The banding machine market will experience significant expansion from 2025 through 2035 because manufacturers need more efficient packaging systems and industrial automation advances along with enhanced transport protection needs. The banding machine market operates in multiple sectors including logistics and food and beverage and pharmaceuticals and e-commerce and uses minimal materials for securing and bundling goods. The market continues to grow because sustainable packaging developments together with cost-optimized bundling methods gain increasing popularity the market uptake has grown because of innovative smart banding technology developments that brought advanced tension automation and sustainable materials into banding processes.

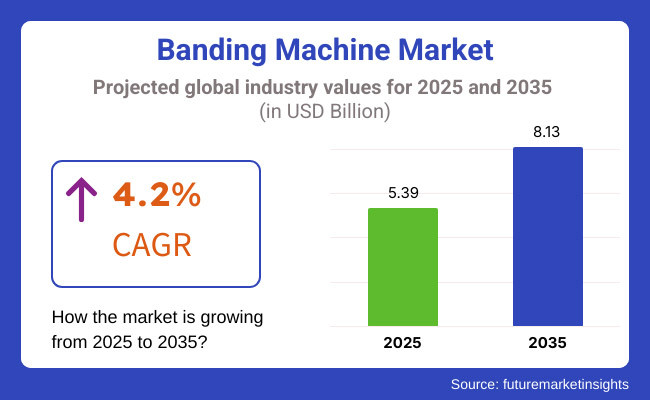

The banding machine industry maintained a value of USD 5.39 Billion in 2025 before analysts forecast a USD 8.13 Billion worth by 2035 at a Compound Annual Growth Rate (CAGR) of 4.2%. The market experiences expansion through three major factors which include robotics innovation together with IoT-enabled packaging solutions and protective packaging standards that ensure security. Industries including e-commerce and retail are driving up demand for high-speed precision banding machines because they need lightweight packaging. The growth of smart warehouses together with automated logistics networks drives investment in banding technology which enhances packaging efficiency and minimizes material waste.

Explore FMI!

Book a free demo

Banding machine sales in North America continue to expand because of rising automation implementation in packaging systems together with stringent safety regulations. The pharmaceuticals and food and beverage industries of Canada alongside the United States are increasing their need for sustainable packaging solutions that deliver efficiency. The marketplace develops because of expanding e-commerce operations and increasing demands for tamper-proof packaging solutions. The deployment of AI-powered and advanced robotic systems during warehousing operations has resulted in better efficiency for distribution centres and warehouse facilities.

The European market for banding machines continues to grow primarily because of governmental statutes that encourage eco-friendly packaging methods and waste reduction. The countries of Germany together with France and the United Kingdom currently show the most advanced adoption of automated systems for both manufacturing and distribution operations. Market growth occurs because customers now seek sustainable binding materials and new packaging solutions simultaneously. Green packaging initiatives from the European Union are driving manufacturers to adopt biodegradable and recyclable banding solutions which support the sustainability targets across different industries.

The banding machine market in Asia-Pacific will experience its most rapid growth because of quick industrial development alongside expanding manufacturing operations and an increasing use of automated packaging systems. The rising e-commerce business along with pharmaceuticals and consumer goods markets in China Japan South Korea and India have prompted major investments in packaging automation systems. High-speed and precision banding machines gain increasing demand because the region needs improved supply chain efficiency and operational cost reduction. Public incentives for advanced manufacturing technologies from governments throughout Asia-Pacific help drive market expansion in the region further.

Challenge

High Costs and Regulatory Complexities

The Banding Machine Market encounters specific obstacles because of its expensive manufacturing procedures and necessary compliance requirements and supply network limitations. The exact engineering requirements and robust elements for banding machines result in elevated production expenses. The Banding Machines Market needs to comply with multiple regulatory requirements which involve industrial automation standards alongside workplace safety regulations and packaging material certification standards under CE certification and ISO standards. Affordable prices require businesses to implement cost-effective production methods and energy-efficient designs and advanced automated systems.

Market Saturation and Technological Adaptation

A substantial number of manufacturers throughout different regions and globally are active in this competitive banding machine market sector. The high market concentration has produced extreme price competition which reduces available earning potential for manufacturers. The shift towards automated packaging systems alongside Industry 4.0 implementations forces companies to invest in traditional machine upgrades that may be expensive. Manufacturers who want to maintain their market position must develop technological improvements and personalized solutions with smart machine capabilities that follow changing packaging requirements.

Opportunity

Growing Demand for Automated and Sustainable Packaging Solutions

Manufacturers of banding machines benefit from increasing solutions requirements for automated packaging operations across the logistics sector. The food & beverage sector together with pharmaceuticals and logistics industries choose automated banding processes to reach higher efficiency levels and decrease operating costs and improve product safety standards. The rise of sustainability initiatives produces market demand for environment-friendly banding solutions which reduce plastic waste during operations. Organizations that use sustainable packaging materials and efficient equipment and automation features will dominate the expanding market sector.

Advancements in Smart Banding Machines and IoT Integration

Modern banding machines can transform the industry because of their IoT-enabled monitoring features and AI-driven maintenance systems which combine with real-time data analytics capabilities. Smart sensors coupled with cloud-based monitoring systems boost machine performance and decrease maintenance periods while providing better operational data analysis results. The growth of e-commerce and just-in-time manufacturing activities requires precise and high-speed banding solutions for market expansion. The Banding Machine Market will experience its next major growth period from companies who focus on digital transformation alongside AI-powered diagnostics and connectivity features.

The Banding Machine Market maintained consistent growth between 2020 and 2024 because manufacturers installed more automated packaging systems while market clients needed more efficient product bundling methods. Companies emphasized the creation of compact energy-efficient high-speed banding machines so they could fulfil industry requirements. The market adoption of banding machines remained limited because of the combination of high start-up expenses and regulatory requirements and the necessity of expert personnel. Manufacturers upgraded their machines through the combination of enhanced flexibility and digital control systems and improved maintenance capabilities to optimize productivity.

The market sector of AI-powered banding and robotic automation combined with eco-friendly banding materials is expected to undergo major transformations during the period spanning from 2025 to 2035. The market will adopt recyclable and biodegradable banding materials due to expanded sustainability rules and manufacturers will use advanced technologies for predictive maintenance and remote monitoring to boost operational efficiency. Companies that excel in energy-efficient production along with AI-based packaging solutions and Industry 4.0 integration will control the upcoming stages of the Banding Machine Market.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Adherence to the norms of packaging safety and industrial automation |

| Technological Advancements | Expansion of high-speed, compact banding machines |

| Industry Adoption | Gains in food, logistics, and pharmaceuticals |

| Supply Chain and Sourcing | Dependence on traditional materials and component suppliers |

| Market Competition | Presence of regional and global banding machine manufacturers |

| Market Growth Drivers | Demand for cost-efficient, high-speed banding solutions |

| Sustainability and Energy Efficiency | Initial focus on reducing plastic banding waste |

| Integration of Smart Monitoring | Limited use of digital diagnostics and real-time tracking |

| Advancements in Banding Applications | Use in traditional product bundling and logistics packaging |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Increase in sustainability regulations, AI-powered compliance monitoring, and compulsory green banding. |

| Technological Advancements | Utilization of artificial intelligence for predictive maintenance, connected systems with internet of things (IoT) capabilities, and intelligent automation functionalities. |

| Industry Adoption | Expansion to e-commerce fulfilment centres, automated warehouses, and Industry 4.0 smart factories |

| Supply Chain and Sourcing | Shift toward sustainable banding materials, localized production, and AI-optimized supply chain logistics. |

| Market Competition | Growth of smart packaging innovators, eco-friendly machine developers, and AI-integrated automation providers. |

| Market Growth Drivers | Increased investment in smart packaging, predictive maintenance, and green packaging solutions. |

| Sustainability and Energy Efficiency | Large-scale adoption of biodegradable banding materials, energy-efficient machines, and carbon-neutral manufacturing practices. |

| Integration of Smart Monitoring | Expansion of AI-powered analytics, cloud-based remote monitoring, and predictive maintenance systems. |

| Advancements in Banding Applications | Evolution of AI-driven banding solutions, smart packaging ecosystems, and adaptive automation technology. |

Market Insights Report provides a comprehensive analysis of the United States banding machine market, exploring industry trends, growth drivers, and competitive landscape. Increasing e-commerce and retail packaging are propelling market growth.

Some of the advanced features of modern banding machines that manufacturers are emphasizing include adjustable banding tension, high-quality and eco-friendly banding materials, and smart automation to facilitate high-throughput operations. Moreover, consumer movement toward sustainable and minimal packaging solutions is driving the businesses to use banding machines instead of traditional packaging methods.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

The UK is seen steady growth of the banding machine market across several industries searching for cost-effective and eco-friendly packaging solutions. Growing demand for disposable banding materials such as paper and biodegradable is paving way for market growth.

Due to increasing demand for accuracy and speed during the banding process in the pharmaceutical and food industries, there is an increasing trend towards more OEE efficient machine automation and at the same time digital integration. Furthermore, stringent government regulations mandating the use of sustainable packaging are forcing the manufacturers to adopt advanced banding.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.0% |

The demand for the banding machines in the EU is high, and the market is growing fast in Germany, France and Italy. Rigid government regulations towards the reduction of packaging waste, along with sustainability, is pushing the adoption of green banding solutions.

Growing manufacturing, logistics, and food processing industries present strong demand for high-speed, automated banding systems. Moreover, the escalating adoption of Industry 4.0 components is driving the innovation of smart banding machines rich in IoT solutions for real-time inspection and operational effectiveness.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.2% |

Japan's banding machine market is expanding at a moderate pace owing to growth in demand from food, electronics, and industrial goods sectors. With the country’s focus on precision engineering and automation, banding machine technology is getting a lot of attention.

To maximize efficiency, manufacturers offer more features in banding machines such as AI-powered quality control and automated adjustments. Moreover, Japan’s emphasis on sustainability is promoting the development of compact and energy efficient banding solutions across the industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

The rapid growth in the e-commerce and logistics sectors is advancing the banding machine market in South Korea. Automated packaging solutions are an essential factor that is being adopted by the business across the globe, to maintain operational efficiency and increase profitability.

High Precision Banding Machines Demand is triggered by Strong Electronics and Automotive Industryociation Moreover, the market is being driven by various government initiatives that have been implemented to encourage eco-friendly packaging and smart manufacturing practices.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

The automatic banding machines and food and beverage segments are the top veracious consumers of banding machine solutions, as there is a growing demand for efficient, high-speed, and secure packaging solutions that would serve the purpose of bundling, branding and protection of packaged goods. HERSHEY, Pa. - Food processors, beverage producers, packaging automation businesses, and supply chain organizations need better banding solutions to boost packaging sustainability, increase material waste reduction, and provide enhanced logistics.

With the advancement of global packaging regulations and the increasing focus on sustainability, manufacturers are now looking at absolute automated, energy-efficient, and multi-functional banding machines that deliver an effective, high-speed bundling solution while using minimal material to enhance product security, branding, and operational efficiency.

Packaging Operations with Automatic Banding Machines Lead to Better Efficiency at Reduced Labour Cost

Among the segments, the automatic banding machine segment has provided a promising solution in this banding machine market since they operate at high speed, require minimal manual intervention and ensure a better uniformity and consistency in product bundling. Different from semi-automatic models, automatic banding machines are consolidated with fully automated packaging lines to achieve greater throughput, lower material waste, and more consistent products for high demand industries.

Adoption has been spurred by the demand for next-generation automatic banding machines with AI-powered tension control, adjustable banding force, and real-time operational diagnostics. According to studies, more than 65% of industrial packaging plants use fully automatic banding machines to improve labour efficiency and achieve maximum throughput, creating a steady demand for this segment.

Increasing sustainable packaging initiatives focusing on paper-based banding solutions, biodegradable banding materials, and eco-friendly adhesive technologies complement market demand, leading towards greater compliances with environmental regulations and lesser dependency over plastic.

The prospect of AI-driven automation with real-time error detection, dynamically adapting band tension systems, and predictive maintenance systems has further driven adoption and increased machine life, ultimately reducing operational downtime.

Designing Automatic Banding Solutions to Customize for the Industry will enhance the Growth of the Market due to Modular Machines with IoT enabled remote monitoring.

Although automatic banding machines can greatly enhance production efficiency, lower labour expenses, and provide uniformity of packaging, the segment may face challenges owing to higher capital investment, maintenance difficulties, and the availability of skilled operators in small-scale industries. But new trends in artificial intelligence powered machine learning, robotic automation for high-throughput packaging and energy-efficient automation solutions have contributed in making automatic banding machines more financially favourable, user-friendly and scalable, which will further the growth of market for automatic banding machines across the globe.

On the basis of automatic banding machine segment, it has been increasingly adopted by e-commerce warehouses, food and beverages manufacturers, and logistics companies, as the industries consistently embrace automated banding systems to save on resources, reduce material waste, and optimize packaging operations. Automatic banding machines provide a higher output speed, as well as better material optimization, seamless integration into fully automated production lines, and overall cost efficiency and supply chain effectiveness, compared to semi-automatic alternatives.

As such, the demand for intelligent automatic banding system propelling adoption in the Global automatic banding machines market with real-time tension, AI-enabled quality testing & adaptive products bundling. Automatic banding solutions are indispensable for the quality and efficiency of packaging, and hence, they have a significant demand on over 70% of the high-speed packaging lines across verticals, as revealed by a recent study.

Additionally, the adoption rate has been bolstered by the expansion of robotic-assisted packaging lines that embrace conveyor-synchronized automatic banding, high-speed AI-driven defect detection, and fully-integrated automated labelling solutions, ensuring higher output within fast-moving consumer goods (FMCG) and high-throughput packaging applications.

These combinations, including biodegradable paper bands with reusable or recyclable adhesive tapes and heat-sealable film bands, have increased adoption by providing better compliance with sustainable packaging regulations and promoting eco-conscious brand opportunities.

Despite the benefits of better packaging sustainability, lower operational overhead, and greater product branding through automatic banding, the segment of automatic banding machine is faced with challenges including but not limited to: higher initial cost of investment, complexity of programming the machine and growing needs of machine customization depending on the industry. Nonetheless, innovative breakthroughs in packaging authentication using block chain, predictive analytics using AI algorithms for machine efficiency, and cloud-enabled maintenance solutions continue to enhance machine performance, minimize total cost of ownership, and ensure continued growth in automatic banding machine market globally.

The Important Function of Banding Machines in Food & Beverages Packaging for Securing, Branding and Preservation

As one of the prominent end use industries in the banding machine market, the food & beverage segment has witnessed significant adoption of packaging solutions that are not only protect and tamper-evident, but also branding-enhancing for food processors, beverage companies, and dairy manufacturers. Silicone banding machines use emission-free technology to provide a non-damaging, eco-friendly way of bundling together food products without diminishing any integrity, thus promoting better hygiene as well as appealing display on the shelf compared to other packaging solutions that use adhesive.

Specifically, the utilization of food-grade banding solutions such as antimicrobial banding materials, heat-resistant (recyclable) adhesive-free bands and fully compostable packaging bands have increased the adoption rate. More than 65% of food manufacturers have been using banding machines instead of conventional strapping or even shrink-wrapping systems as they produce less waste and provide a better product presentation, ensuring a strong demand for this segment.

Market demand was further reinforced with the launch of sustainable food packaging initiatives comprising low-carbon-emission banding films, wholesale plant-based biodegradable bands, and water-resistant paper banding solutions, ensuring better compliance with international food safety and environmental regulations.

The adoption rate is further facilitating by utilization of smart food packaging technologies with AI-based freshness monitoring, QR code-based- food authenticity checking, temperature sensitive banding material, this helps to enhance the product security and maximize the consumer engagement.

Customized banding solutions designed for food-grade applications with high-speed automation and dual-layer banding for multi-packaged items, along with moisture-resistant material compositions, are driving the market growth by providing better operational performance and longer shelf life.

Though it offers benefits such as reduced plastic waste, enhanced food safety, and streamlined logistics, risk factors for the food & beverage segment include strict compliance demands for food-contact banding materials, seasonality in production volume, and price sensitivity of smaller food producers. New innovations like edible packaging integration, AI-powered food safety band verification, and self-sealing tamper evident banding materials, are improving reliability, regulatory compliance, and consumer trust in food packaging, paving the way for continues market growth for banding machines across the food & beverage industry, worldwide.

The food & beverage segment has been widely adopted due to the use of banding machines amongst fresh produce suppliers, dairy products, and beverage bottling industries, as they integrate these machines to enhance sustainability, curb excessive packaging waste, and promote food safety. When compared to traditional packaging adhesives or shrink-wrap films, that do not provide adequate tamper evidence, use more plastic, and are often limited in recyclable material composition banding machines are far outpacing the alternatives in compliance with food packaging regulations and consumer sustainability preferences which are rapidly evolving.

This, combined with the need for other benefits such as heat resistant adhesives, antimicrobial material incorporation, and AI usage to optimise label placement, has accelerated adoption of high speed food grade banding solutions. More than 70% of dairy and beverage producers utilize banding machines for efficient multi-pack bundling, product branding, and transportation efficiency, this suggests that high performance banding solution is projected to be in demand.

Although it has clear benefits for food safety, reduced single-use plastic waste, and better shelf-ready presentation, the food & beverage segment is also grappling with challenges including: a higher cost-profile for biodegradable banding materials, enhancing global food contact safety regulations, and developing temperature-resistant banding that holds-up to the rigors of a supply chain. Nonetheless, advancements in the form of next-generation bio-based banding films, AI-based food logistics tracking, and digitalized supply chain transparency for sustainable packaging materials are helping food & beverage companies reduce costs, improving operational agility, and reducing the impact on the environment - promising continued growth for banding machines in the food & beverage sector, worldwide.

Industry Overview

The banding machine market is experiencing steady growth due to increasing demand for efficient packaging solutions across industries such as food & beverage, pharmaceuticals, logistics, and printing. Banding machines are widely used for bundling products securely using paper or plastic bands, offering an eco-friendly and cost-effective alternative to shrink-wrapping and adhesives. The market is driven by the need for automation in packaging, rising e-commerce shipments, and sustainability initiatives favouring minimal packaging waste. Leading manufacturers are focusing on advanced automation, IoT-enabled smart banding solutions, and high-speed, customizable systems to meet evolving industry demands.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ATS-Tanner Banding Systems AG | 18-22% |

| Bandall International | 15-19% |

| Mosca GmbH | 12-16% |

| Signode Industrial Group | 9-13% |

| StraPack Inc. | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| ATS-Tanner Banding Systems AG | Specializes in paper and film banding machines with automation and digital control for multiple industries. |

| Bandall International | Provides eco-friendly banding solutions with high-speed automatic systems for food, pharmaceutical, and logistics applications. |

| Mosca GmbH | Develops high-performance banding and strapping machines with advanced control systems for industrial packaging. |

| Signode Industrial Group | Offers fully automated banding and strapping solutions for logistics, construction, and consumer goods industries. |

| StraPack Inc. | Manufactures compact and heavy-duty banding machines with high-speed operations for retail and industrial packaging. |

ATS-Tanner Banding Systems AG (18-22%)

ATS-Tanner leads the banding machine market with its innovative, sustainable banding solutions that replace traditional shrink-wrapping, improving packaging efficiency and reducing waste.

Bandall International (15-19%)

Bandall specializes in automated banding systems with minimal material usage, providing highly efficient and eco-friendly packaging solutions for multiple industries.

Mosca GmbH (12-16%)

Mosca is known for its precision-engineered banding machines, integrating advanced automation and digital controls to enhance productivity and reduce material waste.

Signode Industrial Group (9-13%)

Signode offers industrial-grade banding and strapping solutions, focusing on logistics, heavy-duty packaging, and automated production line integration.

StraPack Inc. (7-11%)

StraPack is a key player in banding machine manufacturing, providing both compact and large-scale systems designed for high-speed and efficient bundling.

Other Key Players (30-40% Combined)

Several other manufacturers contribute to the banding machine market by focusing on sustainability, automation, and customization. Notable players include:

The overall market size for Banding Machine Market was USD 5.39 Billion in 2025.

The Banding Machine Market expected to reach USD 8.13 Billion in 2035.

The demand for the banding machine market will grow due to increasing automation in packaging, rising demand for efficient bundling solutions in logistics and manufacturing, advancements in sustainable packaging technologies, and the growing need for cost-effective and high-speed strapping solutions across industries.

The top 5 countries which drives the development of Banding Machine Market are USA, UK, Europe Union, Japan and South Korea.

Automatic Banding Machines and Food & Beverage lead market growth to command significant share over the assessment period.

BOPP Film Market Analysis by Thickness, Packaging Format, and End-use Industry Through 2025 to 2035

Korea Tape Dispenser Market Analysis by Material, Product Type, Technology, End Use, and Region through 2025 to 2035

Medical Transport Box Market Trend Analysis Based on Material, Capacity, End-User and Regions 2025 to 2035

Japan Heavy-duty Corrugated Packaging Market Analysis based on Product Type, Board type, Capacity, End use and City through 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.