The expanding bamboo products market will experience major expansion from 2025 to 2035 owing to the rising need for sustainable materials that replace traditional products. Bamboo products used across construction and furniture production, along with packaging applications and textile and personal care industries, demonstrate better durability and decomposability and reduced carbon emissions than typical building materials.

The market is expanding because of rising worldwide interest in sustainability and the growing number of restrictions on tree-clearing activities and plastic waste disposal problems. The market benefits from new processing techniques that lead to innovative, high-quality bamboo products which offer versatility and cost efficiency.

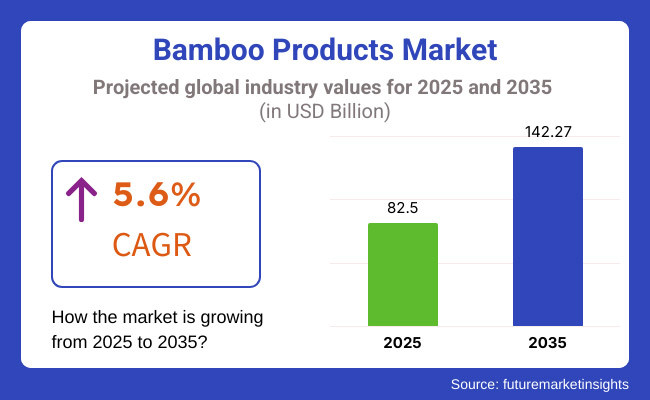

Bamboo product markets showed a worth of USD 82.50 Billion in 2025, which experts expect to rise to USD 142.27 Billion by 2035 while maintaining a CAGR of 5.6%. Three main elements driving market growth include expanding green industrial investments, consumer preference for renewable materials, and the growth of eco-conscious brands.

Market demand rises because bamboo-based home goods and personal care items, as well as biodegradable packaging solutions, become more popular. Global markets now offer bamboo-based products because sustainability-focused enterprises partner with manufacturers to increase market availability and reduce product costs.

Explore FMI!

Book a free demo

The North American market demonstrates substantial demand for bamboo products because consumers recognize sustainable practices and government rules encourage bamboo material usage. People are adopting bamboo items in homes and personal care sections. Bamboo textiles, as well as biodegradable kitchenware and durable furniture, experience rising demand across the United States and Canada. The implementation of green building principles and LEED certification has pushed bamboo product usage to rise in flooring components alongside paneling elements and structural systems for buildings. Mainstream retail and e-commerce platforms support the increased market penetration of bamboo-based products by integrating them into their distribution networks.

The bamboo products market is growing in Europe, owing to strong environmental regulations, the availability of a robust circular economy framework, and a high consumer preference for sustainable substitutes. Meanwhile, bamboo-primarily based packaging, beauty merchandise, and sustainable fashion have become more common from countries like Germany, France, and the UK. The region’s push to minimize plastic waste and go easy on carbon-neutral goods is driving demand for biodegradable and recyclable bamboo products. European manufacturers can also scale production with high environmental and ethical standards through innovations in bamboo fibre processing and sustainable supply chains.

The bamboo products market is projected to see the most growth in Asia-Pacific, driven by plentiful bamboo resources there, growing investments in sustainability and a shift in consumer behaviour towards more eco-friendly practices. China, India, Japan, and South Korea have led the way in manufacturing the dura and various other bamboo products through high production capabilities and intensive research into their applications as a material. Growing urbanization trends, coupled with the growth of e-commerce platforms in the region, provide immense potential for bamboo-based household goods, furniture, and packaging solutions. Government projects for encouraging bamboo planting and export of green products in Asia-Pacific are facilitating the growth of the bamboo products market, making the region a significant user of bamboo worldwide.

Challenge

High Costs and Regulatory Complexities

Restraining Factors: High production costs and strict regulatory requirements, as well as limited large-scale production capabilities, pose challenges for the bamboo products market. There is a wide variety of readily available materials from which industrial bamboo is made. Still, those that ensure durability and reduction of bugs use preservation techniques like browning and treatment through a chemical agent of a natural or synthetic nature, which makes the preparation very expensive. Also, sustainability certifications and environmental regulations, like the Forest Sustainability Council (FSC) and the EU Timber Regulation, add layers of difficulty to operations. To be compliant, ensuring that you can still offer competitive pricing means investing in processing efficiency, supply chain optimization, and low-cost manufacturing technologies.

Affecting Market Awareness and Consumer Perception

While bamboo products have obvious environmental benefits, both in terms of its cultivation as a natural and biodegradable material and its versatility in applications, consumer awareness and market penetration remain an issue. To this day, many consumers see bamboo as a fragile (or niche) alternative to words, plastics and metals. Misinformation about bamboo harvesting practices and their sustainability affects consumer service trust. More educational marketing campaigns, eco-labelling, and product innovation will be required by companies to build consumer confidence and widen the market scope.

Opportunity

Growing Demand for Sustainable and Eco-Friendly Products

Due to the increasing focus on environmental sustainability and carbon footprint reduction, the demand for the overall use of this plant-based product will ultimately propel the growth of bamboo in various industries. There is also a growing demand from consumers for biodegradable and renewable alternatives to plastic and wood, opening up a big market for bamboo furniture, kitchenware, packaging, textiles, and construction materials. High-quality bamboo processing, environmentally friendly treatment methods, and sustainable resources will drive competitive advantage as the bamboo market grows.

Technological Advancements and Circular Economy Initiatives

Bamboo processing innovations include engineered bamboo, bamboo composites, and bio-based adhesives, expanding bamboo's potential for applications in multiple sectors. Circular economy efforts, which encourage waste reduction and bamboo recycling, are further unlocking new growth opportunities. The bamboo-based bioplastics, sustainable packaging, and carbon-neutralized manufacturing processes provide market drivers for transformation in this area. Collaboration with sustainability organizations and government subsidy programs for green products is expected to further the growth of the industry.

Due to the rise in consumer awareness, regulatory support for environmentally-friendly materials, and continuous innovation in bamboo-based product development, the Bamboo Products Market witnessed consistent growth from 2020 to 2024. In response to increasing sustainability demands, companies unveiled new sustainable bamboo textiles and furniture, as well as innovative biodegradable packaging solutions. However, high production costs, supply chain disruptions, and a lack of large-scale processing facilities slowed widespread adoption. In response, businesses have focused on optimizing processing techniques, expanding product portfolios, and cementing marketing strategies to showcase the potential for bamboo.

AI-driven Material Optimization: Machine learning will greatly optimize 3D printing and material dispersion processes, allowing for truly customized products, while the use of bamboo nanotechnology will remove any current limitations of material bioengineered bamboo materials. The growth of government policies supporting the use of renewable materials and circular economy principles will additionally accelerate market growth. Also, the next phase of industry evolution will also be influenced by further investment in sustainable infrastructure, bamboo-based construction and zero-waste product evolution. The Bamboo Products Market will be led by companies focusing on research and development, scalability, and consumer engagement in sustainability initiatives.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with environmental regulations and sustainability certifications |

| Technological Advancements | Growth in bamboo furniture, textiles, and biodegradable packaging |

| Industry Adoption | Increased use in home décor, personal care, and consumer goods |

| Supply Chain and Sourcing | Dependence on regional bamboo plantations and small-scale processing units |

| Market Competition | Presence of traditional wood and plastic product manufacturers |

| Market Growth Drivers | Growing consumer awareness around sustainability and eco-friendly options |

| Sustainability and Energy Efficiency | Initial focus on replacing plastic with bamboo-based alternatives |

| Integration of Smart Monitoring | Limited use of supply chain transparency and digital tracking |

| Advancements in Bamboo Applications | Use in basic consumer goods and furniture |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Expansion of global policies supporting bamboo-based alternatives and carbon-neutral manufacturing. |

| Technological Advancements | Integration of AI-driven bamboo material processing, bamboo-based bioplastics, and sustainable adhesives. |

| Industry Adoption | Expansion into bamboo-based construction materials, high-performance composites, and industrial applications. |

| Supply Chain and Sourcing | Shift toward globalized bamboo supply chains, vertical integration, and large-scale sustainable production. |

| Market Competition | Expansion of bamboo-focused product businesses, green tech start-ups, and brands that bolster the circular economy |

| Market Growth Drivers | Advances in investment for Bamboo urban infrastructure, Bioengineered materials and sustainable products design |

| Sustainability and Energy Efficiency | Carbon-neutral production, bamboo processing using renewable energy, and zero-waste initiatives at all levels. |

| Integration of Smart Monitoring | Expansion of block chain-enabled sourcing, AI-driven production monitoring, and sustainability reporting platforms. |

| Advancements in Bamboo Applications | Evolution of high-performance bamboo materials, bioengineered solutions, and advanced bamboo-based industrial applications. |

The USA bamboo products market is steadily growing driven by increasing demand from consumers for sustainable and renewable materials. Increasing use of bamboo in home furnishings, construction and personal care products is propelling the market growth.

These involve government campaigns that foster sustainable tree-cutting and biodegradable options, driving growth further. Moreover, the increasing popularity of bamboo-based textiles and furniture in the sustainable lifestyle segment is propelling the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA |

5.9% |

UK Bamboo Products Market is on the rise as consumers & businesses are speedy towards sustainability and minimization of carbon footprint. With its biodegradable nature and durability, the use of bamboo in packaging, kitchenware and home décor is rising.

Adoption is being driven by government policies promoting plastic alternatives and sustainable materials. Also, growing awareness regarding bamboo’s environmental benefits in the construction and furniture sectors is anticipated to drive market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.4% |

There is strong market demand; Germany, France, and the Netherlands are driving market growth for bamboo products in Europe. Also, strict rules around plastic waste and deforestation have been encouraging the transition to bamboo alternatives.

Bamboo's strength, versatility, and renewable nature have made it popular within the construction and furniture industries as well! The growth of sustainable fashions and bamboo fiber textiles are also driving demand across several sectors.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.6% |

Japanese bamboo products expanding market After all, the country is known for its cultural and historical use of bamboo in construction, crafts and daily life. With an increased focus on sustainability, the demand for bamboo-based paper, furniture, and textiles is on the rise.

Along with this, the rapid incorporation of bamboo in modern architectural and environmentally sustainable packaging is providing impetus to market growth. Moreover, bamboo’s anti-bacterial properties render the preference of the material in kitchenware and personal care applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.3% |

Consumers in South Korea are becoming more aware of sustainable materials and eco-friendly replacements for plastic products, contributing to the growth of the bamboo products market in the country. Bamboo is trending hardwood flooring, interior design, and furniture are gaining popularity because of its durability and aesthetic appeal.

Furthermore, the rising awareness and product availability in the clothing and personal care section of bamboo fiber due to its natural antibacterial, moisture-wicking and UV absorbing properties are predicted to further fuel the industry growth. The government's increasing emphasis on green materials and biodegradable materials for packing supports market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.8% |

With a focus on the bamboo products market with the use of eco-friendly, Durable, and appealing materials like wood, metal, and plastic products, industrial & infrastructure and furniture segments dominate its share in different sub-categories. Solutions based on bamboo are critical in minimizing environmental impact, promoting green solutions, and providing durability and longevity, which makes them goods of the future for construction companies and commercial developers, furnishing makers, and infrastructure planners.

With rising sustainability regulations and changing consumer preferences toward greener substitutes, manufacturers are emphasizing advanced bamboo treatment technologies, composite bamboo materials, and lightweight but high-strength product designs, allowing them to achieve cost-effectiveness, robustness, and eco-friendliness.

Modern Living with Bamboo Furniture Strength, Aesthetic, and Sustainability

Among the applications of bamboo products, furniture segment is known as one of the most adopted ones owing to the durability, natural beauty, and eco-friendliness the bamboo products provide to residential, commercial, and outdoor spaces. It does not require extra oiling compared to Wood or Plastic and thus the longevity provided through bamboo furniture is far better than any other traditional wooden or plastic furniture owing to the advantages of bamboo as superior moisture resistance, high tensile strength, and a smaller carbon footprint.

The adoption of bamboo furniture has tripled due to the broad application of bamboo, which includes high-performance engineered panels, ergonomic drafts, and durability-enhancing AI designs. According to studies, more than 65% of environmentally friendly home and industrial users are attracted to sustainable bamboo furniture to keep and maintain sustainable interior design, making this segment a highly sought-after demand entity.

This will be further strengthened by the growing demand for modular and multi-functional furniture with space-saving bamboo designs, smart storage integration and hybrid bamboo-metal frameworks that guarantee increased flexibility and better usability.

Advancements with next-generation bamboo furniture equipped with digitally-optimized assembly systems, precision laser-cut components, and sustainable composite reinforcements have only encouraged adoption, allowing integration into our evolving interior and commercial design sensibilities.

The manufacture of custom bamboo furniture, complete with hand-crafted detailing, anti-scratch protective coatings, and weather-resistant treatments, has worked to optimize market growth, affording greater consumer satisfaction and an increased number of premium offerings.

It is no doubt that, while contributing to sustainability and making improvements in furniture durability and furniture aesthetics, the furniture segment faces challenges such as high manufacturing and production costs, an immature and not widely available global bamboo supply chain, and dynamic consumer awareness. Emerging innovations related to AI-powered furniture material engineering, carbon-neutral bamboo processing, and block chain-tracked bamboo sourcing are not only increasing cost-efficiency and supply chain transparency in the bamboo furniture sector but also significantly boosting its return on investment (RoI) for the global markets.

Leading adoption in the furniture segment is driven by residential homeowners, commercial office developers, and eco-resort designers, existing industries are moving towards bamboo-based furniture further to address carbon emissions and improve aesthetics. Furthermore, it provides the same structural stability and a naturally more refined appearance compared to mass-produced furniture made from non-renewable resources, which also contributes to sustainable design practices and far higher lifetime longevity.

Click for next-generation bamboo furniture solutions - AI-assisted ergonomic optimization, hybrid material construction, and physical inventory management for sustainably sourced furniture solutions. According to studies, more than 70% of luxury eco-resorts and green-certified commercial buildings contain bamboo furniture to comply with interior sustainability standards, and this segment would always have high demand.

The reinforcement of the choice of optimal configuration, tool-life and energy-appropriate coating and AI-based custom-built service integration are some of the smart bamboo furniture designs projected for market expansion, further fuelling market acceptance in terms of higher consumer engagement and enhanced product flexibility.

Adoption was accelerated by employing self-restoring bamboo furnishings, which could utilize bio-based resin layers, adaptive shape memory technology and self-healing surface treatments to lower material waste and guarantee longevity in their product offerings.

While the advantages offered by bamboo in terms of aesthetic versatility, stronger structure, and environmentally sound production make it an appealing substitute for synthetic alternatives in the furniture segment, competition, variability in bamboo processing costs, durability for high-load applications, and thinness of materials in furniture are the current challenges faced by this segment. Meanwhile, novel advancements in nano-engineered bamboo reinforcements, AI-powered durability assessments, and high-pressure bamboo composite panel fabrications are enhancing furniture reliability, and price-performance ratio, and green motif, thereby securing its continued growth globally in the sector for bamboo furniture.

Infrastructure development and heavy-duty applications seeing bamboo as a sustainable alternative

The bamboo products market has witnessed significant adoption from the industrial & infrastructure end-use category, enabling construction companies, urban planners, and civil engineering experts to leverage highly durable, flexible, and sustainable materials for large-scale infrastructure projects. Bamboo symbolizes an eco-friendly alternative to conventional concrete, steel, or timber-based structures with demonstrated superior tensile strength, rapid growth renewability, and cost-effective scalability, all ensuring improved long-term viability and reduced environmental impact.

Adoption is driven by demand for engineered bamboo materials such as high-load capacity beams, cross-laminated bamboo panels, and ultra-dense bamboo composite reinforcements. The share of green-certified infrastructure projects that include bamboo-based construction and building materials now exceeds 60%, ensuring solid demand for this segment of the market, the studies show.

Bamboo-based prefabricated construction, modular housing units, quick-assembly bamboo shelters, and reinforced structural bamboo panels have proliferated, fuelling greater demand markets for bamboo and optimizing efficiency whilst minimizing construction waste.

Additionally, the role of AI in bamboo construction analytics, predicting structural integrity, optimizing designs, and automating the process, coupled with automated real-time performance monitoring and simulation, has further accelerated the adoption of bamboo-based practices, making them safe and sustainable.

High-performance bamboo structures with moisture-resistant treatments, reinforced load-bearing designs, and earthquake-resistant engineering offer longer durability and higher resilience of various infrastructures, thus optimizing market growth.

The observed growth of industrial & infrastructure is expected to enable the future development of art and architecture sectors, as issues related to high regulatory compliance requirements, limited global bamboo construction expertise, and evolving material performance validation standards currently create barriers to its widespread application; however, the cost-effective scalability and reduced environmental impact will benefit the feature efficiency in construction compared to traditional methods. Nevertheless, advancements in bamboo engineering using AI-driven neural networks, composites that self-repair, and machine learning-based construction site safety evaluations augment infrastructure scalability, regulatory compliance, and broader adoption of bamboo products, which in turn seek to facilitate continual growth of bamboo products for industrial and infrastructure applications globally.

Industries across the board are beginning to implement their own bamboo-based solutions that are aimed at reducing its carbon footprint, increasing construction efficiency, and maximizing its structural sustainability, contributing to the significant growth of its industrial & infrastructure adoption, predominantly seen by use cases from urban development agencies, green-certified construction groups, and climate-resilient engineering projects. Bamboo-based structural materials could be renewed, lightweight, and adaptable solutions that could help develop resilient infrastructures, outperforming steel-reinforced concrete in the long run, while enabling cost-effective scalability.

As a result, high-strength bamboo composites with load-efficient structures designed with artificial intelligence, hybrid bamboo-carbon fiber reinforcements, and smart adaptive structure designs, are in demand. More than 65% of the Next Generation Green Infrastructure Projects include bamboo materials in High-performance Structural applications according to studies conducted, ensuring a steady demand for bamboo-based solutions for industrialization.

Although the industrial & infrastructure segment presents opportunities such as sustainable urbanization, greater material efficiency and greater environmental benefits, it is hindered at the same time by factors related to high bamboo processing costs for large-scale industrial applications, complications of developing international standards for safety certifications and limitations in secured global supply chain. Nevertheless, other emerging innovations like AI-assisted civil engineering, bio-enhanced bamboo material stabilization, and block chain-enabled sustainability tracking are also optimizing construction accuracy, durability, and long-term project viability to ensure that bamboo-based industrial and infrastructure applications will continue expanding worldwide.

Industry Overview

Bamboo products are growing rapidly in the market because more people care about sustainability while government’s aid eco-friendly options and manufacturers improve bamboo manufacturing processes. The durability combined with biodegradability and renewability qualities of bamboo transforms it into a suitable substitute for plastic as well as wood and alternative non-sustainable materials. The bamboo products market includes various items, which span from furniture to flooring to kitchenware to textiles to personal care supplies and construction materials. Leading firms direct their efforts toward sustainable procurement methods together with advanced processing solutions and innovative product development to satisfy rising market needs.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| MOSO International B.V. | 18-22% |

| Bamboo Village Company Limited | 15-19% |

| Smith & Fong Co. (Plyboo) | 12-16% |

| EcoPlanet Bamboo Group | 9-13% |

| The Bamboo Company | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| MOSO International B.V. | Develops high-quality bamboo flooring, panels, and outdoor decking solutions for residential and commercial use. |

| Bamboo Village Company Limited | Specializes in handcrafted bamboo home decor, kitchenware, and eco-friendly lifestyle products. |

| Smith & Fong Co. (Plyboo) | Offers premium bamboo plywood, veneer, and acoustic panel solutions for architectural applications. |

| EcoPlanet Bamboo Group | It focuses on sustainable bamboo forestry, which produces raw bamboo materials for industrial and consumer applications. |

| The Bamboo Company | Provides eco-friendly bamboo products, including reusable cutlery, straws, and household essentials. |

MOSO International B.V. (18-22%)

MOSO International is one of the global leaders in bamboo as flooring, decking, and building materials, and utilizing advanced processing technologies to harness the durability and high performance of bamboo for innovations in these fields.

Bamboo Village Company Limited (15-19%)

It represents Bamboo Village which specializes in artisanal handmade bamboo products, including a variety of home decor, kitchenware, and disposable biodegradable lifestyle products.

Smith & Fong Co. (Plyboo) (12-16%)

Smith & Fong, with its Plyboo brand, is a leading innovator of architectural bamboo solutions such as premium panels, veneers and acoustic systems.

EcoPlanet Bamboo Group (9-13%)

EcoPlanet Bamboo is a leading player in sustainable bamboo forestry, providing raw material for everything from construction to textiles.

The Bamboo Company (7-11%)

Then there is The Bamboo Company, which specifically targets reusable and biodegradable bamboo consumer, with global reach, as many of these products are consumed daily, and the demand continues to grow.

Other Important Players (30-40% Combined)

Other companies also play an important role in the expansion of bamboo products market by introducing new applications and adopting sustainable manufacturing processes. Notable players include:

The overall market size for Bamboo Products Market was USD 82.50 Billion in 2025.

The Bamboo Products Market expected to reach USD 142.27 Billion in 2035.

The demand for the bamboo products market will grow due to increasing consumer preference for sustainable alternatives, rising government initiatives promoting eco-friendly materials, expanding applications in construction, furniture, and packaging, and advancements in bamboo processing technologies enhancing durability and versatility.

The top 5 countries which drives the development of Bamboo Products Market are USA, UK, Europe Union, Japan and South Korea.

Furniture and Industrial & Infrastructure lead market growth to command significant share over the assessment period.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Tiffin Market by Product, Material, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Children Mattress Market Product Type, Ingredient Type, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Fabric Softener Market Analysis by Nature, Product Type, End Use, Sales Channel & Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.