Between 2025 and 2035, the market transparency for bamboo packaging will expand significantly because of rising sustainable packaging needs alongside ecological worries and regulatory plastic usage restrictions. Bamboo packaging serves the food and beverage, cosmetics, and personal care sectors because it provides durability, visual attraction, and biodegradability.

The market expands because consumers increasingly prefer eco-friendly renewable packaging materials. Modern bamboo processing techniques enable manufacturers to create superior lightweight eco-amici packages that cost-efficiently meet market requirements.

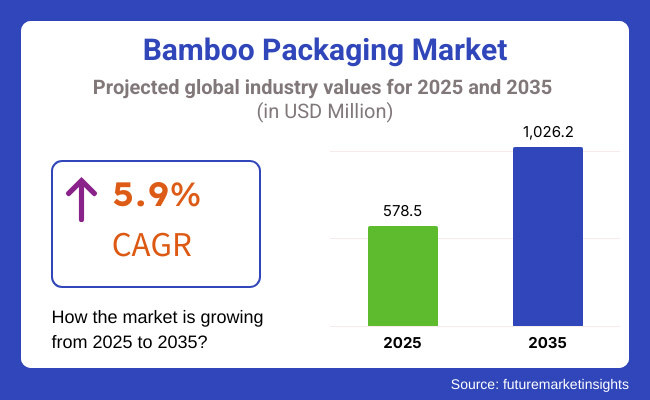

Experts predict bamboo packaging will reach USD 1,026.2 Million by 2035 while maintaining a 5.9% CAGR until 2035 from its initial USD 578.5 Million value in 2025. Three key drivers determine the growth of the bamboo packaging market: first, companies adopt sustainable business practices; second, green packaging innovation funding; and third, government support for biodegradable solutions.

Bamboo packaging experiences increasing demand from e-commerce and direct-to-consumer sales since businesses need attractive packaging to appeal to consumers. Consumers engage more with products and product verification improves because smart packaging technology uses digital tracking methods and QR codes.

Explore FMI!

Book a free demo

The North American marketplace for bamboo packaging continues to be substantial because consumers understand sustainable options better and corporate sustainability grows along with government regulations against single-use plastic products. Biodegradable packaging demand increases rapidly throughout American and Canadian territories among food service providers and retail and personal care businesses. The market growth is being boosted by two factors: the significant participation of essential industry leaders and the increasing popularity of green branding initiatives. The appearance of packaged items improves because companies have developed tamper-evident and compostable bamboo-based containers.

The European bamboo packaging sector continues to develop steadily because of stringent environmental regulations and positive consumer demand for sustainable materials, along with EU initiatives toward circular economy principles. Major brands operating in Germany, along with France and the UK, lead the way in adopting sustainable packaging solutions by implementing bamboo-based materials for their products. Bamboo packaging has become more popular in the market due to manufacturer efforts to develop environmentally friendly packages that both recycle and decompose. Bamboo-based packaging alternatives develop through partnerships established between sustainable material distributors and packaging production companies.

The bamboo packaging market in Asia-Pacific demonstrates the best growth potential because this region possesses abundant bamboo resources and increasing government support for sustainable packaging together with a rising number of sustainability-focused consumers. The countries of China, Japan, India, and South Korea have amplified their investments in bamboo processing and packaging advancement. E-commerce and food delivery industries are driving up demand for biodegradable packaging solutions because of their fast market expansion. The market continues to grow due to government backing of bamboo industries alongside the promotion of export-oriented sustainable packaging solutions. The region stands as a major force in the global bamboo packaging market because of its robust manufacturing sector combined with effective production procedures.

Challenge

High Costs and Regulatory Complexities

Various market factors affect the bamboo packaging market, such as its high production expenses, environmental directive mandates, and supply chain restrictions. Environmental scientists use renewable bamboo resources to create sustainable packaging materials, but expertise in making bamboo products durable leads to manufacturing expenses, which increase costs. The market faces additional difficulty in obtaining sustainability certifications that include both the Forest Stewardship Council (FSC) and the European Union’s Packaging and Packaging Waste Directive. Companies must invest in processing technologies that deliver both reasonable prices and sustainable materials sourcing while providing scalable production methods to achieve cost-effective solutions that balance compliance with affordability.

Limited Consumer Awareness and Market Penetration

Many users show growing interest in sustainable packaging, but bamboo packaging remains unfamiliar in various parts of the market. Most businesses, along with consumers, remain undecided about bamboo's long-term advantages over conventional packaging materials, including plastic, glass, and metal. Businesses that are reluctant to make the shift to bamboo packaging mention concerns about durability and moisture resistance as well as bamboo’s availability. Overcoming these barriers includes educating consumers, increasing product accessibility, and working closely with retailers to position bamboo packaging as a sustainable and long-term solution.

Opportunity

Rising Demand for Sustainable and Biodegradable Packaging

With a growing emphasis on reducing plastic usage and opting for sustainable packaging solutions, bamboo-based packaging offers a substantial opportunity. To push slightly further, a steadily growing number of sectors, from food & beverage to personal care and cosmetics, are switching to biodegradable and compostable packaging options to satisfy consumer demand and regulatory pressure. Therefore, companies focusing on high-quality bamboo processing, durable packaging innovation,s and aesthetically pleasing designs will attract environmentally conscious consumers and gain a competitive edge in the market.

Advancements in Bamboo Packaging Technologies and Circular Economy Initiatives

New applications for bamboo in the packaging sector are emerging, including engineered bamboo composites, water-resistant coatings, and biodegradable adhesives. Furthermore, the market is being driven by circular economy initiatives that promote recyclability and waste reduction. As companies adopt smart packaging technologies, including QR-coded sustainability tracking and AI-enhanced supply chain monitoring, they will be able to engage consumers better and provide product insights at the same time. Companies that invest in closed-loop recycling systems and sustainable manufacturing technologies will be in charge of the growing green packaging industry.

Bamboo Packaging Market grew constantly from 2020 to 2024 File, owing to growing consumer awareness about pollution created by plastic-based materials, regulatory support for sustainable bamboo-based packaging, and a growing move away from plastic-based materials. In line with the global sustainability goals, the companies started researching and developing compostable and biodegradable bamboo packaging solutions. However, high production expenses, supply chain restraints, and uneven material quality delayed universal adoption. In response, businesses optimized manufacturing efficiency, increased product variety, and partnered with retailers to improve access to their offerings in the market.

Forecasts of 2025 to 2035: AI-driven production, bamboo-based nanotechnology, and global sustainability policies are expected to contribute to rapid market participation. Government mandates for plastic-free packaging and zero-waste initiatives will only further accelerate the adoption of bamboo packaging. Technological innovations in moisture-resistant bamboo packaging, antimicrobial coatings, and recyclability will also change industry benchmarks. The Bamboo Packaging Market is expected to witness a major transformation by companies emphasizing sustainable material innovations, intelligent packaging solutions, and circular economy practices.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Adherence to sustainability certifications and policies to reduce plastic |

| Technological Advancements | Biodegradable bamboo packaging and alternative materials growth |

| Industry Adoption | Upswing in food & beverage, cosmetics, and consumer goods |

| Supply Chain and Sourcing | Reliance on local bamboo plantain and artisanal processing |

| Market Competition | Emerging sustainable brands and traditional packaging manufacturers |

| Market Growth Drivers | Demand for eco-friendly and biodegradable packaging |

| Sustainability and Energy Efficiency | Initial focus on replacing plastic with biodegradable bamboo alternatives |

| Integration of Smart Monitoring | Limited use of supply chain tracking and digital transparency |

| Advancements in Bamboo Applications | Use in basic consumer packaging and compostable food containers |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Overarching global initiatives for biodegradable packaging and circular economy policies. |

| Technological Advancements | AI-enhanced manufacturing and smart packaging using bamboo nanotech |

| Industry Adoption | Diversification into pharmaceutical, electronics, and industrial packages. |

| Supply Chain and Sourcing | Shift toward large-scale bamboo processing, improved material consistency, and localized supply chains. |

| Market Competition | Specialized bamboo packaging providers, tech-driven eco-packaging start-ups, and premium sustainable packaging brands are finding a way to grow. |

| Market Growth Drivers | Increased investment in plastic-free regulations, sustainable sourcing, and global zero-waste initiatives. |

| Sustainability and Energy Efficiency | Large-scale adoption of carbon-neutral manufacturing, closed-loop recycling, and renewable energy integration. |

| Integration of Smart Monitoring | Expansion of blockchain-enabled material sourcing, AI-driven supply chain optimization, and real-time packaging analytics. |

| Advancements in Bamboo Applications | Evolution of high-performance bamboo packaging, antimicrobial coatings, and fully recyclable solutions. |

The USA bamboo packaging industry is growing due to rising consumer demand for sustainable and biodegradable packaging alternatives. Industry growth is being propelled by the demand for sustainable products in food and beverages and personal care.

Regulatory guidelines implemented by the governments in favour of minimizing the usage of plastic waste is expected to accelerate the usage of bamboo-based packaging. Owing to that, big retailers and brands are keeping bamboo packaging to support their sustainability efforts while improving brand image.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.2% |

The growing susceptibility of consumers towards environmental issues in the United Kingdom, coupled with stringent policies on plastic packaging, is driving the UK bamboo packaging market. More companies in food service, cosmetics, and e-commerce are integrating bamboo-focused solutions to achieve sustainability targets.

Sustainable branding and eco-conscious consumerism also increase the demand for bamboo packaging. Further supporting market growth are government incentives advocating for biodegradable packaging solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.7% |

The bamboo packaging market is expanding rapidly in the European Union, with Germany, France, and the Netherlands being the key economies. Stricter EU regulations around reducing plastic materials and sustainable packaging are driving businesses to turn towards bamboo alternatives.

Food and beverage is the primary industry for food packaging products, which are being gradually replaced with biodegradable and compostable counterparts. Moreover, innovation in bamboo-based packaging for retail and logistics applications is attributed to an even greater expansion of the market opportunities.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.9% |

Considering Japan's long history of adopting bamboo in traditional packaging, and the rising demand for modern sustainable solutions, the market for bamboo in Japan is growing, steadily, one of the many nations where eco-friendly development is becoming the norm. Market growth is benefiting from the burgeoning bamboo-based packaging across the cosmetics, food, and electronics industries.

Governments across the globe, meanwhile, are promoting green packaging and reducing plastic waste, further accelerating the adoption of bamboo alternates. Furthermore, continuous technological developments for durable and flexible bamboo packaging products are making these products more appealing.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.5% |

Driven by the increasing demand for sustainable packing solutions such as bamboo packaging from the cosmetics and skin care industry, the South Korean bamboo packaging market is growing. As sustainable K-beauty trends pull hard, this is boosting demand for biodegradable and refillable bamboo packaging.

Efforts to drive green manufacturing and corporate sustainability goals are also helping fuel the adoption of bamboo packaging in the country. Moreover, rising expenditure on packaging research and development and innovations in reusable bamboo-based materials are further driving the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.1% |

Industry Trends: The bamboo packaging market has been dominated by boxes & cartons and cosmetics & personal care segments as industries move towards using biodegradable, eco-friendly, and durable packaging solutions to reduce the environmental impact of their packaging while complying with sustainability regulations. Essential for consumer goods companies, beauty and wellness brands, food manufacturers and e-commerce businesses, these bamboo-based packaging solutions can replace single-use plastics, reduce carbon footprints and improve brand reputation.

With plastic waste being restricted by several governments and increasing consumer preference toward ecosystem-friendly packaging solutions, manufacturers are targeting lightweight bamboo packaging, improved structural durability, and enhancing the design aesthetics of their products to ensure product safety, presentation, and long-run sustainability.

Bamboo-Based Boxes & Cartons: Strong, Eco-Friendly, & Premium

The boxes & cartons segment has become one of the most popular forms in the bamboo packaging market due to their excellent forte, biodegradability, and high aesthetic appeal in the case of luxury goods, food items, cosmetics, and e-shipping. The bamboo-based boxes and cartons also have additional benefits compared to traditional cardboard and plastic packaging, such as better moisture resistance, higher rigidity, and greater sustainability, allowing them to protect products better and be more environmentally friendly.

Aided adoption by the demand for high-quality bamboo boxes and cartons, which have AI-assisted structural reinforcement, water-resistant coatings and premium branding finishes. With over 65% of premium and eco-sensitive brands using bamboo-based packaging for added sustainability, you can expect strong demand for this segment.

The rise of sustainable packaging programs, with closed-loop recycling systems, biodegradable ink printing, and low-energy production processes, has bolstered market demand and driven higher acceptance of bamboo packaging across sectors.

Furthermore, the adoption process has been accelerated by incorporating next-generation Innovative Low-Cost Bamboo bottle and Packaging designs with ultra-thin lightweight structures, user-friendly modular packaging designs, and AI and ML strategies for material efficiency optimization, facilitating the adoption of Adaptive Structures to meet evolving sustainability criteria.

Bamboo custom-designed boxes and cartons, for example, are designed with laser engraving, multi-compartment design, and collapsible flat-pack designs for effective market growth, providing much storage ease and premium branding opportunity.

While offering benefits like increased sustainability, improved durability, and elevated brand aesthetics, the boxes & cartons segment is hampered by challenges such as higher initial production costs, supply chain constraints on procuring bamboo raw materials, and limited scalability for mass-market applications. But with new advancements in AI-powered package design, sustainable material composite engineering, and blockchain traceable bamboo sourcing improving cost-efficiency, scalability, and material traceability, the future development of bamboo boxes and cartons globally looks bright.

The boxes & cartons segment has received strong adoption by luxury brands, sustainable product manufacturers, and online retail platforms as manufacturers are shifting toward biodegradable, plastic-free packaging to support their sustainability initiatives while offering a more versatile & appealing method of product presentation. Bamboo-based boxes are also stronger than conventional cardboard or synthetic packaging and feature natural antimicrobial properties, giving consumers not just a superior tactile feel but also a more positive perception and less impact on the environment.

Adoption has been driven by the demand for next-generation bamboo carton solutions, including interlocking designs, durable enhanced coatings, and smart embedded QR-code authentication. As per studies, more than 70% of luxury and eco-friendly product companies use bamboo packaging, which makes them capable of creating a premium-perfect brand position and ensuring the demand for this segment.

Growing trend of zero-waste packaging solutions, including refillable bamboo boxes, compostable seals, and biodegradable ink printing, have bolstered the market uptake, ensuring higher sustainability compliance and consumer preference.

By leveraging smart inventory management tools, predictive material optimization and supply chain transparency solutions under the umbrella of AI-driven packaging analytics, adoption has soared, enabling greater efficiency in packaging production and distribution.

Although the segment has benefited from presenting premium products, improved sustainability, and increased storage strength, it is hampered by the cost sensitivity of mass-market retail packaging, limited supply availability of bamboo as a raw ingredient, and changing regulations in the industry regarding sustainable packaging certifications. Nevertheless, advanced innovations with respect to hay-based material designing, AI-designed eco box making, and waste free manufacturing techniques, etc., which are improving making packaging cost-effective, application long-lasting, and economical, are making this bamboo-based box and carton growing worldwide.

Feel the Good Vibes of Sustainable Packaging with Bamboo: A High-End Alternative for Personal Care/Beauty

The bamboo packaging market is gaining considerable application in the cosmetics & personal care segment, which has turned out to be one of the most prominent end-users, allowing beauty and wellness brands to move away from plastic-based packaging and improve their sustainability efforts. Laviplant Naturals found Bamboo packaging to be biodegradable, aesthetically pleasing, durable, and environmentally friendly, leading to greater customer engagement and conformance with the new green beauty trends.

The growing demand for premium bamboo packaging solutions, including refillable compact cases, airless bamboo pump dispensers, and biodegradable jar lids fuels the adoption. With the increasing usage of bamboo packaging in beauty products, studies show that more than 65% of beauty brands operate with natural and organic structures, meeting sufficient demand for this segment.

Luxury beauty brands specializing in eco-friendly packaging, from FSC-certified bamboo sourcing to non-toxic adhesives to AI-guided supply chain transparency, has been a win-win-win, rewarded by stronger market demand, greater consumer trust and brand differentiation.

Further adoption of offering smart bamboo-based personal care packaging for product authentication and AI-enabled inventory tracking that also allows customizable digital engravings of text/content whilst providing a completed aesthetic and design element for consumer convenience integration has also driven the process.

Modular bamboo packaging formats featuring magnetic refillable pods, customizable bottle sizes, and hybrid bamboo-glass combinations optimized for market growth, resulting in improved user experience and reduced packaging waste.

While the cosmetics & personal care segment has considerable benefits of enhancing brand perception, especially with its natural ingredient preservation capability, a reduction of plastic waste produced, and the high-end product look, there are several hurdles to the mainstream adoption of the segment such as higher manufacturing costs, limited supply chains for high-quality bamboo, and the need for regulatory compliance in most cases of such material usage in cosmetic-grade products. Nonetheless, burgeoning advancements such as lightweight bamboo fiber composites, AI-enabled packaging lifecycle assessment, and biodegradable bamboo-PLA hybrid substrates are driving down costs, enhancing product integrity, and improving packaging sustainability, ensuring ongoing growth for this revolutionary cosmetics & personal care packaging.

The cosmetics & personal care industry already has wide adoption (the biggest drivers being luxury fragrance houses, leathery skincare brands, and natural & organic beauty product manufacturers) as businesses shift their focus toward sustainable, high-end, and compostable packaging that meets the market demand for plastic-free beauty solutions. Providing improved sustainability and branding, unlike plastic substitutes that are less recyclable, bamboo packaging is stronger and offers a more luxurious and natural feel.

Growing demand for high-end bamboo cosmetic packaging solutions, comprising air-tight bamboo dispensers, UV-resistant bamboo cold cream jar lids, and bio-seal protective coatings, has bolstered the adoption further. Over 70% of sustainable beauty brands are transitioning towards bamboo packaging, indicating that demand for biodegradable packaging solutions will continue to thrive to fulfill eco-friendly consumer preference, as highlighted in studies.

While this trend undoubtedly offers benefits to businesses around luxury branding, enhanced sustainability, and overall superior consumer experience, the cosmetics & personal care segment faces the challenges of considerable production costs, long development hours, and supply chain logistics complexities. Innovations such as 3D-printed bamboo packaging, AI-powered supply chain analytics, blockchain-verified sustainable material sourcing, etc., are positively aiding the scalability, efficiency, and brand transparency of the industry so that these keep growing in prominence in the cosmetics & personal care sector globally.

Industry Overview

The global Bamboo packaging market is experiencing positive growth, and it is attributed to the increasing consumer preference towards sustainable packaging, eco-friendly packaging, biodegradable, and also food-grade packaging. Bamboo is recognized as a highly-renewable source material that provides both strong and lightweight qualities; as such, it is seeing growth in food & beverage packaging, personal care packaging, electronics packaging, and e-commerce applications. As governments and corporations are seeking sustainable alternatives to plastic, bamboo packaging is becoming a preferred option in different sectors. The prominent players in the industry are emphasizing biodegradable coatings, custom solutions, and innovative molding techniques to reduce environmental impact while enhancing product function.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Panda Packaging | 18-22% |

| Packwood | 15-19% |

| Huhtamaki Group | 12-16% |

| BioPak | 9-13% |

| Bambrew | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Panda Packaging | It specializes in biodegradable and reusable bamboo packaging for food service and retail applications. |

| Packwood | Offers eco-friendly bamboo-based cutlery, food containers, and luxury packaging solutions. |

| Huhtamaki Group | Develops innovative bamboo fiber-based packaging for food & beverage and sustainable consumer goods. |

| BioPak | It focuses on compostable and recyclable bamboo packaging for food service and takeaway industries. |

| Bambrew | Provides plastic-free, customizable bamboo packaging solutions for cosmetics, FMCG, and e-commerce sectors. |

Panda Packaging (18-22%)

The company Panda Packaging, which specializes in bamboo packaging, offers sustainable and reusable packaging options for restaurants and retailers. What makes it different is its pledge to biodegradable materials and plastic-free options.

Packwood (15-19%)

Packwood specializes in luxury and food-grade bamboo packaging, offering a wide range of biodegradable products for eco-conscious businesses and hospitality sectors.

Huhtamaki Group (12-16%)

Huhtamaki is at the forefront of innovations in bamboo fiber-based packaging, allowing compostable food & beverage packaging while growing its sustainable product portfolio.

BioPak (9-13%)

BioPak-they is an award-winning provider of compostable bamboo packaging and a market-leading supplier of high quality, environmentally friendly packaging solutions for food drive-thru and takeaway.

Bambrew (7-11%)

Bambrew focuses on customized bamboo packaging for cosmetics, FMCG, and e-commerce applications, leveraging cutting-edge manufacturing techniques to provide plastic-free alternatives.

Other Significant Players (30-40% Combined)

Other companies are also working in the bamboo packaging space, creating more innovative, durable, and completely biodegradable packaging. Notable players include:

The overall market size for Bamboo Packaging Market was USD 578.5 Million in 2025.

The Bamboo Packaging Market expected to reach USD 1,026.2 Million in 2035.

The demand for the bamboo packaging market will grow due to increasing consumer preference for sustainable and eco-friendly packaging, rising government regulations on plastic waste, growing adoption in food and beverage industries, and advancements in biodegradable packaging solutions.

The top 5 countries which drives the development of Bamboo Packaging Market are USA, UK, Europe Union, Japan and South Korea.

Cosmetics & Personal Care lead market growth to command significant share over the assessment period.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.