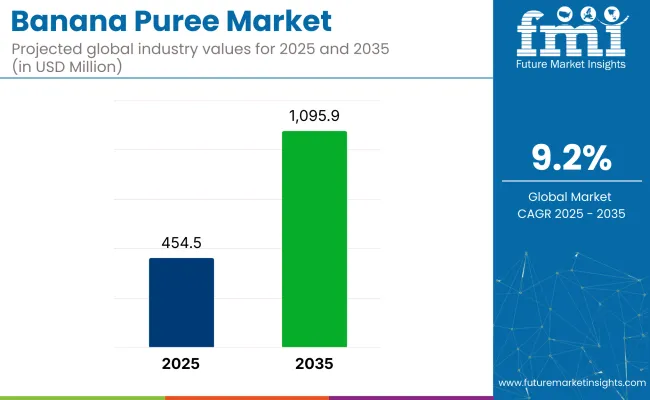

In 2025, the global banana puree market is valued at USD 454.5 million and is expected to reach USD 1,095.9 million by 2035, growing at a CAGR of 9.2%.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 454.5 Million |

| Projected Industry Value (2035F) | USD 1096.3 Million |

| Value-based CAGR (2025 to 2035) | 9.2% |

This growth is driven by the rising consumer demand for natural, organic, and minimally processed ingredients. Increasing preference for clean-label and plant-based foods is propelling banana puree adoption across the food and beverage sector, positioning it as a key ingredient in health-conscious consumer products.

The banana puree market captures varying proportions across its parent categories. Within the fruit puree market, it holds a notable 15-18% share, owing to its widespread use in blended fruit products. In the infant food sector, it accounts for nearly 20-25% of the market, driven by its ease of digestion and natural sweetness. The beverages market sees a 5-7% contribution from banana puree, especially in smoothies and functional drinks. In the processed food segment, its share remains limited at around 3–5%, mostly used in bakery and snack formulations.

For frozen foods, banana puree represents about 2-4% of usage, featured in frozen desserts and fruit-based packs. These figures reflect its steady integration across value-added product categories.

In a 2024 press release, Nestlé S.A.’s Infant Nutrition Division highlighted its commitment to uncompromised purity in infant food. The company emphasized that organic banana puree offers natural sweetness and a beneficial potassium profile, reducing the need for added sugars and supporting foundational health.

Nestlé also reinforced the importance of full traceability from farm to pouch, ensuring transparency and product integrity for parents seeking the highest quality nutrition for their infants.

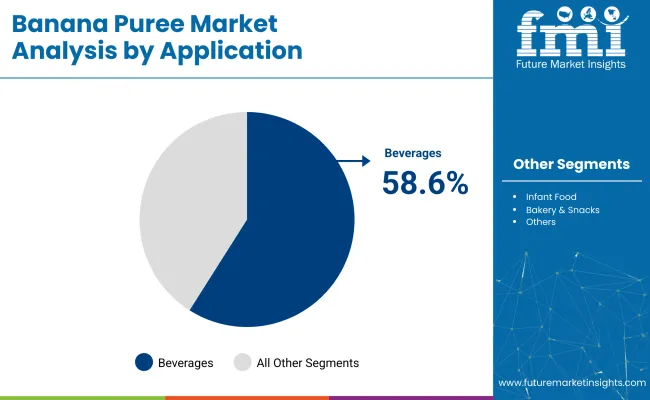

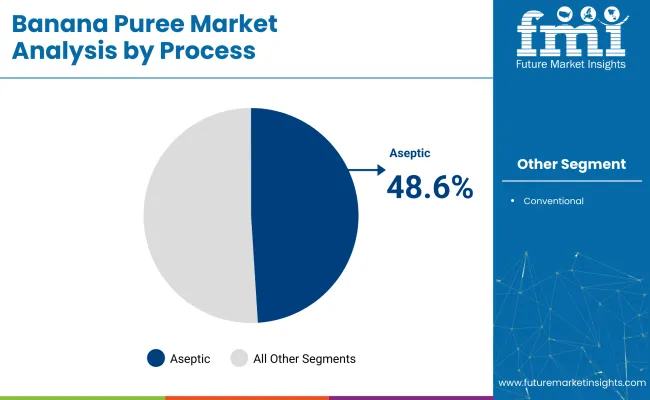

The application segment is categorized into beverages, infant food, bakery & snacks, others, dressings & sauces, and ice cream & yoghurt. The process segment is divided into conventional and aseptic. The source segment is classified into organic and conventional.

Regional analysis has been conducted across North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, and the Middle East & Africa.

The beverage sector dominates banana puree consumption, with a 58.6% market share in 2025, reflecting an estimated volume exceeding 150,000 metric tons globally. Growth is propelled by rising demand for smoothies, juices, and functional beverages, which incorporate banana puree for natural sweetness and enhanced mouthfeel.

Leading companies such as PepsiCo, Nestlé, and regional producers are innovating products targeting an annual beverage market growth rate of approximately 6-7% in health-oriented categories.

Aseptic processing controls nearly 48.6% of production volume, surpassing 120,000 metric tons annually. This method extends shelf life up to 12-18 months without preservatives, enabling wider distribution across 70+ countries. Key players like Dole Food Company, Ingredion, and Frutco utilize aseptic technology, contributing to an annual processing capacity increase of roughly 8% worldwide.

Organic holds a majority share at 55% of the source segment in 2025, reflecting a compound annual growth rate (CAGR) of about 9-10% in organic food categories. Certified organic banana production for puree is expected to reach more than 80,000 metric tons globally by 2025.

Brands such as Chiquita Organic and Fyffes have expanded organic acreage by over 15% annually to meet growing consumer demand valuing natural and chemical-free ingredients.

Post-harvest optimization and product diversification are steering supply-side behavior, while freight volatility and formulation constraints are impacting profitability. Manufacturers and processors are responding through ingredient blending, tropical sourcing shifts, and controlled fermentation protocols.

Processing Throughput Gains from Pulp Stabilization Tech

The puree processors in Ecuador and the Philippines achieved a 23% increase in yield stability by integrating low-temperature enzymatic deactivation lines. This cut post-pasteurization phase separation by 19%, allowing for longer fill times during aseptic bagging. Indian packhouses adopted midline pH control sensors, reducing off-spec pulp rejections by 27% in Q2 2025. In Colombia, a 41-day extension in ambient shelf life was documented through the use of high-viscosity thermal binders in blended purées targeting baby food manufacturers.

Production clusters have begun implementing modular mixers and inline de-aerators to accommodate higher-viscosity tropical fruit blends, pushing batch continuity metrics above 92%. These upgrades have reduced unplanned downtime and enabled leaner safety stock planning across export-focused plants.

Profit Strain from Export Bottlenecks and Input Substitution Constraints

Exporters in Costa Rica and India faced higher reefer container costs, with 40-foot freight rates to Rotterdam climbing 14% YoY by June 2025. Ethylene-ripened volumes for puree use saw a 9% rejection spike due to transit bruising and inconsistent pulp texture. Processors dependent on consistent Brix levels for multiblend beverages struggled with puree variability, raising QA costs.

Brazilian formulators trialed partial replacement with mango pulp to dilute price pressures, but flavor harmonization setbacks slowed integration. Several private-label buyers in the UK tightened moisture specifications, citing thinning issues in shelf-stable smoothie packs. These dynamics are forcing recalibrations in both upstream fruit sourcing and downstream formulation strategies.

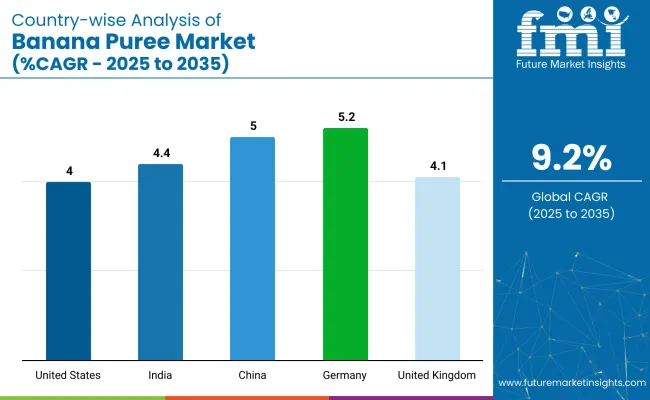

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference

| Countries | CAGR (2025-2035) |

|---|---|

| United States | 4.0% |

| Germany | 5.2% |

| China | 5.0% |

| India | 4.4% |

| United Kingdom | 4.1 % |

Global demand for banana-based puree is projected to grow at a 9.2% CAGR from 2025 to 2035. Among the five profiled markets out of 40 covered, Germany leads with a 5.2% CAGR, followed by China at 5.0%, India at 4.4%, the United Kingdom at 4.1%, and the United States at 4.0%. These growth rates represent a significant discount to the global average, ranging from -43.5% in Germany to -56.5% in the USA The slower pace in developed markets stems from saturation in processed fruit categories, limited domestic banana production, and competition from other fruit purées.

In contrast, global demand is propelled by rising tropical sourcing, expanding infant nutrition needs, and increased foodservice usage in high-growth regions across Asia and Latin America.

The United States industry is rising at 4.0% CAGR through 2035, driven by health-positioned innovation across beverages, baby food, and clean-label snacks. Major food processors in Illinois, California, and Oregon are incorporating banana puree into shelf-stable smoothies, plant-based desserts, and infant formulas.

In 2024, over42% of puree demand was tied to the beverage segment, while meal replacements and gluten-free energy bars used high-viscosity formats for improved texture. Organic and non-GMO variants are now a staple across multiple distribution channels including club retail and meal-kit platforms.

The banana puree market in Germany is advancing at 5.2% CAGR, fueled by high uptake in fortified baby foods, vegan-ready snacks, and oat-based yogurts. Bio-labeled puree imports are on the rise as processors seek traceable, potassium-rich, allergen-safe fruit inputs.

In 2024, over 38% of total volume came from organic-certified sources, with bakery fillings and spoonable desserts accounting for a growing share. Demand from Berlin and Hamburg-based formulators is centered around long-shelf applications and EU-regulated clean-label packaging protocols.

China’s banana based puree consumption is expanding at 5.0% CAGR, led by premiumized infant meals, clean dairy substitutes, and functional snacking formats. Manufacturers in Zhejiang, Henan, and Guangdong processed over 92,000 metric tonsin 2024, focused on pesticide-free puree inputs for baby porridge, breakfast cubes, and probiotic drinks.

Government-driven health education campaigns and school-based nutrition reforms are influencing demand across urban and tier-2 cities. Functional attributes like gut health, iron absorption, and potassium density are shaping formulation decisions in key retail categories.

India is witnessing growth in puree industry at 4.4% CAGR, underpinned by expansion in ayurvedic food blends, infant nutrition, and low-cost wellness products. Tamil Nadu, Maharashtra, and Gujarat accounted for over 110,000 metric tons of banana puree output in 2024.

Demand is centered around domestic baby food brands and exporters supplying the Middle East and Africa. Fruit processing units operating under APEDA and MIDH guidelines have scaled batch dehydration and aseptic packaging, targeting puree blends rich in potassium and vitamin B6 for herbal and energy-focused SKUs.

The puree industry UK is projected to grow at 4.1% CAGR, led by uptake in allergen-free baby foods, clean-label smoothies, and plant-based dessert formulations. British brands are reformulating SKUs for potassium fortification and sugar reduction, integrating banana puree as both a natural sweetener and fiber enhancer.

Meal-replacement sachets and kids’ fruit packs have been the top growth categories, especially in health-centric supermarket chains. In 2024, organic banana puree accounted for 28% oftotal usage, while local food startups explored hybrid formats using dairy-free bases and fruit concentrates.

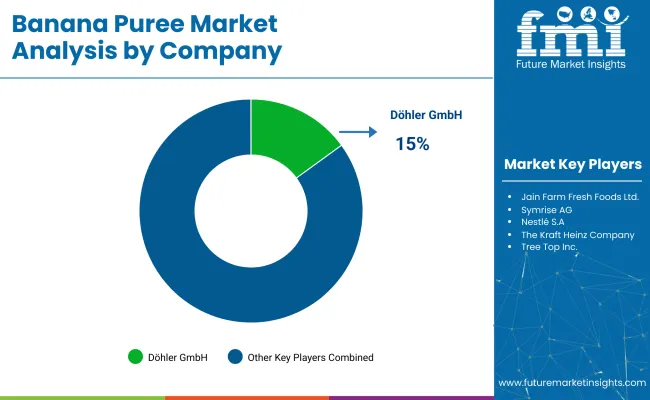

The industry is shaped by a mix of integrated processors and ingredient formulators. Döhler GmbH and Nestlé SA have invested in origin-sourcing partnerships and aseptic packaging expansions to strengthen foodservice and baby food channels. Jain Farm Fresh Foods and Tree Top Inc. are scaling through backward integration and volume-driven export agreements. KirilMischeff and AGRANA rely on European cold-chain contracts, while Symrise AG develops fruit bases blended with stabilizers for dairy and bakery use.

Shimla Hills and LaFruitière are growing via small-batch gourmet segments. Market consolidation is underway across mid-tier players, though barriers remain due to capital-heavy processing, perishability management, and traceability requirements that favor incumbents.

Emerging players face complex regulatory approvals for food safety and origin labeling, especially in Europe and East Asia. Product differentiation remains low outside premium applications, adding pressure to maintain margins. R&D is focused on natural sugar preservation and improving storage life without synthetic preservatives. Newer entrants often rely on freeze-dried variants or local cooperative sourcing, but scaling remains limited by infrastructure gaps in equatorial regions and tight control over green banana supply in Latin America and India.

Recent Banana Puree Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 454.5 million |

| Projected Market Size (2035) | USD 1,095.9 million |

| CAGR (2025 to 2035) | 9.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Applications Analyzed | Beverages, Infant Food, Bakery & Snacks, Others, Dressings & Sauces, Ice Cream & Yoghurt |

| Processes Analyzed | Conventional, Aseptic |

| Sources Analyzed | Organic, Conventional |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, United Kingdom, China, India, Japan, South Korea, Russia, South Africa, UAE |

| Leading Players | Döhler GmbH, Jain Farm Fresh Foods Ltd., Symrise AG, Nestlé S.A., The Kraft Heinz Company, Tree Top Inc., AGRANA Beteiligungs -AG, Kiril Mischeff Ltd., Shimla Hills Offerings Pvt. Ltd., LaFruitière du Val Evel |

| Additional Attributes | Dollar sales growth by application, regional demand trends, competitive landscape, packaging innovations, pricing strategies, supply chain dynamics, emerging market opportunities. |

This segment is further categorized into Beverages, Infant Food, Bakery & Snacks, Others, Dressings & Sauces, and Ice Cream & Yoghurt.

This segment is further categorized into Conventional and Aseptic.

This segment is further categorized into Organic and Conventional.

Industry analysis has been carried out in key countries of North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus and the Middle East & Africa.

The market is projected to reach approximately USD 1,095.9 million by 2035.

The market is expected to grow at a CAGR of 9.2% from 2025 to 2035.

The beverage segment is expected to hold 58.6% of the market share in 2025.

Organic sources are expected to account for 55% of the market share in 2025.

The market will grow by USD 641.4 million, from USD 454.5 million in 2025 to USD 1,095.9 million in 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Banana Flour Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Banana Flakes Market Size and Share Forecast Outlook 2025 to 2035

Banana Bread Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Banana Milk Market Trends - Demand & Growth 2025 to 2035

Korea Banana Flour Market Analysis by Source, Application, Distribution Channel, and Region Through 2035

Green Banana Flour Market Analysis - Growth & Demand 2025 to 2035

Upcycled Banana Flour Market Size, Growth, and Forecast 2025 to 2035

Cavendish Banana Market Size and Share Forecast Outlook 2025 to 2035

Demand for Banana Flour in EU Size and Share Forecast Outlook 2025 to 2035

Western Europe Banana Flour Market Analysis by Source, Application, Distribution Channel, and Country Through 2025 to 2035

Banana Flour in Japan - Size and Share Forecast Outlook 2025 to 2035

Guava Puree Market Size and Share Forecast Outlook 2025 to 2035

Mango Puree Market Analysis – Size, Share & Forecast 2024 to 2034

Fruit Concentrate Puree Market Growth - Trends & Forecast 2025 to 2035

Analyzing Not From Concentrated (NFC) Puree Market Share & Industry Leaders

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA