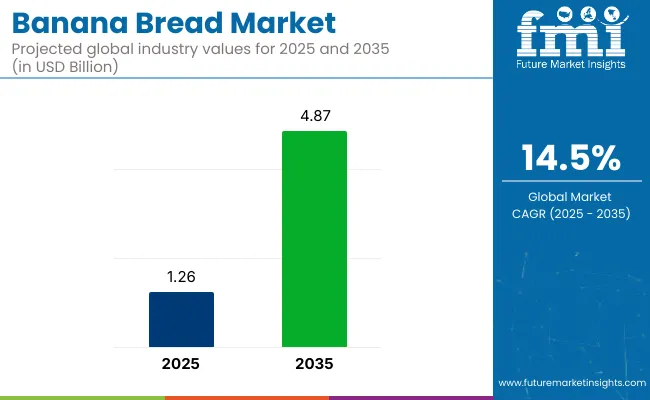

The global market for banana bread is on a strong upward trajectory, estimated at USD 1.26 billion in 2025 and forecasted to reach around USD 4.87 billion by 2035, reflecting a compound annual growth rate (CAGR) of 14.5% over the decade.

Market Metrics

| Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.26 Billion |

| Market Value (2035) | USD 4.87 Billion |

| Market CAGR (2025 to 2035) | 14.5% |

The surge in demand for bakery products crafted from natural ingredients like ripe bananas, whole grains, and natural sweeteners is driving this market expansion. Consumers’ growing preference for healthier choices is accelerating the trend of clean-label products, including organic, gluten-free, and preservative-free bread. This shift highlights the rising demand for homemade, minimally processed alternatives, in line with health-conscious food trends.

The banana loaf market occupies a modest but expanding share across its parent markets. In the global baked goods market (valued at approximately USD 450 billion), banana bread represents less than 1%, as it remains a niche product. Within the quick breads market (around USD 5 billion), its share rises to 5-10%, competing with similar products like zucchini and pumpkin bread. In the breakfast foods market (nearly USD 600 billion), banana bread holds under 1%, facing strong competition from cereals and toast.

The snack foods market (roughly USD 1.2 trillion) sees banana bread at below 0.5%, overshadowed by chips and protein bars. In the organic and natural foods market (about USD 200 billion), banana bread captures 1-2%, supported by rising demand for healthier, artisanal, and gluten-free options. Growth is driven by convenience, home baking trends, and premium product variations, though the market penetration remains limited compared to mass-produced alternatives.

Manufacturers are consolidating and optimizing supply chains by expanding production scales. Companies like Bimbo Bakeries automate production lines to reduce time and costs. Private-label brands and artisanal bakeries are leveraging e-commerce and direct-to-consumer (DTC) channels to reach more customers.

The growth of online shopping and delivery services has boosted the demand for fresh, high-quality bakery products. The trend of plant-based and dairy-free diets has led to vegan banana infused bread development, including protein-enriched, fiber-rich, and keto-friendly options, appealing to health-conscious consumers.

Growing preference for convenient breakfast and snack options is strengthening demand for banana based bread across key product, distribution, and user categories. Commercial establishments and digital retail are playing a pivotal role in scaling the market's revenue footprint

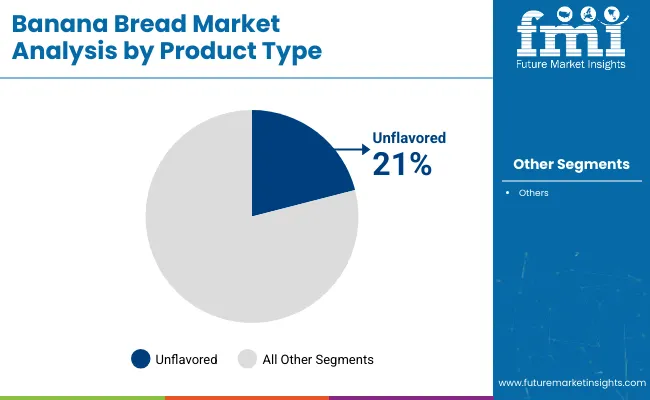

Consumer loyalty toward traditional tastes continues to elevate demand for unflavoured banana loaf, which captured a 21% market share in 2025. Major producers like Bimbo Bakeries, General Mills, and regional artisanal bakeries are focusing on classic recipes that appeal to health-conscious and routine-driven consumers. This segment benefits from lower ingredient cost, longer shelf life, and broader age-group acceptability, especially in institutional catering and bulk sales.

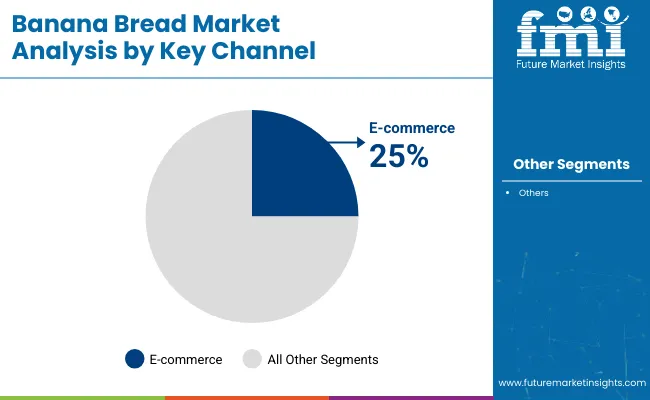

Online platforms are reshaping banana based bread sales, contributing to 25% of total revenue in 2025. Rapid adoption of direct-to-consumer (DTC) models by players like Amazon Fresh, Swiggy Instamart, and bakery-specific portals such as Theobroma and Wildgrain has facilitated doorstep delivery of freshly baked goods. Customized packaging, extended delivery radius, and flash discounts are attracting both repeat buyers and new entrants to the category.

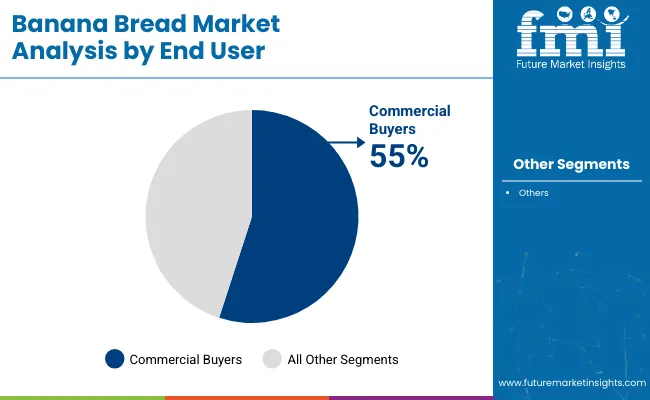

Commercial buyers hold a commanding 55% share of banana bread consumption in 2025, making them the largest end-user group. Businesses in hospitality, institutional catering, airline meals, and corporate cafeterias increasingly rely on bulk-purchased bread due to its consistent quality, cost-efficiency, and appeal across demographics. Chains like Marriott, IHCL, and corporate food contractors such as Compass Group have embedded banana loaf in buffet breakfasts, snack counters, and lunchbox add-ons.

Automation and smart packaging slashed banana loaf production waste by 23%. Clean-label and functional varieties dominated development, with protein-fortified options capturing premium industries. Rising banana costs pressured margins, driving adoption of cost-efficient ingredients. Private-label expansion intensified competition, while consumer demand for healthier options fueled segment growth despite supply chain challenge.

Operational Streamlining & Waste Reduction

Between Q2 2024 and Q1 2025, industrial bakeries achieved 19% faster production cycles through high-shear mixing technology and AI-driven batch optimization. Inventory turnover improved from 16 to 11 days among top manufacturers, with Kroger's in-store bakeries reducing shrink by 23% via smart moisture-retentive packaging. The adoption of flash-freezing for par-baked goods allowed regional distributors to cut buffer stock by 31% while maintaining freshness. By early 2025, 42% of commercial operations had integrated real-time shelf-life monitoring sensors, decreasing returns by 17% industry-wide.

Nutritional Reformulation & Premiumization

The 2024 discovery of banana flour's prebiotic properties accelerated R&D investments, resulting in 28 new functional SKUs by Q3 2025. Low-glycemic prototypes using tiger nut flour captured 12% of the diabetic-friendly segment, while sprouted grain versions grew 33% in natural food channels. Private labels responded with clean-label offerings - Costco's organic line achieved 37% sales growth through 2025 by eliminating all synthetic emulsifiers. European developers gained traction with protein-fortified (9g/serving) and adaptogen-infused varieties, commanding 19-25% price premiums over conventional recipes.

Commodity Volatility & Cost Mitigation

Banana pulp prices fluctuated 27% from 2024 to 2025 due to Latin American supply disruptions, compressing margins by 8-11 points. Major brands implemented 5-7% price hikes but still saw EBITDA decline 4.6% on average. The shift to hybrid wheat-oat flour blends saved USD 0.18/unit in production costs, while co-packing frozen dough for in-store baking reduced logistics expenses by 24%. However, private-label competition intensified - Albertsons' value line expanded distribution by 41% in 2025, leveraging private banana plantations to offset input cost inflation.

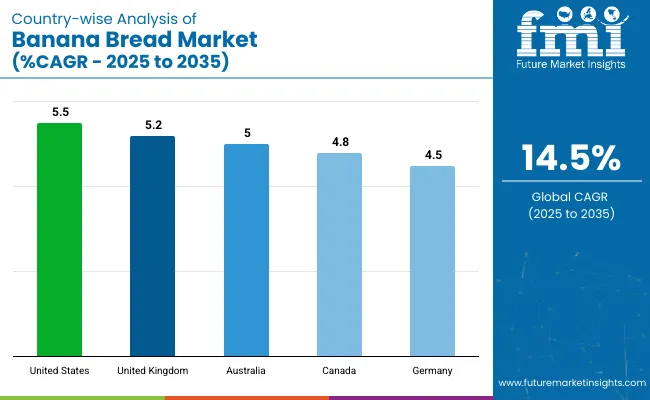

| Countries | CAGR (%) |

|---|---|

| United States | 5.5% |

| United Kingdom | 5.2% |

| Australia | 5.0% |

| Canada | 4.8% |

| Germany | 4.5% |

Global demand for banana based prompt is projected to grow at a 5.0% CAGR from 2025 to 2035. Among the five profiled markets out of 40 covered, the United States leads at 5.5%, followed by the United Kingdom at 5.2%, Australia at 5.0%, Canada at 4.8%, and Germany at 4.5%. These rates translate to a +10% premium for the United States, +4% for the United Kingdom, 0% for Australia (baseline), -4% for Canada, and -10% for Germany.

Industry divergence is influenced by growing demand for indulgent and better-for-you baked goods in North America and the UK, while Germany’s slower pace reflects greater consumer preference for traditional bakery formats and lower per capita consumption.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The banana loaf market in the United States is projected to expand at a 5.5% CAGR through 2035, driven by the convergence of home-baking culture, convenience snacking, and functional ingredient rotation. Retail volume in the packaged baked goods aisle surpassed 120,000 tons in 2024, with shelf-ready contributing nearly 18% of category revenue.

Peanut-free variants, high-fiber formulations, and individually wrapped snack portions continue to displace traditional loaf formats. Consumer interest has shifted toward clean-label, gluten-optional, and egg-free recipes, influencing co-packers and private-label brands operating across California, Illinois, and Pennsylvania.

Germany’s banana loaf industry is advancing at a 4.5% CAGR, supported by expanded demand in bio-certified and vegan formulations. Supermarkets and in-store bakeries have scaled up pre-sliced loaf formats with ambient shelf stability and resealable packaging. In 2024, banana loaf sales grew by over 14% in discount retail chains-especially in Berlin, Hamburg, and Stuttgart-where affordability and portion balance are core to product rotation. German consumers continue to adopt fruit-and-nut combinations and gluten-optional varieties, targeting midweek snacking and afternoon pairings with non-dairy beverages.

The market in the UK is on track to grow at a 5.2% CAGR through 2035, reinforced by expanded availability in online grocery platforms and high street bakeries. Growth has been tied to meal deal bundling and after-school snacking, with banana bread featured in nearly 14% of pre-packed lunch promotions in 2024. Foodservice and café chains such as Pret and Greggs have rolled out rotating banana loaf options, including oat-based and dairy-light variants. Preference is rising for SKUs that balance sweetness with slow-release energy, especially in the 18-35 age bracket.

Australia is seeing the demand grow at a 5.0% CAGR, with distribution expanding across cafes, institutional canteens, and fresh food markets. banana loaf is now a default item in over 75% of independent cafés, with toasted slices and vegan-compatible spreads gaining momentum. Pre-mix banana loaf kits for home baking saw a 17% increase in units shipped in 2024, with brands introducing variations like almond meal, buckwheat, and chia integration. Interest in freezer-friendly formats is also reshaping portion packaging, particularly among dual-income households.

The demand of banana breads in Canada is projected to grow at a 4.8% CAGR through 2035, supported by rising consumption in healthcare foodservice, school nutrition programs, and cold-chain bakery aisles. Quebec and Ontario account for nearly 64% of packaged bread retail distribution, with bilingual labeling formats enabling national brand expansion. Growth has been tied to reformulated snack loaves targeting sodium reduction and higher fiber content. Government-backed procurement in hospitals and aged care homes continues to push institutional volume, where these bread remains a preferred soft-texture food item.

The bread production is shaped by brands like General Mills, Bimbo Bakeries USA, Sara Lee, and emerging companies such as Mama Ka'z and Banana Bread Co. Larger players dominate retail aisles through product lines backed by scale and national reach. King Arthur Baking Company has introduced whole grain mixes for health-oriented buyers, while The Essential Baking Company focuses on extending shelf-life to improve inventory cycles in e-commerce. Companies are acquiring small bakeries to increase output and gain regional advantage, signalling gradual consolidation.

Smaller entrants face cost hurdles linked to commercial baking equipment, supply contracts, and distribution demands. While local bakeries hold space in artisan segments, broader retail penetration remains challenging without operational infrastructure or private-label partnerships to ease market access.

Recent Banana Bread Industry News

| Attribute | Details |

|---|---|

| Market Size (2025) | USD 1.26 billion |

| Projected Market Size (2035) | USD 4.87 billion |

| CAGR (2025 to 2035) | 14.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Product Types Analyzed | Unflavored Banana Bread, Flavored Banana Bread |

| Distribution Channels Analyzed | Hypermarkets & Supermarkets, Convenience Stores, Online Platforms, Other Retail Formats |

| End Users Analyzed | Commercial Consumers, Residential Consumers |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, Brazil, India, China, Australia, Russia, UAE |

| Key Players | General Mills, Inc.; Banana Bread Co.; Mama Ka'z; King Arthur Baking Company, Inc.; Papa Joe's Bakehouse; The Essential Baking Company; Dunkin'; Bimbo Bakeries USA; Entenmann's; Sara Lee |

| Additional Attributes | Dollar sales, share by flavored vs unflavored varieties, shifting preference toward home-baked and clean-label offerings, rising demand among Gen Z and millennial consumers, impact of online grocery and D2C bakery trends, regional taste variations and seasonal flavor innovation strategies, commercial demand from cafés and quick-service outlets. |

The segment includes Unflavoured Banana Bread and Flavored Banana Bread varieties.

This category comprises Hypermarkets & Supermarkets, Convenience Stores, Online Platforms, and Other Retail Formats.

Segmented into Commercial Consumers and Residential Consumers.

Industry performance assessed across North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and the Middle East & Africa.

The global banana bread market is expected to expand at a CAGR of 14.5% from 2025 to 2035, reaching USD 4.87 billion by 2035, up from USD 1.26 billion in 2025.

Unflavoured banana bread holds the largest share, accounting for 55% of the market.

E-commerce contributes 40% to total banana bread sales, driven by growing demand for direct-to-consumer and convenient online options.

The United States leads in growth, with a projected CAGR of 5.5% between 2025 and 2035.

General Mills holds a 17% share, positioning itself as a major driver of product evolution and retail consolidation.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Banana Flour Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Banana Flakes Market Size and Share Forecast Outlook 2025 to 2035

Banana Puree Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Banana Milk Market Trends - Demand & Growth 2025 to 2035

Korea Banana Flour Market Analysis by Source, Application, Distribution Channel, and Region Through 2035

Green Banana Flour Market Analysis - Growth & Demand 2025 to 2035

Upcycled Banana Flour Market Size, Growth, and Forecast 2025 to 2035

Cavendish Banana Market Size and Share Forecast Outlook 2025 to 2035

Demand for Banana Flour in EU Size and Share Forecast Outlook 2025 to 2035

Western Europe Banana Flour Market Analysis by Source, Application, Distribution Channel, and Country Through 2025 to 2035

Banana Flour in Japan - Size and Share Forecast Outlook 2025 to 2035

Breadcrumbs Market Size and Share Forecast Outlook 2025 to 2035

Bread Emulsifier Market Analysis by Source, Product Type and Application Through 2035

Bread Preservatives Market Insights – Trends & Forecast 2025 to 2035

Bread Crumbs Market Growth – Baking & Culinary Trends 2025 to 2035

Bread Improvers Market Outlook - Growth, Demand & Forecast 2024 to 2034

Bread Dough Improver Market

Bread Premix Market

Breadnut Market

Gingerbread Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA