies in Hotels, Convention Centers, and wedding venues so countries such as China, India, and Japan are the major contributing countries to market expansion. As hotels, convention centers, and wedding venues over the years, have started investing in banquet storage solutions for food.

The hospitality and catering industry is booming in Brazil and Mexico. Growing preference for destination weddings and corporate conferences is adding to the demand for banquet cabinet that are versatile and space saving.

The Middle East is a growing market, thanks to its luxury tourism, large venue events and mega hotel projects in the UAE, Saudi Arabia and Qatar. There is a growing demand for modern, trip-resistant banquet cabinets in 5-star hotels, resorts, and event management companies.

Challenges

High Initial Investment and Maintenance Costs

Restaurants, catering companies and venues must purchase durable custom storage solutions, which drives cost. Maintenance (fixing things that always break) and wear-and-tear issues then jack up long-term ownership costs to the moon, something that is always a concern in high-usage commercial applications.

A challenge is limited space within event venues, banquet halls, etc. Designing especially modular and space-saving options is important, as it will allow for optimization of storage solutions for one-off events or long-term partnerships with consumers.

Opportunities

Growing Demand for Customizable and Smart Storage Solutions

The growth of luxury event venues, premium banquet services, and commercial catering is contributing to the demand for banquet cabinets that provide smart storage features. The development of modular, temperature-controlled, and multifunctional banquet cabinets is gaining traction in the market to enhance operational efficiency and preserve food quality.

Additionally, there are game-changing opportunities to explore smart inventory tracking, automated climate control, and green materials in banquet cabinet majors. A fundamental shift towards sustainable materials and energy-efficient designs combined with technology-integrated storage solutions will be the key to staying in the game.

The demand for durable and space-saving banquet cabinets was on the rise from 2020 to 2024 due to the growth of the hospitality and events industry. The pandemic paved the way for dedication to hygiene-driven foodservice storage options, i.e. the adoption of stainless steel, antimicrobial-coated, and simple-to-clean banquet cabinets.

In 2025 to 2035, the market will move towards technologically driven and sustainable storage solutions. And smart banquet cabinets with IoT-enabled inventory tracking, automated climate regulation, and modular designs will be in demand. Also, the demand for greener banquet cabinet material and energy-efficient storage will change the market play.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Material Innovations | Use of stainless steel and durable wood materials |

| Smart Storage Solutions | Limited integration of smart technology |

| Market Demand | Post-pandemic recovery with hygiene-focused banquet storage |

| Cost and Investment | High initial investment with slow ROI in hospitality businesses |

| Customization Trends | Fixed-size cabinets with basic designs |

| Energy Efficiency and Sustainability | Introduction of eco-friendly coatings and recyclable materials |

| Material Innovations | Use of stainless steel and durable wood materials |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Material Innovations | Expansion of eco-friendly, antimicrobial-coated, and lightweight storage materials |

| Smart Storage Solutions | Increased adoption of IoT-enabled banquet cabinets with real-time inventory tracking |

| Market Demand | Growth in luxury, modular, and space-optimized banquet cabinets |

| Cost and Investment | Cost-efficient modular designs with AI-driven inventory management for optimized usage |

| Customization Trends | Expansion into customizable, modular, and multi-purpose banquet storage solutions |

| Energy Efficiency and Sustainability | Large-scale adoption of sustainable manufacturing, carbon-neutral banquet cabinets, and energy-efficient storage solutions |

| Material Innovations | Expansion of eco-friendly, antimicrobial-coated, and lightweight storage materials |

The USA banquet cabinets market is moderately growing due to rising requirement for commercial kitchen equipment from hotels, banquet halls, and catering services. Growing wedding, corporate events and social gathering will facilitate in increasing banquets facilities and event catering infrastructure, which will lead to the demand for high-capacity, temperature-controlled banquet cabinets.

As the hospitality industry revives after the pandemic, hotel chains and event venues are modernizing their banquet setups to optimize food service efficiency, hygiene and sustainability. Since last few years an energy-efficient and smart banquet cabinet with accurate temperature control, automatic humidity adjustment, and IoT-enabled monitoring are gaining pace among high-end catering services and luxury hotels.

The increasing popularity of food delivery and off-site catering businesses is also detected to boost the market growth as the operators require mobile and space-efficient banquet cabinets that are flexible in transporting and storing food.

Manufacturers are developing eco-friendly stainless steel banquet cabinets by tailoring energy-efficient insulation and developing lower carbon footprint products driven by the rising trend of sustainable kitchen equipment.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.3% |

Furthermore, the rising demand for the banquet cabinets from hotels, catering businesses, and event venues is aiding this growth. In the age of destination weddings, corporate retreats, and luxury dining experiences, banquet halls and hospitality operators are turning to high-performance, temperature-controlled food storage options.

Moreover, the Food Standards Agency's (FSA) strict food safety regulations are fuelling demand for hygienic, easy-to-clean stainless steel banquet cabinets featuring advanced temperature monitoring systems.

As pocket-friendly high-end catering services continue to burgeon in London, Manchester, and Edinburgh, energy-efficient banquet cabinets that can preserve quality of food for long duration are witnessing high adoption.

The UK demand for energy-efficient and green commercial kitchens is leading buyers to prefer banquet cabinets that consume lesser power and are built with advanced insulating material. The growing fine dining segment and luxurious hotel chains are serving as additional driving factors for demand for customizable high-capacity banquet storage units.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.1% |

The banquet cabinets market in the Europe is expected to grow at a steady pace during the forecast period, owing to growing demand of the hospitality and foodservice sector, rising desire for energy efficient commercial kitchen equipment, and hard and fast food safety regulations set by EU.

Countries such as Germany, France, and Italy, where the banquet, event catering, and fine dining industries are thriving, and with them, the demand for high-quality, durable, and versatile banquet cabinets.

EU’s approach towards sustainable commercial kitchen practices is compelling manufacturers to design energy-efficient and environmentally friendly banquet storage solutions. Moreover, the rising trend for remote catering and outdoor catering in luxury hotels and event venues has further propelled the demand for portable, mobile banquet cabinets.

Increasing HACCP (Hazard Analysis and Critical Control Points) standards regulatory compliance also play a role in facilitating the implementation of sizable temperature-controlled banquet cabinets to ensure food safety and hygiene levels.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 3.0% |

The banquet cabinets market in Japan is growing steadily, led by increased demand from luxury hotels, upscale restaurants and premium catering businesses. It is important for banquet cabinets to keep food fresh and control temperature during events, and Japan has a high demand for food presentation and quality.

In cities such as Tokyo, Kyoto, and Osaka, the booming tourism industry and many global businesses hosting conferences at international venues are investing heavily in premium hospitality services with demand for custom-designed, space-efficient banquet cabinets.

Furthermore, the rising technological innovation in Japan is encouraging the adoption of smart cabinet of banquet with real-time temperature monitoring, artificial intelligence-based food preservation, and internet of things-enabled inventory tracking.

Manufacturers are also designing high-performance banquet cabinets in response to Japan's trend of energy efficiency and consuming kitchen equipment, requiring food to be realized in various degrees under different temperatures with low power consumption.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.2% |

The South Korean banquet cabinets market is expected to grow in the coming years, driven by the growth of investments in hotels and banquet halls, catering for weddings and corporate events, and the need for the storage of food with premium quality.

This is something the luxury hospitality industry in urban markets like Seoul and Busan is incorporating into its large-scale catering efforts, with new high-tech banquet cabinets promising consistent temperatures and food hygiene for banqueting operations.

As part of Korean government efforts to create smart and sustainable commercial kitchens, IoT-enabled banquet cabinets are being installed in the districts to provide timely temperature changes and real-time remote monitoring. Moreover, the expansion of fine dining outlets and luxury hotel brands is contributing to the demand of custom-built banquet cabinets featuring LED touch controls, independently insulated modules, etc.

The increasing popularity of Korean food and global food tourism is also leading catering companies to invest in high-performance banquet cabinets that allow to preserve traditional dishes while serving them at the same ideal temperature.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.1% |

Food service operators are keen on the benefits offered by banquet cabinets, such as temperature control, convenience, and transportation, which is fundamentally driving the banquet cabinet’s market growth. Two product types, meeting different operational demands and ensuring the flexibility to meet the needs of catering businesses, hotels, and banquet halls.

The Electric Banquet cabinets market is increasing on the back of hotels and restaurants involving in preparing hot meals for serving and hence require a ready-reserve for offering attendees who takes time to arrive to the event venous. Built-in heating elements in these cabinets keep food at safe temperatures, ensuring that meals are served fresh.

The increasing acceptance of energy-efficient banquet cabinets with total thermostat control, rapid heating elements, and programmable temperature control, which keeps the optimum temperature for the food and conserves energy is anticipated to boost demand in the market.

Besides the above advantages, its smart technology integration (e.g., digital touch controls, real-time temperature monitoring, automated alerts, etc.) enhanced operational efficiency and ensured consistent heating while reducing food waste.

The insulation electric banquet cupboard market is growing rapidly as insulated electric banquet cabinets are becoming more common than cabinets owing to superior grade stainless steel constructing the cabinets that offers better heat retention before energy-efficient cupboards sans excess power consumption on the fly.

The growing adoption of electric cabinets in food service operations which use relatively large trays, with multiple food service countertop tray configurations, advanced thermal airflow designs, and improved mobility features, has proven to be vital in the bolstering of market growth, by offering required food service efficiency.

The Non-Electric banquet cabinets segment is still prominent in the market, particularly in outdoor catering, remote locations, and venues with no or limited access to electricity. These cabinets use upper-grade insulation to keep food temperature for hours on end without outside energy input.

The market is also growing due to the increasing demand for lightweight, portable banquet cabinets that use durable materials with high-impact-resistance and easy maneuverability for various events, ensuring smoother transportation and management.

Advanced insulation materials, phase change cooling elements, and vacuum sealed compartments have all contributed to an increase in passive heating and cooling technologies, which spurs further market demand by ensuring effective heat and cold retention.

The growing desire for cost-saving banquet cabinets with low operation costs, lower maintenance expense, and high durability also contributed to the growth of the market ensuring availability for small catering firms.

The increasing adoption of modular and stackable non-electric banquet cabinets with customizable tray arrangements, easy-access doors for quick retrieval, and ergonomic designs to enhance safety and comfort has further bolstered market growth by providing improved storage flexibility and adaptability for a variety of events.

Non electric cabinets, though, have an edge in portability, the ability to save money, and energy independence, but they can't control temperatures over long periods of time. Nevertheless, advancements in thermal retention pasteurization, vacuum-insulated materials, and hybrid heating solutions are improving their efficiency and keeping them in demand in the market.

The banquet cabinets market is dominated by the 50-100 Trays segment, as mid-size catering operations, banquet halls, and hotels prefer versatile storage solutions that offer a balance between storage capacity and a small footprint.

Moreover, the market is anticipated to witness an upsurge due to the rising demand for banquet cabinets from various sectors with 50-100 tray capacity, having dual-zone temperature control humidity management, and heavy-duty casters for mobility to ensure maintenance of appropriate food storage for large gatherings and functions.

Hybrid banquet cabinets that offer modular interior shelving, removable tray racks, and convertible compartments have increased market demand and provided increased flexibility for different types of events.

The increasing adoption of medium-capacity cabinets in wedding venues, corporate catering, and high-end restaurants, equipped with advanced insulation, energy-efficient heating elements, and ergonomic handling designs, has fueled industry growth by ensuring high-speed service efficiency.

More than 100 Trays is in high demand for banquet facilities, convention centers and large scale or institutional food service providers that need bulk food storage.

Rapid advancements in the marketplace, coupled with developments in the form of multi-compartment heating zones, AI-powered temperature regulation, and automated tray rotation systems are further providing scalable food service applications are expected to quell the market growth.

The increasing demand for custom banquet cabinets, with adjustable shelving, reinforced door seals, and advanced ventilation systems for prolonged food freshness and even heat distribution, has been a primary driver for this market.

Moreover, the growing utilization of commercial-grade banquet cabinets in airline catering, cruise ships, and military food service operations owing to heavy-duty construction, impact-resistant casters, and high-volume storage configurations has augmented market growth.

The banquet cabinets market is driven by the increasing demand for efficient food storage, transport, and serving solutions in the hospitality industry. In light of these factors, hotels, event venues, catering services are turning to temperature-controlled (Smart), modular and autonomously-operating banquet cabinets to increase operational effectiveness and food safety.

Also, growing advancements in technologies like IoT-based temperature monitoring and ergonomic designs are contributing to the growth of the market.

Market Share Analysis by Key Players & Banquet Cabinet Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Cres Cor | 19-23% |

| Alto-Shaam, Inc. | 15-19% |

| Carter-Hoffmann | 12-16% |

| FWE (Food Warming Equipment Company, Inc.) | 10-14% |

| Metro (InterMetro Industries Corporation) | 7-11% |

| Others | 23-33% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Cres Cor | Provides durable, insulated banquet cabinets with humidity control and advanced heat-retention technology. |

| Alto-Shaam, Inc. | Specializes in Halo Heat technology-based banquet cabinets for precise temperature control and energy efficiency. |

| Carter-Hoffmann | Offers modular and stackable banquet cabinets for large-scale food service and banquet operations. |

| FWE (Food Warming Equipment Company, Inc.) | Focuses on mobile and high-volume banquet holding cabinets with touchscreen controls. |

| Metro (InterMetro Industries Corporation) | Develops smart storage and transport solutions, including IoT-enabled banquet cabinets for real-time temperature tracking. |

Key Market Insights

Cres Cor (19-23%)

A leading manufacturer of high-capacity, stainless steel banquet cabinets, Cres Cor integrates humidity control and rapid heat recovery features to ensure food quality in large-scale catering operations.

Alto-Shaam, Inc. (15-19%)

Known for its Halo Heat® technology, Alto-Shaam designs energy-efficient, low-maintenance banquet cabinets ideal for fine dining and luxury catering services.

Carter-Hoffmann (12-16%)

Carter-Hoffmann focuses on compact, stackable banquet cabinets designed for space-saving solutions in high-volume catering environments.

FWE (Food Warming Equipment Company, Inc.) (10-14%)

FWE develops customizable banquet cabinets with touchscreen controls and advanced mobility features for easy transportation and large-event catering.

Metro (InterMetro Industries Corporation) (7-11%)

Metro is pioneering smart banquet cabinet technology, offering IoT-enabled storage solutions with remote temperature monitoring and predictive maintenance alerts.

The overall market size for banquet cabinets market was USD 940.9 million in 2025.

The banquet cabinets market is expected to reach USD 1264.5 million in 2035.

The growth of the banquet cabinets market will be driven by increasing demand for efficient food storage and serving solutions in hospitality and event management, supported by advancements in temperature control and durable materials.

The top 5 countries which drives the development of banquet cabinets market are USA, European Union, Japan, South Korea and UK

Electric and non-electric banquet cabinets to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End-use Industry, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End-use Industry, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End-use Industry, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by End-use Industry, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by End-use Industry, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Product, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by End-use Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End-use Industry, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Capacity, 2023 to 2033

Figure 23: Global Market Attractiveness by End-use Industry, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End-use Industry, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 45: North America Market Attractiveness by Product, 2023 to 2033

Figure 46: North America Market Attractiveness by Capacity, 2023 to 2033

Figure 47: North America Market Attractiveness by End-use Industry, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End-use Industry, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Capacity, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End-use Industry, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by End-use Industry, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product, 2023 to 2033

Figure 94: Europe Market Attractiveness by Capacity, 2023 to 2033

Figure 95: Europe Market Attractiveness by End-use Industry, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by End-use Industry, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Product, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Capacity, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by End-use Industry, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by End-use Industry, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 141: MEA Market Attractiveness by Product, 2023 to 2033

Figure 142: MEA Market Attractiveness by Capacity, 2023 to 2033

Figure 143: MEA Market Attractiveness by End-use Industry, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Banquet Carts and Heated Cabinets Market

Banquet Carts Market – Large-Scale Catering & Mobility 2025-2035

Display Cabinets Market

Medicine Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Industrial Drying Cabinets Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cable Distribution Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Holding and Proofing Cabinets Market - Temperature Control & Bakery Solutions 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA